概述

突破昨日最高价策略是一种趋势跟踪策略,它在突破昨日最高价时打开多头仓位,即使当天多次突破也可以开仓。它以追踪趋势为主要特征,适用于市场呈现出明显趋势行情且波动率较高的情况。

原理

该策略通过引入一系列指标来识别入场时机和出场时机。

ROC曲线筛选器 - 当天收盘价较上一交易日收盘价的涨跌幅超过设定门槛时开启策略。该指标用于过滤不符合策略的波动市场。

突破点 - 记录当天最高价,最低价,开盘价。 当价格突破当天最高价时为入场信号。

入场退出条件 - 入场后设置止损和止盈比例,同时可启用追踪止损来锁定利润。也可以针对特定EMA有条件止损。

优化配置 - 可设置入场前的间距比例来定制入场时机,避免假突破。可设置止损,止盈,追踪止损的动态参数。

具体来说,策略通过记录当天最高价来判断入场时机。当价格超过当天最高价时多头入场。此后设置止损和止盈退出,同时可启用追踪止损。也可在价格跌破特定EMA时止损。优化方式是设置入场前的间距比例,调整止损止盈比例来控制风险,启用追踪止损来锁定利润。

优势分析

该策略具有以下优势:

趋势跟踪,能抓取趋势行情的利润。

突破策略,入场信号明确。

考虑当天最高价,避免连续入场。

止损止盈设置,有助于风险控制。

追踪止损设置,可锁定利润。

可通过参数优化调整入场时机,控制风险。

简单直观,容易理解实现。

多空双向可运用。

风险分析

该策略也存在以下风险:

突破类策略容易被套牢。入场后价格可能立即回落。

仅针对趋势行情有效,震荡行情下表现不佳。

需要合理设置止损比例,过于宽松可能增加亏损。

需要合理设置入场间距比例,过于激进可能增加亏损。

假突破可能导致不必要的亏损,需要调整优化。

需关注突破的交易量能否支撑后续行情。

需关注不同时间周期参数设置之间的协调性。

优化方向

该策略可以从以下方面进行优化:

增加其他技术指标判断,例如交易量,震荡指标等,避免在震荡行情下被套。

增加曲线拟合指标,判断趋势质量,避免跟随虚假趋势。

对入场间距设置动态优化,根据市场波动率调整间距要求。

对止损止盈设置动态优化,跟随市场调整参数。

针对不同品种不同周期设置不同参数。

利用机器学习方法TRAINING测试不同参数对策略的影响。

增加 Options 选项功能优化配置。

研究如何在震荡行情中应用该策略。

扩展为跨时间周期和品种的组合策略。

总结

该策略基于突破昨日最高价的趋势跟踪思路,在趋势行情中表现不俗。但是也存在被套风险和参数优化难题。通过引入更多判断指标,动态优化参数设置,扩展为组合策略等手段可进一步优化。总体来说,该策略适合短线追踪趋势行情,但需要关注风险控制和参数优化。

