EMA/ADX/VOL - Pembunuh Kripto

Strategi perdagangan kuantitatif untuk masuk ke pasar dengan menggunakan sistem EMA untuk menentukan arah tren, indikator ADX untuk menentukan kekuatan tren, dan menggabungkan penyaringan volume perdagangan

Prinsip

Strategi ini pertama-tama menggunakan 5 EMA rata-rata dari periode yang berbeda untuk menentukan arah tren harga, ketika 5 EMA rata-rata semuanya naik, diputuskan sebagai tren multihead, dan ketika 5 EMA rata-rata semuanya turun, diputuskan sebagai tren kosong.

Kemudian menggunakan indikator ADX untuk menilai kekuatan dan kelemahan tren, menilai tren yang kuat ketika garis DI + lebih tinggi dari garis DI-dan nilai ADX melebihi batas yang ditetapkan, dan menilai tren yang kosong ketika garis DI-lebih tinggi dari garis DI + dan nilai ADX melebihi batas yang ditetapkan.

Pada saat yang sama, untuk melakukan konfirmasi tambahan dengan memanfaatkan volume transaksi yang terobosan, volume transaksi K-line saat ini harus lebih besar dari beberapa kali rata-rata periode tertentu, sehingga menghindari masuk yang salah di posisi volume rendah.

Strategi ini menggabungkan arah tren, kekuatan tren, dan volume perdagangan untuk membentuk logika multihead dan kosong.

Keunggulan

Menggunakan sistem EMA rata-rata untuk menentukan arah tren lebih dapat diandalkan daripada EMA rata-rata tunggal.

Menggunakan indikator ADX untuk menilai kekuatan dan kelemahan tren, untuk menghindari kesalahan masuk tanpa tren yang jelas.

Mekanisme penyaringan volume transaksi, memastikan dukungan volume transaksi yang memadai, dan meningkatkan keandalan strategi.

“Kalau kita melihat kondisi yang ada, kita bisa melihat bahwa sinyal untuk membuka posisi lebih akurat dan lebih dapat diandalkan”.

Lebih banyak parameter kebijakan, Anda dapat terus meningkatkan efektivitas kebijakan dengan mengoptimalkan parameter.

Risiko dan Solusi

Dalam situasi goncangan, penilaian seperti EMA, ADX, dan lain-lain dapat mengirimkan sinyal yang salah, sehingga menghasilkan kerugian yang tidak perlu. Parameter dapat disesuaikan sesuai, atau menambahkan indikator lain untuk penilaian tambahan.

Kondisi penyaringan volume terlalu ketat dan mungkin melewatkan peluang pasar, parameter penyaringan volume dapat dikurangi sesuai.

Strategi ini dapat menghasilkan frekuensi perdagangan yang lebih tinggi, yang memerlukan perhatian pada manajemen dana dan pengendalian yang tepat pada ukuran posisi tunggal.

Arah optimasi

Uji kombinasi parameter yang berbeda untuk menemukan parameter terbaik dan meningkatkan efektivitas strategi.

Menambahkan indikator lain seperti MACD, KDJ dan lain-lain dalam kombinasi dengan EMA dan ADX untuk membentuk penilaian posisi terbuka yang lebih komprehensif.

Menambahkan strategi stop loss untuk mengendalikan risiko lebih lanjut.

Mengoptimalkan strategi manajemen posisi dan manajemen dana yang lebih ilmiah.

Meringkaskan

Strategi ini secara komprehensif mempertimbangkan arah tren harga, kekuatan tren dan informasi volume perdagangan, membentuk aturan pembukaan posisi, sampai batas tertentu menghindari kesalahan dalam jebakan umum, memiliki reliabilitas yang lebih kuat. Namun, masih perlu lebih lanjut melalui optimasi parameter, pilihan indikator dan kontrol risiko untuk menyempurnakan sistem strategi, untuk meningkatkan efektivitas lebih lanjut. Secara keseluruhan, kerangka strategi ini memiliki potensi pengembangan dan ruang optimasi yang besar.

