Strategi Momentum Squeeze Beruang malas

Penulis:ChaoZhang, Tanggal: 2024-02-02 17:42:58Tag:

Gambaran umum

Strategi Momentum Squeeze Lazy Bear adalah strategi perdagangan kuantitatif yang menggabungkan Bollinger Bands, Keltner Channels dan indikator momentum.

Keuntungan utama dari strategi ini adalah dapat secara otomatis mengidentifikasi awal pergerakan tren dan menentukan waktu masuk dengan indikator momentum.

Logika Strategi

Strategi Lazy Bear Squeeze Momentum membuat penilaian berdasarkan tiga indikator berikut:

- Bollinger Bands: Termasuk band tengah, band atas dan band bawah

- Saluran Keltner: Termasuk garis tengah, garis atas dan garis bawah

- Indikator Momentum: Harga saat ini dikurangi harga n hari yang lalu

Ketika band atas Bollinger berada di bawah garis atas Keltner dan band bawah Bollinger berada di atas garis bawah Keltner, kita menentukan pasar berada dalam tekanan.

Untuk menentukan waktu masuk, kita menggunakan indikator momentum untuk mengukur kecepatan perubahan harga. Sinyal beli dihasilkan ketika momentum melintasi di atas rata-rata bergerak, dan sinyal jual ketika momentum melintasi di bawah rata-rata bergerak.

Analisis Keuntungan

Keuntungan utama dari strategi Lazy Bear Squeeze Momentum:

- Mengidentifikasi secara otomatis entri awal dalam tren baru

- Kombinasi indikator mencegah sinyal palsu

- Menangkap baik tren dan rata-rata-reversi

- Parameter yang dapat disesuaikan untuk optimasi

- Kuat di berbagai produk

Analisis Risiko

Ada juga risiko tertentu untuk strategi Lazy Bear Squeeze Momentum:

- Kemungkinan sinyal palsu dari Bollinger & Keltner

- Momentum ketidakstabilan, hilang entri terbaik

- Kinerja yang buruk tanpa optimasi

- Korélasi tinggi dengan pemilihan produk

Untuk mengurangi risiko, rekomendasi termasuk: mengoptimalkan panjang untuk Bollinger & Keltner, menyesuaikan stop loss, memilih produk cair, memverifikasi sinyal dengan indikator lain.

Arahan Optimasi

Arah utama untuk meningkatkan kinerja lebih lanjut:

- Kombinasi uji parameter di seluruh produk dan kerangka waktu

- Mengoptimalkan panjang untuk Bollinger Bands dan Saluran Keltner

- Mengoptimalkan panjang indikator momentum

- Stop loss/take profit yang berbeda untuk long dan short

- Indikator tambahan untuk verifikasi sinyal

Melalui pengujian dan optimasi yang ketat, strategi ini dapat meningkatkan keunggulan dan profitabilitasnya.

Kesimpulan

Strategi Lazy Bear Squeeze Momentum memiliki generasi sinyal yang kuat melalui pendekatan multi-indikator, dan dapat secara efektif mengidentifikasi awal tren baru. tetapi juga membawa risiko yang memerlukan optimasi di seluruh instrumen perdagangan. dengan pengujian dan peningkatan terus-menerus, ini dapat menjadi sistem perdagangan algoritmik yang kuat.

