クロスタイムフレーム スーパートレンド ブレイクストラテジー

作者: リン・ハーンチャオチャン, 日付: 2023-11-24 10:27:52タグ:

概要

この戦略は,複数のタイムフレームとボリンジャーバンドを介してスーパートレンド指標を組み込み,トレンド方向と主要なサポート/レジスタンスレベルを特定し,波動性中にブレイクアウトで取引を行う.主に金,銀,原油などの非常に波動性の高い商品先物向けに設計されています.

戦略の論理

カスタム パインスクリプト機能pine_supertrend()異なる時間枠 (例えば1分と5分) のスーパートレンドを計算し,より大きな時間枠のトレンドの方向性を決定するために実装されます.

ボリンジャーバンド 上部/下部帯はチャネルとして機能する.ブレイクアウトはトレンド方向性をシグナルする.上部帯の上部を閉じるとブレイクアウトを意味する.下部帯を下部を閉じると下降を意味する.

入力信号:

長: 閉じる > 上部帯と閉じる > スーパートレンド (複数 TF) ショート: 閉じる < 下帯 AND 閉じる < スーパートレンド (複数 TF)

出口:

長い出口: 接近 < 5m スーパートレンド ショートアウト: 閉じる> 5m スーパートレンド

超トレンドとBBの間の共鳴を捉えるのです

利点分析

- 超トレンドをタイムフレーム全体で利用し,高確信トレンドの方向性を決定する

- BB帯は,誤ったブレイクを避けるための主要なサポート/レジスタンスレベルとして機能します.

- SuperTrendはリスクを制御するためのダイナミックストップ・ロストとして機能します

リスク分析

- スーパートレンドは,ターニングポイントとトレンド逆転を遅らせることができます.

- BB のパラメータが最適でない場合,取引数が多すぎたり少なすぎたりする可能性があります.

- 突如な一夜間のギャップやニュースイベントはストップ損失を打つ可能性があります.

リスク軽減

- 信号を確認し,偽のブレイクを避けるためにより多くの指標を追加します

- 最適なバランスのためにBBパラメータを最適化

- ストップ・ロスのバッファを拡大し,ギャップを補う

増進 の 機会

- KDJ MACD などの他のトレンド指標をテストし,追加信号の確認を行う.

- 突破確率のMLモデルを追加する

- 最適なパラメータセットのためのパラメータ調整

結論

この戦略は,超トレンドとボリンジャーバンドの力を組み合わせ,クロスタイムフレーム分析とチャネルブレイクアウトを使用して高確率取引を行う.リスクを効果的に制御し,不安定なインスツメントで良い利益を生むことができる.さらなる最適化と指標組み合わせによりパフォーマンスを向上させる.

