コモディティ・フューチャー・インターテンポラル・ボリンジャー・ヘッジ・ストラテジーの Python バージョン (研究目的のみ)

作者: リン・ハーン優しさ, 作成日: 2020-06-20 10:52:34, 更新日: 2025-01-14 20:40:43

前述した時間間仲介戦略では,開設・閉じるポジションのヘージング・スプレッドの手動入力が必要です.価格差を判断することはより主観的です.本記事では,以前のヘージング戦略をBOLL指標を使用してポジションを開設・閉じる戦略に変更します.

class Hedge:

'Hedging control class'

def __init__(self, q, e, initAccount, symbolA, symbolB, maPeriod, atrRatio, opAmount):

self.q = q

self.initAccount = initAccount

self.status = 0

self.symbolA = symbolA

self.symbolB = symbolB

self.e = e

self.isBusy = False

self.maPeriod = maPeriod

self.atrRatio = atrRatio

self.opAmount = opAmount

self.records = []

self.preBarTime = 0

def poll(self):

if (self.isBusy or not exchange.IO("status")) or not ext.IsTrading(self.symbolA):

Sleep(1000)

return

insDetailA = exchange.SetContractType(self.symbolA)

if not insDetailA:

return

recordsA = exchange.GetRecords()

if not recordsA:

return

insDetailB = exchange.SetContractType(self.symbolB)

if not insDetailB:

return

recordsB = exchange.GetRecords()

if not recordsB:

return

# Calculate the spread price K line

if recordsA[-1]["Time"] != recordsB[-1]["Time"]:

return

minL = min(len(recordsA), len(recordsB))

rA = recordsA.copy()

rB = recordsB.copy()

rA.reverse()

rB.reverse()

count = 0

arrDiff = []

for i in range(minL):

arrDiff.append(rB[i]["Close"] - rA[i]["Close"])

arrDiff.reverse()

if len(arrDiff) < self.maPeriod:

return

# Calculate Bollinger Bands indicator

boll = TA.BOLL(arrDiff, self.maPeriod, self.atrRatio)

ext.PlotLine("upper trail", boll[0][-2], recordsA[-2]["Time"])

ext.PlotLine("middle trail", boll[1][-2], recordsA[-2]["Time"])

ext.PlotLine("lower trail", boll[2][-2], recordsA[-2]["Time"])

ext.PlotLine("Closing price spread", arrDiff[-2], recordsA[-2]["Time"])

LogStatus(_D(), "upper trail:", boll[0][-1], "\n", "middle trail:", boll[1][-1], "\n", "lower trail:", boll[2][-1], "\n", "Current closing price spread:", arrDiff[-1])

action = 0

# Signal trigger

if self.status == 0:

if arrDiff[-1] > boll[0][-1]:

Log("Open position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Positive")

elif arrDiff[-1] < boll[2][-1]:

Log("Open position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Negative")

elif self.status == 1 and arrDiff[-1] > boll[1][-1]:

Log("Close position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Close Negative")

elif self.status == 2 and arrDiff[-1] < boll[1][-1]:

Log("Close position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Close Positive")

# Execute specific instructions

if action == 0:

return

self.isBusy = True

tasks = []

if action == 1:

tasks.append([self.symbolA, "sell" if self.status == 0 else "closebuy"])

tasks.append([self.symbolB, "buy" if self.status == 0 else "closesell"])

elif action == 2:

tasks.append([self.symbolA, "buy" if self.status == 0 else "closesell"])

tasks.append([self.symbolB, "sell" if self.status == 0 else "closebuy"])

def callBack(task, ret):

def callBack(task, ret):

self.isBusy = False

if task["action"] == "sell":

self.status = 2

elif task["action"] == "buy":

self.status = 1

else:

self.status = 0

account = _C(exchange.GetAccount)

LogProfit(account["Balance"] - self.initAccount["Balance"], account)

self.q.pushTask(self.e, tasks[1][0], tasks[1][1], self.opAmount, callBack)

self.q.pushTask(self.e, tasks[0][0], tasks[0][1], self.opAmount, callBack)

def main():

SetErrorFilter("ready|login|timeout")

Log("Connecting to the trading server...")

while not exchange.IO("status"):

Sleep(1000)

Log("Successfully connected to the trading server")

initAccount = _C(exchange.GetAccount)

Log(initAccount)

def callBack(task, ret):

Log(task["desc"], "success" if ret else "failure")

q = ext.NewTaskQueue(callBack)

p = ext.NewPositionManager()

if CoverAll:

Log("Start closing all remaining positions...")

p.CoverAll()

Log("Operation complete")

t = Hedge(q, exchange, initAccount, SA, SB, MAPeriod, ATRRatio, OpAmount)

while True:

q.poll()

t.poll()

