モメンタム反転デュアルトラックペアリング戦略

作成日:

2023-11-24 10:17:15

最終変更日:

2023-11-24 10:17:15

コピー:

0

クリック数:

624

1

フォロー

1627

フォロワー

概要

この戦略は,多種多様な技術指標を総合的に使用して,動力反転と双線配合を実現し,取引信号を形成する.戦略は,123形状判断反転点を使用し,エルゴディックCSI指標と配合信号を形成し,トレンド追跡を実現する.この戦略は,中短線トレンドを捕捉し,より高い利益を得ることを目的としている.

戦略原則

この戦略には2つの部分があります.

- 123 形状判断の転換点

- ergodic CSI指標はペアリング信号を生成する

123形判定は,最近3つのK線の閉盘価格関係によって価格逆転を判定する.具体的判定論理は: 前2つのK線の後1つの閉盘価格が上昇し,現在の快慢ストッチ指数がどちらも50を下回っている場合は,買入信号である. 前2つのKラインの1つ後にクローズオフ価格が下がり,現在のH/C・ストッチ指数が50以上である場合は,セール・シグナルである。

ergodic CSI指数は,価格,実際の波幅,トレンド指数などの複数の要因を考慮し,市場動向を総合的に判断し,買入販売地域を生成する. 指数が買取区域より高く,売出区域より低く,買取信号が生じる.

最後に,123形の反転信号は,エルゴディックCSIの軌道信号と対操作を行い,最終策略信号が得られる.

戦略的優位性

- 中短線トレンドを捉え,大きな収益の可能性を秘める

- 逆転形状判断は,転換点を捉えるのに役立ちます.

- 双線配線により,偽信号を減らす

戦略リスク

- 株価の変動が起こり,ストップダメージが発生する可能性がある

- 逆転形は市場の揺れに弱い

- パラメータの最適化空間は限られ,効果は波動的です.

最適化の方向

- パラメータを最適化し,戦略の収益性を向上させる

- ストップ・ロジックを増やし,単一損失を減らす

- 多要素モデルの組み合わせで 株選抜の質向上

要約する

この戦略は,反転形状と双線を組み合わせることで,対中短線のトレンドを効果的に追跡できます.単一の技術指標と比較して,より高い安定性と収益性のレベルがあります.次のステップは,パラメータをさらに最適化し,止損と株式選択モジュールを追加して,撤回を軽減し,全体的な効果を向上します.

