Ringkasan

Strategi ini menggunakan persimpangan rata-rata dan MACD sebagai sinyal perdagangan utama. Strategi ini menggunakan persimpangan rata-rata cepat dengan beberapa garis rata-rata lambat sebagai sinyal pembukaan posisi, sementara digabungkan dengan positif-negatif dari grafik pilar linier MACD sebagai dasar untuk menilai tren. Strategi ini mengatur stop loss dan stop loss multi-level pada saat pembukaan posisi, dan terus mengubah posisi stop loss untuk mengunci keuntungan seiring bertambahnya waktu memegang posisi.

Prinsip Strategi

- Garis rata-rata cepat dan garis rata-rata lambat 1 berpotongan ke atas, sementara harga penutupan berada di atas garis rata-rata lambat 2, grafik MACD lebih besar dari 0;

- Garis rata-rata cepat dan garis rata-rata lambat 1 berpotongan ke bawah, sementara harga penutupan berada di bawah garis rata-rata lambat 2, grafik MACD lebih kecil dari 0, melakukan shorting;

- Buka posisi dengan pengaturan stop loss dan stop loss multi-tingkat, posisi stop loss diatur sesuai dengan preferensi risiko, dan posisi stop loss terus disesuaikan dengan waktu pemegang posisi, secara bertahap mengunci keuntungan;

- Periode rata-rata, parameter MACD, dan stop loss dapat disesuaikan secara fleksibel untuk menyesuaikan dengan kondisi pasar yang berbeda.

Strategi ini memanfaatkan tren penangkapan silang rata-rata, sementara menggunakan indikator MACD untuk konfirmasi arah, meningkatkan keandalan penilaian tren. Pengaturan stop loss multi-level dapat mengontrol risiko dan keuntungan dengan lebih baik.

Keunggulan Strategis

- Garis rata adalah metode pelacakan tren klasik yang dapat menangkap tren yang sedang terbentuk.

- Penggunaan garis rata-rata multi-level memungkinkan penilaian yang lebih komprehensif terhadap kekuatan dan kelangsungan tren;

- Indikator MACD dapat secara efektif mengidentifikasi tren dan menilai momentum, sebagai pelengkap kuat untuk persilangan garis rata-rata;

- Pengaturan multi-level stop loss dan stop loss dinamis untuk mengendalikan risiko, tetapi juga untuk menjalankan keuntungan dan meningkatkan stabilitas sistem;

- Parameter yang dapat disesuaikan, adaptif, dan dapat diatur secara fleksibel sesuai dengan varietas dan siklus yang berbeda.

Risiko Strategis

- Ada risiko sinyal tertinggal pada persimpangan rata-rata, yang dapat melewatkan tren awal atau mengejar naik;

- Pengaturan parameter yang tidak tepat dapat menyebabkan perdagangan berlebihan atau jangka waktu penyimpanan yang terlalu lama, meningkatkan biaya dan risiko;

- Penetapan stop loss yang terlalu radikal dapat menyebabkan stop loss prematur, dan penetapan stop loss yang terlalu konservatif dapat mempengaruhi keuntungan;

- Perubahan tren atau perubahan pasar dapat menyebabkan strategi gagal.

Risiko ini dapat dikendalikan dengan cara mengoptimalkan parameter, menyesuaikan posisi, dan mengatur kondisi tambahan. Namun, tidak ada strategi yang dapat sepenuhnya menghindari risiko dan perlu diperhatikan oleh investor.

Arah optimasi strategi

- Untuk lebih mengkonfirmasi tren dan sinyal, pertimbangkan untuk memperkenalkan lebih banyak indikator, seperti RSI, BRI, dan lain-lain.

- Anda dapat mengoptimalkan pengaturan stop loss dengan lebih halus, seperti mempertimbangkan ATR atau stop loss persentase.

- Adaptasi yang lebih baik dapat dilakukan dengan mengadaptasi parameter berdasarkan dinamika fluktuasi pasar;

- Modul manajemen posisi dapat diperkenalkan untuk menyesuaikan ukuran posisi sesuai dengan kondisi risiko;

- Strategi dapat dikelompokkan, dan portofolio strategi dapat dibuat untuk mendistribusikan risiko.