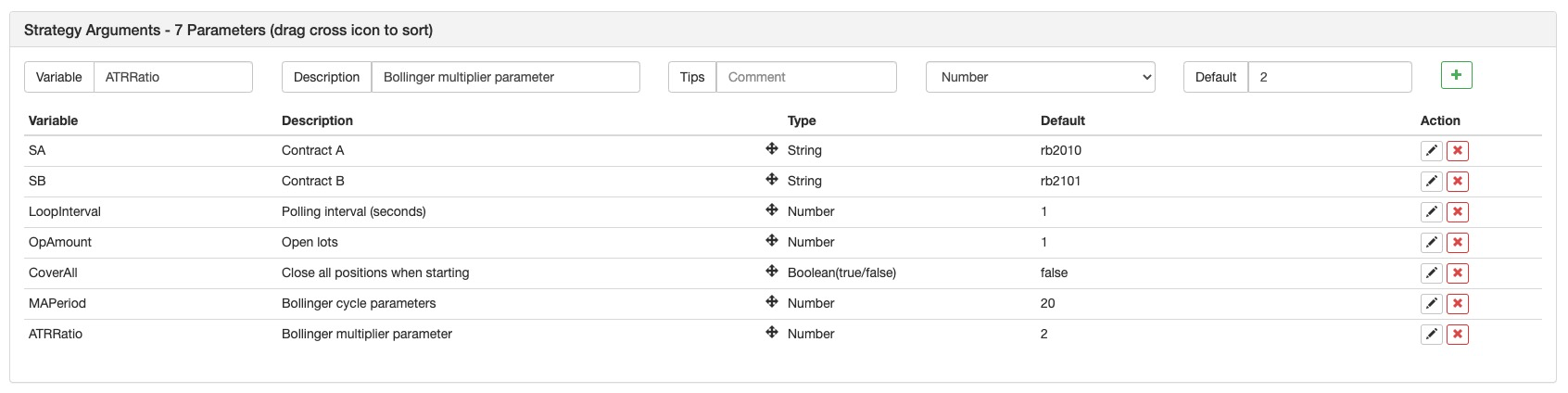

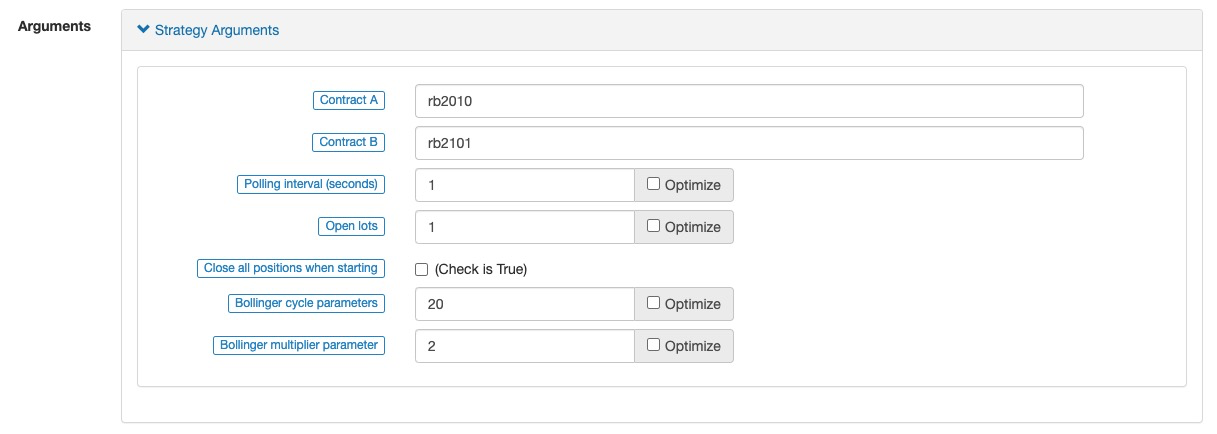

戦略パラメータ設定:

