移動平均に基づくトレンドフォロー戦略

作成日:

2024-01-24 14:24:36

最終変更日:

2024-01-24 14:24:36

コピー:

0

クリック数:

318

1

フォロー

1179

フォロワー

概要

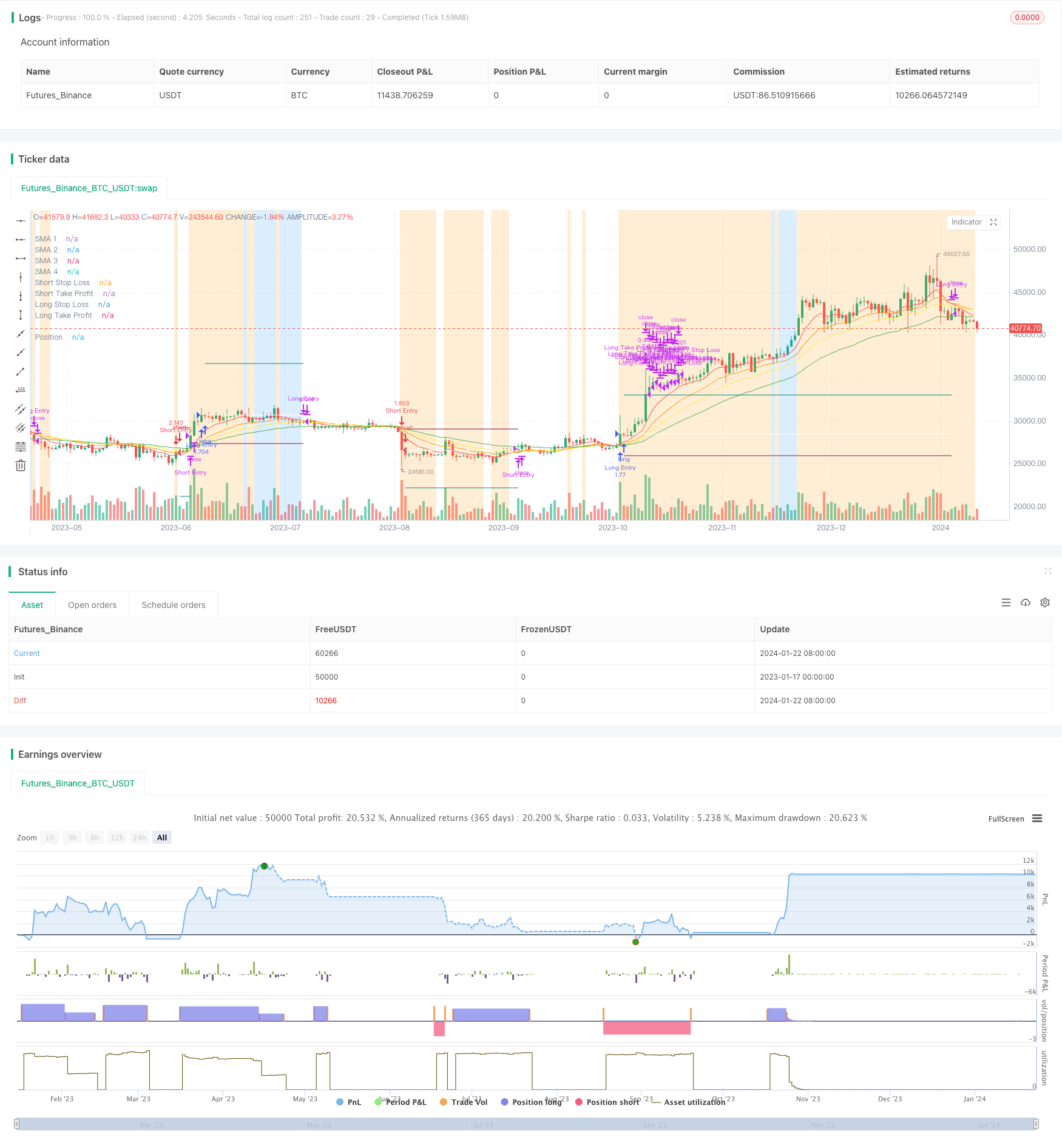

この戦略は,移動平均に基づく簡単なトレンドフォロー戦略である.これは,異なる周期の移動平均の大きさの関係によって,現在のトレンドの方向を判断し,トレンドの持続期間を判断する.短周期平均線は,短周期平均線が,下から上へと長周期平均線を横切るときに多し,短周期平均線が,上から下へと長周期平均線を横切るときに空にする.同時に,この戦略は,リスクを管理するために,止損点と停止点を設定する.

