EMA/ADX/VOL - 暗号通貨キラー

EMA均線システムを使用してトレンドの方向性を判断し,ADX指標はトレンドの強さを判断し,取引量フィルターと組み合わせた入場のための量的な取引戦略

原則

この戦略は,まず,5つの異なる周期のEMA平均線を使用して価格トレンドの方向を判断します. 5つのEMA平均線がすべて上昇すると,多頭トレンドを形成すると判断し,5つのEMA平均線がすべて下落すると,空頭トレンドを形成すると判断します.

ADX指標を使用してトレンドの強さや弱さを判断し,DI+ラインがDI-ラインより高く,ADX値が設定値を超えると強気多頭行情と判断し,DI-ラインがDI+ラインより高く,ADX値が設定値を超えると空頭行情と判断する.

同時に,取引量突破を利用して追加確認を行うため,現在のK線取引量が一定周期平均の倍数より大きいことを要求し,低量位置で誤入場を避ける.

トレンドの方向,トレンドの強さ,取引量の総合的な判断を組み合わせて,この戦略の多頭と空頭開設ロジックを形成する.

利点

EMA平均線システムを使用してトレンドの方向を判断することは,単一のEMA平均線判断よりも信頼性があります.

ADX指標でトレンドの強さや弱さを判断し,明確なトレンドがない場合の誤入場を避ける.

取引量フィルタリングメカニズムにより,十分な取引量のサポートを確保し,戦略の信頼性を高めます.

複数の条件の総合判断により,開場シグナルがより正確で信頼性が高い.

戦略のパラメータが多く,パラメータを最適化することで戦略の効果を継続的に向上させることができる.

リスクと解決

震動状況では,EMA平均線,ADXなどの判断が誤信号を発し,不必要な損失を生じさせ,パラメータを適切に調整するか,または他の指標を補助判断のために追加することができます.

取引量フィルタリング条件が過度に厳格で,市場機会が逃れている可能性があるため,取引量フィルタリングのパラメータを適切に低下させることができます.

策略によって発生する取引頻度は高く,資金管理に注意し,単位のポジションの規模を適切に制御する必要があります.

最適化の方向

異なるパラメータの組み合わせをテストし,最適のパラメータを探し,戦略の効果を高める.

MACD,KDJなどの他の指標をEMAとADXと組み合わせ,より強力な総合的な開設判断を形成する.

リスクのコントロールをさらに進めるためのストップ・ロスの策略を追加します.

ポジション管理戦略を最適化し,より科学的資金管理を実現する.

要約する

この戦略は,価格トレンドの方向,トレンドの強さ,取引量情報を総合的に考慮して,開場ルールを形成し,ある程度は誤った一般的な罠を回避し,強力な信頼性を有する.しかし,パラメータ最適化,指標最適化,リスク制御による戦略システムの改善をさらに進めて,効果をさらに向上させる必要がある.全体として,この戦略の枠組みは,広げる可能性と最適化の余地がある.

