MyLanguageによる暗号市場での使用のサーモスタット戦略

作者: リン・ハーン優しさ作成日:2020年8月21日 19:19:20 更新日:2023年10月10日 21:15:32 更新日:2020年8月21日 19:19:20 更新日:2023年10月10日 21:15:32 更新日:2020年10月21日 更新日:2020年10月21日 21:15:32 更新日:2020年10月21日 21:15:32 更新日:2020年10月21日 21:15:32 更新日:2020年10月21日 21:15:32 更新日:2020年10月21日 21:15:32 更新日:2020年10月21日

戦略名:アップグレードされた温度計戦略

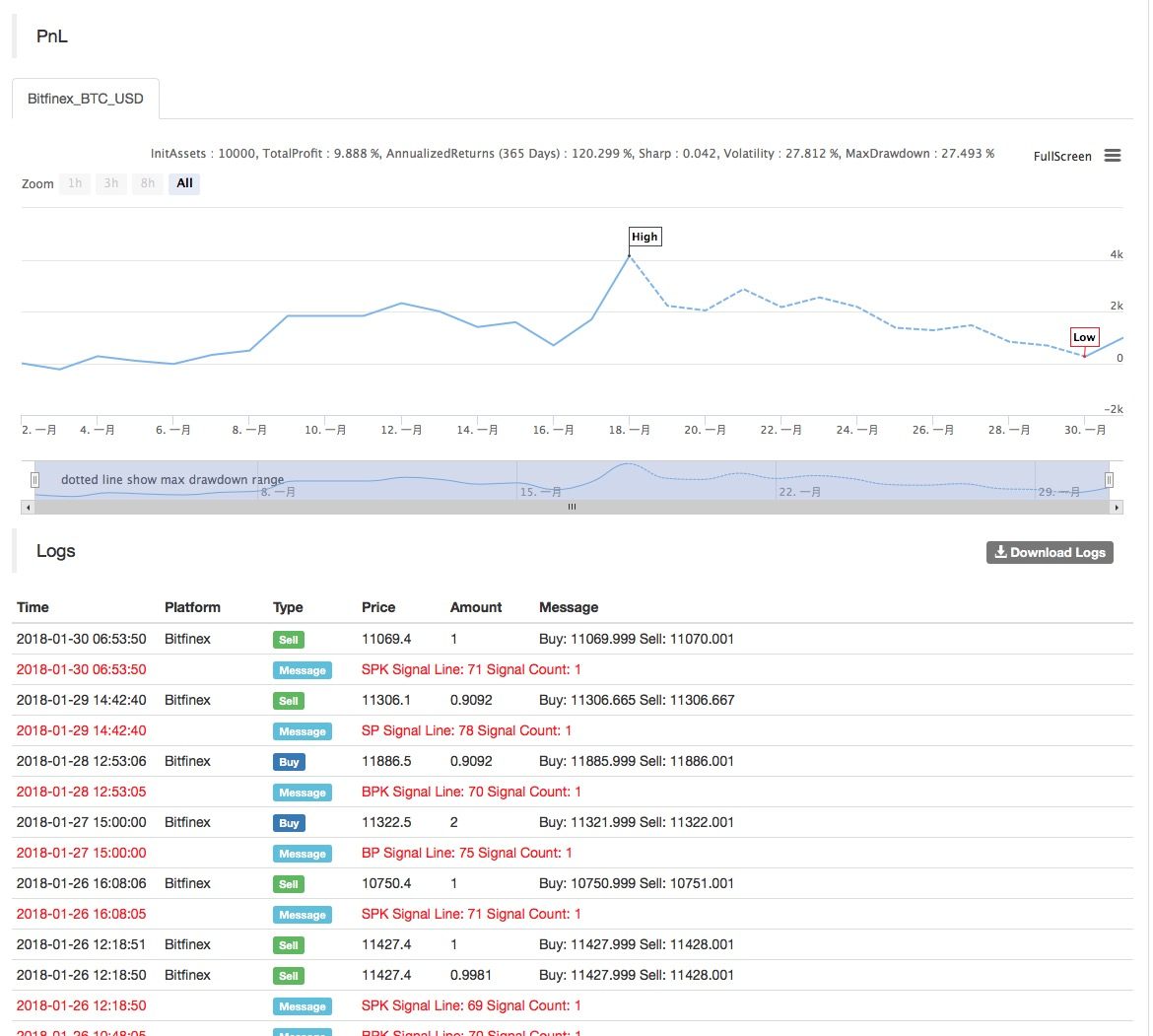

データサイクル: 1H

サポート: 商品先物,デジタル通貨先物,デジタル通貨スポット

メインチャート: 上部線,公式: TOP^^MAC+N_TMPTMP; / / ボールの上部線 低軌,式: BTTOM^^MAC-N_TMPTMP

副図: CMI,公式:CMI:ABS (C-REF (C,N_CMI-1))/HHV (H,N_CMI) -LLV (L,N_CMI))*100 CMI <20 は振動,CMI>20 はトレンド

