概述

该策略采用了布林带、RSI、ADX、MACD等多个指标对市场趋势进行判断,具有较强的趋势识别能力。当指标信号同时 bullish 时,采取追涨策略;当指标信号同时 bearish 时,平仓止损。

策略原理

- 使用布林带判断价格是否处在布林带上轨或下轨附近,作为判定趋势是否形成的依据

- 结合RSI指标判断是否处于超买超卖区域,避免假突破

- 使用ADX判断趋势力度,只有在趋势力度较强时才发出信号

- 采用MACD判断短期和长期趋势一致性

- 结合日内时间段,只在指定交易时段交易

通过多指标组合判断,准确识别价格趋势,在趋势发生时及时追踪,实现超额收益。

优势分析

该策略最大的优势在于指标组合判断较为全面和准确,能有效识别价格趋势,避免因单一指标造成的假信号。

具体来说,优势有:

- 布林带能判断价格波动范围和强弱程度

- RSI避免买进超买区域,卖出超卖区域

- ADX判断趋势力度,只跟随强势趋势

- MACD判断短长线一致性

- 限定交易时段,避免隔夜风险

通过指标组合判断,能最大程度减少假信号,增强策略稳定性。

风险分析

该策略主要风险来自:

- 突发事件造成指标失效

- 震荡行情中产生大量假信号

针对风险1,由于依赖多个指标,能够一定程度上避免单一指标失效的问题,但仍需完善风控机制。

针对风险2,可适当调整参数,缩小交易区间,减少交易频率,降低风险。

优化方向

该策略主要可优化的方向包括:

