ダイナミック・モメンタム・ウェイトド・ムービング・平均クロスオーバー戦略

作者: リン・ハーンチャオチャン開催日:2024年01月12日 (火) 12:04:55タグ:

概要

この戦略は,異なる期間の2つの指数関数移動平均 (MAEMA) の移動平均が交差するときに購入・売却信号を生成する. 短期期線は市場傾向と短期逆転信号を決定するために使用され,長期期線は主要なトレンド方向を決定するために使用されます.

原則

- 急速なMAEMA (80回) と遅いMAEMA (144回) を計算する.

- 速い線は短期的なトレンドと逆転点を反映する. ゆっくりとした線は主要なトレンドの方向性を反映する.

- 速い線がスローラインを横切ると,買い信号が生成され,速い線がスローラインを横切ると,売り信号が生成されます.

- 戦略は,将来のクロスオーバートレンドを決定するために,次の期間の可能な値を表す3つの予測ポイントをグラフ化しています.

- この戦略は MAEMA の動力と予測機能を完全に利用しています.

利点

- MAEMA自身は動力因子を組み込み,傾向の変化をより早く把握します.

- 2つの移動平均戦略は,異なる時間枠における傾向を判断します.

- MAEMAの予測点と 急速な線と遅い線の交差点を組み合わせることで 取引シグナルがより信頼性が高まります

- 完全な自動チャート化により,市場の変動が直感的に反映されます.

リスク

- 異常波動が発生すると,MAEMAの感度が高すぎたため,誤った信号が生じる.ストップ・ロスは適切に緩めることができる.

- 移動平均システムでは,範囲限定市場では誤った信号を出す傾向があります.追加のフィルターを追加することができます.

- 急速な線と遅い線の期間は,各製品に対して最適なパラメータを見つけることによって決定されるべきです.

強化

- 最適なパラメータの組み合わせを見つけるために,高速で遅いMAEMAの期間を最適化します.

- シグザグ市場中にポジションを開くのを避けるためにフィルター条件を追加します.例えば,傾向を決定するためにDMI,MACDを導入します.

- バックテスト結果に基づいて ATR 倍数と遅延停止を調整し続けて 偽陽性値を減らしてリスクを制御します

概要

この戦略は,MAEMAの二重移動平均クロスオーバーを使用して市場傾向の変化を判断する.基本原則はシンプルで明確である.MAEMA自身の勢いと予測能力と組み合わせると,逆転信号を識別するのに効果的です.パラメータ最適化とフィルターの強化に注意を払う必要があります.