Dengan terus-menerus mengoptimalkan dan memperbaiki, strategi dapat dibuat lebih stabil dan dapat diandalkan dan lebih baik beradaptasi dengan perubahan lingkungan pasar. Namun, optimisasi harus hati-hati dan hindari over-fitting.

Meringkaskan

Strategi ini digabungkan dengan crossover rata-rata dan indikator MACD untuk membangun sistem perdagangan yang relatif lengkap. Desain dengan operasi rata-rata dan multi-kepala meningkatkan kemampuan sistem untuk menangkap tren dan kontrol risiko. Logika strategi jelas, mudah dipahami dan diimplementasikan, cocok untuk pengoptimalan dan perbaikan lebih lanjut.

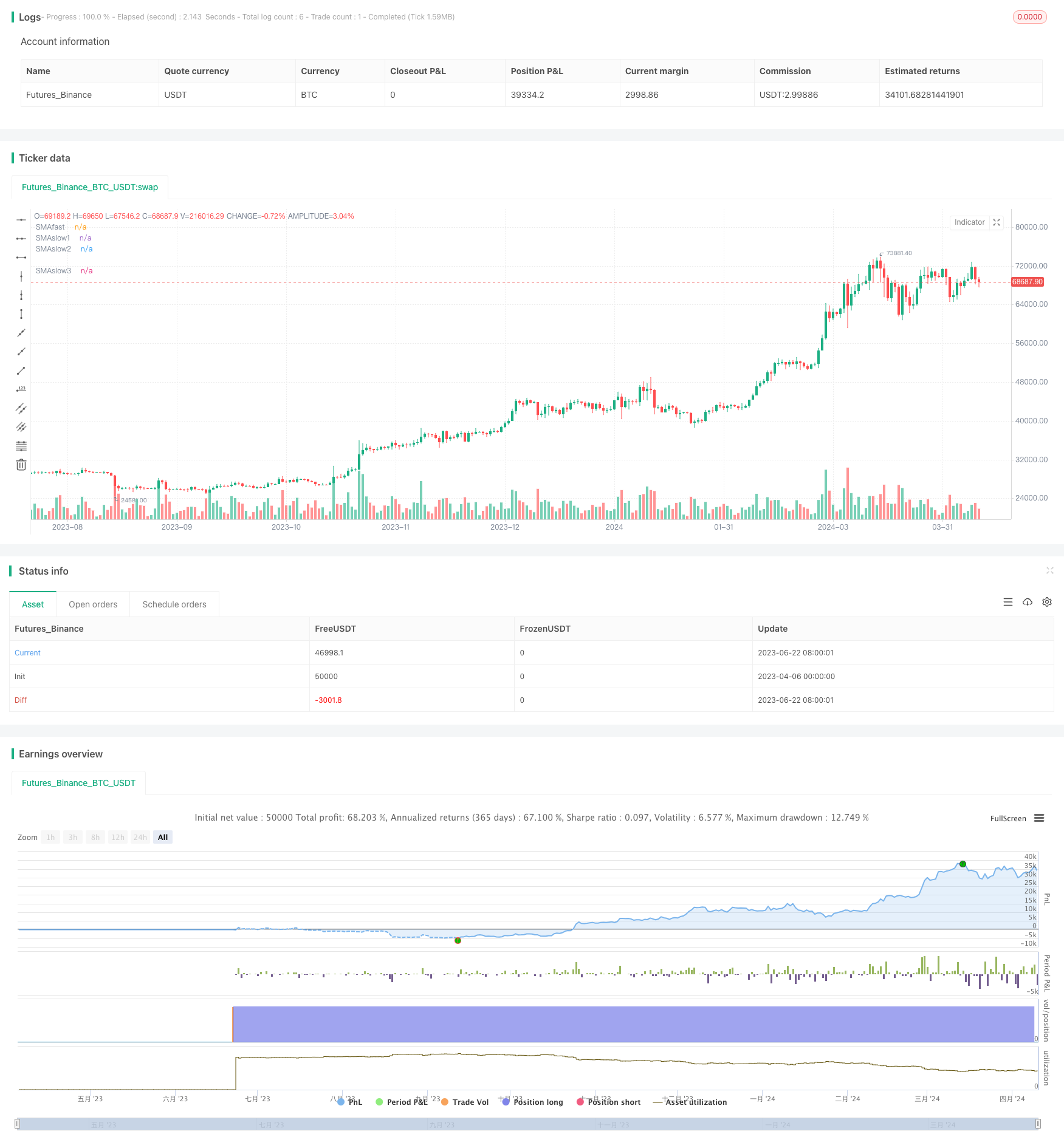

/*backtest

start: 2023-04-06 00:00:00

end: 2024-04-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxmirus

//@version=5

strategy("My strategy_Cross_SMA(EMA)+Macd,slow3",overlay=true)

// ver 4

// Date Inputs

startDate = input(timestamp('2019-01-01T00:00:00+0300'), '' , inline='time1',

tooltip=' Время первого бара расчета стратегии. Первый ордер может быть выставлен на следующем баре после стартового.')

finishDate = input(timestamp('2044-01-01T00:00:00+0300'), '' , inline='time2',

tooltip=' Время после которого больше не будут размещаться ордера входа в позицию.')

// Calculate start/end date and time condition

time_cond = true

//SMA(EMA) Inputs

fast=input.int(12, title="Fastlength",group="MA")

slow1=input.int(54,title="Slowlength1",group="MA")

slow2=input.int(100, title="Slowlength2",group="MA")

slow3=input.int(365, title="Slowlength3",group="MA")

fastma=input.string(title="Fastlength", defval="EMA",options=["SMA","EMA"],group="MA")

slowma1=input.string(title="Slowlength1", defval="EMA",options=["SMA","EMA"],group="MA")

slowma2=input.string(title="Slowlength2", defval="EMA",options=["SMA","EMA"],group="MA")