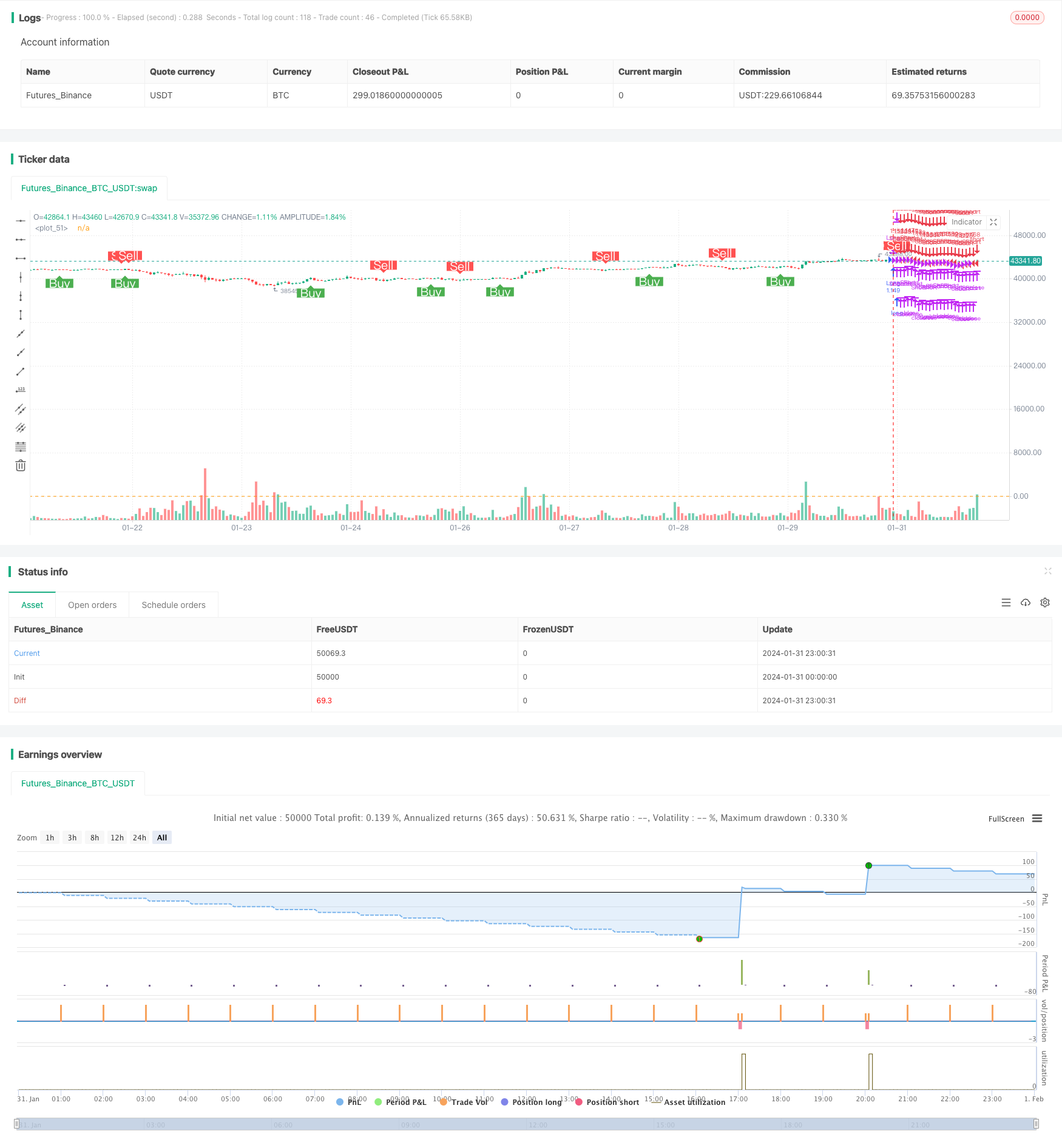

/*backtest

start: 2024-01-31 00:00:00

end: 2024-02-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mtahreemalam original strategy by LazyBear

strategy(title = 'SQM Strategy, TP & SL',

shorttitle = 'Squeeze.M Strat',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 1000,

commission_type=strategy.commission.percent,

commission_value=0.0,

process_orders_on_close=true,

use_bar_magnifier=true)

//Strategy logic

strategy_logic = input.string("Cross above 0", "Strategy Logic", options = ["LazyBear", "Cross above 0"])