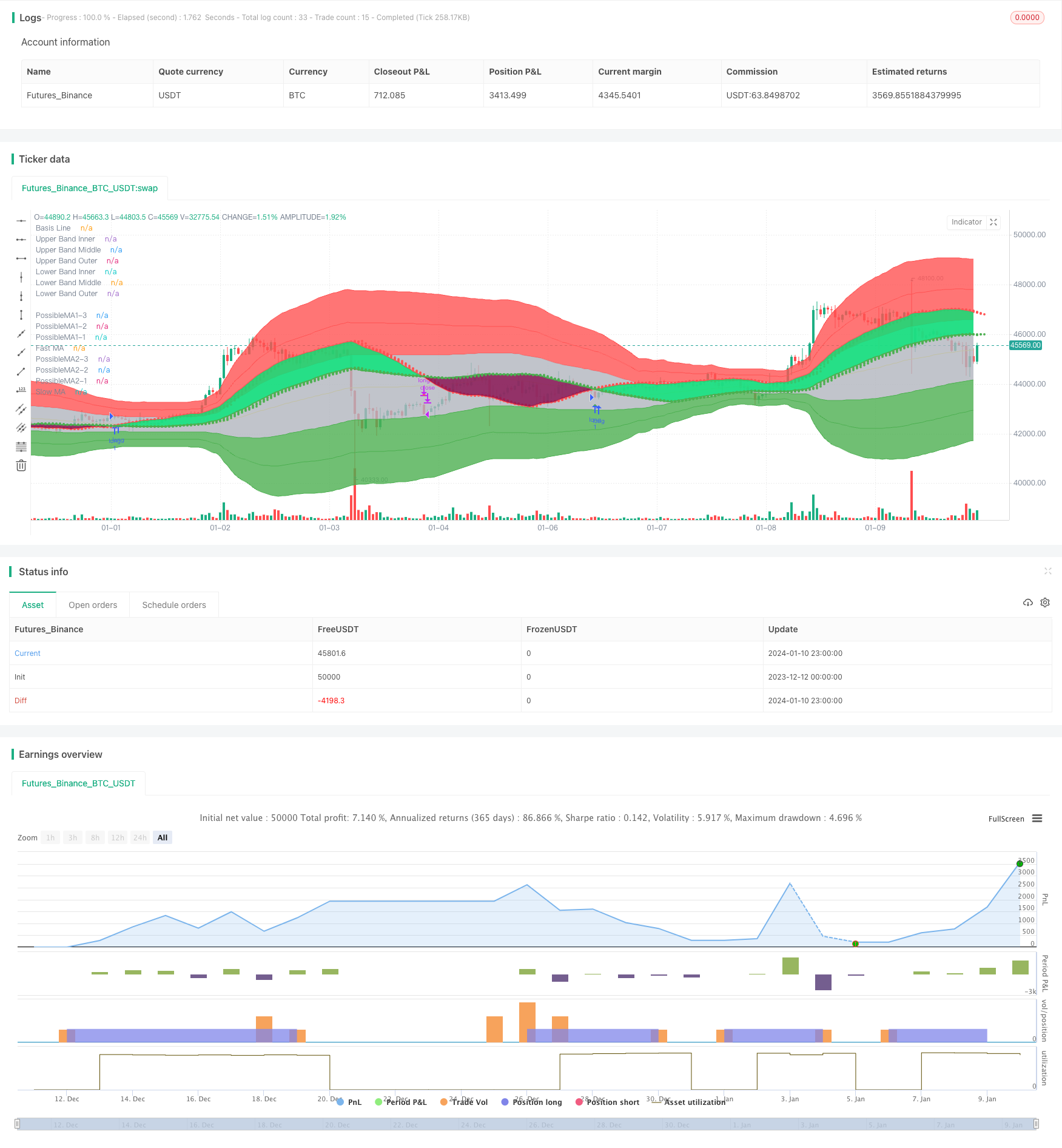

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © informanerd

//@version=4

strategy("MultiType Shifting Predictive MAs Crossover", shorttitle = "MTSPMAC + MBHB Strategy", overlay = true)

//inputs

predict = input(true, "Show MA Prediction Tails")

trendFill = input(true, "Fill Between MAs Based on Trend")

signal = input(true, "Show Cross Direction Signals")

showMA1 = input(true, "[ Show Fast Moving Average ]══════════")

type1 = input("MAEMA (Momentum Adjusted Exponential)", "Fast MA Type", options = ["MAEMA (Momentum Adjusted Exponential)", "DEMA (Double Exponential)", "EMA (Exponential)", "HMA (Hull)", "LSMA (Least Squares)", "RMA (Adjusted Exponential)", "SMA (Simple)", "SWMA (Symmetrically Weighted)", "TEMA (Triple Exponential)", "TMA (Triangular)", "VMA / VIDYA (Variable Index Dynamic Average)", "VWMA (Volume Weighted)", "WMA (Weighted)"])

src1 = input(high, "Fast MA Source")

len1 = input(80, "Fast MA Length", minval = 2)

shift1 = input(0, "Fast MA Shift")

maThickness1 = input(2, "Fast MA Thickness", minval = 1)

trendColor1 = input(false, "Color Fast MA Based on Detected Trend")

showBand1 = input(false, "Show Fast MA Range Band")

atrPer1 = input(20, "Fast Band ATR Lookback Period")

atrMult1 = input(3, "Fast Band ATR Multiplier")

showMA2 = input(true, "[ Show Slow Moving Average ]══════════")