slowma3=input.string(title="Slowlength3", defval="EMA",options=["SMA","EMA"],group="MA")

fastlength = fastma == "EMA" ? ta.ema(close, fast) : ta.sma(close, fast)

slowlength1 = slowma1 == "EMA" ? ta.ema(close, slow1) : ta.sma(close, slow1)

slowlength2 = slowma2 == "EMA" ? ta.ema(close, slow2) : ta.sma(close, slow2)

slowlength3 = slowma3 == "EMA" ? ta.ema(close, slow3) : ta.sma(close, slow3)

//Macd Inputs

macdfastline = input.int(12, title="FastMacd",group="MACD")

macdslowline = input.int(26,title="SlowMacd",group="MACD")

macdhistline = input.int(9,title="HistMacd",group="MACD")

src=input(defval=close,title="Source",group="MACD")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

fast_ma = sma_source == "SMA" ? ta.sma(src, macdfastline) : ta.ema(src, macdfastline)

slow_ma = sma_source == "SMA" ? ta.sma(src, macdslowline) : ta.ema(src, macdslowline)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, macdhistline) : ta.ema(macd, macdhistline)

hist = macd - signal

//fastMACD = ta.ema(close, macdline) - ta.ema(close, signalline)

//signalMACD = ta.ema(MACD, histline)

//histMACD = MACD - aMACD

//EMA Plot

plot(fastlength,title="SMAfast",color=color.blue)

plot(slowlength1,title="SMAslow1",color=color.orange)

plot(slowlength2,title="SMAslow2",color=color.red)

plot(slowlength3,title="SMAslow3",color=color.black)

//Macd plot

//col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

//col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

//col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

//col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

//col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

//col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)))

//plot(macd, title="MACD", color=col_macd)

//plot(signal, title="Signal", color=col_signal)

