一目均衡表に基づくマルチシグナル定量取引戦略

概要

この戦略は,Ichimoku Kinko Hyo指数と他の様々な技術指標を総合的に使用し,複数の取引シグナルを組み合わせて,Ichimokuシステムの優位性を発揮し,同時に複数のシグナル確認で入場し,偽信号を効果的にフィルターし,高い勝率を追求しながらリスクを制御します.

戦略原則

この戦略は以下の部分に分かれています.

Ichimoku Kinko Hyo指標の計算には,転向線 ((Tenkan-sen),基準線 ((Kijun-sen),先行線 ((Senkou Span A),遅れ線 ((Senkou Span B),雲積 ((Kumo) などを含む計算公式。

複数のフィルターの設定,Kumo クラウドプレスフィルター,Kijun 基準線フィルター,MACD フィルター,RSI フィルター,Bill Williams ARGUMENTS フラクタルフィルター,SuperTrend フィルター,Parabolic SAR フィルター,ADX フィルターなど.これらのフィルターは,トレンドの方向を確認し,取引が震動市場の影響を受けないようにするために使用されます.

多種多様な取引シグナルの設定は,前期閉盘価格が基準線を突破する信号,チコウ幅と価格または雲積の関係信号,ターニングラインと基準線または雲積の関係信号など,合計23種類のイチモク原生取引シグナルがあります.さらに,MACD,RSI,フラクタルなど,他の多くの技術指標信号が加わっています.これらの取引シグナルは,潜在的な取引機会を探すために使用されます.

入力信号をフィルタリングするために2級フィルタを設定する. 一級および二級フィルタとしてそれぞれ1つのフィルタを選択することで,偽信号を効果的に回避できます.

2段階のフィルターの設定は,出場信号をフィルタリングする. 入場フィルターに類似する.

多信号集成は,最終的な入場および出場信号である. ユーザが選択した特定の取引信号に応じて,一級および二級の入場フィルターと出場フィルターを組み合わせて,最終的な取引決定を形成する.

止損停止設定. 選択可能な止損停止の設定と特定の止損停止の位置.

回測周期設定。回測の開始終了時間を設定できます。

戦略的優位性

この戦略は以下の利点があります.

イチモクウの複数の指標と複数の取引シグナルの優位性を総合的に利用し,トレンド追跡とシグナルフィルタリングの両方を兼ね備えています.

2つのレベルのフィルター設定により,入口を回避して,リスクを効果的に制御します.

複数の取引シグナルが提供され,異なる市場環境で最適化できます.

複数のフィルタが提供され,個々の株の特徴に合わせて最適化できます.

ストップ・ストップ・ロスの位置を設定して,利益をロックし,リスクを制御する.

戦略を最適化するために,異なる反測サイクルを検証するために設定できます.

戦略リスク

この戦略にはいくつかのリスクがあります.

Ichimokuシステムでは,買出信号の判断が遅いため,ショートラインの取引機会を逃してしまう可能性があります.適切な周期の最適化を短縮することができます.

複数のフィルタリングは過度に慎重であり,入場不確実性をもたらす可能性があります.フィルタリングパラメータをテストして調整することができます.

単一の止損点位設定は,複雑な状況に対応するほど柔軟ではない. 動的止損を考慮することができる.

回測周期の設定は不正確で,実体環境を完全にシミュレートすることはできません. 検証を何度も調整する必要があります.

戦略最適化の方向性

この戦略は,以下の点で最適化できます.

イチモクシステムのパラメータの調整,例えば,ショートライン取引に適した回転回路の短縮.

異なる取引信号の組み合わせをテストし,個々の株に最も適した信号選択を識別する.

フィルターパラメータを最適化し,フィルタリング効果と入場確実性をバランスさせる.

動的ストップを試して,市場の変化に合わせてストップをします.

より長い回帰周期を設定するか,または,シミュレーションをより正確にするために,tick回帰データを使用する.

ポジション管理モジュールを追加し,貯蓄方法による資金利用効率を最適化する.

自動パラメータ最適化機能が追加され,よりスマートな戦略調整が可能になります.