ソースコード:

(*backtest

start: 2018-11-06 00:00:00

end: 2018-12-04 00:00:00

period: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*)

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP;// upper track of boll

BOTTOM^^MAC-N_TMP*TMP;// lower track of boll

BBOLL:=C>MAC;

SBOLL:=C<MAC;

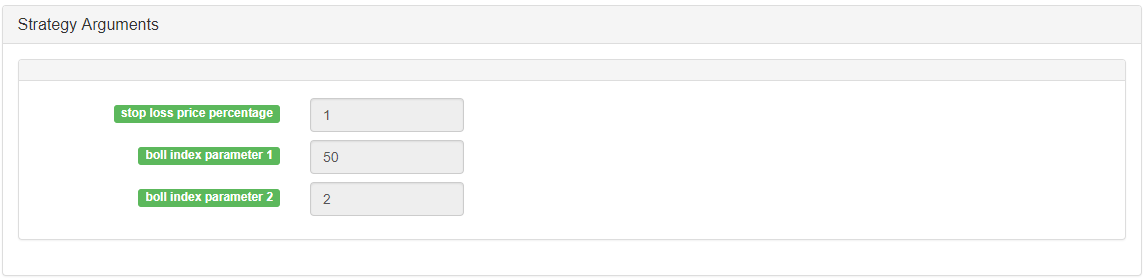

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation mode, CMI>20 is the trend

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100;

//(1)closing price - the lowest of cycle N, (2)the highest of cycle N - the lowest of cycle N, (1)/(2)

K:=SMA(RSV,M1,1);//MA of RSV

D:=SMA(K,M2,1);//MA of K

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

//oscillation mode

BUYPK1:=CMI < 20 AND BKD;//if it's oscillation, buy to cover and buy long immediately

SELLPK1:=CMI < 20 AND SKD;//if it's oscillation, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D;//if it's oscillation, long position take profit

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D;//if it's oscillation, short position take profit

//trend mode

BUYPK2:=CMI >= 20 AND C > TOP;//if it's trend, buy to cover and buy long immediately

SELLPK2:=CMI >= 20 AND C < BOTTOM;//if it's trend, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//if it's trend, long position take profit

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//if it's trend, short position take profit

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//if it's trend, long position stop loss

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//if it's trend, short position stop loss

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

関連コンテンツ

- DEX取引所の定量実践 (2) -- ハイパーリキッドユーザーガイド

- DEX取引所の量化実践 (2) -- Hyperliquidの使用ガイド

- DEX取引所の定量実践 (1) -- dYdX v4 ユーザーガイド

- 暗号通貨におけるリード・レイグ・アービトラージへの導入 (3)

- DEX取引所の量化実践 ((1)-- dYdX v4 ユーザーガイド

- デジタル通貨におけるリード-ラグ套路の紹介 (3)

- 暗号通貨におけるリード・ラグ・アービトラージへの導入 (2)

- デジタル通貨におけるリード-ラグ套路の紹介 (2)

- FMZプラットフォームの外部信号受信に関する議論: 戦略におけるHttpサービス内蔵の信号受信のための完全なソリューション

- FMZプラットフォームの外部信号受信に関する探求:戦略内蔵Httpサービス信号受信の完全な方案

- 暗号通貨におけるリード・ラグ・アービトラージへの導入 (1)

もっと見る

- 量化取引におけるサーバー使用の浅谈

- [千軍戦争] 通貨対安率 約戦略3 バターフライ・ヘッジ

- バランス・ハンガリー・戦略 (教学戦略)

- RSI2 フューチャーで使う平均逆転戦略

- フューチャーと暗号通貨のAPI説明

- 半自動量的な取引ツールを迅速に導入する

- アルーン指標の導入

- デジタル通貨オプション戦略のバックテストに関する予備研究

- 量的な取引と主観的な取引の違い

- ATRチャネル戦略 暗号市場で実施

- hans123 日中の突破戦略

- デジタル通貨オプション戦略の初回調査

- TradingViewWebHookアラームはFMZロボットに直接接続されています

- 取引戦略に目覚まし時計を追加

- C++ を使った OKEX フューチャー契約のヘッジ戦略

- 資金の活発な流れに基づいた取引戦略

- 手動取引を容易にするために,取引端末プラグインを使用します.

- 定量型タイプレートの取引戦略

- バランス戦略とグリッド戦略

- マルチロボット市場 コートシェアリングソリューション