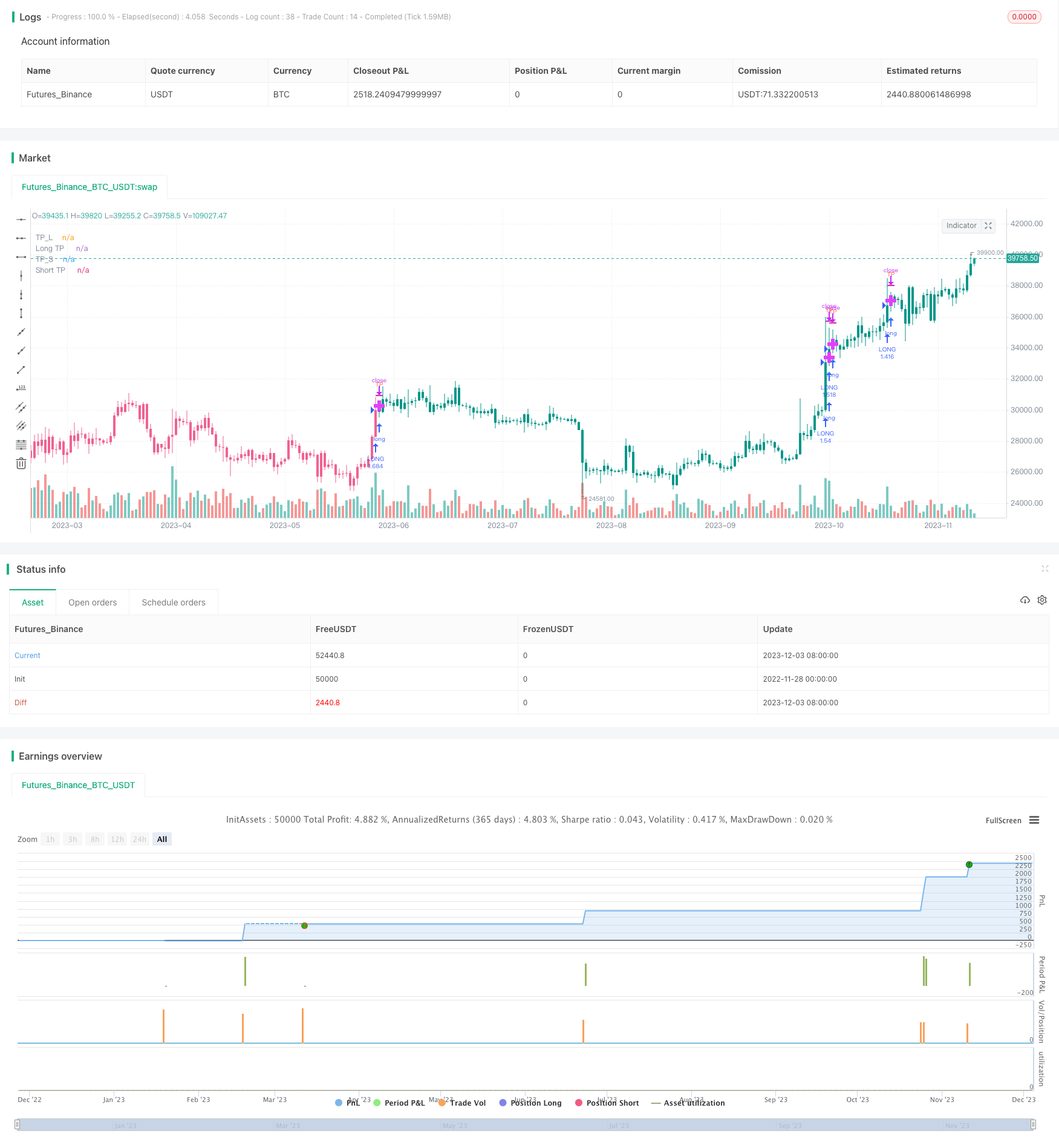

/*backtest

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BabehDyo

//@version=4

strategy("EMA/ADX/VOL-CRYPTO KILLER [15M]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

//SOURCE =============================================================================================================================================================================================================================================================================================================

src = input(open, title=" Source")

// Inputs ========================================================================================================================================================================================================================================================================================================

//ADX --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="ADX")

ADX_len = input(21, title=" Adx Length", type=input.integer, minval = 1, group="ADX")

th = input(20, title=" Adx Treshold", type=input.float, minval = 0, step = 0.5, group="ADX")

//EMA--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length_ema1 = input(8, title=" 1-EMA Length", minval=1)

Length_ema2 = input(13, title=" 2-EMA Length", minval=1)

Length_ema3 = input(21, title=" 3-EMA Length", minval=1)

Length_ema4 = input(34, title=" 4-EMA Length", minval=1)

Length_ema5 = input(55, title=" 5-EMA Length", minval=1)

