Ringkasan

Strategi ini adalah sistem perdagangan mengikuti tren yang menggabungkan Exponential Moving Average (EMA) dan Average Directional Index (ADX). Strategi ini menentukan arah perdagangan melalui perpotongan EMA50 dan harga, dan menggunakan indikator ADX untuk menyaring kekuatan tren pasar, sembari mengadopsi metode stop loss dinamis berdasarkan garis K yang menguntungkan secara terus-menerus guna melindungi laba. Metode ini tidak hanya dapat menangkap tren utama pasar, tetapi juga keluar tepat waktu ketika tren melemah.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada elemen-elemen kunci berikut:

- Gunakan rata-rata pergerakan eksponensial periode 50 (EMA50) sebagai panduan arah tren

- Saring kekuatan tren pasar melalui indikator ADX (parameter default adalah 20) dan masuk pasar hanya ketika trennya jelas

- Syarat masuk:

- Long: Harga ditutup di atas EMA50 dan ADX lebih besar dari ambang batas

- Pendek: Harga ditutup di bawah EMA50 dan ADX lebih besar dari ambang batas

- Mekanisme stop loss yang unik:

- Hitung jumlah garis K menguntungkan yang berurutan

- Aktifkan trailing stop loss dinamis ketika 4 candlestick menguntungkan muncul secara berurutan

- Harga stop loss akan disesuaikan secara dinamis dengan harga tertinggi/terendah baru

Keunggulan Strategis

- Konfirmasi tren penyaringan ganda

- Perpotongan EMA memberikan arah tren

- Penyaringan ADX memastikan kekuatan tren dan mengurangi penembusan palsu

- Desain stop loss yang cerdas

- Stop loss dinamis berdasarkan volatilitas pasar

- Hanya mulai trailing stop loss setelah keuntungan berkelanjutan untuk menghindari pengambilan keuntungan prematur

- Sangat mudah beradaptasi

- Kemampuan penyesuaian parameter tinggi

- Berlaku untuk berbagai produk perdagangan

- Pengendalian risiko yang sempurna

- Keluar secara otomatis saat tren melemah

- Stop loss dinamis melindungi keuntungan yang ada

Risiko Strategis

- Risiko pembalikan tren

- Mungkin mengalami retracement besar jika terjadi pembalikan tren secara tiba-tiba

- Disarankan untuk menambahkan mekanisme konfirmasi sinyal pembalikan

- Parameter Sensitivitas

- Pemilihan parameter EMA dan ADX memengaruhi kinerja strategi

- Disarankan untuk mengoptimalkan parameter melalui pengujian ulang

- Ketergantungan lingkungan pasar

- Mungkin sering berdagang di pasar yang bergejolak

- Disarankan untuk menambahkan mekanisme penyaringan pasar sampingan

- Risiko Eksekusi Stop Loss

- Kesenjangan yang besar dapat menyebabkan penyimpangan eksekusi stop loss

- Disarankan untuk mempertimbangkan pengaturan proteksi stop loss yang keras

Arah optimasi strategi

- Optimalisasi mekanisme entri

- Meningkatkan sinyal konfirmasi volume

- Menambahkan analisis pola harga

- Mekanisme stop loss yang sempurna

- Sesuaikan jarak stop loss secara dinamis berdasarkan ATR

- Tambahkan mekanisme penghentian kerugian waktu

- Kemampuan beradaptasi terhadap lingkungan pasar

- Menambahkan filter volatilitas pasar

- Sesuaikan parameter sesuai dengan siklus pasar yang berbeda

- Peningkatan konfirmasi sinyal

- Integrasikan indikator teknis lainnya

- Tambahkan filter fundamental

Meringkaskan

Ini adalah strategi mengikuti tren yang dirancang dengan baik yang menggabungkan keunggulan EMA dan ADX untuk menangkap tren secara efektif sambil mengendalikan risiko. Mekanisme stop-loss dinamis pada strategi ini sangat inovatif dan dapat mencapai keseimbangan yang baik antara perlindungan keuntungan dan penangkapan tren. Meskipun masih ada ruang untuk pengoptimalan, kerangka kerja secara keseluruhan sudah lengkap dan logikanya jelas. Ini adalah sistem strategi yang layak diverifikasi dalam perdagangan nyata.