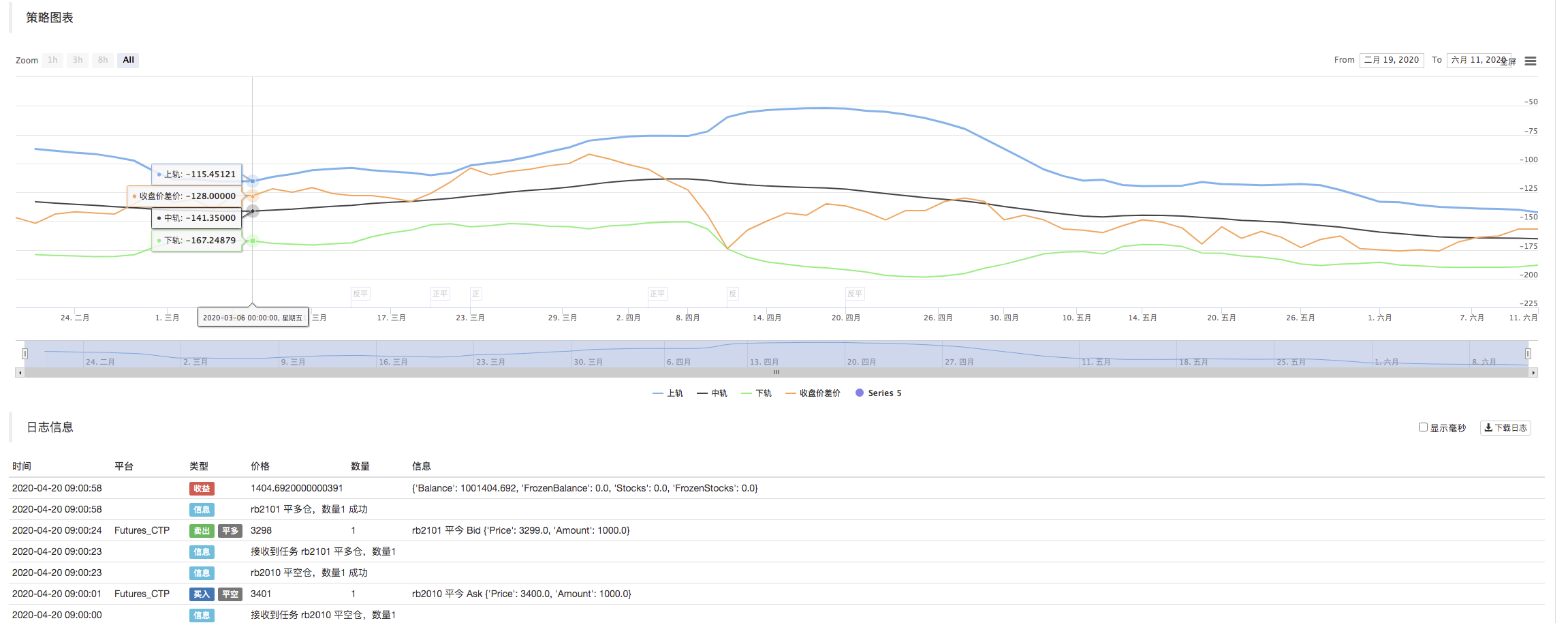

戦略の枠組みは基本的にコモディティ・フューチャー間の時間間のヘッジ戦略の Python バージョン戦略が実行されているとき,両契約のK線データは得られ,その後価格差はスプレッドを計算するために計算されます.配列は,SPREDのデータとして使用されます.TA.BOLLBollinger Bands を計算する関数です.スプレッドがBollinger Band

バックテスト:

この 記事 は 主 に 研究 目的 で のみ 用い られ て い ます. 完全な戦略:https://www.fmz.com/strategy/213826

関連コンテンツ

- DEX取引所の定量実践 (2) -- ハイパーリキッドユーザーガイド

- DEX取引所の量化実践 (2) -- Hyperliquidの使用ガイド

- DEX取引所の定量実践 (1) -- dYdX v4 ユーザーガイド

- 暗号通貨におけるリード・レイグ・アービトラージへの導入 (3)

- DEX取引所の量化実践 ((1)-- dYdX v4 ユーザーガイド

- デジタル通貨におけるリード-ラグ套路の紹介 (3)

- 暗号通貨におけるリード・ラグ・アービトラージへの導入 (2)

- デジタル通貨におけるリード-ラグ套路の紹介 (2)

- FMZプラットフォームの外部信号受信に関する議論: 戦略におけるHttpサービス内蔵の信号受信のための完全なソリューション

- FMZプラットフォームの外部信号受信に関する探求:戦略内蔵Httpサービス信号受信の完全な方案

- 暗号通貨におけるリード・ラグ・アービトラージへの導入 (1)

もっと見る

- FMEX取引は,オーダーボリュームの最適化を実現する

- コモディティ・フューチャーズの分析と実現 量占有グラフ

- FMEXの順序解読 最適値の量最適化

- ロボットがメッセージを送信する際には,ノイルインターフェースを呼び出す.

- FMEX取引をロックする 最適の単位の最適化

- シンプル・ボラティリティ・EMV戦略

- Pythonの手順をパッケージ化するコストを削減します

- 偏差率 BIAS トレーディング戦略

- "pyfolio"ツールを使用してバックテスト資本曲線を評価する

- FMZ量化ミール (My) 言語 - インタフェースグラフ

- "Tradingview"インジケーターを使用してFMZロボットとインタフェース

- FMZ 量化 マン語 (My) - マン語取引クラスデータベースのパラメータ

- 商品"先物・先物" アルビトラージ・チャート FMZ基本データに基づく

- 各トランザクションとK線バックテストの欠陥に基づく高周波バックテストシステム

- コモディティ・フューチャー間の時間間のヘッジ戦略の Python バージョン

- 仮想通貨先物取引の論理について

- Alpha101 の文法開発に基づいた強化分析ツール

- カスタムデータソースをバックテストする

- 筆付取引に基づく高周波回音システムとK線回音の欠陥

- FMZシミュレーションレベルバックテストメカニズムの説明