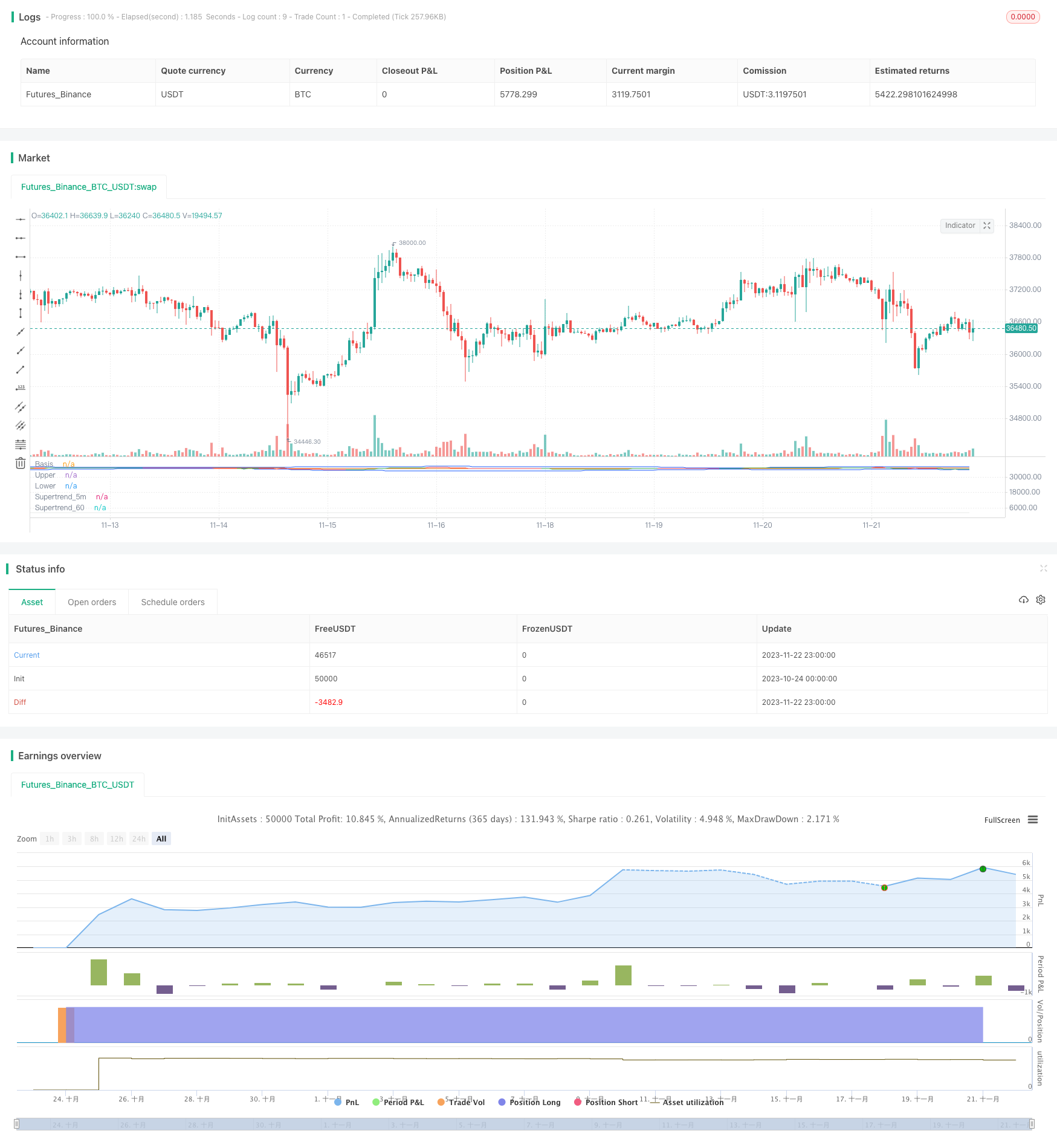

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ambreshc95

//@version=5

strategy("Comodity_SPL_Strategy_01", overlay=false)

// function of st

// [supertrend, direction] = ta.supertrend(3, 10)

// plot(direction < 0 ? supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(direction > 0 ? supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

// VWAP

// src_vwap = input(title = "Source", defval = hlc3, group="VWAP Settings")

// [_Vwap,stdv,_] = ta.vwap(src_vwap,false,1)

// plot(_Vwap, title="VWAP", color = color.rgb(0, 0, 0))

// The same on Pine Script®

pine_supertrend(factor, atrPeriod,len_ma) =>

h= ta.sma(high,len_ma)

l= ta.sma(low,len_ma)

hlc_3 = (h+l)/2

src = hlc_3

atr = ta.atr(atrPeriod)

upperBand = src + factor * atr

lowerBand = src - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

lowerBand := lowerBand > prevLowerBand or close[1] < prevLowerBand ? lowerBand : prevLowerBand

upperBand := upperBand < prevUpperBand or close[1] > prevUpperBand ? upperBand : prevUpperBand

int direction = na

float superTrend = na

prevSuperTrend = superTrend[1]

if na(atr[1])

direction := 1

else if prevSuperTrend == prevUpperBand

direction := close > upperBand ? -1 : 1

else

direction := close < lowerBand ? 1 : -1

superTrend := direction == -1 ? lowerBand : upperBand

[superTrend, direction]

len_ma_given = input(75, title="MA_SMA_ST")

[Pine_Supertrend, pineDirection] = pine_supertrend(3, 10,len_ma_given)

// plot(pineDirection < 0 ? Pine_Supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(pineDirection > 0 ? Pine_Supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

//

// Define Supertrend parameters

atrLength = input(10, title="ATR Length")

factor = input(3.0, title="Factor")

// // Calculate Supertrend

[supertrend, direction] = ta.supertrend(factor, atrLength)

st_color = supertrend > close ? color.red : color.green

// // Plot Supertrend

// plot(supertrend, "Supertrend", st_color)

//

// BB Ploting

length = input.int(75, minval=1)

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.5, minval=0.001, maxval=50, title="StdDev")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// h= ta.sma(high,60)

// l= ta.sma(low,60)

// c= sma(close,60)

// hlc_3 = (h+l)/2

// supertrend60 = request.security(syminfo.tickerid, supertrend)