要約する

この戦略は,Ichimokuシステムによって提供される複数の指標と取引シグナル,および他の技術指標を使用して信号のフィルタリングと確認を配合して,融合トレンド追跡と突破シグナルの量化取引戦略を実現する.この戦略は,Ichimokuシステムの優位性を充分に活用し,パラメータ化されたモジュールを調整と最適化のために設計し,市場の変化によりうまく適応することができます.この戦略は,継続的なテストと最適化により,高い安定した収益性を達成する見込みである.

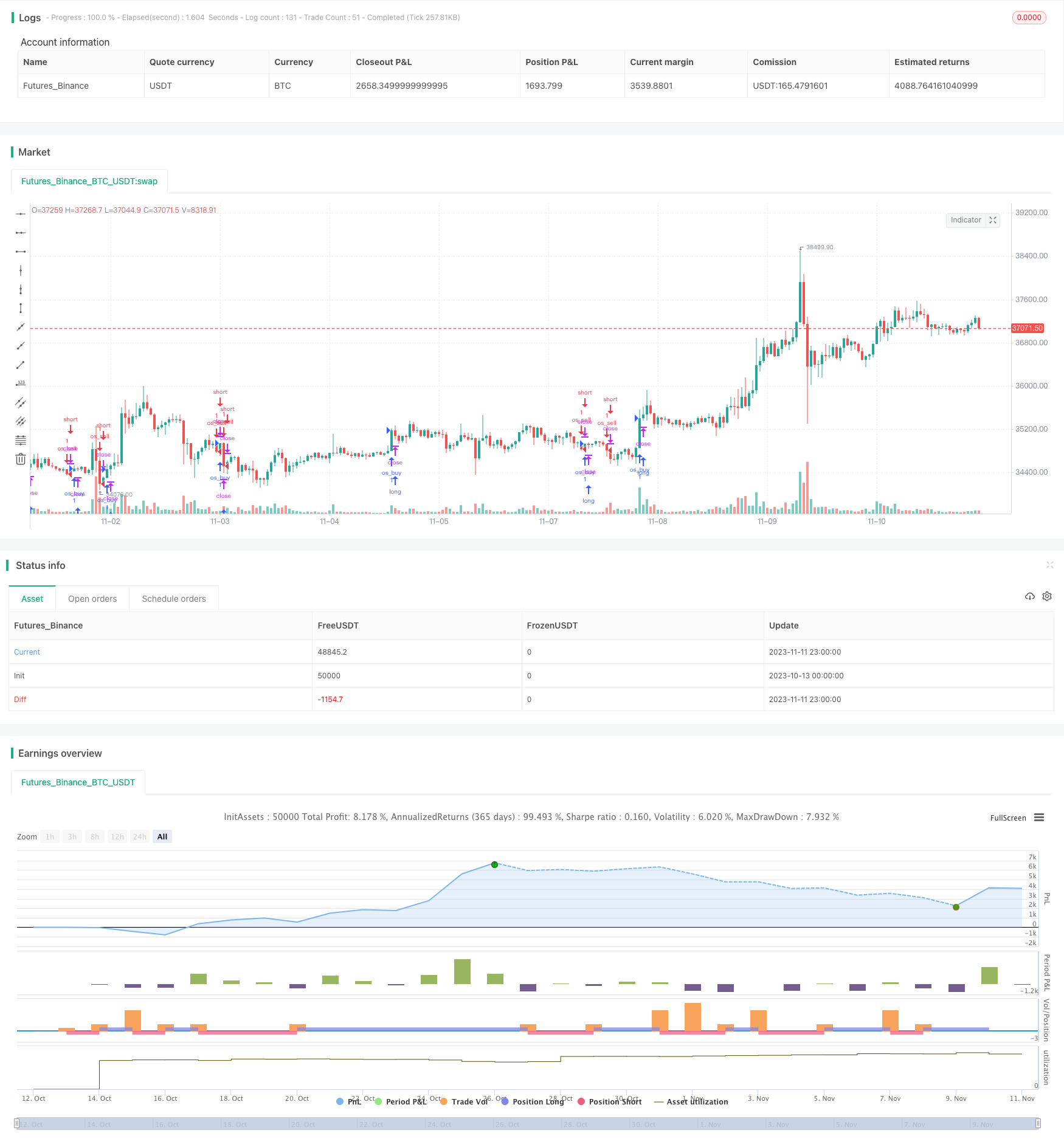

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ramsay09

//@version=4

strategy(title="The Strategy - Ichimoku Kinko Hyo and more",shorttitle="Strategy ", overlay=true)