ストラテジーソースコード

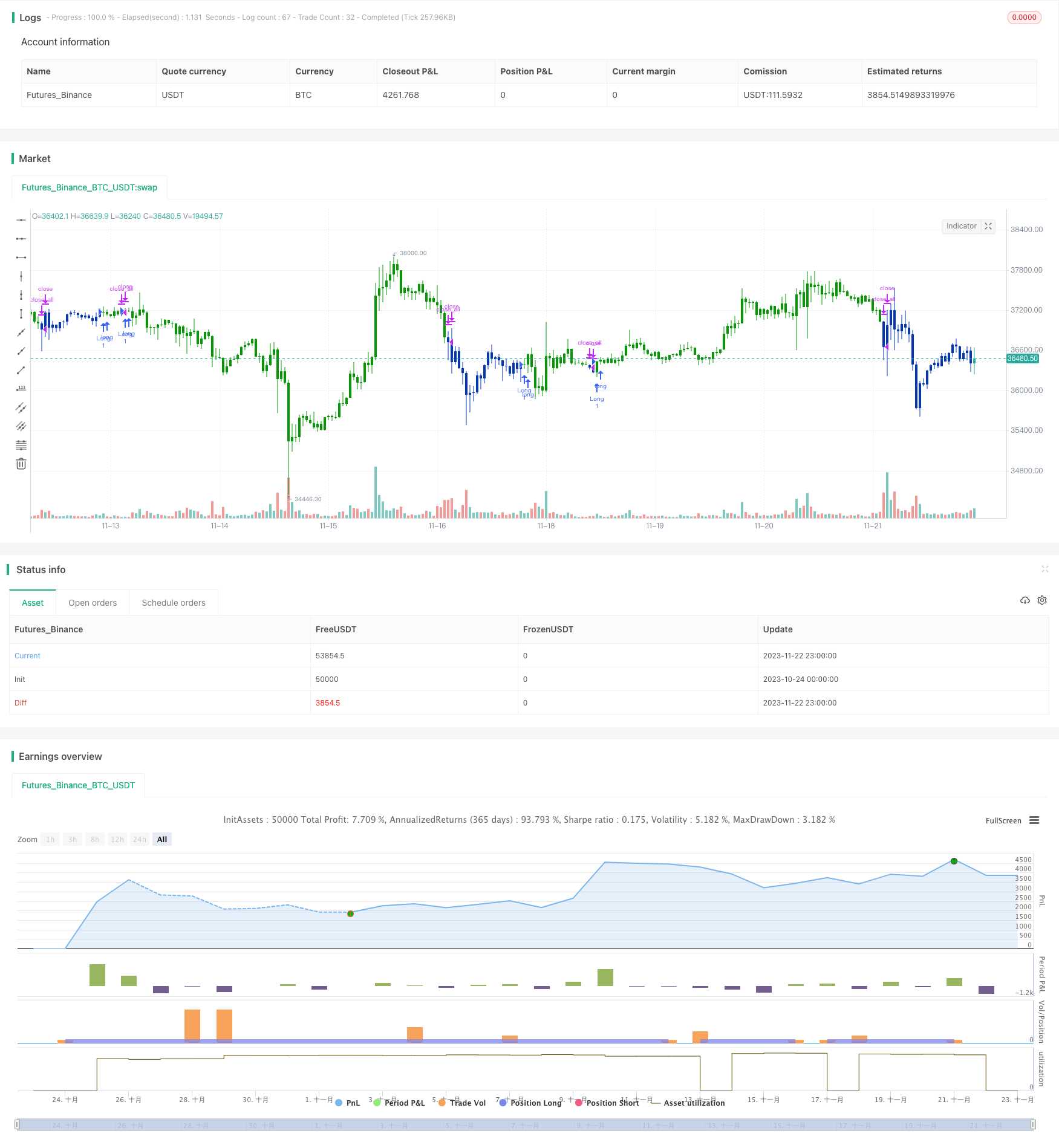

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 22/07/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship between

// price and momentum in step-by-step examples. From this grounding, he then looks

// at the deficiencies in other oscillators and introduces some innovative techniques,

// including a fresh twist on Stochastics. On directional issues, he analyzes the

// intricacies of ADX and offers a unique approach to help define trending and

// non-trending periods.

// This indicator plots Ergotic CSI and smoothed Ergotic CSI to filter out noise.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fADX(Len) =>

up = change(high)

down = -change(low)

trur = rma(tr, Len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, Len) / trur)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, Len) / trur)

sum = plus + minus

100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), Len)

ECSI(r,Length,BigPointValue,SmthLen,SellZone,BuyZone) =>

pos = 0

source = close

K = 100 * (BigPointValue / sqrt(r) / (150 + 5))

xTrueRange = atr(1)

xADX = fADX(Length)

xADXR = (xADX + xADX[1]) * 0.5

nRes = iff(Length + xTrueRange > 0, K * xADXR * xTrueRange / Length,0)

xCSI = iff(close > 0, nRes / close, 0)

xSMA_CSI = sma(xCSI, SmthLen)

pos := iff(xSMA_CSI > BuyZone, 1,

iff(xSMA_CSI <= SellZone, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Ergodic CSI", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

r = input(32, minval=1)

LengthECSI = input(1, minval=1)

BigPointValue = input(1.0, minval=0.00001)

SmthLen = input(5, minval=1)

SellZone = input(0.06, minval=0.00001)

BuyZone = input(0.02, minval=0.001)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posECSI = ECSI(r,LengthECSI,BigPointValue,SmthLen,SellZone,BuyZone)

pos = iff(posReversal123 == 1 and posECSI == 1 , 1,

iff(posReversal123 == -1 and posECSI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )