クルラマギー 脱出V2戦略

作者: リン・ハーンチャオチャン開催日:2023年10月24日 16時30分32秒タグ:

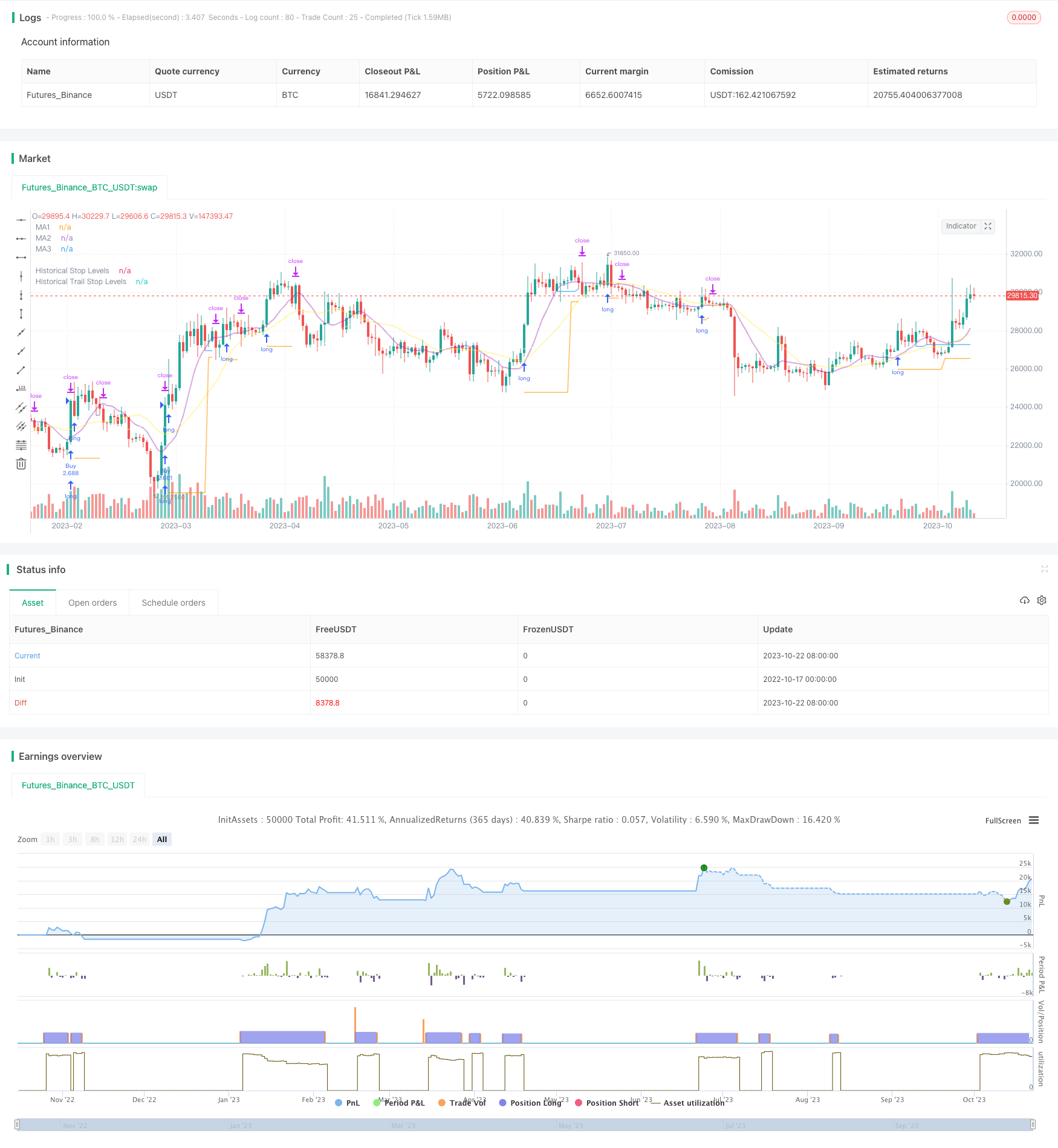

概要

この戦略は,ストップ・ロスのストップ・ストップの移動平均を用いながら,より長い時間枠でサポート/レジスタンス・ストップ・シグナルを捕捉し,より長期的なトレンドの方向で利益を得ながらリスクをコントロールするためのブレークアウトとトレンドフォロー・トレリング・ストップ戦略の利点を組み合わせています.

戦略の論理

-

この戦略はまず,トレンド決定,サポート/レジスタンス,ストップロスの異なるパラメータを持つ複数の移動平均を計算します.

-

価格がこれらのレベルを突破すると,買い売りシグナルが生成されます.

-

この戦略は,価格が最高値を超えると購入し,価格が最低値を下回ると販売します.

-

入場後,最低値がポジションの初期ストップ損失として使用されます.

-

ポジションが収益性を持つと,ストップ・ロスは移動平均値に切り替わります.価格が移動平均値を下回ると,ストップはキャンドルスティックの底に設定されます.

-

ポジションが利益を得られるようにする一方で,トレンドを追うのに十分な余地を与えます.

-

この戦略には,フィルタリングのための平均の真の範囲も含まれ,拡張されたブレークアウトを避けるために適切な範囲ブレークアウトのみが取られていることを保証します.

利点分析

-

ブレイクアウトとトライリングストップの利点を組み合わせます

-

より高い確率で長期的トレンドに従って 脱出を買える

-

トレイリングストップ戦略は 位置を保護し 十分なスペースを 保持します

-

ATRフィルタリングは,不良な長期の脱出を回避する.

-

自動取引はパートタイムで行うことができます

-

調整可能な移動平均パラメータ

-

柔軟な後押し停止メカニズム

リスク分析

-

逃亡戦略は 偽の逃亡リスクに 傾向があります より広範な逃亡の確認が 役立つかもしれません

-

シグナルを生むのに必要な十分な変動は 不安定な市場では失敗する可能性があります

-

短期間で より多くの機会が 明らかになるかもしれません

-

トレイリングストップは,市場範囲で頻繁に停止されることがあります.より広いストップは役立ちます.

-

ATRフィルタリングは,いくつかの潜在的な取引を見逃す可能性があります. 低いフィルター設定は役立ちます.

オプティマイゼーションの方向性

-

適正なパラメータのために異なる移動平均の組み合わせを試験する.

-

チャネルやキャンドルスタイクパターンなど

-

最良のストップ・ロスを探すために 異なるストップ・メカニズムを試す.

-

ポジションスコアなどのマネーマネジメント戦略を最適化します

-

信号の質を改善するために技術指標フィルターを追加します.

-

異なる製品で有効性をテストする.

-

機械学習アルゴリズムを組み込み 戦略のパフォーマンスを向上させる

結論

この戦略は,ブレイクアウトとトレンドフォローするトレンドストップ戦略の哲学を組み合わせている.適切なトレンド決定により,制御されたリスクを維持しながら利益の可能性を最適化する.鍵は最適なパラメータセットを見つけ,慎重なマネーマネジメントを組み込むことである.さらなる強化により,これは強力なトレンドフォロー方法に変わることがあります.

/*backtest

start: 2022-10-17 00:00:00

end: 2023-10-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © millerrh

// The intent of this strategy is to buy breakouts with a tight stop on smaller timeframes in the direction of the longer term trend.

// Then use a trailing stop of a close below either the 10 MA or 20 MA (user choice) on that larger timeframe as the position

// moves in your favor (i.e. whenever position price rises above the MA).

// Option of using daily ADR as a measure of finding contracting ranges and ensuring a decent risk/reward.

// (If the difference between the breakout point and your stop level is below a certain % of ATR, it could possibly find those consolidating periods.)

// V2 - updates code of original Qullamaggie Breakout to optimize and debug it a bit - the goal is to remove some of the whipsaw and poor win rate of the

// original by incorporating some of what I learned in the Breakout Trend Follower script.