backtest = input(title= "Backtest (no comment-string)", type= input.bool, defval= false)

entry_type = input("Both", title= "Long/Short Entry", options= ["Both", "Long", "Short"])

shared_param = input(false, title= " Shared Filter and Entry Parameters :", type= input.bool)

fr_period = input(2, title= "Fractals Period (Filter/Entry)", minval= 1)

rsi_period = input(14, title= "RSI Period (Filter/Entry)", minval= 1)

mult = input(2, type= input.float, title= "SuperTrend multiplier (Filter/Entry)", minval= 1)

len = input(5, type= input.integer, title= "SuperTrend length (Filter/Entry)", minval= 1)

start = 0.02//input(0.02, title= "PSAR Start (Filter/Entry)", minval= 0)

inc = 0.02//input(0.02, title= "PSAR Increment (Filter/Entry)", minval= 0)

max = 0.2//input(.2, title= "PSAR Maximum (Filter/Entry)", minval= 0)

adx_period = input(10, title= "ADX Period (Filter/Entry)", minval= 1)

adx_tres = input(25, title= "ADX threshold (Filter/Entry)", minval= 1)

X_opt = input("Price X Kumo sig", title="Signal", options= ["---", "Inside Bar sig", "Outside Bar sig", "Sandwich Bar sig", "Bar sig", "SMA50 sig", "RSI50 sig",

"Fractals sig", "Parabolic SAR sig", "SuperTrend sig", "Price X Kijun sig", "Price X Kumo sig", "Kumo flip sig",

"Price filtered Kumo flip sig", "Chikou X Price sig", "Chikou X Kumo sig", "Price X Tenkan sig", "Tenkan X Kumo sig",

"Tenkan X Kijun sig", "Kumo filtered Tenkan X Kijun sig", "CB/CS sig", "IB/IS sig", "B1/S1 sig", "B2/S2 sig"])

entry_f_1 = input("---", title="Entry filter 1", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

entry_f_2 = input("---", title="Entry filter 2", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

exit_f_1 = input("---", title="Exit filter 1", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

exit_f_2 = input("---", title="Exit filter 2", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

//-------------------- Ichimoku --------------------

TKlength = 9 //input(9, "Tenkan-sen length", minval= 1)

KJlength = 26 //input(26, "Kijun-sen length", minval= 1)

CSHSlength = 26 //input(26, "Chikouspan length/horizontal shift", minval= 1)

SBlength = 52 //input(52, "SenkouspanB length", minval= 1)

SAlength = 26 //input(26, "SenkouspanA length", minval= 1)

// calculation

TK = avg(lowest(TKlength), highest(TKlength))

KJ = avg(lowest(KJlength), highest(KJlength))

CS = close

SB = avg(lowest(SBlength), highest(SBlength))

SA = avg(TK,KJ)

kumo_high = max(SA[CSHSlength-1], SB[CSHSlength-1])

kumo_low = min(SA[CSHSlength-1], SB[CSHSlength-1])

//------------------------------------- Filters and entry signals --------------------------------------

//---------------------- Kumo filter ------------------------

kumo_buy = close > kumo_high

kumo_sell = close < kumo_low

//--------------------- Kijun filter ----------------------

kijun_buy = close > KJ

kijun_sell = close < KJ

//----------------------- macd filter -----------------------

[macdLine_f, signalLine_f, histLine_f] = macd(close, 12, 26, 9)

macd_buy = macdLine_f > signalLine_f

macd_sell = macdLine_f < signalLine_f

//---------------------- rsi filter and entry signal------------------------

rsi_f_buy = rsi(close, rsi_period) > 50

rsi_f_sell = rsi(close, rsi_period) < 50

//---------------- Bill Williams Fractals (filter and entry signal) -----------------