// Date Range

testPeriodSwitch = input(false, "Custom Backtesting Date Range",group="Backtesting Date Range")

i_startTime = input(defval = timestamp("01 Jan 2022 00:01 +0000"), title = "Backtesting Start Time",group="Backtesting Date Range")

i_endTime = input(defval = timestamp("31 Dec 2022 23:59 +0000"), title = "Backtesting End Time",group="Backtesting Date Range")

timeCond = true

isPeriod = testPeriodSwitch == true ? timeCond : true

//// Stoploss and Take Profit Parameters

// Enable Long Strategy

enable_long_strategy = input.bool(true, title='Enable Long Strategy', group='SL/TP For Long Strategy', inline='1')

long_stoploss_value = input.float(defval=5, title='Stoploss %', minval=0.1, group='SL/TP For Long Strategy', inline='2')

long_stoploss_percentage = close * (long_stoploss_value / 100) / syminfo.mintick

long_takeprofit_value = input.float(defval=5, title='Take Profit %', minval=0.1, group='SL/TP For Long Strategy', inline='2')

long_takeprofit_percentage = close * (long_takeprofit_value / 100) / syminfo.mintick

// Enable Short Strategy

enable_short_strategy = input.bool(true, title='Enable Short Strategy', group='SL/TP For Short Strategy', inline='3')

short_stoploss_value = input.float(defval=5, title='Stoploss %', minval=0.1, group='SL/TP For Short Strategy', inline='4')

short_stoploss_percentage = close * (short_stoploss_value / 100) / syminfo.mintick

short_takeprofit_value = input.float(defval=5, title='Take Profit %', minval=0.1, group='SL/TP For Short Strategy', inline='4')

short_takeprofit_percentage = close * (short_takeprofit_value / 100) / syminfo.mintick

//// Inputs

//SQUEEZE MOMENTUM STRATEGY

length = input(20, title='BB Length', group = "Squeeze Momentum Settings")

mult = input(2.0, title='BB MultFactor', group = "Squeeze Momentum Settings")

source = close

lengthKC = input(20, title='KC Length', group = "Squeeze Momentum Settings")

multKC = input(1.5, title='KC MultFactor', group = "Squeeze Momentum Settings")

useTrueRange = input(true, title='Use TrueRange (KC)', group = "Squeeze Momentum Settings")

signalPeriod=input(5, title="Signal Length", group = "Squeeze Momentum Settings")

show_labels_sqm = input(title='Show Buy/Sell SQM Labels', defval=true, group = "Squeeze Momentum Settings")

h0 = hline(0)

// Defining MA

ma = ta.sma(source, length)

// Calculate BB

basis = ma

dev = mult * ta.stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

// SqzON | SqzOFF | noSqz

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// Momentum

val = ta.linreg(source - math.avg(math.avg(ta.highest(high, lengthKC), ta.lowest(low, lengthKC)), ta.sma(close, lengthKC)), lengthKC, 0)

red_line = ta.sma(val,signalPeriod)

blue_line = val

// lqm = if val > 0

// if val > nz(val[1])

// long_sqm_custom

// if val < nz(val[1])

// short_sqm_custom

// Plots

//plot(val, style = plot.style_line, title = "blue line", color= color.blue, linewidth=2)

//plot(ta.sma(val,SignalPeriod), style = plot.style_line, title = "red line",color = color.red, linewidth=2)

//plot(val, color=blue, linewidth=2)

//plot(0, color=color.gray, style=plot.style_cross, linewidth=2)

//plot(red_line, color=red, linewidth=2)

//LOGIC

//momentum filter

//filterMom = useMomAverage ? math.abs(val) > MomentumMin / 100000 ? true : false : true

//}

////SQM Long Short Conditions

//Lazy Bear Buy Sell Condition

// long_sqm_lazy = (blue_line>red_line)

// short_sqm_lazy = (blue_line<red_line)

long_sqm_lazy = ta.crossover(blue_line,red_line)

short_sqm_lazy = ta.crossunder(blue_line,red_line)