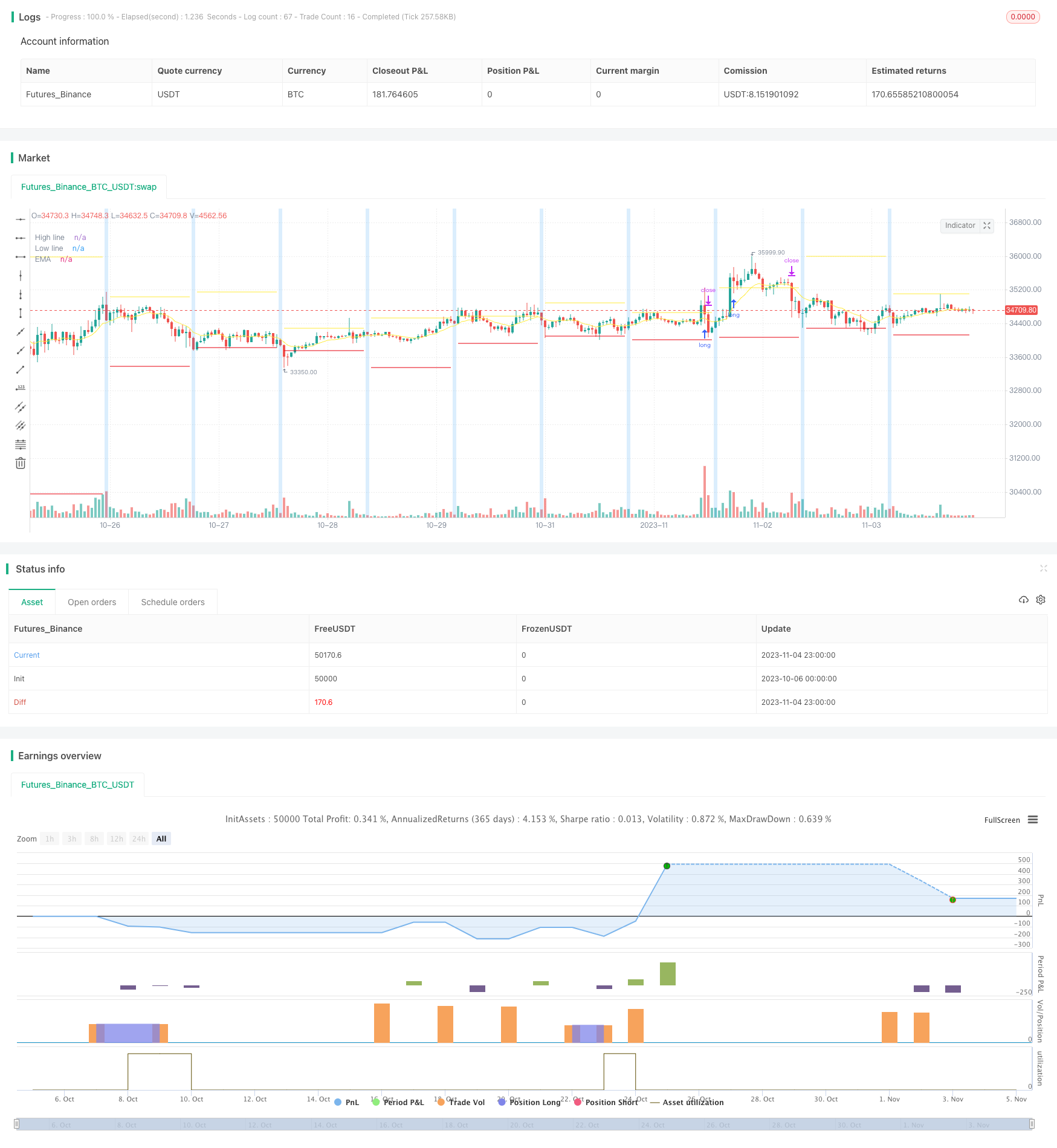

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Author: © tumiza 999

// © TheSocialCryptoClub

//@version=5

strategy("Yesterday's High v.17.07", overlay=true, pyramiding = 1,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity, default_qty_value=10,

slippage=1, backtest_fill_limits_assumption=1, use_bar_magnifier=true,

commission_type=strategy.commission.percent, commission_value=0.075

)

// -----------------------------------------------------------------------------

// ROC Filter

// -----------------------------------------------------------------------------

// f_security function by LucF for PineCoders available here: https://www.tradingview.com/script/cyPWY96u-How-to-avoid-repainting-when-using-security-PineCoders-FAQ/

f_security(_sym, _res, _src, _rep) => request.security(_sym, _res, _src[not _rep and barstate.isrealtime ? 1 : 0])[_rep or barstate.isrealtime ? 0 : 1]

high_daily = f_security(syminfo.tickerid, "D", high, false)

roc_enable = input.bool(false, "", group="ROC Filter from CloseD", inline="roc")

roc_threshold = input.float(1, "Treshold", step=0.5, group="ROC Filter from CloseD", inline="roc")

