Menganalisis dengan sabar strategi pita rata-rata bergerak rangkap tiga yang berisi informasi berharga dalam K-line

Ringkasan

Strategi Triple Equilibrium Banding menggunakan beberapa indikator moving average untuk menggali aturan yang tersembunyi di antara fluktuasi harga melalui analisis mendalam pada garis K. Strategi ini memungkinkan perdagangan risiko rendah.

Prinsip Strategi

Strategi ini mengaplikasikan beberapa set indikator EMA berdasarkan garis Brin, membangun saluran harga, dan menemukan hukum fluktuasi harga.

- Menggunakan indikator BodyResistanceChannel untuk memetakan titik resistensi entitas K-line.

- Menggunakan indikator Support/Resistance untuk memetakan titik dukungan dan resistensi multi-hari.

- Menggunakan sistem dual EMA untuk menentukan arah tren harga.

- Menggunakan Hull Mean Line Indicator untuk meluruskan kurva harga.

Pada dasar ini, identifikasi bentuk, penilaian peluang reversal, dan strategi perdagangan lelang dibuat.

Analisis Keunggulan

Strategi ini memiliki keuntungan sebagai berikut:

- Menggunakan beberapa EMA untuk membangun saluran harga, Anda dapat dengan jelas menentukan arah pergerakan harga.

- Aplikasi Hull Average Line Indicator dapat secara efektif meluruskan harga terobosan.

- Kombinasi reversal mode dan channel indicator, memungkinkan transaksi dengan probabilitas tinggi dan risiko rendah.

- Membangun sistem indikator multi-lapisan, sinyal perdagangan stabil dan dapat diandalkan.

Analisis risiko

Strategi ini juga memiliki risiko sebagai berikut:

- Risiko terobosan saluran harga yang menyebabkan kerugian besar. Solusi yang tepat adalah dengan menggunakan stop loss bergerak untuk mengurangi kerugian tunggal.

- Risiko kesalahan penghakiman bentuk terbalik yang menyebabkan sinyal yang salah. Solusi yang tepat adalah mengoptimalkan parameter dan meningkatkan akurasi penghakiman bentuk.

- Risiko ketidakcocokan parameter indikator yang menyebabkan penurunan kualitas sinyal perdagangan. Solusi yang ditargetkan adalah pengujian optimasi parameter kombinasi ganda.

Arah optimasi

Strategi ini dapat dioptimalkan dengan cara:

- Mengoptimalkan kombinasi parameter EMA siklus agar indikator lebih sesuai dengan karakteristik pasar.

- Adaptasi posisi stop loss untuk meminimalkan risiko kerugian tunggal dengan asumsi bahwa keuntungan dijamin.

- Menambahkan modul penyesuaian posisi dinamis berdasarkan volatilitas, untuk mengontrol risiko secara efektif.

- Dengan menggunakan teknologi pembelajaran mendalam, kita dapat menggali lebih banyak aturan harga dan meningkatkan kualitas sinyal.

Meringkaskan

Triple Equilibrium Waveband Strategi dalam menggali hukum fluktuasi harga, stabil dan efisien, layak untuk diterapkan dalam jangka panjang dan terus dioptimalkan. Investasi membutuhkan akal dan kesabaran, langkah demi langkah adalah cara untuk menang.