up_fr = pivothigh(fr_period, fr_period)

dn_fr = pivotlow(fr_period, fr_period)

fractal_up_v = valuewhen(up_fr, high[fr_period],0)

fractal_dn_v = valuewhen(dn_fr, low[fr_period],0)

fr_upx = high > fractal_up_v

fr_dnx = low < fractal_dn_v

//-------------------- SuperTrend filter and entry signal ---------------------

[SuperTrend, Dir] = supertrend(mult, len)

sup_buy = close > SuperTrend

sup_sell = close < SuperTrend

//--------------------- Heikin Ashi -----------------------

//heikin_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

//heikin_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

//h_buy = heikin_close[1] > heikin_open[1]

//h_sell = heikin_close[1] < heikin_open[1]

//----------------- Parabolic SAR Signal (pb/ps) and filter -------------------

psar_buy = high > sar(start, inc, max)[0]

psar_sell = low < sar(start, inc, max)[0]

//-------------------------- ADX filter ---------------------------

[diplus_f, diminus_f, adx_f] = dmi(adx_period, adx_period)

//-------------------------- SMA50 filter and entry---------------------------

sma50_buy = close[2] > sma(close, 50)

sma50_sell = close[2] < sma(close, 50)

//-------------------------- entry filter -------------------------------

//entry buy filter 1 options

entry_filter_buy_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_buy :

entry_f_1 == "RSI50 filter" ? rsi_f_buy :

entry_f_1 == "Fractals filter" ? fr_upx :

entry_f_1 == "SuperTrend filter" ? sup_buy :

entry_f_1 == "Parabolic SAR filter" ? psar_buy :

entry_f_1 == "Cloud filter" ? kumo_buy :

entry_f_1 == "Kijun filter" ? kijun_buy :

entry_f_1 == "SMA50 filter" ? sma50_buy :

entry_f_1 == "ADX filter" ? adx_f > 25 : true

//entry sell filter 1 options

entry_filter_sell_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_sell :

entry_f_1 == "RSI50 filter" ? rsi_f_sell :

entry_f_1 == "Fractals filter" ? fr_dnx :

entry_f_1 == "SuperTrend filter" ? sup_sell :

entry_f_1 == "Parabolic SAR filter" ? psar_sell :

entry_f_1 == "Cloud filter" ? kumo_sell :

entry_f_1 == "Kijun filter" ? kijun_sell :

entry_f_1 == "SMA50 filter" ? sma50_sell :

entry_f_1 == "ADX filter" ? adx_f > 25 : true

//entry buy filter 2 options

entry_filter_buy_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_buy :

entry_f_2 == "RSI50 filter" ? rsi_f_buy :

entry_f_2 == "Fractals filter" ? fr_upx :

entry_f_2 == "SuperTrend filter" ? sup_buy :

entry_f_2 == "Parabolic SAR filter" ? psar_buy :

entry_f_2 == "Cloud filter" ? kumo_buy :

entry_f_2 == "Kijun filter" ? kijun_buy :

entry_f_2 == "SMA50 filter" ? sma50_buy :

entry_f_2 == "ADX filter" ? adx_f > 25 : true

//entry sell filter 2 options

entry_filter_sell_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_sell :

entry_f_2 == "RSI50 filter" ? rsi_f_sell :

entry_f_2 == "Fractals filter" ? fr_dnx :

entry_f_2 == "SuperTrend filter" ? sup_sell :

entry_f_2 == "Parabolic SAR filter" ? psar_sell :

entry_f_2 == "Cloud filter" ? kumo_sell :

entry_f_2 == "Kijun filter" ? kijun_sell :

entry_f_2 == "SMA50 filter" ? sma50_sell :

entry_f_2 == "ADX filter" ? adx_f > 25 : true

//------------------------- exit filter -----------------------

//exit buy filter 1 options

exit_filter_buy_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "MACD filter" ? macd_buy :

exit_f_1 == "RSI50 filter" ? rsi_f_buy :

exit_f_1 == "Fractals filter" ? fr_upx :