//Take profit

tp1=input.float(5.1,title="Take Profit1_%",step=0.1)/100

tp2=input.float(10.1,title="Take Profit2_%",step=0.1)/100

//Stop loss

sl1=input.float(5.1,title="Stop loss1_%",step=0.1)/100

sl2=input.float(0.1,title="Stop loss2_%",step=0.1)/100

sl3=input.float(-5.5,title="Stop loss3_%", step=0.1)/100

//Qty closing position

Qty1 = input.float(0.5, title="QtyClosingPosition1",step=0.01)

Qty2 = input.float(0.25, title="QtyClosingPosition2",step=0.01)

//Take profit Long and Short

LongTake1=strategy.position_avg_price*(1+tp1)

LongTake2=strategy.position_avg_price*(1+tp2)

ShortTake1=strategy.position_avg_price*(1-tp1)

ShortTake2=strategy.position_avg_price*(1-tp2)

//Plot Levels Take

plot(strategy.position_size > 0 ? LongTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongTake2 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake2 : na,color=color.green,style=plot.style_linebr)

//Stop loss long and short

LongStop1=strategy.position_avg_price*(1-sl1)

LongStop2=strategy.position_avg_price*(1-sl2)

LongStop3=strategy.position_avg_price*(1-sl3)

ShortStop1=strategy.position_avg_price*(1+sl1)

ShortStop2=strategy.position_avg_price*(1+sl2)

ShortStop3=strategy.position_avg_price*(1+sl3)

//Stop=strategy.position_avg_price

//Plot Levels Stop

plot(strategy.position_size > 0 ? LongStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop3 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop3 : na,color=color.red,style=plot.style_linebr)

//Entry condition

LongCondition1 = ta.crossover(fastlength, slowlength1)

LongCondition2 = close>slowlength2

LongCondition3 = time_cond

LongCondition4=close>slowlength3

//LongCondition5=slowlength100>slowlength3

LongCondition6 = hist > 0

buy=(LongCondition1 and LongCondition2 and LongCondition3 and LongCondition4 and LongCondition6 ) and strategy.position_size<=0

//longCondition3 = nz(strategy.position_size) == 0//если отсутствует открытая позиция

ShortCondition1 = ta.crossunder(fastlength, slowlength1)

ShortCondition2 = close<slowlength2

ShortCondition3 = time_cond

ShortCondition4=close<slowlength3

//ShortCondition5=slowlength100<slowlength3

ShortCondition6=hist < 0

sell=(ShortCondition1 and ShortCondition2 and ShortCondition3 and ShortCondition4 and ShortCondition6 ) and strategy.position_size>=0

//Strategy entry

strategy.cancel_all(not strategy.position_size)

if(buy)

strategy.cancel_all()

strategy.entry("Buy",strategy.long)

if(sell)

strategy.cancel_all()

strategy.entry("Sell",strategy.short)

//Strategy Long exit

var int exitCounter=0

exitCounter := not strategy.position_size or strategy.position_size > 0 and strategy.position_size[1] < 0 or strategy.position_size < 0 and strategy.position_size[1] > 0 ? 0:

strategy.position_size > 0 and strategy.position_size[1]>strategy.position_size? exitCounter[1] + 1:

strategy.position_size < 0 and strategy.position_size[1]<strategy.position_size? exitCounter[1] - 1:

exitCounter[1]

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long1",strategy.short, qty=math.abs(strategy.position_size*Qty1), limit=LongTake1, oca_name='Long1', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long2",strategy.short, qty=math.abs(strategy.position_size*Qty2), limit=LongTake2, oca_name='Long2', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Stop Long1",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop1,oca_name='Long1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==1

strategy.order("Stop Long2",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop2,oca_name='Long2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==2

strategy.order("Stop Long3",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop3)

// Strategy Short exit

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short1", strategy.long, qty=math.abs(strategy.position_size*Qty1), limit=ShortTake1, oca_name='Short1', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short2", strategy.long, qty=math.abs(strategy.position_size*Qty2), limit=ShortTake2, oca_name='Short2', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Stop Short1",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop1,oca_name='Short1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-1

strategy.order("Stop Short2",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop2,oca_name='Short2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-2

strategy.order("Stop Short3",strategy.long,qty=math.abs(strategy.position_size),stop=ShortStop3)