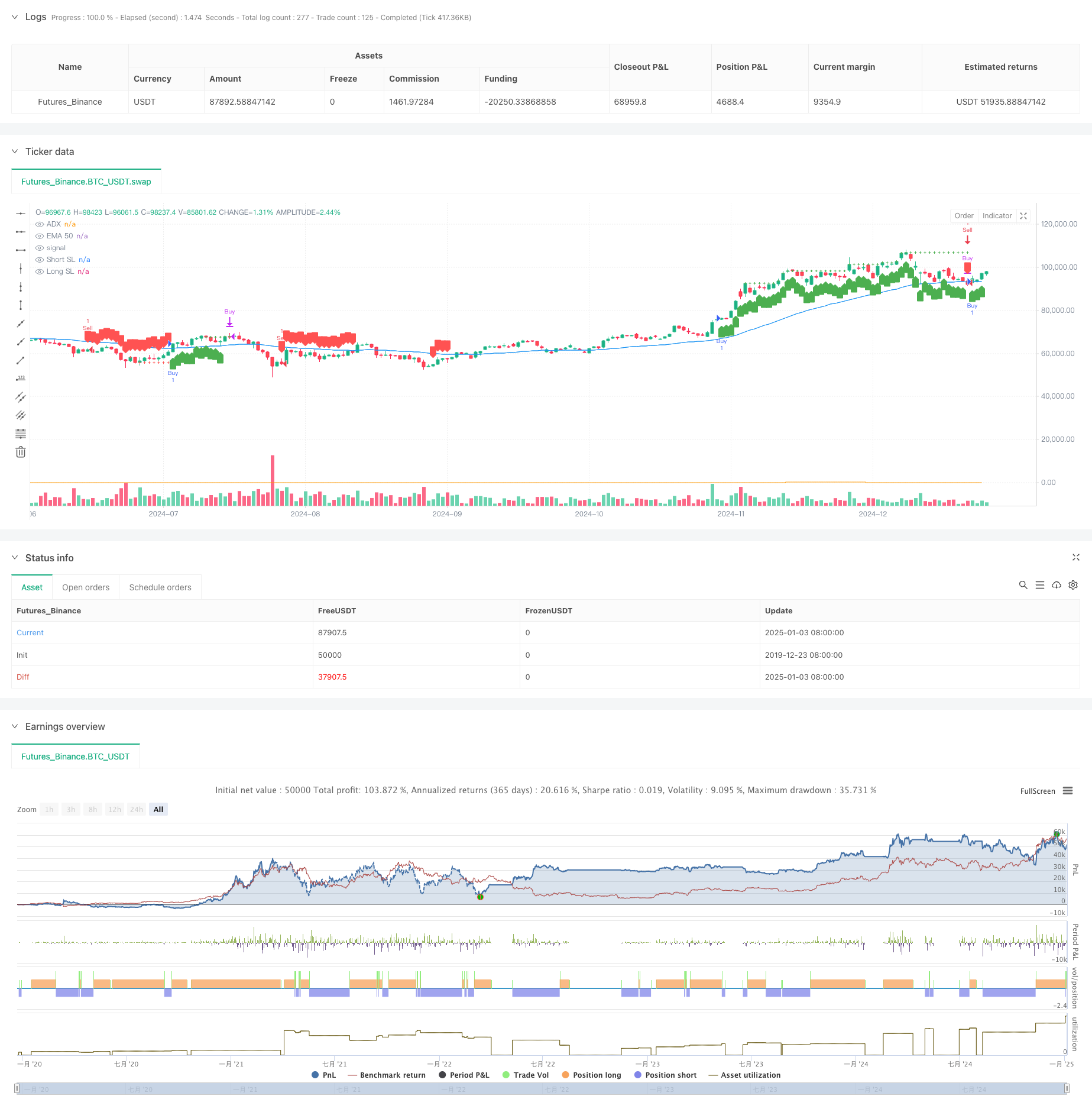

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Simple EMA 50 Strategy with ADX Filter", overlay=true)

// Input parameters

emaLength = input.int(50, title="EMA Length")

adxThreshold = input.float(20, title="ADX Threshold", minval=0)

// Calculate EMA and ADX

ema50 = ta.ema(close, emaLength)

adxSmoothing = input.int(20, title="ADX Smoothing")

[diPlus, diMinus, adx] = ta.dmi(20, adxSmoothing)

// Conditions for long and short entries

adxCondition = adx > adxThreshold

longCondition = adxCondition and close > ema50 // Check if candle closes above EMA

shortCondition = adxCondition and close < ema50 // Check if candle closes below EMA

// Exit conditions based on 4 consecutive profitable candles

var float longSL = na

var float shortSL = na

var longCandleCounter = 0

var shortCandleCounter = 0

// Increment counters if positions are open and profitable

if (strategy.position_size > 0 and close > strategy.position_avg_price)

longCandleCounter += 1

if (longCandleCounter >= 4)

longSL := na(longSL) ? close : math.max(longSL, close) // Update SL dynamically

else

longCandleCounter := 0

longSL := na

if (strategy.position_size < 0 and close < strategy.position_avg_price)

shortCandleCounter += 1

if (shortCandleCounter >= 4)

shortSL := na(shortSL) ? close : math.min(shortSL, close) // Update SL dynamically

else

shortCandleCounter := 0

shortSL := na

// Exit based on trailing SL

if (strategy.position_size > 0 and not na(longSL) and close < longSL)

strategy.close("Buy", comment="Candle-based SL")

if (strategy.position_size < 0 and not na(shortSL) and close > shortSL)

strategy.close("Sell", comment="Candle-based SL")

// Entry logic: Check every candle for new positions

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Plot EMA and ADX for reference

plot(ema50, color=color.blue, title="EMA 50")

plot(adx, color=color.orange, title="ADX", style=plot.style_stepline, linewidth=1)

plot(longSL, color=color.green, title="Long SL", style=plot.style_cross, linewidth=1)

plot(shortSL, color=color.red, title="Short SL", style=plot.style_cross, linewidth=1)

// Plot signals

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")