exit_f_1 == "SuperTrend filter" ? sup_buy :

exit_f_1 == "Parabolic SAR filter" ? psar_buy :

exit_f_1 == "Cloud filter" ? kumo_buy :

exit_f_1 == "Kijun filter" ? kijun_buy :

exit_f_1 == "SMA50 filter" ? sma50_buy :

exit_f_1 == "ADX filter" ? adx_f > 25 : false

//exit sell filter 1 options

exit_filter_sell_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "MACD filter" ? macd_sell :

exit_f_1 == "RSI50 filter" ? rsi_f_sell :

exit_f_1 == "Fractals filter" ? fr_dnx :

exit_f_1 == "SuperTrend filter" ? sup_sell :

exit_f_1 == "Parabolic SAR filter" ? psar_sell :

exit_f_1 == "Cloud filter" ? kumo_sell :

exit_f_1 == "Kijun filter" ? kijun_sell :

exit_f_1 == "SMA50 filter" ? sma50_sell :

exit_f_1 == "ADX filter" ? adx_f > 25 : false

//exit buy filter 2 options

exit_filter_buy_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "MACD filter" ? macd_buy :

exit_f_2 == "RSI50 filter" ? rsi_f_buy :

exit_f_2 == "Fractals filter" ? fr_upx :

exit_f_2 == "SuperTrend filter" ? sup_buy :

exit_f_2 == "Parabolic SAR filter" ? psar_buy :

exit_f_2 == "Cloud filter" ? kumo_buy :

exit_f_2 == "Kijun filter" ? kijun_buy :

exit_f_2 == "SMA50 filter" ? sma50_buy :

exit_f_2 == "ADX filter" ? adx_f > 25 : false

//exit sell filter 2 options

exit_filter_sell_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "MACD filter" ? macd_sell :

exit_f_2 == "RSI50 filter" ? rsi_f_sell :

exit_f_2 == "Fractals filter" ? fr_dnx :

exit_f_2 == "SuperTrend filter" ? sup_sell :

exit_f_2 == "Parabolic SAR filter" ? psar_sell :

exit_f_2 == "Cloud filter" ? kumo_sell :

exit_f_2 == "Kijun filter" ? kijun_sell :

exit_f_2 == "SMA50 filter" ? sma50_sell :

exit_f_2 == "ADX filter" ? adx_f > 25 : false

//----------------------- i-o-s signals ------------------------

i_bar_buy = high[1] < high[2] and low[1] > low[2] and close > high[1]

i_bar_sell = high[1] < high[2] and low[1] > low[2] and close < low[1]

o_bar_buy = high[1] > high[2] and low[1] < low[2] and high > high[1]

o_bar_sell = high[1] > high[2] and low[1] < low[2] and low < low[1]

s_bar_buy = high[2] < high[3] and low[2] > low[3] and high[1] > high[2] and low[1] < low[2] and high > high[1]

s_bar_sell = high[2] < high[3] and low[2] > low[3] and high[1] > high[2] and low[1] < low[2] and low < low[1]

//----------------- Ichimoku Signal B1/S1 -----------------

buy_strong_B1 = (TK >= KJ) and close > kumo_high and CS > high[(26-1)] and CS > kumo_high[26-1] and SA > SB

sell_strong_S1 = (TK <= KJ) and close < kumo_low and CS < low[(26-1)] and CS < kumo_low[26-1] and SA < SB

var buy_sig = true

var sell_sig = true

B1_a = buy_strong_B1 and buy_sig

S1_a = sell_strong_S1 and sell_sig

if sell_strong_S1

buy_sig := true, sell_sig := false

if buy_strong_B1

sell_sig := true, buy_sig := false

//----------------- Ichimoku Signal B2/S2 -----------------

buy_strong_B2 = (TK >= KJ) and close > kumo_high and CS > high[26-1]

sell_strong_S2 = (TK <= KJ) and close < kumo_low and CS < low[26-1]

var buy_sig_B2 = true

var sell_sig_S2 = true

B2_a = buy_strong_B2 and buy_sig_B2

S2_a = sell_strong_S2 and sell_sig_S2

if sell_strong_S2

buy_sig_B2 := true, sell_sig_S2 := false

if buy_strong_B2

sell_sig_S2 := true, buy_sig_B2 := false

//---------------------------- Confluence Signal ----------------------------

long_short_trig = 7 //input(7, type= input.float, title= "Confluence signal trigger Level", step= 0.1)

trig_gap_cbcs = input(2, type= input.float, title= "CB/CS signal sesitivity", minval= 0, maxval= 6, step= 1)

//Indicators

// ma

sma1 = sma(close, 50)

sma2 = sma(close, 200)

ema1 = ema(close, 50)

ema2 = ema(close, 200)

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

rsi = rsi(close, 14)

[diplus, diminus, adx] = dmi(7, 7)

[superTrend, dir] = supertrend(2, 5)

//Klinger Oszillator

sv = change(hlc3) >= 0 ? volume : -volume

kvo = ema(sv, 34) - ema(sv, 55)

sig = ema(kvo, 13)

//Vortex Indicator

VMP = sum( abs( high - low[1]), 14 )

VMM = sum( abs( low - high[1]), 14 )

STR = sum( atr(1), 14 )

VIP = VMP / STR

VIM = VMM / STR

//Signals

var float sma_sig_w = na

var float ema_sig_w = na

var float p_kj_sig_w = na

var float tk_kj_sig_w = na

var float B1_S1_sig_w = na

var float B2_S2_sig_w = na

var float psar_sig_w = na

var float frac_sig_w = na

var float macd_sig_w = na

var float rsi_sig_w = na

var float p_tk_sig_w = na

var float dmi_sig_w = na

var float klin_sig_w = na

var float vort_sig_w = na

var float sup_sig_w = na

if sma1 > sma2

sma_sig_w := 1

else if sma1 < sma2

sma_sig_w := 0

if ema1 > ema2

ema_sig_w := 1

else if ema1 < ema2

ema_sig_w := 0

if close > KJ

p_kj_sig_w := 1

else if close < KJ

p_kj_sig_w := 0

if TK > KJ

tk_kj_sig_w := 1

else if TK < KJ

tk_kj_sig_w := 0

if buy_strong_B1

B1_S1_sig_w := 1

else if sell_strong_S1

B1_S1_sig_w := 0

if buy_strong_B2

B2_S2_sig_w := 1

else if sell_strong_S2

B2_S2_sig_w := 0

if high >= sar(start, inc, max)[0]

psar_sig_w := 1

else if low <= sar(start, inc, max)[0]

psar_sig_w := 0

if high > fractal_up_v

frac_sig_w := 1

else if low < fractal_dn_v

frac_sig_w := 0

if macdLine > signalLine

macd_sig_w := 1

else if macdLine < signalLine

macd_sig_w := 0

if rsi > 50

rsi_sig_w := 1

else if rsi < 50

rsi_sig_w := 0

if close[2] > TK

p_tk_sig_w := 1

else if close[2] < TK

p_tk_sig_w := 0

if diplus > diminus

dmi_sig_w := 1

else if diplus < diminus

dmi_sig_w := 0

if sig > 0

klin_sig_w := 1

else if sig < 0

klin_sig_w := 0

if VIP > VIM

vort_sig_w := 1

else if VIP < VIM

vort_sig_w := 0

if close > superTrend

sup_sig_w := 1

else if close < superTrend

sup_sig_w := 0

bs_conf_sig = sma_sig_w + ema_sig_w + p_kj_sig_w + tk_kj_sig_w + B1_S1_sig_w + B2_S2_sig_w + psar_sig_w + frac_sig_w + macd_sig_w +

rsi_sig_w + dmi_sig_w + klin_sig_w + vort_sig_w + sup_sig_w + p_tk_sig_w

long_c = bs_conf_sig > long_short_trig + trig_gap_cbcs //with +- signal is less fluctuating

short_c = bs_conf_sig < long_short_trig - trig_gap_cbcs

//---------------------------- Pure Ichimoku Confluence Signal ----------------------------

pic_l_s_trig = 4 //input(4, type= input.float, title= "Ichimoku confluence signal trigger Level", step= 0.1)

trig_gap_ibis = input(0, type= input.float, title= "IB/IS signal sesitivity", minval= 0, maxval= 3, step= 1)