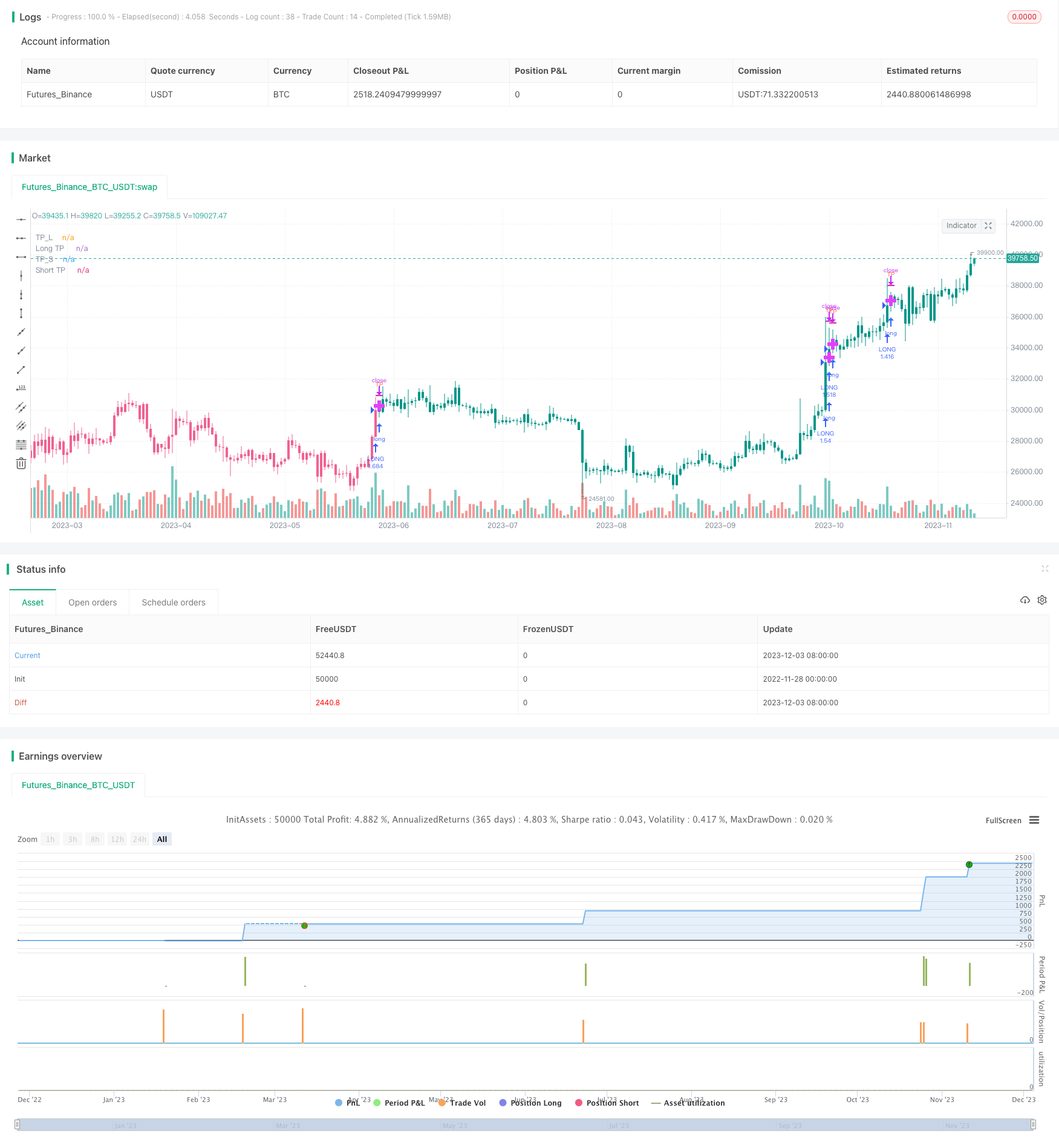

/*backtest

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BabehDyo

//@version=4

strategy("EMA/ADX/VOL-CRYPTO KILLER [15M]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

//SOURCE =============================================================================================================================================================================================================================================================================================================

src = input(open, title=" Source")

// Inputs ========================================================================================================================================================================================================================================================================================================

//ADX --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="ADX")

ADX_len = input(21, title=" Adx Length", type=input.integer, minval = 1, group="ADX")

th = input(20, title=" Adx Treshold", type=input.float, minval = 0, step = 0.5, group="ADX")

//EMA--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length_ema1 = input(8, title=" 1-EMA Length", minval=1)

Length_ema2 = input(13, title=" 2-EMA Length", minval=1)

Length_ema3 = input(21, title=" 3-EMA Length", minval=1)

Length_ema4 = input(34, title=" 4-EMA Length", minval=1)

Length_ema5 = input(55, title=" 5-EMA Length", minval=1)

// Range Filter ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

per_ = input(15, title=" Period", minval=1, group = "Range Filter")

mult = input(2.6, title=" mult.", minval=0.1, step = 0.1, group = "Range Filter")

// Volume ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

volume_f = input(3.2, title=" Volume mult.", minval = 0, step = 0.1, group="Volume")

sma_length = input(20, title=" Volume lenght", minval = 1, group="Volume")

volume_f1 = input(1.9, title=" Volume mult. 1", minval = 0, step = 0.1, group="Volume")

sma_length1 = input(22, title=" Volume lenght 1", minval = 1, group="Volume")