//@version=4

strategy("Qullamaggie Breakout V2", overlay=true, initial_capital=100000, currency='USD', calc_on_every_tick = true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// === BACKTEST RANGE ===

Start = input(defval = timestamp("01 Jan 2019 06:00 +0000"), title = "Backtest Start Date", type = input.time, group = "backtest window and pivot history")

Finish = input(defval = timestamp("01 Jan 2100 00:00 +0000"), title = "Backtest End Date", type = input.time, group = "backtest window and pivot history")

// Inputs

showPivotPoints = input(title = "Show Historical Pivot Points?", type = input.bool, defval = false, group = "backtest window and pivot history",

tooltip = "Toggle this on to see the historical pivot points that were used. Change the Lookback Periods to adjust the frequency of these points.")

htf = input(defval="D", title="Timeframe of Moving Averages", type=input.resolution, group = "moving averages",

tooltip = "Allows you to set a different time frame for the moving averages and your trailing stop.

The default behavior is to identify good tightening setups on a larger timeframe

(like daily) and enter the trade on a breakout occuring on a smaller timeframe, using the moving averages of the larger timeframe to trail your stop.")

maType = input(defval="SMA", options=["EMA", "SMA"], title = "Moving Average Type", group = "moving averages")

ma1Length = input(defval = 10, title = "1st Moving Average Length", minval = 1, group = "moving averages")

ma2Length = input(defval = 20, title = "2nd Moving Average Length", minval = 1, group = "moving averages")

ma3Length = input(defval = 50, title = "3rd Moving Average Length", minval = 1, group = "moving averages")

useMaFilter = input(title = "Use 3rd Moving Average for Filtering?", type = input.bool, defval = true, group = "moving averages",

tooltip = "Signals will be ignored when price is under this slowest moving average. The intent is to keep you out of bear periods and only

buying when price is showing strength or trading with the longer term trend.")

trailMaInput = input(defval="1st Moving Average", options=["1st Moving Average", "2nd Moving Average"], title = "Trailing Stop", group = "stops",

tooltip = "Initial stops after entry follow the range lows. Once in profit, the trade gets more wiggle room and

stops will be trailed when price breaches this moving average.")

trailMaTF = input(defval="Same as Moving Averages", options=["Same as Moving Averages", "Same as Chart"], title = "Trailing Stop Timeframe", group = "stops",

tooltip = "Once price breaches the trail stop moving average, the stop will be raised to the low of that candle that breached. You can choose to use the

chart timeframe's candles breaching or use the same timeframe the moving averages use. (i.e. if daily, you wait for the daily bar to close before setting

your new stop level.)")

currentColorS = input(color.new(color.orange,50), title = "Current Range S/R Colors: Support", type = input.color, group = "stops", inline = "lineColor")

currentColorR = input(color.new(color.blue,50), title = " Resistance", type = input.color, group = "stops", inline = "lineColor")

// Pivot lookback

lbHigh = 3

lbLow = 3

// MA Calculations (can likely move this to a tuple for a single security call!!)

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

ma1 = security(syminfo.tickerid, htf, ma(maType, close, ma1Length))

ma2 = security(syminfo.tickerid, htf, ma(maType, close, ma2Length))

ma3 = security(syminfo.tickerid, htf, ma(maType, close, ma3Length))

plot(ma1, color=color.new(color.purple, 60), style=plot.style_line, title="MA1", linewidth=2)

plot(ma2, color=color.new(color.yellow, 60), style=plot.style_line, title="MA2", linewidth=2)

plot(ma3, color=color.new(color.white, 60), style=plot.style_line, title="MA3", linewidth=2)

// === USE ADR FOR FILTERING ===

// The idea here is that you want to buy in a consolodating range for best risk/reward. So here you can compare the current distance between

// support/resistance vs. the ADR and make sure you aren't buying at a point that is too extended.

useAdrFilter = input(title = "Use ADR for Filtering?", type = input.bool, defval = false, group = "adr filtering",

tooltip = "Signals will be ignored if the distance between support and resistance is larger than a user-defined percentage of ADR (or monthly volatility

in the stock screener). This allows the user to ensure they are not buying something that is too extended and instead focus on names that are consolidating more.")

