ポイントベースのRSIディバージェンツ戦略

作者: リン・ハーンチャオチャン開催日:2023年11月28日 13:43:05タグ:

概要

この戦略は"ピボットベースのRSIダイバージェンシー戦略"と呼ばれる.これは,異なるサイクルにおけるRSI指標の間のダイバージェンスを利用してエントリー・アウトプット点を決定し,戦略の安定性を向上させるためのフィルター条件として長期RSIを追加する.

戦略の論理

この戦略は,短期RSI (例えば5日間のRSI) と価格の間の"隠れた上昇差"または"定期的な上昇差"があるときに購入し,"隠れた下落差"または"定期的な下落差"があるときに売却する機会を主に判断します.

さらに,戦略はフィルター条件として長期RSI (例えば50日間のRSI) も導入している.ロングRSIが50を超えると購入信号のみを検討し,ロングRSIが30未満の場合,ストップ・ロストまたはテイク・プロフィート・エグジットも考慮する.

利点

この戦略の最大の利点は,短期間のRSIの差異信号と長期間のRSIのフィルターの両方を利用することで,一定程度にトラップされ,トレンドを見逃すのを回避できるということです.具体的には,以下の主な利点があります:

- 短期RSI差異信号は,価格逆転の機会を早期に判断し,ターニングポイントを間に合うようにすることができます.

- 長期RSIフィルターは,トレンドが不確実であるときに,長時間盲目に行動を避ける.

- 多種多様な得益方法や部分的得益方法がリスクを軽減するのに役立ちます.

- ピラミッドメカニズムは ポジションを追加し 利益の可能性をさらに拡大します

リスク

この戦略には,注意すべきいくつかのリスクもあります.

- RSIの差異は必ずしも有効ではなく,誤った信号がある可能性があります.

- リスクはピラミッド投行後 増加し 判断が間違えば 損失は加速する

- 誤った収益設定は,早期の収益または不十分な利益につながることもあります.

対応するリスク管理措置には,ストップ・ロース/得益条件を合理的に設定し,ポジションサイズを制御し,株式曲線を平滑させるために部分的な得益を取ることなどが含まれます.

オプティマイゼーションの方向性

戦略をさらに最適化できる余地があります.

- RSI パラメータは,最適な組み合わせを見つけるためにさらに最適化できます.

- MACDやKDなどの他の指標の差異信号をテストすることができる.

- パラメータは特定の製品 (原油,貴金属など) に特異的に最適化され,適応性が向上します.

概要

この戦略は,リスクを制御しながら収益性を向上させるため,短期および長期のRSIの長/短差信号を組み合わせます.これは,いつ入るか,いつ出るか,部分的利益占い,ストップ損失/利益占い設定などを含む定量戦略設計の複数の原則を反映しています.これは参照のための例のRSIの分散戦略です.