//Signals

var float tkkh_sig_w = na

var float csh_sig_w = na

var float cskh_sig_w = na

var float pkj_sig_w = na

var float ptk_sig_w = na

var float tkkj_sig_w = na

var float sasb_sig_w = na

var float ckh_sig_w = na

if TK > kumo_high

tkkh_sig_w := 1

else if TK < kumo_low

tkkh_sig_w := 0

if CS > high[(26-1)]

csh_sig_w := 1

else if CS < low[(26-1)]

csh_sig_w := 0

if CS > kumo_high[26-1]

cskh_sig_w := 1

else if CS < kumo_low[26-1]

cskh_sig_w := 0

if close > TK

ptk_sig_w := 1

else if close < TK

ptk_sig_w := 0

if close > KJ

pkj_sig_w := 1

else if close < KJ

pkj_sig_w := 0

if TK > KJ

tkkj_sig_w := 1

else if TK < KJ

tkkj_sig_w := 0

if SA > SB

sasb_sig_w := 1

else if SA < SB

sasb_sig_w := 0

if close > kumo_high

ckh_sig_w := 1

else if close < kumo_low

ckh_sig_w := 0

bs_pic_sig = tkkh_sig_w + csh_sig_w + cskh_sig_w + ptk_sig_w + pkj_sig_w + tkkj_sig_w + sasb_sig_w + ckh_sig_w

long_pic = bs_pic_sig > pic_l_s_trig + trig_gap_ibis

short_pic = bs_pic_sig < pic_l_s_trig - trig_gap_ibis

//--------------------------- Entry Signal Options ---------------------------

var buy_sig_opt = true

var sell_sig_opt = true

// cross conditions for "Strong" bg's

var bool sasb_x = true

if crossover(SA, SB) and low > kumo_high

sasb_x := true

if crossunder(SA, SB) and high < kumo_low

sasb_x := false

var bool tkkj_x = true

if crossover(TK, KJ) and TK > kumo_high and KJ > kumo_high

tkkj_x := true

if crossunder(TK, KJ) and TK < kumo_low and KJ < kumo_low

tkkj_x := false

// buy signal options

opt_sig_buy =

X_opt == "---" ? na :

X_opt == "Inside Bar sig" ? i_bar_buy :

X_opt == "Outside Bar sig" ? o_bar_buy :

X_opt == "Sandwich Bar sig" ? s_bar_buy :

X_opt == "Bar sig" ? close > high[1] :

X_opt == "SMA50 sig" ? close[2] > sma(close, 50) :

X_opt == "Fractals sig" ? fr_upx :

X_opt == "RSI50 sig" ? rsi_f_buy :

X_opt == "Parabolic SAR sig" ? psar_buy :

X_opt == "SuperTrend sig" ? sup_buy :

X_opt == "Price X Kijun sig" ? close > KJ :

X_opt == "Price X Kumo sig" ? close > kumo_high :

X_opt == "Kumo flip sig" ? SA > SB :

X_opt == "Price filtered Kumo flip sig" ? sasb_x and low > kumo_high :

X_opt == "Chikou X price sig" ? CS > high[(26-1)] :

X_opt == "Chikou X Kumo sig" ? CS > kumo_high[26-1] :

X_opt == "Price X Tenkan sig" ? close > TK :

X_opt == "Tenkan X Kumo sig" ? TK > kumo_high :

X_opt == "Tenkan X Kijun sig" ? TK > KJ :

X_opt == "Kumo filtered Tenkan X Kijun sig" ? tkkj_x and TK > kumo_high and KJ > kumo_high and TK > KJ :

X_opt == "CB/CS sig" ? long_c :

X_opt == "IB/IS sig" ? long_pic :

X_opt == "B1/S1 sig" ? buy_strong_B1 :

X_opt == "B2/S2 sig" ? buy_strong_B2 : na

// sell signal options

opt_sig_sell =

X_opt == "---" ? na :

X_opt == "Inside Bar sig" ? i_bar_sell :