adrPerc = input(defval = 120, title = "% of ADR Value", minval = 1, group = "adr filtering")

tableLocation = input(defval="Bottom", options=["Top", "Bottom"], title = "ADR Table Visibility", group = "adr filtering",

tooltip = "Place ADR table on the top of the pane, the bottom of the pane, or off.")

adrValue = security(syminfo.tickerid, "D", sma((high-low)/abs(low) * 100, 21)) // Monthly Volatility in Stock Screener (also ADR)

adrCompare = (adrPerc * adrValue) / 100

// === PLOT SWING HIGH/LOW AND MOST RECENT LOW TO USE AS STOP LOSS EXIT POINT ===

ph = pivothigh(high, lbHigh, lbHigh)

pl = pivotlow(low, lbLow, lbLow)

highLevel = valuewhen(ph, high[lbHigh], 0)

lowLevel = valuewhen(pl, low[lbLow], 0)

barsSinceHigh = barssince(ph) + lbHigh

barsSinceLow = barssince(pl) + lbLow

timeSinceHigh = time[barsSinceHigh]

timeSinceLow = time[barsSinceLow]

//Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

pvthis = fixnan(ph)

pvtlos = fixnan(pl)

hipc = change(pvthis) != 0 ? na : color.new(color.maroon, 0)

lopc = change(pvtlos) != 0 ? na : color.new(color.green, 0)

// Display Pivot lines

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=-lbHigh, title="Top Levels")

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=0, title="Top Levels 2")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=-lbLow, title="Bottom Levels")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=0, title="Bottom Levels 2")

// BUY AND SELL CONDITIONS

buyLevel = valuewhen(ph, high[lbHigh], 0) //Buy level at Swing High

// Conditions for entry

stopLevel = float(na) // Define stop level here as "na" so that I can reference it in the ADR calculation before the stopLevel is actually defined.

buyConditions = (useMaFilter ? buyLevel > ma3 : true) and

(useAdrFilter ? (buyLevel - stopLevel[1]) < adrCompare : true)

buySignal = crossover(high, buyLevel) and buyConditions

// Trailing stop points - when price punctures the moving average, move stop to the low of that candle - Define as function/tuple to only use one security call

trailMa = trailMaInput == "1st Moving Average" ? ma1 : ma2

f_getCross() =>

maCrossEvent = crossunder(low, trailMa)

maCross = valuewhen(maCrossEvent, low, 0)

maCrossLevel = fixnan(maCross)

maCrossPc = change(maCrossLevel) != 0 ? na : color.new(color.blue, 0) //Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

[maCrossEvent, maCross, maCrossLevel, maCrossPc]

crossTF = trailMaTF == "Same as Moving Averages" ? htf : ""

[maCrossEvent, maCross, maCrossLevel, maCrossPc] = security(syminfo.tickerid, crossTF, f_getCross())

plot(showPivotPoints ? maCrossLevel : na, color = maCrossPc, linewidth=1, offset=0, title="Ma Stop Levels")

// == STOP AND PRICE LEVELS ==

inPosition = strategy.position_size > 0

buyLevel := inPosition ? buyLevel[1] : buyLevel

stopDefine = valuewhen(pl, low[lbLow], 0) //Stop Level at Swing Low

inProfit = strategy.position_avg_price <= stopDefine[1]

// stopLevel := inPosition ? stopLevel[1] : stopDefine // Set stop loss based on swing low and leave it there

stopLevel := inPosition and not inProfit ? stopDefine : inPosition and inProfit ? stopLevel[1] : stopDefine // Trail stop loss until in profit

trailStopLevel = float(na)

// trying to figure out a better way for waiting on the trail stop - it can trigger if above the stopLevel even if the MA hadn't been breached since opening the trade

notInPosition = strategy.position_size == 0

inPositionBars = barssince(notInPosition)

maCrossBars = barssince(maCrossEvent)

trailCross = inPositionBars > maCrossBars

// trailCross = trailMa > stopLevel

trailStopLevel := inPosition and trailCross ? maCrossLevel : na

plot(inPosition ? stopLevel : na, style=plot.style_linebr, color=color.new(color.orange, 50), linewidth = 2, title = "Historical Stop Levels", trackprice=false)

plot(inPosition ? trailStopLevel : na, style=plot.style_linebr, color=color.new(color.blue, 50), linewidth = 2, title = "Historical Trail Stop Levels", trackprice=false)