type2 = input("MAEMA (Momentum Adjusted Exponential)", "Slow MA Type", options = ["MAEMA (Momentum Adjusted Exponential)", "DEMA (Double Exponential)", "EMA (Exponential)", "HMA (Hull)", "LSMA (Least Squares)", "RMA (Adjusted Exponential)", "SMA (Simple)", "SWMA (Symmetrically Weighted)", "TEMA (Triple Exponential)", "TMA (Triangular)", "VMA / VIDYA (Variable Index Dynamic Average)", "VWMA (Volume Weighted)", "WMA (Weighted)"])

src2 = input(close, "Slow MA Source")

len2 = input(144, "Slow MA Length", minval = 2)

shift2 = input(0, "Slow MA Shift")

maThickness2 = input(2, "Slow MA Thickness", minval = 1)

trendColor2 = input(false, "Color Slow MA Based on Detected Trend")

showBand2 = input(false, "Show Slow MA Range Band")

atrPer2 = input(20, "Slow Band ATR Lookback Period")

atrMult2 = input(3, "Slow Band ATR Multiplier")

//ma calculations

ma(type, src, len) =>

if type == "MAEMA (Momentum Adjusted Exponential)"

goldenRatio = (1 + sqrt(5)) / 2

momentumLen = round(len / goldenRatio), momentum = change(src, momentumLen), probabilityLen = len / goldenRatio / goldenRatio

ema(src + (momentum + change(momentum, momentumLen) * 0.5) * sum(change(src) > 0 ? 1 : 0, round(probabilityLen)) / probabilityLen, len)

else if type == "DEMA (Double Exponential)"

2 * ema(src, len) - ema(ema(src, len), len)

else if type == "EMA (Exponential)"

ema(src, len)

else if type == "HMA (Hull)"

wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

else if type == "LSMA (Least Squares)"

3 * wma(src, len) - 2 * sma(src, len)

else if type == "RMA (Adjusted Exponential)"

rma(src, len)

else if type == "SMA (Simple)"

sma(src, len)

else if type == "SWMA (Symmetrically Weighted)"

swma(src)

else if type == "TEMA (Triple Exponential)"

3 * ema(src, len) - 3 * ema(ema(src, len), len) + ema(ema(ema(src, len), len), len)

else if type == "TMA (Triangular)"

swma(wma(src, len))

else if type == "VMA / VIDYA (Variable Index Dynamic Average)"

smoothing = 2 / len, volIndex = abs(cmo(src, len) / 100)

vma = 0., vma := (smoothing * volIndex * src) + (1 - smoothing * volIndex) * nz(vma[1])

else if type == "VWMA (Volume Weighted)"

vwma(src, len)

else if type == "WMA (Weighted)"

wma(src, len)

ma1 = ma(type1, src1, len1)

ma2 = ma(type2, src2, len2)

//ma predictions

pma11 = len1 > 2 ? (ma(type1, src1, len1 - 1) * (len1 - 1) + src1 * 1) / len1 : na

pma12 = len1 > 3 ? (ma(type1, src1, len1 - 2) * (len1 - 2) + src1 * 2) / len1 : na

pma13 = len1 > 4 ? (ma(type1, src1, len1 - 3) * (len1 - 3) + src1 * 3) / len1 : na

pma21 = len2 > 2 ? (ma(type2, src2, len2 - 1) * (len2 - 1) + src2 * 1) / len2 : na

pma22 = len2 > 3 ? (ma(type2, src2, len2 - 2) * (len2 - 2) + src2 * 2) / len2 : na

pma23 = len2 > 4 ? (ma(type2, src2, len2 - 3) * (len2 - 3) + src2 * 3) / len2 : na

