Strategi Intraday mengikuti tren dengan beberapa stop

Ringkasan

Strategi ini menggabungkan beberapa ATR stop loss dinamis dan Renko block yang disempurnakan untuk menangkap tren intraday. Ini menggabungkan indikator tren dan indikator block, yang memungkinkan analisis multi-frame waktu untuk secara efektif mengidentifikasi arah tren dan menghentikan stop loss tepat waktu.

Prinsip Strategi

Inti dari strategi ini adalah mekanisme multi-stop ATR. Ini mengatur 3 set stop dinamis ATR, dengan parameter 5x ATR, 10x ATR dan 15x ATR. Ketika harga jatuh di bawah 3 set stop line, ini menunjukkan bahwa tren berubah, dan saat ini posisi terbuka. Dengan pengaturan multi-stop ini, Anda dapat secara efektif menyaring sinyal palsu yang disebabkan oleh fluktuasi jangka pendek.

Bagian inti lainnya adalah blok Renko yang ditingkatkan. Blok ini membagi kenaikan berdasarkan nilai ATR, dan digabungkan dengan indikator SMA untuk menentukan arah tren.

Kondisi masuk dilakukan ketika harga menerobos 3 grup ATR stop loss ke atas, dan kosong ketika harga menembus 3 grup ATR stop loss ke bawah. Kondisi keluar dilakukan ketika harga memicu salah satu grup ATR stop loss atau perubahan warna Renko block.

Keunggulan Strategis

- Multiple ATR Stop Loss, Pengendalian Resiko yang Efektif

- Blok Renko yang lebih baik, lebih sensitif, dan dapat menghentikan kerusakan lebih awal

- Kombinasi indikator tren dan indikator blok untuk memastikan menangkap tren

- Analisis multi-frame waktu, lebih dapat diandalkan untuk menentukan arah tren

- Parameter dapat disesuaikan dengan kondisi pasar yang berbeda

Risiko dan Optimalisasi Strategi

Risiko utama dari strategi ini adalah bahwa stop loss akan diperluas oleh penembusan. Strategi ini dapat dioptimalkan dengan cara berikut:

- Mengatur kelipatan stop loss ATR, dengan relaksasi yang tepat di pasar yang sedang tren; dengan pengetatan yang tepat di pasar yang sedang tren

- Menyesuaikan parameter siklus ATR pada blok Renko untuk menyeimbangkan sensitivitas dan stabilitas

- Menambahkan indikator stop loss lainnya, seperti saluran Donchian, untuk memastikan stop loss lebih dapat diandalkan

- Menambahkan filter untuk menghindari transaksi yang sering terjadi dalam pencatatan

Meringkaskan

Strategi ini secara keseluruhan cocok untuk situasi tren Intraday yang kuat, ditandai dengan ilmu pengaturan stop loss, indikator blok dapat mengidentifikasi perubahan tren lebih awal. Dengan penyesuaian parameter yang dapat disesuaikan dengan lingkungan pasar yang berbeda, ini adalah strategi pelacakan tren yang layak untuk diuji di lapangan.