//TP PLOTSHAPE -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tp_long0 = input(0.9, title=" % TP Long", type = input.float, minval = 0, step = 0.1, group="Target Point")

tp_short0 = input(0.9, title=" % TP Short", type = input.float, minval = 0, step = 0.1, group="Target Point")

// SL PLOTSHAPE ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

sl0 = input(4.2, title=" % Stop loss", type = input.float, minval = 0, step = 0.1, group="Stop Loss")

//INDICATORS =======================================================================================================================================================================================================================================================================================================

//ADX-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

//EMA-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

xPrice = close

EMA1 = ema(xPrice, Length_ema1)

EMA2 = ema(xPrice, Length_ema2)

EMA3 = ema(xPrice, Length_ema3)

EMA4 = ema(xPrice, Length_ema4)

EMA5 = ema(xPrice, Length_ema5)

L_ema = EMA1 < close and EMA2 < close and EMA3 < close and EMA4 < close and EMA5 < close

S_ema = EMA1 > close and EMA2 > close and EMA3 > close and EMA4 > close and EMA5 > close

// Range Filter ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool L_RF = na, var bool S_RF = na

Range_filter(_src, _per_, _mult)=>

var float _upward = 0.0

var float _downward = 0.0

wper = (_per_*2) - 1

avrng = ema(abs(_src - _src[1]), _per_)

_smoothrng = ema(avrng, wper)*_mult

_filt = _src

_filt := _src > nz(_filt[1]) ? ((_src-_smoothrng) < nz(_filt[1]) ? nz(_filt[1]) : (_src-_smoothrng)) : ((_src+_smoothrng) > nz(_filt[1]) ? nz(_filt[1]) : (_src+_smoothrng))

_upward := _filt > _filt[1] ? nz(_upward[1]) + 1 : _filt < _filt[1] ? 0 : nz(_upward[1])

_downward := _filt < _filt[1] ? nz(_downward[1]) + 1 : _filt > _filt[1] ? 0 : nz(_downward[1])

[_smoothrng,_filt,_upward,_downward]

[smoothrng, filt, upward, downward] = Range_filter(src, per_, mult)

hband = filt + smoothrng

lband = filt - smoothrng

L_RF := high > hband and upward > 0

S_RF := low < lband and downward > 0

// Volume -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Volume_condt = volume > sma(volume,sma_length)*volume_f

Volume_condt1 = volume > sma(volume,sma_length1)*volume_f1

//STRATEGY ==========================================================================================================================================================================================================================================================================================================

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

L_1 = L_adx and Volume_condt and L_RF and L_ema

S_1 = S_adx and Volume_condt and S_RF and S_ema

L_2 = L_adx and L_RF and L_ema and Volume_condt1

S_2 = S_adx and S_RF and S_ema and Volume_condt1

L_basic_condt = L_1 or L_2

S_basic_condt = S_1 or S_2

longCond := L_basic_condt

shortCond := S_basic_condt

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

//POSITION PRICE-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

last_open_longCondition := longCondition ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition ? sum_long/nLongs : shortCondition ? sum_short/nShorts : na

//TP---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool long_tp = na, var bool short_tp = na

var int last_long_tp = na, var int last_short_tp = na

var bool Final_Long_tp = na, var bool Final_Short_tp = na

var bool Final_Long_sl0 = na, var bool Final_Short_sl0 = na

var bool Final_Long_sl = na, var bool Final_Short_sl = na

var int last_long_sl = na, var int last_short_sl = na

tp_long = ((nLongs > 1) ? tp_long0 / nLongs : tp_long0) / 100

tp_short = ((nShorts > 1) ? tp_short0 / nShorts : tp_short0) / 100

long_tp := high > (fixnan(Position_Price) * (1 + tp_long)) and in_longCondition

short_tp := low < (fixnan(Position_Price) * (1 - tp_short)) and in_shortCondition

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

Final_Long_tp := (long_tp and last_longCondition > nz(last_long_tp[1]) and last_longCondition > nz(last_long_sl[1]))

Final_Short_tp := (short_tp and last_shortCondition > nz(last_short_tp[1]) and last_shortCondition > nz(last_short_sl[1]))

L_tp = iff(Final_Long_tp, fixnan(Position_Price) * (1 + tp_long) , na)

S_tp = iff(Final_Short_tp, fixnan(Position_Price) * (1 - tp_short) , na)

//TP SIGNALS--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tplLevel = (in_longCondition and

(last_longCondition > nz(last_long_tp[1])) and

(last_longCondition > nz(last_long_sl[1])) and not Final_Long_sl[1]) ?