//ma range bands

r1 = atr(atrPer1) * atrMult1

hBand1 = ma1 + r1

lBand1 = ma1 - r1

r2 = atr(atrPer2) * atrMult2

hBand2 = ma2 + r2

lBand2 = ma2 - r2

//drawings

ma1Plot = plot(showMA1 ? ma1 : na, "Fast MA", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, maThickness1, offset = shift1)

ma2Plot = plot(showMA2 ? ma2 : na, "Slow MA", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, maThickness2, offset = shift2)

fill(ma1Plot, ma2Plot, trendFill and ma1 > ma2 ? color.lime : trendFill and ma1 < ma2 ? color.maroon : na, 90)

plot(showMA1 and predict ? pma11 : na, "PossibleMA1-1", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 1, show_last = 1)

plot(showMA1 and predict ? pma12 : na, "PossibleMA1-2", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 2, show_last = 1)

plot(showMA1 and predict ? pma13 : na, "PossibleMA1-3", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 3, show_last = 1)

plot(showMA2 and predict ? pma21 : na, "PossibleMA2-1", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 1, show_last = 1)

plot(showMA2 and predict ? pma22 : na, "PossibleMA2-2", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 2, show_last = 1)

plot(showMA2 and predict ? pma23 : na, "PossibleMA2-3", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 3, show_last = 1)

plot(showBand1 ? hBand1 : na, "Fast Higher Band", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, offset = shift1)

plot(showBand1 ? lBand1 : na, "Fast Lower Band", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, offset = shift1)

plot(showBand2 ? hBand2 : na, "Slow Higher Band", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, offset = shift2)

plot(showBand2 ? lBand2 : na, "Slow Lower Band", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, offset = shift2)

//crosses & alerts

up = crossover(ma1, ma2)

down = crossover(ma2, ma1)

plotshape(signal ? up : na, "Buy", shape.triangleup, location.belowbar, color.green, offset = shift1, size = size.small)

plotshape(signal ? down : na, "Sell", shape.triangledown, location.abovebar, color.red, offset = shift1, size = size.small)

alertcondition(up, "Buy", "Buy")

alertcondition(down, "Sell", "Sell")

// @version=1

// Title: "Multi Bollinger Heat Bands - EMA/Breakout options".

// Author: JayRogers

//

// * Description *

// Short: It's your Basic Bollinger Bands, but 3 of them, and some pointy things.

//

// Long: Three stacked sma based Bollinger Bands designed just to give you a quick visual on the "heat" of movement.

// Set inner band as you would expect, then set your preferred additional multiplier increments for the outer 2 bands.

// Option to use EMA as alternative basis, rather than SMA.

// Breakout indication shapes, which have their own multiplier seperate from the BB's; but still tied to same length/period.

// strategy(shorttitle="[JR]MBHB_EBO", title="[JR] Multi Bollinger Heat Bands - EMA/Breakout options", overlay=true)

// Bollinger Bands Inputs

bb_use_ema = input(false, title="Use EMA Basis?")

bb_length = input(80, minval=1, title="Bollinger Length")

bb_source = input(close, title="Bollinger Source")

bb_mult = input(1.0, title="Base Multiplier", minval=0.001, maxval=50)

bb_mult_inc = input(1, title="Multiplier Increment", minval=0.001, maxval=2)

// Breakout Indicator Inputs

break_mult = input(3, title="Breakout Multiplier", minval=0.001, maxval=50)

breakhigh_source = input(high, title="High Break Source")

breaklow_source = input(low, title="Low Break Source")

bb_basis = bb_use_ema ? ema(bb_source, bb_length) : sma(bb_source, bb_length)

// Deviation

// * I'm sure there's a way I could write some of this cleaner, but meh.

dev = stdev(bb_source, bb_length)

bb_dev_inner = bb_mult * dev

bb_dev_mid = (bb_mult + bb_mult_inc) * dev

bb_dev_outer = (bb_mult + (bb_mult_inc * 2)) * dev

break_dev = break_mult * dev

// Upper bands

inner_high = bb_basis + bb_dev_inner

mid_high = bb_basis + bb_dev_mid

outer_high = bb_basis + bb_dev_outer

// Lower Bands

inner_low = bb_basis - bb_dev_inner

mid_low = bb_basis - bb_dev_mid

outer_low = bb_basis - bb_dev_outer

// Breakout Deviation

break_high = bb_basis + break_dev

break_low = bb_basis - break_dev

// plot basis

plot(bb_basis, title="Basis Line", color=color.yellow, transp=50)

