本策略综合运用双移动平均线和RSI指标构建多空交叉交易策略。该策略可以捕捉中长线趋势,同时利用短线指标避免不必要的震荡。

策略原理

本策略使用两组移动平均线,分别是快速移动平均线(EMA 59和EMA 82)和慢速移动平均线(EMA 96和EMA 95)。当价格从下向上跨过快速移动平均线时,做多;当价格从上向下跨过快速移动平均线时,做空。同时,RSI指标的过买过卖区域用于确认交易信号和止损。

具体来说,当快速EMA向上突破慢速EMA时生成多头信号。此时如果RSI低于30(超卖区域),则进行多头入场。当快速EMA向下跌破慢速EMA时,产生空头信号。如果这时RSI高于70(超买区域),则进行空头入场。

使用双移动平均线的优势是可以更好地识别中长线趋势的变化。RSI指标则可以过滤掉部分假突破带来的噪音交易。

策略优势

- 利用双移动平均线捕捉中长线趋势

- RSI指标过滤噪音交易

- 结合趋势跟随和反转交易

- 交易逻辑简单清晰

风险分析

- 大幅度震荡市场中,移动平均线生成的交易信号可能受到欺骗

- RSI指标在某些市场情况下也会失效

- 止损点设置需要谨慎,避免过于宽松或紧迫

策略优化方向

- 测试更长周期的移动平均线组合

- 尝试不同的参数调整,如RSI看涨看跌区间的变化

- 增加附加过滤条件,如交易量指标等

- 优化止损策略,结合ATR等指标动态止损

总结

本策略整合双移动平均线的趋势跟随与RSI指标的反转交易。双EMA追踪中长线趋势方向,RSI用于确认交易信号有效性和止损。这是一个简单实用的多空交叉策略,通过参数调整和优化可适应不同市场环境。