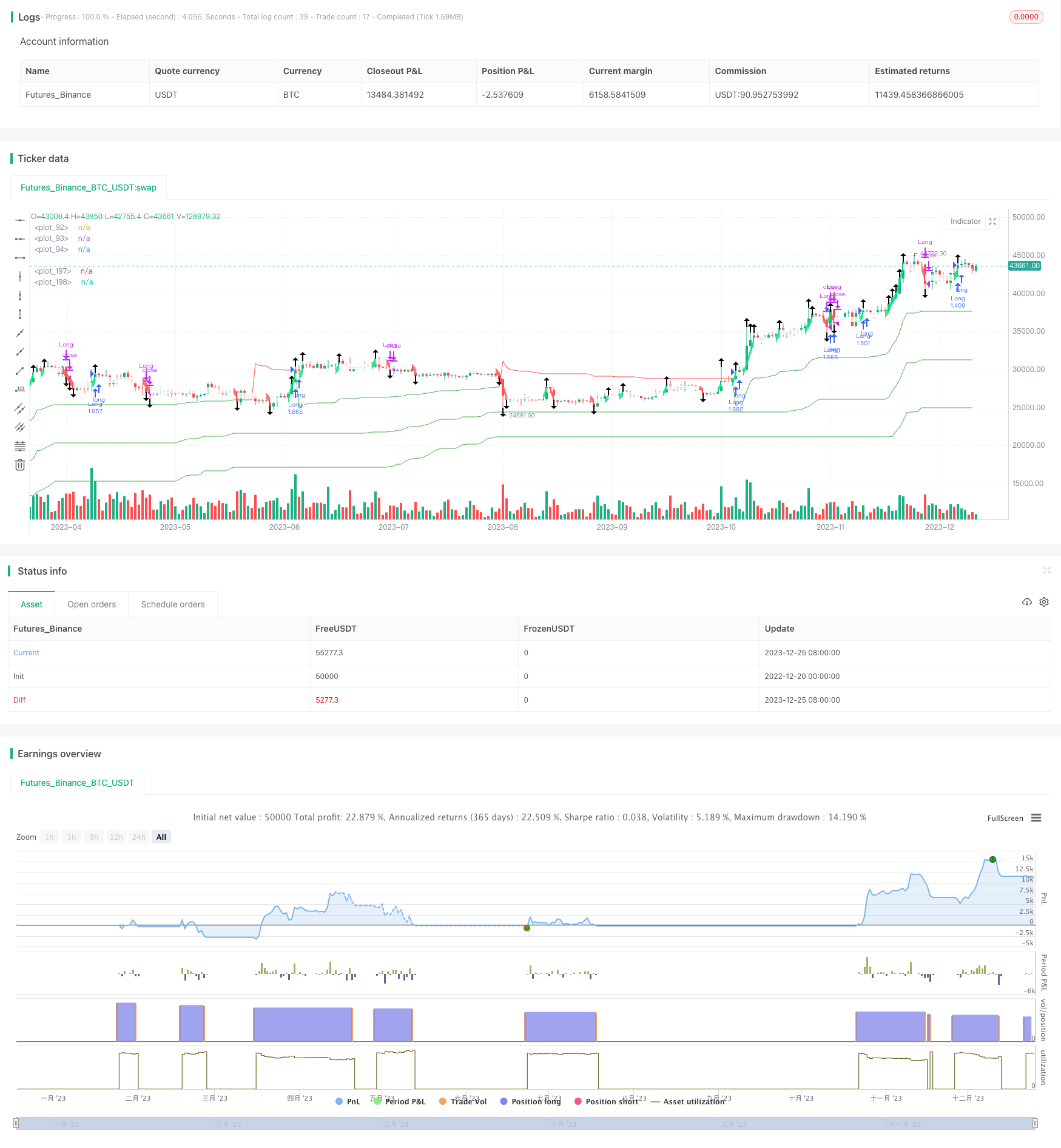

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Lancelot vstop intraday strategy", overlay=true, currency=currency.NONE, initial_capital = 100, commission_type=strategy.commission.percent,

commission_value=0.075, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

///Volatility Stop///

lengtha = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1a = 5

atr_a = atr(lengtha)

max1a = 0.0

min1a = 0.0

is_uptrend_preva = false

stopa = 0.0

vstop_preva = 0.0

vstop1a = 0.0

is_uptrenda = false

is_trend_changeda = false

max_a = 0.0

min_a = 0.0

vstopa = 0.0

max1a := max(nz(max_a[1]), ohlc4)

min1a := min(nz(min_a[1]), ohlc4)

is_uptrend_preva := nz(is_uptrenda[1], true)

stopa := is_uptrend_preva ? max1a - mult1a * atr_a : min1a + mult1a * atr_a

vstop_preva := nz(vstopa[1])

vstop1a := is_uptrend_preva ? max(vstop_preva, stopa) : min(vstop_preva, stopa)

is_uptrenda := ohlc4 - vstop1a >= 0

is_trend_changeda := is_uptrenda != is_uptrend_preva

max_a := is_trend_changeda ? ohlc4 : max1a

min_a := is_trend_changeda ? ohlc4 : min1a

vstopa := is_trend_changeda ? is_uptrenda ? max_a - mult1a * atr_a : min_a + mult1a * atr_a :

vstop1a

///Volatility Stop///

lengthb = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1b = 10

atr_b = atr(lengthb)

max1b = 0.0

min1b = 0.0

is_uptrend_prevb = false

stopb = 0.0

vstop_prevb = 0.0

vstop1b = 0.0

is_uptrendb = false

is_trend_changedb = false

max_b = 0.0

min_b = 0.0

vstopb = 0.0

max1b := max(nz(max_b[1]), ohlc4)

min1b := min(nz(min_b[1]), ohlc4)

is_uptrend_prevb := nz(is_uptrendb[1], true)

stopb := is_uptrend_prevb ? max1b - mult1b * atr_b : min1b + mult1b * atr_b

vstop_prevb := nz(vstopb[1])

vstop1b := is_uptrend_prevb ? max(vstop_prevb, stopb) : min(vstop_prevb, stopb)

is_uptrendb := ohlc4 - vstop1b >= 0

is_trend_changedb := is_uptrendb != is_uptrend_prevb

max_b := is_trend_changedb ? ohlc4 : max1b

min_b := is_trend_changedb ? ohlc4 : min1b

vstopb := is_trend_changedb ? is_uptrendb ? max_b - mult1b * atr_b : min_b + mult1b * atr_b :

vstop1b

///Volatility Stop///

lengthc = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1c = 15

atr_c = atr(lengthc)