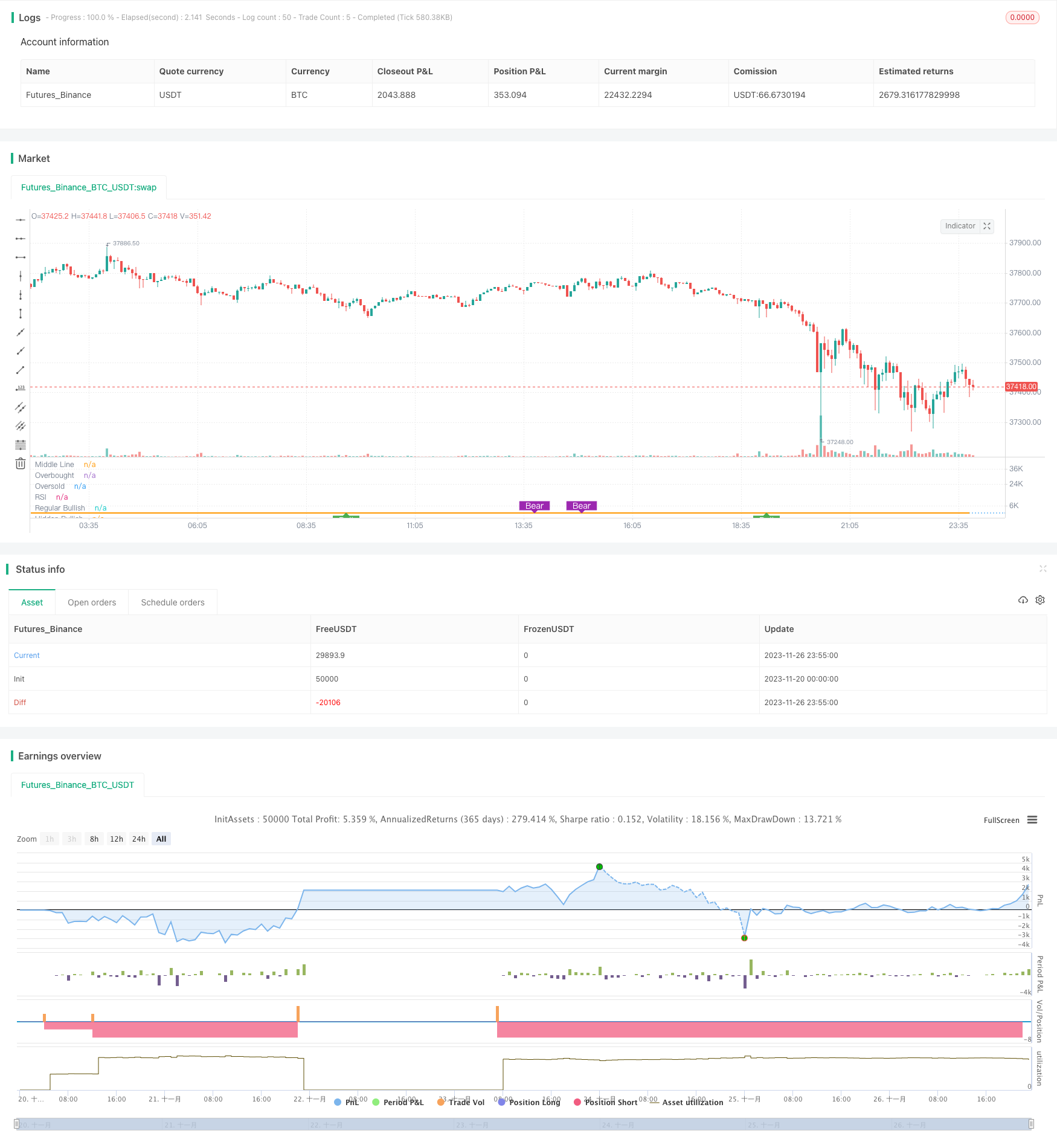

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

//GOOGL setting 5 ,50 close, 3 , 1 profitLevel at 75 and No stop Loss shows win rate 99.03 % profit factor 5830.152

strategy(title="RSI5_50 with Divergence", overlay=false,pyramiding=2, default_qty_type=strategy.fixed, default_qty_value=3, initial_capital=10000, currency=currency.USD)

len = input(title="RSI Period", minval=1, defval=5)

longRSILen = input(title="Long RSI Period", minval=10, defval=50)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=1)

takeProfitRSILevel = input(title="Take Profit at RSI Level", minval=50, defval=75)

stopLoss = input(title="Stop Loss%(if checked 8% rule applied)", defval=false)

shortTermRSI = rsi(close,len)

longTermRSI = rsi(close,longRSILen)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=false)

bearColor = color.purple

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

plot(shortTermRSI, title="RSI", linewidth=2, color=#8D1699)

plot(longTermRSI, title="longTermRSI", linewidth=2, color=color.orange)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=longTermRSI >=50 ? color.green:color.purple, transp=65) // longTermRSI >=50

plFound = na(pivotlow(shortTermRSI, lbL, lbR)) ? false : true

phFound = na(pivothigh(shortTermRSI, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// shortTermRSI: Higher Low

oscHL = shortTermRSI[lbR] > valuewhen(plFound, shortTermRSI[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

plFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bullish

// shortTermRSI: Lower Low

oscLL = shortTermRSI[lbR] < valuewhen(plFound, shortTermRSI[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

plFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor),

transp=0

)

plotshape(

hiddenBullCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

longCondition= longTermRSI >=50 and ( (bullCond or hiddenBullCond ) ) or (strategy.position_size>0 and crossover(shortTermRSI,20) )

//last condition above is to leg in if you are already in the Long trade,

strategy.entry(id="RSIDivLE", long=true, when=longCondition)

//------------------------------------------------------------------------------

// Regular Bearish

// shortTermRSI: Lower High

oscLH = shortTermRSI[lbR] < valuewhen(phFound, shortTermRSI[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

phFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bearish

// shortTermRSI: Higher High

oscHH = shortTermRSI[lbR] > valuewhen(phFound, shortTermRSI[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

phFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor),

transp=0

)

plotshape(

hiddenBearCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//calculate stop Loss

stopLossVal = stopLoss==true ? ( strategy.position_avg_price - (strategy.position_avg_price*0.08) ) : 0

//partial profit

strategy.close(id="RSIDivLE", comment="TP1", qty=strategy.position_size*3/4, when=strategy.position_size>0 and (longTermRSI>=takeProfitRSILevel or crossover(longTermRSI,90)))

strategy.close(id="RSIDivLE",comment="TP2", qty=strategy.position_size*3/4 , when=crossover(longTermRSI,70))

strategy.close(id="RSIDivLE",comment="TP3", qty=strategy.position_size/2, when=crossover(longTermRSI,65))

strategy.close(id="RSIDivLE",comment="TP4", qty=strategy.position_size/2 , when=crossover(longTermRSI,60))

//close the whole position when stoploss hits or longTermRSI goes below 30

strategy.close(id="RSIDivLE",comment="Exit", when=crossunder(longTermRSI,30) or close<stopLossVal)

- マルチSMA移動平均のクロスオーバー戦略

- マルチRSIインジケーター取引戦略

- 超トレンド戦略 ストップ損失を後押しする

- 重度の移動平均のブレイクアウト逆転戦略

- 移動平均相対強度指数戦略

- ADX インテリジェントトレンド追跡戦略

- RSIのモメントマグネレーション戦略

- 価格格差に基づくストップ損失戦略

- 移動平均のブレイクアウト戦略

- コンボトレンド逆転移動平均クロスオーバー戦略

- 黄金比率 長期戦略

- RSIフィルター付きのボリンガーバンド戦略

- ケルトナー チャンネル に 基づく 戦略 を フォロー する 傾向

- RSI移動平均のクロスオーバー戦略

- モメントブレイクトレード戦略

- ダイナミックなRSIとCCIを組み合わせた多要素量的な取引戦略

- スーパーZ量的な傾向戦略

- キャンドルスタイク・パターンの戦略

- CKモメンタム逆転ストップ損失戦略

- 2つの移動平均振動突破戦略