- 增加止损机制,如移动止损、时间止损、突破止损等,避免拉回过深

- 优化参数,调整指标参数组合,寻找最优参数

- 增加过滤条件,如成交量过滤,避免量小的假突破

- 结合更多指标,如KDJ、OBV等,提升信号准确性

- 采用机器学习方法自动优化参数

通过持续优化,不断提高策略参数健壮性,降低假信号概率。

总结

该策略整体来说识别趋势信号能力较强,通过指标组合判断,能有效识别价格趋势,max|max|

但是也存在一定风险,需要不断完善风控机制,持续优化参数,才能长期稳定运作。如果后期能引入机器学习等方法实现参数自动优化,将大大增强策略的鲁棒性和收益能力。

策略源码

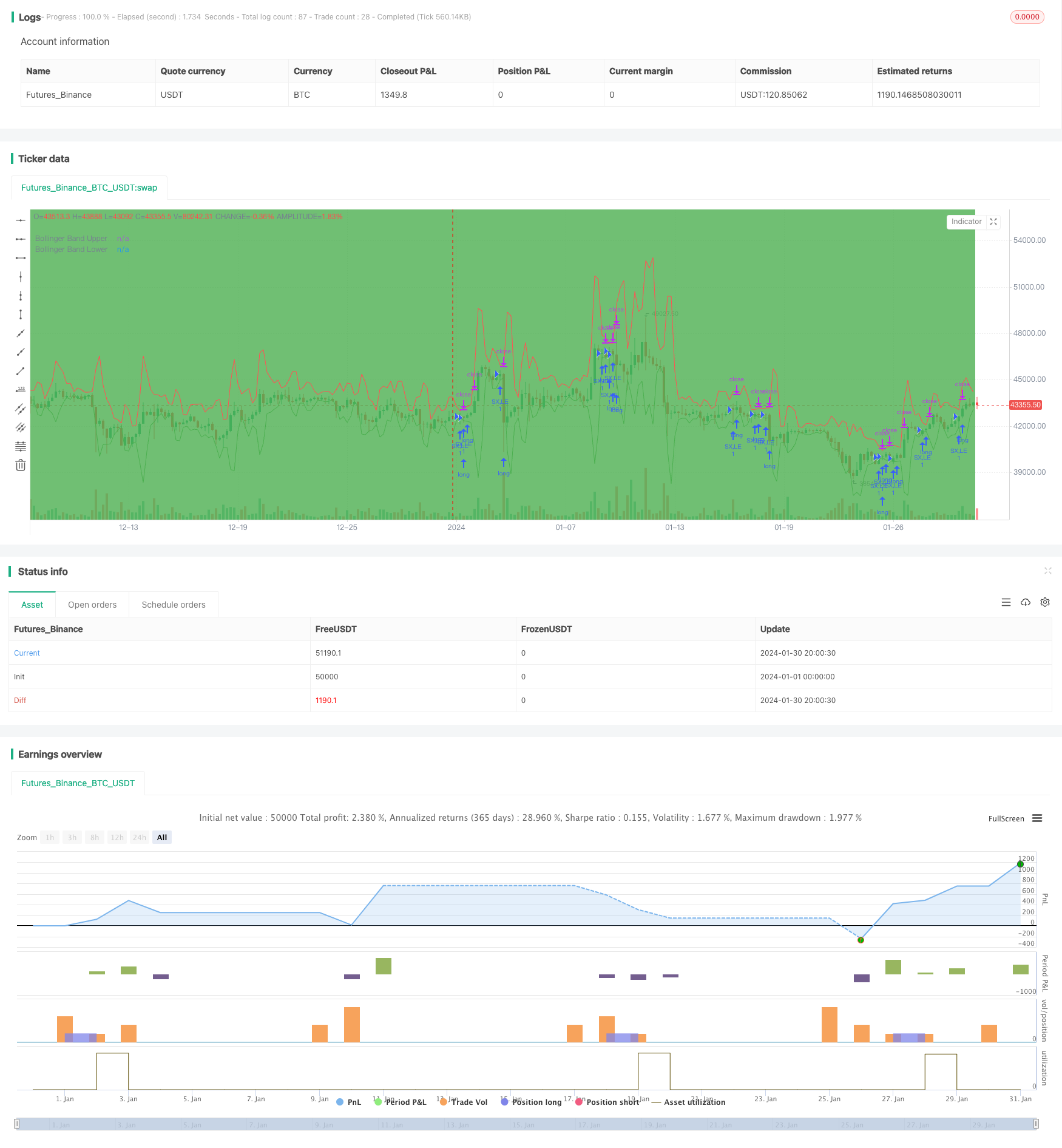

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 5h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © abilash.s.90

dIMinusCalc(adxLen) =>

smoothedTrueRange = 0.0

smoothedDirectionalMovementMinus = 0.0

dIMinus = 0.0

trueRange = 0.0

directionalMovementMinus = 0.0

trueRange := max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

directionalMovementMinus := nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

smoothedTrueRange := nz(smoothedTrueRange[1]) - (nz(smoothedTrueRange[1])/adxLen) + trueRange

smoothedDirectionalMovementMinus := nz(smoothedDirectionalMovementMinus[1]) - (nz(smoothedDirectionalMovementMinus[1])/adxLen) + directionalMovementMinus

dIMinus := smoothedDirectionalMovementMinus / smoothedTrueRange * 100

dIMinus

dIPlusCalc(adxLen) =>

smoothedTrueRange = 0.0

smoothedDirectionalMovementPlus = 0.0

dIPlus = 0.0

trueRange = 0.0

directionalMovementPlus = 0.0

trueRange := max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

directionalMovementPlus := high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

smoothedTrueRange := nz(smoothedTrueRange[1]) - (nz(smoothedTrueRange[1])/adxLen) + trueRange

smoothedDirectionalMovementPlus := nz(smoothedDirectionalMovementPlus[1]) - (nz(smoothedDirectionalMovementPlus[1])/adxLen) + directionalMovementPlus

dIPlus := smoothedDirectionalMovementPlus / smoothedTrueRange * 100

dIPlus

Adx(adxLen) =>

dIPlus = 0.0

dIMinus = 0.0

dX = 0.0

aDX = 0.0

dIPlus := dIPlusCalc(adxLen)

dIMinus := dIMinusCalc(adxLen)

dX := abs(dIPlus-dIMinus) / (dIPlus+dIMinus)*100

aDX := sma(dX, adxLen)

aDX

BarInSession(sess) => time(timeframe.period, sess) != 0

//@version=4

strategy("Bollinger Band + RSI + ADX + MACD", overlay=true)

//Session

session = input(title="Trading Session", type=input.session, defval="0930-1500")

sessionColor = BarInSession(session) ? color.green : na

bgcolor(color=sessionColor, transp=95)

// Bollinger Bands

src = input(high, title="Bollinger Band Source", type=input.source)

length = input(3, minval=1, type=input.integer, title="Bollinger Band Length")

mult = input(4.989, minval=0.001, maxval=50, step=0.001, type=input.float, title="Bollinger Band Std Dev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(upper, title="Bollinger Band Upper", color=color.red)

plot(lower, title="Bollinger Band Lower", color=color.green)

// RSI

rsiSrc = input(close, title="RSI Source", type=input.source)

rsiLength = input(16, minval=1, type=input.integer, title="RSI Length")

rsiComparator = input(39.2, title="RSI Comparator", type=input.float, step=0.1)

rsi = rsi(rsiSrc, rsiLength)

// ADX

adxLength = input(14, minval=1, type=input.integer, title="ADX Length")

adxComparator = input(14, minval=1, type=input.integer, title="ADX Comparator")

adx = Adx(adxLength)

// Heikinashi

haClose = security(heikinashi(syminfo.ticker), timeframe.period, close)

haOpen = security(heikinashi(syminfo.ticker), timeframe.period, open)

nextHaOpen = (haOpen + haClose) / 2

//MACD

macdCalcTypeProcessed = input(title="MACD Source", type=input.source, defval=high)

fast = input(12, title="MACD Fast")

slow = input(20, title="MACD Slow")

signalLen = input(15, title="MACD Signal")

fastMA = ema(macdCalcTypeProcessed, fast)

slowMA = ema(macdCalcTypeProcessed, slow)

macd = fastMA - slowMA

signal = sma(macd, signalLen)

longCondition() =>

(low < lower) and (rsi[0] > rsiComparator) and (adx > adxComparator) and (close > nextHaOpen) and BarInSession(session) and macd > signal

stop = (close - max((low - (low * 0.0022)), (close - (close * 0.0032)))) / syminfo.mintick

target = (max(upper, (close + (close * 0.0075))) - close) / syminfo.mintick

strategy.entry("SX,LE", strategy.long, when=longCondition(), comment="SX,LE")

strategy.close_all(when=(not BarInSession(session)))

strategy.exit("LX", from_entry="SX,LE", profit=target, loss=stop)