max1c = 0.0

min1c = 0.0

is_uptrend_prevc = false

stopc = 0.0

vstop_prevc = 0.0

vstop1c = 0.0

is_uptrendc = false

is_trend_changedc = false

max_c = 0.0

min_c = 0.0

vstopc = 0.0

max1c := max(nz(max_c[1]), ohlc4)

min1c := min(nz(min_c[1]), ohlc4)

is_uptrend_prevc := nz(is_uptrendc[1], true)

stopc := is_uptrend_prevc ? max1c - mult1c * atr_c : min1c + mult1c * atr_c

vstop_prevc := nz(vstopc[1])

vstop1c := is_uptrend_prevc ? max(vstop_prevc, stopc) : min(vstop_prevc, stopc)

is_uptrendc := ohlc4 - vstop1c >= 0

is_trend_changedc := is_uptrendc != is_uptrend_prevc

max_c := is_trend_changedc ? ohlc4 : max1c

min_c := is_trend_changedc ? ohlc4 : min1c

vstopc := is_trend_changedc ? is_uptrendc ? max_c - mult1c * atr_c : min_c + mult1c * atr_c :

vstop1c

plot(vstopa, color=is_uptrenda ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopb, color=is_uptrendb ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopc, color=is_uptrendc ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstopa and close > vstopb and close > vstopc and vstopa > vstopb and vstopa > vstopc and vstopb > vstopc

vstoplongclosecondition = crossunder(close, vstopa)

vstopshortcondition = close < vstopa and close < vstopb and close < vstopc and vstopa < vstopb and vstopa < vstopc and vstopb < vstopc

vstopshortclosecondition = crossover(close, vstopa)

///Renko///

TF = input(title='TimeFrame', type=input.resolution, defval="240")

ATRlength = input(title="ATR length", type=input.integer, defval=60, minval=2, maxval=100)

SMAlength = input(title="SMA length", type=input.integer, defval=5, minval=2, maxval=100)

SMACurTFlength = input(title="SMA CurTF length", type=input.integer, defval=20, minval=2, maxval=100)

HIGH = security(syminfo.tickerid, TF, high)

LOW = security(syminfo.tickerid, TF, low)

CLOSE = security(syminfo.tickerid, TF, close)

ATR = security(syminfo.tickerid, TF, atr(ATRlength))

SMA = security(syminfo.tickerid, TF, sma(close, SMAlength))

SMACurTF = sma(close, SMACurTFlength)

RENKOUP = float(na)

RENKODN = float(na)

H = float(na)

COLOR = color(na)

BUY = int(na)

SELL = int(na)

UP = bool(na)

DN = bool(na)

CHANGE = bool(na)

RENKOUP := na(RENKOUP[1]) ? (HIGH + LOW) / 2 + ATR / 2 : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? (HIGH + LOW) / 2 - ATR / 2 : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP - RENKODN : RENKOUP[1] - RENKODN[1]

COLOR := na(COLOR[1]) ? color.white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

if not CHANGE and close >= RENKOUP[1] + H * 3

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 3

RENKODN := RENKOUP[1] + ATR * 2

COLOR := color.lime

SELL := 0

BUY := BUY + 3

BUY

if not CHANGE and close >= RENKOUP[1] + H * 2

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 2

RENKODN := RENKOUP[1] + ATR

COLOR := color.lime

SELL := 0

BUY := BUY + 2

BUY

if not CHANGE and close >= RENKOUP[1] + H

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR

RENKODN := RENKOUP[1]

COLOR := color.lime

SELL := 0

BUY := BUY + 1

BUY

if not CHANGE and close <= RENKODN[1] - H * 3

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 3

RENKOUP := RENKODN[1] - ATR * 2

COLOR := color.red

BUY := 0

SELL := SELL + 3

SELL

if not CHANGE and close <= RENKODN[1] - H * 2

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 2

RENKOUP := RENKODN[1] - ATR

COLOR := color.red

BUY := 0

SELL := SELL + 2

SELL

if not CHANGE and close <= RENKODN[1] - H

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR

RENKOUP := RENKODN[1]

COLOR := color.red

BUY := 0

SELL := SELL + 1

SELL

plotshape(UP, style=shape.arrowup, location=location.abovebar, size=size.normal)

plotshape(DN, style=shape.arrowdown, location=location.belowbar, size=size.normal)

p1 = plot(RENKOUP, style=plot.style_line, linewidth=1, color=COLOR)

p2 = plot(RENKODN, style=plot.style_line, linewidth=1, color=COLOR)

fill(p1, p2, color=COLOR, transp=80)

///Long Entry///

longcondition = vstoplongcondition and UP

if (longcondition)

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = vstoplongclosecondition or DN

if (closeconditionlong)

strategy.close("Long")

// ///Short Entry///

// shortcondition = vstopshortcondition and DN

// if (shortcondition)

// strategy.entry("Short", strategy.short)

// ///Short exit///

// closeconditionshort = vstopshortclosecondition or UP

// if (closeconditionshort)

// strategy.close("Short")