closed = f_security(syminfo.tickerid,"1D",close, false)

roc_filter= roc_enable ? (close-closed)/closed*100 > roc_threshold : true

// -----------------------------------------------------------------------------

// Trigger Point

// -----------------------------------------------------------------------------

open_session = ta.change(time('D'))

price_session = ta.valuewhen(open_session, open, 0)

tf_session = timeframe.multiplier <= 60

bgcolor(open_session and tf_session ?color.new(color.blue,80):na, title = "Session")

first_bar = 0

if open_session

first_bar := bar_index

var max_today = 0.0

var min_today = 0.0

var high_daily1 = 0.0

var low_daily1 = 0.0

var today_open = 0.0

if first_bar

high_daily1 := max_today

low_daily1 := min_today

today_open := open

max_today := high

min_today := low

if high >= max_today

max_today := high

if low < min_today

min_today := low

same_day = today_open == today_open[1]

plot( timeframe.multiplier <= 240 and same_day ? high_daily1 : na, color= color.yellow , style=plot.style_linebr, linewidth=1, title='High line')

plot( timeframe.multiplier <= 240 and same_day ? low_daily1 : na, color= #E8000D , style=plot.style_linebr, linewidth=1, title='Low line')

// -----------------------------------------------------------------------------

// Strategy settings

// -----------------------------------------------------------------------------

Gap = input.float(1,"Gap%", step=0.5, tooltip="Gap di entrata su entry_price -n anticipa entrata, con +n posticipa entrata", group = "Entry")

Gap2 = (high_daily1 * Gap)/100

sl = input.float(3, "Stop-loss", step= 0.5, group = "Entry")

tp = input.float(9, "Take-profit", step= 0.5, group = "Entry")

stop_loss_price = strategy.position_avg_price * (1-sl/100)

take_price = strategy.position_avg_price * (1+tp/100)

sl_trl = input.float(2, "Trailing-stop", step = 0.5, tooltip = "Attiva trailing stop dopo che ha raggiunto...",group = "Trailing Stop Settings")//group = "Trailing Stop Settings")

Atrl= input.float(1, "Offset Trailing", step=0.5,tooltip = "Distanza dal prezzo", group = "Trailing Stop Settings")

stop_trl_price_cond = sl_trl * high/syminfo.mintick/100

stop_trl_price_offset_cond = Atrl * high/syminfo.mintick/100

stop_tick = sl * high/syminfo.mintick/100

profit_tick = tp * high/syminfo.mintick/100

mess_buy = "buy"

mess_sell = "sell"

// -----------------------------------------------------------------------------

// Entry - Exit - Close

// -----------------------------------------------------------------------------

if close < high_daily1 and roc_filter

strategy.entry("Entry", strategy.long, stop = high_daily1 + (Gap2), alert_message = mess_buy)

ts_n = input.bool(true, "Trailing-stop", tooltip = "Attiva o disattiva trailing-stop", group = "Trailing Stop Settings")

close_ema = input.bool(false, "Close EMA", tooltip = "Attiva o disattiva chiusura su EMA", group = "Trailing Stop Settings")

len1 = input.int(10, "EMA length", step=1, group = "Trailing Stop Settings")

ma1 = ta.ema(close, len1)

plot(ma1, title='EMA', color=color.new(color.yellow, 0))

if ts_n == true

strategy.exit("Trailing-Stop","Entry",loss= stop_tick, stop= stop_loss_price, limit= take_price, trail_points = stop_trl_price_cond, trail_offset = stop_trl_price_offset_cond, comment_loss="Stop-Loss!!",comment_profit ="CASH!!", comment_trailing = "TRL-Stop!!", alert_message = mess_sell)

else

strategy.exit("TP-SL", "Entry",loss= stop_tick, stop=stop_loss_price, limit= take_price, comment_loss= "Stop-loss!!!", comment_profit = "CASH!!", alert_message = mess_sell)

if close_ema == true and ta.crossunder(close,ma1)

strategy.close("Entry",comment = "Close" , alert_message = mess_sell)