// Range Filter ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

per_ = input(15, title=" Period", minval=1, group = "Range Filter")

mult = input(2.6, title=" mult.", minval=0.1, step = 0.1, group = "Range Filter")

// Volume ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

volume_f = input(3.2, title=" Volume mult.", minval = 0, step = 0.1, group="Volume")

sma_length = input(20, title=" Volume lenght", minval = 1, group="Volume")

volume_f1 = input(1.9, title=" Volume mult. 1", minval = 0, step = 0.1, group="Volume")

sma_length1 = input(22, title=" Volume lenght 1", minval = 1, group="Volume")

//TP PLOTSHAPE -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tp_long0 = input(0.9, title=" % TP Long", type = input.float, minval = 0, step = 0.1, group="Target Point")

tp_short0 = input(0.9, title=" % TP Short", type = input.float, minval = 0, step = 0.1, group="Target Point")

// SL PLOTSHAPE ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

sl0 = input(4.2, title=" % Stop loss", type = input.float, minval = 0, step = 0.1, group="Stop Loss")

//INDICATORS =======================================================================================================================================================================================================================================================================================================

//ADX-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

//EMA-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

xPrice = close

EMA1 = ema(xPrice, Length_ema1)

EMA2 = ema(xPrice, Length_ema2)

EMA3 = ema(xPrice, Length_ema3)

EMA4 = ema(xPrice, Length_ema4)

EMA5 = ema(xPrice, Length_ema5)

L_ema = EMA1 < close and EMA2 < close and EMA3 < close and EMA4 < close and EMA5 < close

S_ema = EMA1 > close and EMA2 > close and EMA3 > close and EMA4 > close and EMA5 > close

// Range Filter ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool L_RF = na, var bool S_RF = na

Range_filter(_src, _per_, _mult)=>

var float _upward = 0.0

var float _downward = 0.0

wper = (_per_*2) - 1

avrng = ema(abs(_src - _src[1]), _per_)

_smoothrng = ema(avrng, wper)*_mult

_filt = _src

_filt := _src > nz(_filt[1]) ? ((_src-_smoothrng) < nz(_filt[1]) ? nz(_filt[1]) : (_src-_smoothrng)) : ((_src+_smoothrng) > nz(_filt[1]) ? nz(_filt[1]) : (_src+_smoothrng))

_upward := _filt > _filt[1] ? nz(_upward[1]) + 1 : _filt < _filt[1] ? 0 : nz(_upward[1])

_downward := _filt < _filt[1] ? nz(_downward[1]) + 1 : _filt > _filt[1] ? 0 : nz(_downward[1])

[_smoothrng,_filt,_upward,_downward]

[smoothrng, filt, upward, downward] = Range_filter(src, per_, mult)

hband = filt + smoothrng

lband = filt - smoothrng

L_RF := high > hband and upward > 0

S_RF := low < lband and downward > 0

// Volume -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Volume_condt = volume > sma(volume,sma_length)*volume_f

Volume_condt1 = volume > sma(volume,sma_length1)*volume_f1

//STRATEGY ==========================================================================================================================================================================================================================================================================================================

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

L_1 = L_adx and Volume_condt and L_RF and L_ema

S_1 = S_adx and Volume_condt and S_RF and S_ema

L_2 = L_adx and L_RF and L_ema and Volume_condt1

S_2 = S_adx and S_RF and S_ema and Volume_condt1

L_basic_condt = L_1 or L_2

S_basic_condt = S_1 or S_2

longCond := L_basic_condt

shortCond := S_basic_condt

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

//POSITION PRICE-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

last_open_longCondition := longCondition ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition ? sum_long/nLongs : shortCondition ? sum_short/nShorts : na

//TP---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool long_tp = na, var bool short_tp = na

var int last_long_tp = na, var int last_short_tp = na

var bool Final_Long_tp = na, var bool Final_Short_tp = na

var bool Final_Long_sl0 = na, var bool Final_Short_sl0 = na

var bool Final_Long_sl = na, var bool Final_Short_sl = na

var int last_long_sl = na, var int last_short_sl = na

tp_long = ((nLongs > 1) ? tp_long0 / nLongs : tp_long0) / 100

tp_short = ((nShorts > 1) ? tp_short0 / nShorts : tp_short0) / 100

long_tp := high > (fixnan(Position_Price) * (1 + tp_long)) and in_longCondition

short_tp := low < (fixnan(Position_Price) * (1 - tp_short)) and in_shortCondition

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

Final_Long_tp := (long_tp and last_longCondition > nz(last_long_tp[1]) and last_longCondition > nz(last_long_sl[1]))

Final_Short_tp := (short_tp and last_shortCondition > nz(last_short_tp[1]) and last_shortCondition > nz(last_short_sl[1]))

L_tp = iff(Final_Long_tp, fixnan(Position_Price) * (1 + tp_long) , na)

S_tp = iff(Final_Short_tp, fixnan(Position_Price) * (1 - tp_short) , na)

//TP SIGNALS--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tplLevel = (in_longCondition and

(last_longCondition > nz(last_long_tp[1])) and

(last_longCondition > nz(last_long_sl[1])) and not Final_Long_sl[1]) ?

(nLongs > 1) ?

(fixnan(Position_Price) * (1 + tp_long)) : (last_open_longCondition * (1 + tp_long)) : na

tpsLevel = (in_shortCondition and

(last_shortCondition > nz(last_short_tp[1])) and

(last_shortCondition > nz(last_short_sl[1])) and not Final_Short_sl[1]) ?

(nShorts > 1) ?

(fixnan(Position_Price) * (1 - tp_short)) : (last_open_shortCondition * (1 - tp_short)) : na

//SL ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Risk = sl0

Percent_Capital = 99

sl = in_longCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nLongs)))) :

in_shortCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nShorts)))) : sl0

Normal_long_sl = ((in_longCondition and low <= ((1 - (sl / 100)) * (fixnan(Position_Price)))))

Normal_short_sl = ((in_shortCondition and high >= ((1 + (sl / 100)) * (fixnan(Position_Price)))))

last_long_sl := Normal_long_sl ? time : nz(last_long_sl[1])

last_short_sl := Normal_short_sl ? time : nz(last_short_sl[1])

Final_Long_sl := Normal_long_sl and last_longCondition > nz(last_long_sl[1]) and last_longCondition > nz(last_long_tp[1]) and not Final_Long_tp

Final_Short_sl := Normal_short_sl and last_shortCondition > nz(last_short_sl[1]) and last_shortCondition > nz(last_short_tp[1]) and not Final_Short_tp

//RE-ENTRY ON TP-HIT-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Final_Long_tp or Final_Long_sl

CondIni_long := -1

sum_long := 0.0

nLongs := na

if Final_Short_tp or Final_Short_sl

CondIni_short := 1

sum_short := 0.0

nShorts := na

// Colors ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bar_color = in_longCondition ? #009688 : in_shortCondition ? #f06292 : color.orange

barcolor (color = Bar_color)

//PLOTS==============================================================================================================================================================================================================================================================================================================

plot(L_tp, title = "TP_L", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

plot(S_tp, title = "TP_S", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

//Price plots ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plot((nLongs > 1) or (nShorts > 1) ? Position_Price : na, title = "Price", color = in_longCondition ? color.aqua : color.orange, linewidth = 2, style = plot.style_cross)

plot(tplLevel, title="Long TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

plot(tpsLevel, title="Short TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

//PLOTSHAPES----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(Final_Long_tp, title="TP Long Signal", style = shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , text="TP", textcolor=color.red, transp = 0 )

plotshape(Final_Short_tp, title="TP Short Signal", style = shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny , text="TP", textcolor=color.green, transp = 0 )

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.tiny , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , transp = 0 )

// Backtest ==================================================================================================================================================================================================================================================================================================================================

if L_basic_condt

strategy.entry ("LONG", strategy.long )

if S_basic_condt

strategy.entry ("SHORT", strategy.short )

strategy.exit("TP_L", "LONG", profit = (abs((last_open_longCondition * (1 + tp_long)) - last_open_longCondition) / syminfo.mintick), limit = nLongs >= 1 ? strategy.position_avg_price * (1 + tp_long) : na, loss = (abs((last_open_longCondition*(1-(sl/100)))-last_open_longCondition)/syminfo.mintick))

strategy.exit("TP_S", "SHORT", profit = (abs((last_open_shortCondition * (1 - tp_short)) - last_open_shortCondition) / syminfo.mintick), limit = nShorts >= 1 ? strategy.position_avg_price*(1-(tp_short)) : na, loss = (abs((last_open_shortCondition*(1+(sl/100)))-last_open_shortCondition)/syminfo.mintick))

//By BabehDyo