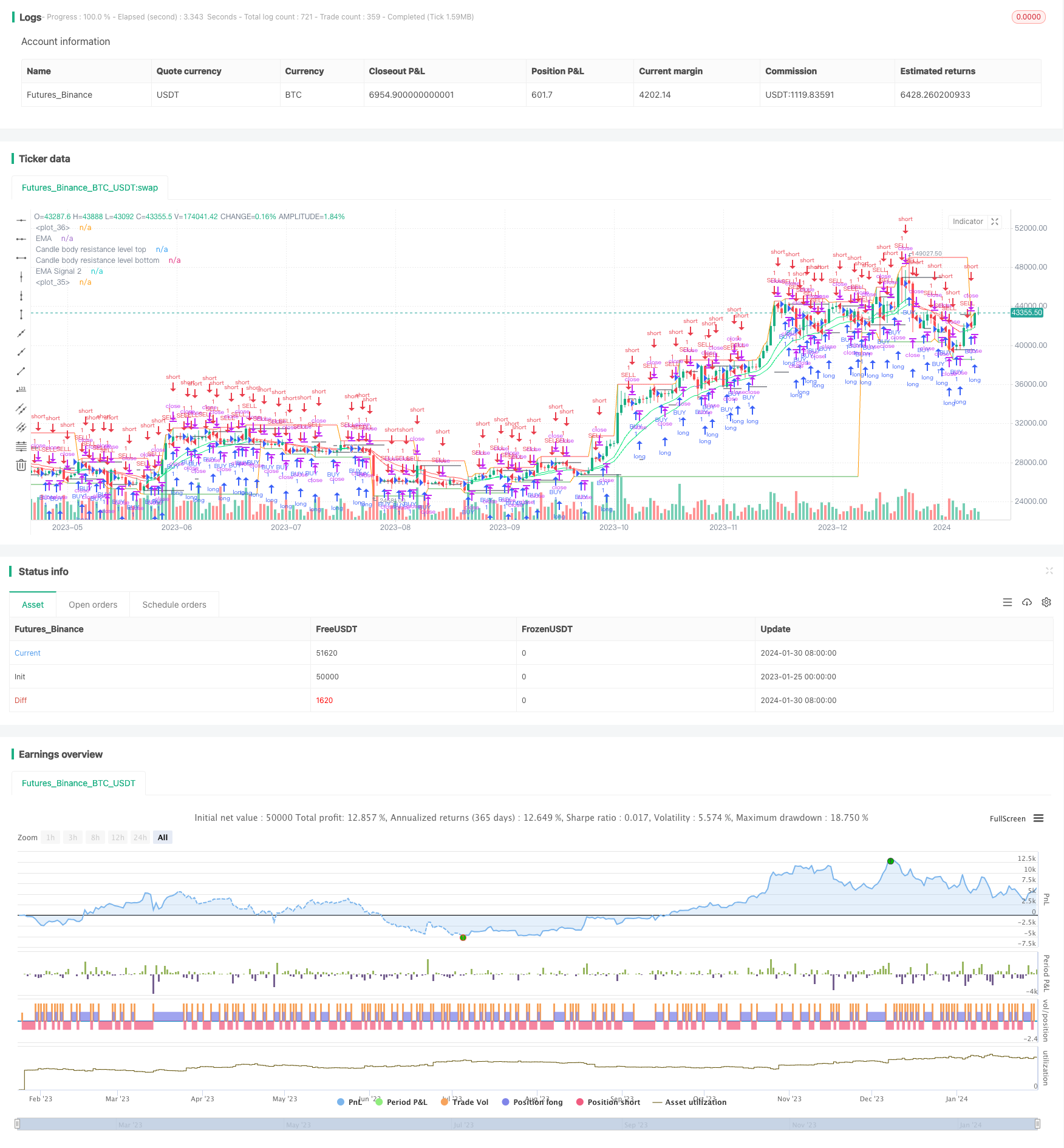

/*backtest

start: 2023-01-25 00:00:00

end: 2024-01-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//╭╮╱╱╭╮╭╮╱╱╭╮

//┃╰╮╭╯┃┃┃╱╱┃┃

//╰╮┃┃╭┻╯┣╮╭┫╰━┳╮╭┳━━╮

//╱┃╰╯┃╭╮┃┃┃┃╭╮┃┃┃┃━━┫

//╱╰╮╭┫╰╯┃╰╯┃╰╯┃╰╯┣━━┃

//╱╱╰╯╰━━┻━━┻━━┻━━┻━━╯

//╭━━━┳╮╱╱╱╱╱╱╱╭╮

//┃╭━╮┃┃╱╱╱╱╱╱╱┃┃

//┃┃╱╰┫╰━┳━━┳━╮╭━╮╭━━┫┃

//┃┃╱╭┫╭╮┃╭╮┃╭╮┫╭╮┫┃━┫┃

//┃╰━╯┃┃┃┃╭╮┃┃┃┃┃┃┃┃━┫╰╮

//╰━━━┻╯╰┻╯╰┻╯╰┻╯╰┻━━┻━╯

//━╯

// http://www.vdubus.co.uk/

strategy(title='Vdub FX SniperVX3 / Strategy v3', shorttitle='Vdub_FX_SniperVX3_Strategy', overlay=true, pyramiding=0, initial_capital=1000, currency=currency.USD)

//Candle body resistance Channel-----------------------------//

len = 34

src = input(close, title="Candle body resistance Channel")

out = sma(src, len)

last8h = highest(close, 13)

lastl8 = lowest(close, 13)

bearish = cross(close,out) == 1 and falling(close, 1)

bullish = cross(close,out) == 1 and rising(close, 1)

channel2=input(false, title="Bar Channel On/Off")

ul2=plot(channel2?last8h:last8h==nz(last8h[1])?last8h:na, color=black, linewidth=1, style=linebr, title="Candle body resistance level top", offset=0)

ll2=plot(channel2?lastl8:lastl8==nz(lastl8[1])?lastl8:na, color=black, linewidth=1, style=linebr, title="Candle body resistance level bottom", offset=0)

//fill(ul2, ll2, color=black, transp=95, title="Candle body resistance Channel")

//-----------------Support and Resistance

RST = input(title='Support / Resistance length:', defval=10)

RSTT = valuewhen(high >= highest(high, RST), high, 0)

RSTB = valuewhen(low <= lowest(low, RST), low, 0)

RT2 = plot(RSTT, color=RSTT != RSTT[1] ? na : red, linewidth=1, offset=+0)

RB2 = plot(RSTB, color=RSTB != RSTB[1] ? na : green, linewidth=1, offset=0)

//--------------------Trend colour ema------------------------------------------------//