// // Define timeframes for signals

tf1 = input(title="Timeframe 1", defval="1")

tf2 = input(title="Timeframe 2",defval="5")

// tf3 = input(title="Timeframe 3",defval="30")

// // // Calculate Supertrend on multiple timeframes

supertrend_60 = request.security(syminfo.tickerid, tf1, Pine_Supertrend)

supertrend_5m = request.security(syminfo.tickerid, tf2, supertrend)

// supertrend3 = request.security(syminfo.tickerid, tf3, supertrend)

// // Plot Supertrend_60

st_color_60 = supertrend_60 > close ? color.rgb(210, 202, 202, 69) : color.rgb(203, 211, 203, 52)

plot(supertrend_60, "Supertrend_60", st_color_60)

// // Plot Supertrend_5m

st_color_5m = supertrend_5m > close ? color.red : color.green

plot(supertrend_5m, "Supertrend_5m", st_color_5m)

ma21 = ta.sma(close,21)

// rsi = ta.rsi(close,14)

// rsima = ta.sma(rsi,14)

// Define the Indian Standard Time (IST) offset from GMT

ist_offset = 5.5 // IST is GMT+5:30

// Define the start and end times of the trading session in IST

// start_time = timestamp("GMT", year, month, dayofmonth, 10, 0) + ist_offset * 60 * 60

// end_time = timestamp("GMT", year, month, dayofmonth, 14, 0) + ist_offset * 60 * 60

// Check if the current time is within the trading session

// in_trading_session = timenow >= start_time and timenow <= end_time

in_trading_session = not na(time(timeframe.period, "0945-1430"))

// bgcolor(inSession ? color.silver : na)

out_trading_session = not na(time(timeframe.period, "1515-1530"))

// // // Define buy and sell signals

buySignal = close>upper and close > supertrend_5m and close > supertrend_60 and close > ma21 and in_trading_session //close > supertrend and

sellSignal = close<lower and close < supertrend_5m and close < supertrend_60 and close < ma21 and in_trading_session //close < supertrend and

var bool long_position = false

var bool long_exit = false

var float long_entry_price = 0

var float short_entry_price = 0

if buySignal and not long_position

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_label_up, color = color.green, size = size.small)

long_position := true

strategy.entry("Buy",strategy.long)

long_exit := (close < supertrend_5m)

if long_position and long_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.green, size = size.tiny)

long_position := false

strategy.exit("Exit","Buy",stop = close)

var bool short_position = false

var bool short_exit = false

if sellSignal and not short_position

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_label_down, color = color.red, size = size.small)

short_position := true

strategy.entry("Sell",strategy.short)

short_exit := (close > supertrend_5m)

if short_position and short_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.red, size = size.tiny)

short_position := false

strategy.exit("Exit","Sell", stop = close)

if out_trading_session

long_position := false

strategy.exit("Exit","Buy",stop = close)

short_position := false

strategy.exit("Exit","Sell", stop = close)

// if long_position

// long_entry_price := close[1] + 50//bar_index

// if short_position

// short_entry_price := close[1] - 50//bar_index

// if (long_position and high[1] > long_entry_price)

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_triangledown, color = color.yellow, size = size.tiny)

// if (short_position and low[1] < short_entry_price)

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_triangleup, color = color.yellow, size = size.tiny)

もっと

- 月間購入日に基づく定量投資戦略

- 標準偏差を考慮した取引戦略

- トリプル・ムービング・平均量的な取引戦略

- EMAのクロスオーバー戦略

- 短期・中期・長期のEMAクロスオーバー取引戦略

- 時系列分解とボリンジャーバンドの量重量化に基づく戦略をフォローする傾向

- 価格オシレーター数値取引戦略

- 多指標の傾向 戦略をフォローする

- CCIの二重タイムフレームトレンド 戦略をフォローする

- T3-CCI トレンドトラッキング戦略

- モメント逆転移動平均組み合わせ戦略

- ダイナミック・ムービング・アベア・リトレースメント マーティン戦略

- コンボ・モメント・リバース・ダブル・レールマッチング戦略

- イチモク・クラウド・量子戦略

- 2つのタイムフレームとモメントインディケーターに基づく適応型得益・ストップ損失戦略

- 複数の期間のRSIグリッド取引戦略

- 2倍指数関数移動平均のクロスオーバー戦略

- トレンドトラッキング 移動平均RSI戦略

- 月間閉店価格と移動平均のクロスオーバー戦略

- ボリンジャー・バンド ストラテジーをフォローする短期トレンド