BB Percent Index Trend Fading Strategi

Penulis:ChaoZhang, Tanggal: 2023-12-06 14:43:39Tag:

Gambaran umum

Strategi ini didasarkan pada indeks persentase BB dikombinasikan dengan indikator RSI dan MFI. Strategi ini membuat keputusan panjang dan pendek dengan mendeteksi price breakout dari Bollinger Bands upper dan lower rail, bersama dengan sinyal oversold/overbought RSI dan sinyal oversold/overbought MFI.

Logika Strategi

- Hitung Bollinger Band Percentage (BB%). BB% mewakili standar deviasi harga relatif terhadap Bollinger middle band, yang menilai arah pasar melalui saluran Bollinger.

- Menggabungkan indikator RSI dan MFI untuk menentukan kondisi overbought dan oversold. RSI membandingkan keuntungan rata-rata dan kerugian rata-rata selama periode waktu untuk menentukan tingkat overbought dan oversold. MFI membandingkan volume dan volume turun untuk menentukan tingkat overbought dan oversold.

- Ketika harga menembus Bollinger lower rail ke atas, pergi panjang; ketika harga menembus Bollinger upper rail ke bawah, pergi pendek. Pada saat yang sama, gunakan sinyal oversold / overbought dari indikator RSI dan MFI untuk penyaringan.

Keuntungan

- Trading trend fading menghindari tren pasar dan mengurangi fluktuasi laba.

- Kombinasi dari beberapa indikator menyaring sinyal dan meningkatkan akurasi keputusan.

- Pengaturan parameter fleksibel untuk menyesuaikan karakteristik risiko-pengembalian strategi.

- Terapkan pada instrumen yang sangat fluktuatif seperti komoditas, forex, cryptocurrency, dll.

Risiko dan Solusi

- Ada kemungkinan tinggi sinyal palsu dari Bollinger breakout, yang membutuhkan kombinasi dari beberapa indikator untuk penyaringan.

- Penghakiman sinyal breakout membutuhkan kriteria yang cukup santai untuk menghindari kehilangan peluang yang baik.

- Sesuaikan pengaturan parameter untuk mengendalikan risiko, seperti ukuran posisi, menaikkan garis stop loss, dll.

Arahan Optimasi

- Menggabungkan mekanisme stop loss berbasis volatilitas seperti indikator ATR.

- Memperkenalkan model pembelajaran mesin untuk membantu menilai kualitas sinyal.

- Mengoptimalkan mekanisme pemilihan instrumen untuk menyesuaikan instrumen yang berpartisipasi secara dinamis.

- Masukkan lebih banyak faktor seperti indikator sentimen, berita, dll untuk meningkatkan kerangka keputusan.

Kesimpulan

Strategi ini terutama diterapkan pada instrumen non-trending volatilitas tinggi. Strategi ini menerapkan perdagangan trend fading melalui kombinasi saluran Bollinger dan indikator. Karakteristik risiko-pengembalian dapat dikendalikan dengan menyesuaikan parameter. Perbaikan lebih lanjut dapat dilakukan dengan memperkenalkan lebih banyak indikator dan model tambahan untuk mengoptimalkan kualitas keputusan, sehingga mencapai kinerja strategi yang lebih baik.

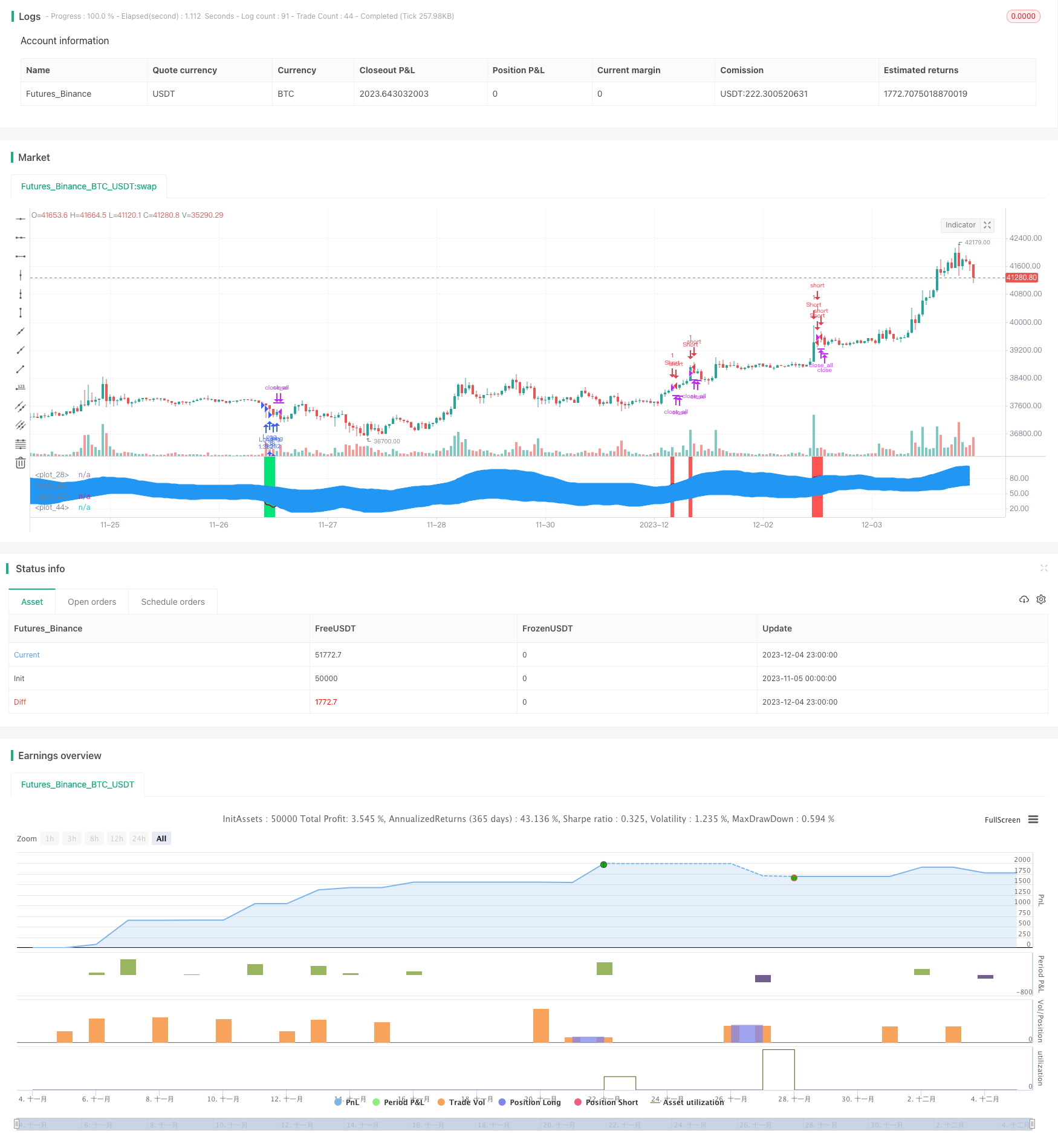

/*backtest

start: 2023-11-05 00:00:00

end: 2023-12-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "BB%/MFI/RSI", shorttitle = "BB%/MFI/RSI", default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 100)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(false, defval = false, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Lot, %")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From Day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To Day")

source = hlc3

length = input(14, minval=1), mult = input(2.0, minval=0.001, maxval=50), bblength = input(50, minval=1, title="BB Period")

DrawRSI_f=input(true, title="Draw RSI?", type=bool)

DrawMFI_f=input(false, title="Draw MFI?", type=bool)

HighlightBreaches=input(true, title="Highlight Oversold/Overbought?", type=bool)

DrawMFI = (not DrawMFI_f) and (not DrawRSI_f) ? true : DrawMFI_f

DrawRSI = (DrawMFI_f and DrawRSI_f) ? false : DrawRSI_f

// RSI

rsi_s = DrawRSI ? rsi(source, length) : na

plot(DrawRSI ? rsi_s : na, color=maroon, linewidth=2)

// MFI

upper_s = DrawMFI ? sum(volume * (change(source) <= 0 ? 0 : source), length) : na

lower_s = DrawMFI ? sum(volume * (change(source) >= 0 ? 0 : source), length) : na

mf = DrawMFI ? rsi(upper_s, lower_s) : na

plot(DrawMFI ? mf : na, color=green, linewidth=2)

// Draw BB on indices

bb_s = DrawRSI ? rsi_s : DrawMFI ? mf : na

basis = sma(bb_s, length)

dev = mult * stdev(bb_s, bblength)

upper = basis + dev

lower = basis - dev

plot(basis, color=red)

p1 = plot(upper, color=blue)

p2 = plot(lower, color=blue)

fill(p1,p2, blue)

b_color = (bb_s > upper) ? red : (bb_s < lower) ? lime : na

bgcolor(HighlightBreaches ? b_color : na, transp = 0)

//Signals

up = bb_s < lower and close < open

dn = bb_s > upper and close > open

size = strategy.position_size

lp = size > 0 and close > open

sp = size < 0 and close < open

exit = (up == false and dn == false) and (lp or sp)

//Trading

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 : lot[1]

if up

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if dn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()

- Bollinger Bands Reversal dengan MA Trend Filter

- Strategi Perdagangan Kuantitatif Berdasarkan RSI

- Strategi perdagangan lintas multi moving average

- Strategi Crossover Rata-rata Bergerak

- Auto S/R Breakout Strategi

- Momentum Strategi Pembukaan dan Penutupan Saluran Harga

- Strategi crossover rata-rata bergerak yang ditingkatkan dengan panduan tren pasar

- Strategi Perdagangan Lilin Yang Besar

- SSL Hybrid Exit Arrow Quant Strategi

- Strategi Waktu ADX Rata-rata Bergerak Ganda

- Strategi perdagangan MACD Bollinger Turtle

- Triple SuperTrend dan Strategi RSI Stoch

- 1% Keuntungan Moving Average Cross Strategy

- Strategi perdagangan lintas rata-rata bergerak kuantitatif tertimbang

- strategi indikator RSI tambahan ganda

- Strategi Tren Crossover Rata-rata Bergerak Ganda

- Strategi Bollinger Bands Reversal

- Strategi Tren Adaptif ATR-ADX V2

- Strategi perdagangan siklus dua faktor

- Strategi Swinger Rata-rata Tertinggi Tertinggi dan Terendah Terendah