(nLongs > 1) ?

(fixnan(Position_Price) * (1 + tp_long)) : (last_open_longCondition * (1 + tp_long)) : na

tpsLevel = (in_shortCondition and

(last_shortCondition > nz(last_short_tp[1])) and

(last_shortCondition > nz(last_short_sl[1])) and not Final_Short_sl[1]) ?

(nShorts > 1) ?

(fixnan(Position_Price) * (1 - tp_short)) : (last_open_shortCondition * (1 - tp_short)) : na

//SL ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Risk = sl0

Percent_Capital = 99

sl = in_longCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nLongs)))) :

in_shortCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nShorts)))) : sl0

Normal_long_sl = ((in_longCondition and low <= ((1 - (sl / 100)) * (fixnan(Position_Price)))))

Normal_short_sl = ((in_shortCondition and high >= ((1 + (sl / 100)) * (fixnan(Position_Price)))))

last_long_sl := Normal_long_sl ? time : nz(last_long_sl[1])

last_short_sl := Normal_short_sl ? time : nz(last_short_sl[1])

Final_Long_sl := Normal_long_sl and last_longCondition > nz(last_long_sl[1]) and last_longCondition > nz(last_long_tp[1]) and not Final_Long_tp

Final_Short_sl := Normal_short_sl and last_shortCondition > nz(last_short_sl[1]) and last_shortCondition > nz(last_short_tp[1]) and not Final_Short_tp

//RE-ENTRY ON TP-HIT-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Final_Long_tp or Final_Long_sl

CondIni_long := -1

sum_long := 0.0

nLongs := na

if Final_Short_tp or Final_Short_sl

CondIni_short := 1

sum_short := 0.0

nShorts := na

// Colors ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bar_color = in_longCondition ? #009688 : in_shortCondition ? #f06292 : color.orange

barcolor (color = Bar_color)

//PLOTS==============================================================================================================================================================================================================================================================================================================

plot(L_tp, title = "TP_L", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

plot(S_tp, title = "TP_S", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

//Price plots ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plot((nLongs > 1) or (nShorts > 1) ? Position_Price : na, title = "Price", color = in_longCondition ? color.aqua : color.orange, linewidth = 2, style = plot.style_cross)

plot(tplLevel, title="Long TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

plot(tpsLevel, title="Short TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

//PLOTSHAPES----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(Final_Long_tp, title="TP Long Signal", style = shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , text="TP", textcolor=color.red, transp = 0 )

plotshape(Final_Short_tp, title="TP Short Signal", style = shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny , text="TP", textcolor=color.green, transp = 0 )

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.tiny , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , transp = 0 )

// Backtest ==================================================================================================================================================================================================================================================================================================================================

if L_basic_condt

strategy.entry ("LONG", strategy.long )

if S_basic_condt

strategy.entry ("SHORT", strategy.short )

strategy.exit("TP_L", "LONG", profit = (abs((last_open_longCondition * (1 + tp_long)) - last_open_longCondition) / syminfo.mintick), limit = nLongs >= 1 ? strategy.position_avg_price * (1 + tp_long) : na, loss = (abs((last_open_longCondition*(1-(sl/100)))-last_open_longCondition)/syminfo.mintick))

strategy.exit("TP_S", "SHORT", profit = (abs((last_open_shortCondition * (1 - tp_short)) - last_open_shortCondition) / syminfo.mintick), limit = nShorts >= 1 ? strategy.position_avg_price*(1-(tp_short)) : na, loss = (abs((last_open_shortCondition*(1+(sl/100)))-last_open_shortCondition)/syminfo.mintick))

//By BabehDyo