X_opt == "Outside Bar sig" ? o_bar_sell :

X_opt == "Sandwich Bar sig" ? s_bar_sell :

X_opt == "Bar sig" ? close < low[1] :

X_opt == "SMA50 sig" ? close[2] < sma(close, 50) :

X_opt == "Fractals sig" ? fr_dnx :

X_opt == "RSI50 sig" ? rsi_f_sell :

X_opt == "Parabolic SAR sig" ? psar_sell :

X_opt == "SuperTrend sig" ? sup_sell :

X_opt == "Price X Kijun sig" ? close < KJ :

X_opt == "Price X Kumo sig" ? close < kumo_low :

X_opt == "Kumo flip sig" ? SA < SB :

X_opt == "Price filtered Kumo flip sig" ? not sasb_x and high < kumo_low :

X_opt == "Chikou X price sig" ? CS < low[(26-1)] :

X_opt == "Chikou X Kumo sig" ? CS < kumo_high[26-1] :

X_opt == "Price X Tenkan sig" ? close < TK :

X_opt == "Tenkan X Kumo sig" ? TK < kumo_low :

X_opt == "Tenkan X Kijun sig" ? TK < KJ :

X_opt == "Kumo filtered Tenkan X Kijun sig" ? not tkkj_x and TK < kumo_low and KJ < kumo_low and TK < KJ :

X_opt == "CB/CS sig" ? short_c :

X_opt == "IB/IS sig" ? short_pic :

X_opt == "B1/S1 sig" ? sell_strong_S1 :

X_opt == "B2/S2 sig" ? sell_strong_S2 : na

if opt_sig_sell

buy_sig := true, sell_sig_opt := false

if opt_sig_buy

sell_sig := true, buy_sig_opt := false

//---------------------------- Take profit and stop loss ------------------------------

tp_en = input(title= "Enable take profit", type= input.bool, defval= false)

qty_tp = input(50, title= "Take profit - quantity of position (percent)", type= input.float, minval= 1, maxval= 100, step= 5)

tp_ticks = input(1000, title= "Take profit - ticks", type= input.integer, minval= 0, step= 10)

sl_en = input(title= "Enable stop loss", type= input.bool, defval= false)

sl_ticks = input(1000, title= "Stop loss - ticks", type= input.integer, minval= 0, step= 10)

//----------------------- Backtest periode --------------------------------

start_year = input(2018, "Start year")

start_month = input(1, "Start month", minval= 1, maxval= 12)

start_day = input(1, "Start day", minval= 1, maxval= 31)

period_start = timestamp(start_year, start_month, start_day, 0, 0)

stop_year = input(2021, "Stop year")

stop_month = input(12, "Stop month", minval= 1, maxval= 12)

stop_day = input(31, "Stop day", minval= 1, maxval= 31)

period_stop = timestamp(stop_year, stop_month, stop_day, 0, 0)

backtest_period() => time >= period_start and time <= period_stop ? true : false

//--------------------- strategy entry ---------------------

long = entry_type != "Short"

short = entry_type != "Long"

not_both = entry_type != "Both"

if not backtest

if long

strategy.entry("os_buy", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2,

comment= "")

strategy.close("os_buy", when = exit_filter_sell_1 or exit_filter_sell_2 or not_both ? opt_sig_sell : na

, comment= "")

strategy.exit("tpl", "os_buy", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if short

strategy.entry("os_sell",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2,

comment= "")

strategy.close("os_sell", when = exit_filter_buy_1 or exit_filter_buy_2 or not_both ? opt_sig_buy : na

, comment= "")

strategy.exit("tps", "os_sell", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if backtest_period() and backtest

if long

strategy.entry("os_buy", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2)

strategy.close("os_buy", when = exit_filter_sell_1 or exit_filter_sell_2 or not_both ? opt_sig_sell : na)

strategy.exit("tpl", "os_buy", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if short

strategy.entry("os_sell",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2)

strategy.close("os_sell", when = exit_filter_buy_1 or exit_filter_buy_2 or not_both ? opt_sig_buy : na)

strategy.exit("tps", "os_sell", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)