// == PLOT SUPPORT/RESISTANCE LINES FOR CURRENT CHART TIMEFRAME ==

// Use a function to define the lines

// f_line(x1, y1, y2, _color) =>

// var line id = na

// line.delete(id)

// id := line.new(x1, y1, time, y2, xloc.bar_time, extend.right, _color)

// highLine = f_line(timeSinceHigh, highLevel, highLevel, currentColorR)

// lowLine = f_line(timeSinceLow, lowLevel, lowLevel, currentColorS)

// == ADR TABLE ==

tablePos = tableLocation == "Top" ? position.top_right : position.bottom_right

var table adrTable = table.new(tablePos, 2, 1, border_width = 3)

lightTransp = 90

avgTransp = 80

heavyTransp = 70

posColor = color.rgb(38, 166, 154)

negColor = color.rgb(240, 83, 80)

volColor = color.new(#999999, 0)

f_fillCellVol(_table, _column, _row, _value) =>

_transp = abs(_value) > 7 ? heavyTransp : abs(_value) > 4 ? avgTransp : lightTransp

_cellText = tostring(_value, "0.00") + "%\n" + "ADR"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(volColor, _transp), text_color = volColor, width = 6)

srDistance = (highLevel - lowLevel)/highLevel * 100

f_fillCellCalc(_table, _column, _row, _value) =>

_c_color = _value >= adrCompare ? negColor : posColor

_transp = _value >= adrCompare*0.8 and _value <= adrCompare*1.2 ? lightTransp :

_value >= adrCompare*0.5 and _value < adrCompare*0.8 ? avgTransp :

_value < adrCompare*0.5 ? heavyTransp :

_value > adrCompare*1.2 and _value <= adrCompare*1.5 ? avgTransp :

_value > adrCompare*1.5 ? heavyTransp : na

_cellText = tostring(_value, "0.00") + "%\n" + "Range"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(_c_color, _transp), text_color = _c_color, width = 6)

if barstate.islast

f_fillCellVol(adrTable, 0, 0, adrValue)

f_fillCellCalc(adrTable, 1, 0, srDistance)

// f_fillCellVol(adrTable, 0, 0, inPositionBars)

// f_fillCellCalc(adrTable, 1, 0, maCrossBars)

// == STRATEGY ENTRY AND EXIT ==

strategy.entry("Buy", strategy.long, stop = buyLevel, when = buyConditions)

stop = stopLevel > trailStopLevel ? stopLevel : close[1] > trailStopLevel and close[1] > trailMa ? trailStopLevel : stopLevel

strategy.exit("Sell", from_entry = "Buy", stop=stop)

- 超トレンド強化ピボット逆転戦略

- モメントアービトラージ戦略 バックテスト分析

- 平均逆転ボリンジャーバンド戦略

- 線形回帰移動平均取引戦略

- 双帯域フィルター戦略

- 2つの移動平均のクロスマーケット取引戦略

- ボリンジャー・バンド・フィッティング戦略

- 雄牛と熊の力 バックテスト戦略

- 移動平均のクロスオーバー戦略

- ストカスティック・モメンタム・ブレイクアウト戦略

- カマリラ・チャネルに基づく脱出戦略

- トレンド・ムービング・アベア・クロスオーバー・戦略に

- 月間トレンドブレイク戦略

- DEMAの変動指数戦略

- 戦略 を フォロー する 傾向

- 複数のタイムフレームストーカスティック・クロスオーバー戦略

- 移動平均追跡取引戦略

- SMAがRSIを横切る ゴールデンクロス デスクロス 取引戦略

- スーパートレンド戦略に従うこと

- トレンド逆転波動性組み合わせ戦略