//Custom Buy Sell Condition

dir_sqm = val < 0 ? -1 : 1

long_sqm_custom = dir_sqm == 1 //and dir_sqm[1] == -1

short_sqm_custom = dir_sqm == -1 //and dir_sqm[1] == 1

long_sqm = strategy_logic == "LazyBear" ? long_sqm_lazy : long_sqm_custom

short_sqm = strategy_logic == "LazyBear" ? short_sqm_lazy : short_sqm_custom

// Plot Stoploss & Take Profit Levels

long_stoploss_price = strategy.position_avg_price * (1 - long_stoploss_value / 100)

long_takeprofit_price = strategy.position_avg_price * (1 + long_takeprofit_value / 100)

short_stoploss_price = strategy.position_avg_price * (1 + short_stoploss_value / 100)

short_takeprofit_price = strategy.position_avg_price * (1 - short_takeprofit_value / 100)

plot(enable_long_strategy and not enable_short_strategy ? long_stoploss_percentage : na, color=color.red, style=plot.style_linebr, linewidth=2, title='Long SL Level')

plot(enable_long_strategy and not enable_short_strategy ? long_takeprofit_percentage : na, color=color.green, style=plot.style_linebr, linewidth=2, title='Long TP Level')

plot(enable_short_strategy and not enable_long_strategy ? short_stoploss_price : na, color=color.red, style=plot.style_linebr, linewidth=2, title='Short SL Level')

plot(enable_short_strategy and not enable_long_strategy ? short_takeprofit_price : na, color=color.green, style=plot.style_linebr, linewidth=2, title='Short TP Level')

// Long Strategy

if long_sqm and enable_long_strategy == true

strategy.entry('Long', strategy.long)

strategy.exit('Long SL/TP', from_entry='Long', loss=long_stoploss_percentage, profit=long_takeprofit_percentage)

strategy.close('Long', comment = "L. CL")

// Short Strategy

if short_sqm and enable_short_strategy == true

strategy.entry('Short', strategy.short)

strategy.exit('Short SL/TP', from_entry='Short', loss=short_stoploss_percentage, profit=short_takeprofit_percentage)

strategy.close('Short', comment = "S.Cl")

plot_sqm_long = long_sqm and not long_sqm[1]

plot_sqm_short = short_sqm and not short_sqm[1]

plotshape(plot_sqm_long and show_labels_sqm, title='Buy', style=shape.labelup, location=location.belowbar, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(plot_sqm_short and show_labels_sqm, title='Sell', style=shape.labeldown, location=location.abovebar, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

// Date Range EXIT

if (not isPeriod)

strategy.cancel_all()

strategy.close_all()

- Strategi Pelacakan Osilasi Pita Isolasi

- Strategi Double Donchian Channel Breakout

- Strategi rata-rata bergerak CRSI

- Strategi Perdagangan Jaringan Kuantum yang Beradaptasi Sendiri

- Strategi gabungan Ichimoku, MACD dan DMI Multi-Timeframe

- Strategi Trading Tren Berdasarkan Divergensi Harga

- Supertrend Bitcoin Long Line Strategi

- Tren Mengikuti Strategi dengan Moving Average dan Pola Candlestick

- Strategi perdagangan kuantitatif berdasarkan Ichimoku Cloud Breakout dan Indeks ADX

- Strategi kombinasi Bollinger Bands dan Moving Averages

- Prediksi Tren Strategi Rata-rata Bergerak Ganda

- Strategi pembalikan rata-rata bergerak ganda

- Strategi perdagangan rata-rata bergerak dengan terobosan ganda

- Tren Bolt yang Mencolok Mengikuti Strategi

- Strategi VRSI dan MARSI

- Strategi Stop Loss and Take Profit Berdasarkan Pola Doji

- Tren Rata-rata Bergerak Eksponensial Ganda Mengikuti Strategi

- Strategi Beli/Jual Saldo DMI

- Strategi Amplop Rata-rata yang Dipindahkan

- Potensi Pasar Ichimoku Bullish Cloud Strategi