// plot and fill upper bands

ubi = plot(inner_high, title="Upper Band Inner", color=color.red, transp=90)

ubm = plot(mid_high, title="Upper Band Middle", color=color.red, transp=85)

ubo = plot(outer_high, title="Upper Band Outer", color=color.red, transp=80)

fill(ubi, ubm, title="Upper Bands Inner Fill", color=color.red, transp=90)

fill(ubm, ubo, title="Upper Bands Outer Fill",color=color.red, transp=80)

// plot and fill lower bands

lbi = plot(inner_low, title="Lower Band Inner", color=color.green, transp=90)

lbm = plot(mid_low, title="Lower Band Middle", color=color.green, transp=85)

lbo = plot(outer_low, title="Lower Band Outer", color=color.green, transp=80)

fill(lbi, lbm, title="Lower Bands Inner Fill", color=color.green, transp=90)

fill(lbm, lbo, title="Lower Bands Outer Fill", color=color.green, transp=80)

// center channel fill

fill(ubi, lbi, title="Center Channel Fill", color=color.silver, transp=100)

// plot breakouts

plotshape(breakhigh_source >= break_high, title="High Breakout", style=shape.triangledown, location=location.abovebar, size=size.tiny, color=color.white, transp=0)

plotshape(breaklow_source <= break_low, title="Low Breakout", style=shape.triangleup, location=location.belowbar, size=size.tiny, color=color.white, transp=0)

High_Break = breakhigh_source >= break_high

Low_Break = breaklow_source <= break_low

// Conditions

Stop_Momentum = low < ma1

//Strategy Tester

strategy.entry("long", strategy.long, when=(up and (hlc3 < inner_high)))

strategy.close("long", when=down)

strategy.entry("longwickdown", strategy.long, when=Low_Break)

strategy.close("longwickdown", when=(high > ma1))

//true signals test

//var winCount = 0, var loseCount = 0, testBarIndex = 1

//if (up[testBarIndex] and close > close[testBarIndex]) or (down[testBarIndex] and close < close[testBarIndex])

// label.new(bar_index, 0, "W", yloc = yloc.abovebar, color = color.green)

// winCount := winCount + 1

//else if (up[testBarIndex] and close < close[testBarIndex]) or (down[testBarIndex] and close > close[testBarIndex])

// label.new(bar_index, 0, "L", yloc = yloc.abovebar, color = color.red)

// loseCount := loseCount + 1

//winRate = label.new(time + (time - time[1]) * 2, ohlc4, tostring(round(winCount / (winCount + loseCount) * 100)) + "%", xloc = xloc.bar_time, color = color.orange, style = label.style_label_left)

//if not na(winRate[1])

// label.delete(winRate[1])

もっと

- EMAの双重ゴールドクロス収益戦略

- ダイナミックサンタ・クロース回帰戦略

- ストカスティック・オーバーラップとRSI・インデックス・量子・トレーディング・戦略

- RSI V型パターンスウィング・トレード戦略

- 動向突破 ATR 変動戦略

- ポリノミアルインターポレーションに基づくRSIモメント戦略

- モメント・リバース・コンボ・戦略

- BTC ハッシュリボン戦略

- 量子マスターのための多レベル移動平均の横断戦略

- 取引戦略 取引量比逆転

- トールパワー・トレード戦略

- 黄金の価値の日々の移動平均追跡戦略

- 多期移動平均値と取引時間の組み合わせ 定量的な取引戦略

- マックドに基づいた多期取引戦略

- 熊の力追跡戦略

- 複数の指標に基づく取引戦略の傾向

- 20/50 EMA クロス と スウィング 取引 戦略

- ダイナミック・トレンド・トラッキング 最適化された戦略

- ストカスティック指標と組み合わせた二重移動平均戦略

- 移動平均値と平均値の真の範囲に基づいたトレンド追跡戦略