策略源码

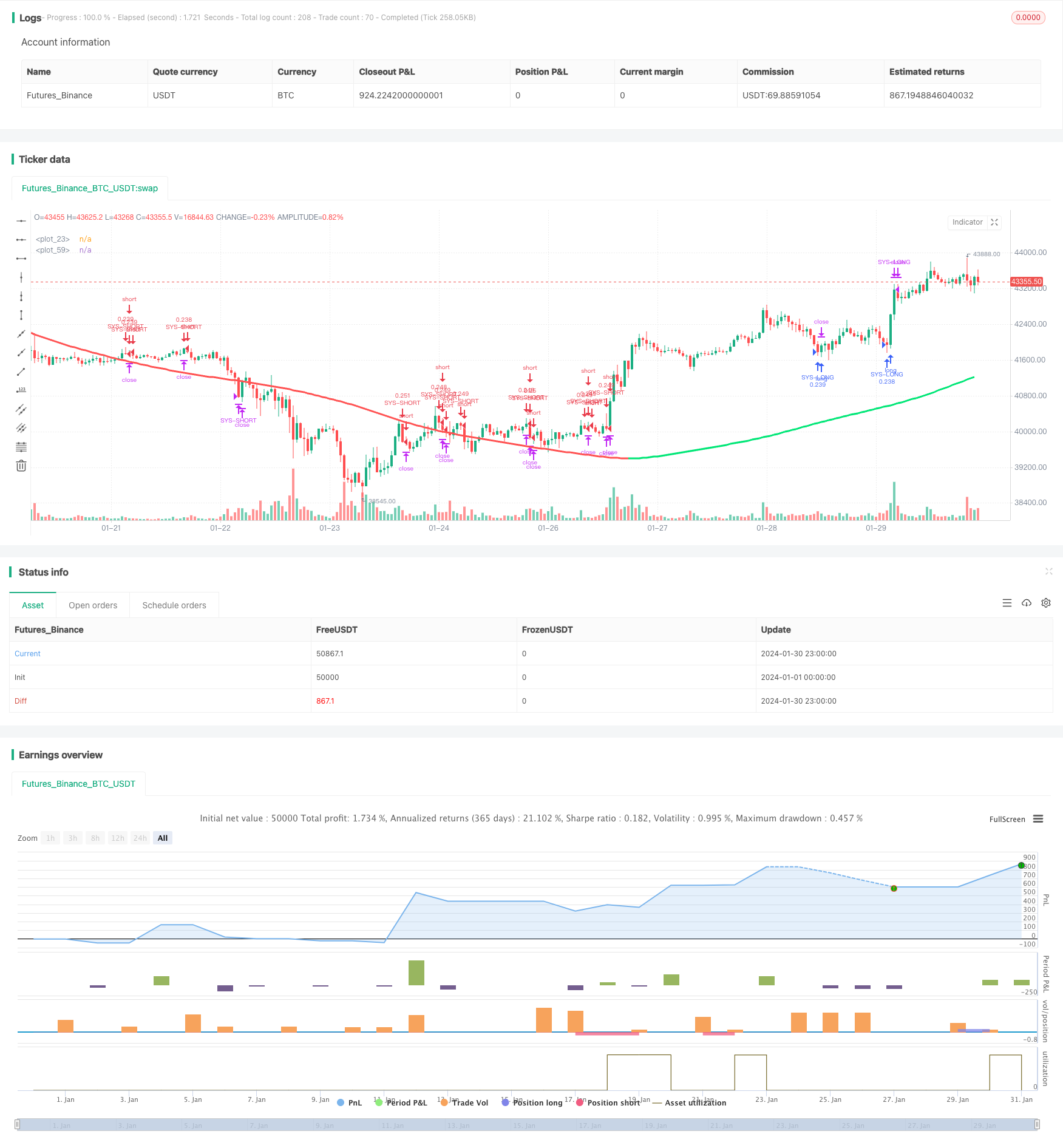

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Swing Hull/rsi/EMA Strategy", overlay=true,default_qty_type=strategy.cash,default_qty_value=10000,scale=true,initial_capital=10000,currency=currency.USD)

//A Swing trading strategy that use a combination of indicators, rsi for target, hull for overall direction enad ema for entering the martket.

// hull ma copied from syrowof HullMA who copied from mohamed982 :) thanks both

// Performance

n=input(title="period",defval=500)

n2ma=2*wma(close,round(n/2))

nma=wma(close,n)

diff=n2ma-nma

sqn=round(sqrt(n))

n2ma1=2*wma(close[1],round(n/2))

nma1=wma(close[1],n)

diff1=n2ma1-nma1

sqn1=round(sqrt(n))

n1=wma(diff,sqn)

n2=wma(diff1,sqn)

c=n1>n2?green:red

ma=plot(n1,color=c)

// RSi and Moving averages

length = input( 14 )

overSold = input( 70)

overBought = input( 30)

point = 0.0001

dev= 2

fastLength = input(59)

fastLengthL = input(82)

slowLength = input(96)

slowLengthL = input(95)

price = close

mafast = ema(price, fastLength)

mafastL= ema(price, fastLengthL)

maslow = ema(price, slowLength)

maslowL = ema(price, slowLengthL)

vrsi = rsi(price, length)

cShort = (crossunder(vrsi, overBought))

condDown = n2 >= n1

condUp = condDown != true

closeLong = (crossover(vrsi, overSold))

closeShort = cShort

// Strategy Logic

longCondition = n1> n2

shortCondition = longCondition != true

col =condUp ? lime : condDown ? red : yellow

plot(n1,color=col,linewidth=3)

if (not na(vrsi))

if shortCondition

if (price[0] < maslow[0] and price[1] > mafast[1]) //cross entry

strategy.entry("SYS-SHORT", strategy.short, comment="short")

strategy.close("SYS-SHORT", when=closeShort) //output logic

if (not na(vrsi))

if longCondition // swing condition

if (price[0] < mafast[0] and price[1] > mafast[1]) //cross entry

strategy.entry("SYS-LONG", strategy.long, comment="long")

strategy.close("SYS-LONG", when=closeLong) //output logic

// Stop Loss

sl = input(75)

Stop = sl * 10

Q = 100

strategy.exit("Out Long", "SYS-LONG", qty_percent=Q, loss=Stop)

strategy.exit("Out Short", "SYS-SHORT", qty_percent=Q, loss=Stop)

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)