src0 = close, len0 = input(13, minval=1, title="EMA 1")

ema0 = ema(src0, len0)

direction = rising(ema0, 2) ? +1 : falling(ema0, 2) ? -1 : 0

plot_color = direction > 0 ? lime: direction < 0 ? red : na

plot(ema0, title="EMA", style=line, linewidth=1, color = plot_color)

//-------------------- ema 2------------------------------------------------//

src02 = close, len02 = input(21, minval=1, title="EMA 2")

ema02 = ema(src02, len02)

direction2 = rising(ema02, 2) ? +1 : falling(ema02, 2) ? -1 : 0

plot_color2 = direction2 > 0 ? lime: direction2 < 0 ? red : na

plot(ema02, title="EMA Signal 2", style=line, linewidth=1, color = plot_color2)

//=============Hull MA//

show_hma = input(false, title="Display Hull MA Set:")

hma_src = input(close, title="Hull MA's Source:")

hma_base_length = input(8, minval=1, title="Hull MA's Base Length:")

hma_length_scalar = input(5, minval=0, title="Hull MA's Length Scalar:")

hullma(src, length)=>wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

plot(not show_hma ? na : hullma(hma_src, hma_base_length+hma_length_scalar*6), color=black, linewidth=2, title="Hull MA")

//============ signal Generator ==================================//

Piriod=input('720')

ch1 = request.security(syminfo.tickerid, Piriod, open)

ch2 = request.security(syminfo.tickerid, Piriod, close)

longCondition = crossover(request.security(syminfo.tickerid, Piriod, close),request.security(syminfo.tickerid, Piriod, open))

if (longCondition)

strategy.entry("BUY", strategy.long)

shortCondition = crossunder(request.security(syminfo.tickerid, Piriod, close),request.security(syminfo.tickerid, Piriod, open))

if (shortCondition)

strategy.entry("SELL", strategy.short)

///////////////////////////////////////////////////////////////////////////////////////////