戦略原則

この戦略は,4つの異なる周期の移動平均を使用します: 5日線,10日線,15日線および25日線. この4つの平均線はMA1,MA2,MA3およびMA4と呼ばれています. その中,MA1は最も短い,MA4は最も長いです.

MA1>MA2>MA3>MA4であるとき,価格が上昇傾向にあることを示す,このとき多;MA1

オーバーと空白の開設条件は,ATRのストップダストフィルター,すなわちATRの値がATRの40サイクルSMAより大きいことを同時に満たす必要があります.これは,価格の振動が1時間後に誤った信号を発信するのを防ぐことができます.

戦略的優位性

この戦略の利点は以下の通りです.

- シンプルで理解しやすく,実行しやすいのです.

- 移動平均の複数のグループを使ってトレンドの方向を判断する.

- ストップ・ストップ・ロスの設定は,一回の取引で最大損失を効果的に制御できます.

- ATRのストップダメージフィルターは,価格の揺れが1時間過ぎた時に誤った信号を発するのを防ぐことができます.

リスク分析

この戦略には以下のリスクもあります.

- 市場が激しく揺れ動いた時,誤ったシグナルが発せられる.

- パラメータ設定 (平均周期など) が不適切である場合,戦略の効果が悪くなる可能性があります.

- 価格に影響する基本面や重要なニュースは考慮されていません.

これらのリスクを軽減するために,パラメータを適切に最適化したり,戦略の安定性を高めるために他のフィルター条件を追加したりできます.

最適化の方向

この戦略の最適化方向は以下の通りです.

- 異なる移動平均周期パラメータの組み合わせをテストし,最適なパラメータを探します.

- 信号信頼性を判断するMACD,KDJなどの他の技術指標フィルターを追加する.

- 取引量フィルターを追加し,取引量が大きくなった場合にのみ取引を行う.

- 異なる品種のパラメータの違いに応じて細かい分種パラメータの最適化.

- 機械学習アルゴリズムの判断信号を増やす.

要約する

この戦略は全体的に比較的単純なトレンドフォロー戦略であり,移動平均によってトレンドの方向を判断し,合理的なストップ・ストロスを設定してリスクレベルを制御する.戦略の最適化スペースは広大であり,パラメータ調整,フィルターを追加などの手段によって戦略の安定性と収益性をさらに向上させることができる.

ストラテジーソースコード

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// @version=5

// # ========================================================================= #

// # | STRATEGY |

// # ========================================================================= #

strategy(title = 'MA Simple Strategy with SL & TP & ATR Filters',

shorttitle = 'MA Strategy',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_type = strategy.commission.percent,

commission_value = 0.1,

initial_capital = 100000,

max_lines_count = 150,

max_labels_count = 300)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

c_timeCond = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// 3. Use Filters? What Filters?

i_ATRFilterOn = input.bool(defval = true , title = "ATR Filter On?", tooltip = "ATR Filter On?", inline = "ATR Filter", group = "Filters")

i_ATRSMALen = input.int(defval = 40 , title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "ATR Filter", group = "Filters")

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: normal? or trailing?

//// If trailing, always trailing or trailing after take profit order executed?

i_useSLTP = input.bool(defval = true, title = "Enable SL & TP?", tooltip = "", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

i_tslEnabled = input.bool(defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

// i_tslAfterTP = input.bool(defval = true , title = "Enable Trailing SL after TP?", tooltip = "Enable Trailing SL after TP?", inline = "Trailing SL Execution", group = "Shared Inputs")

i_slType = input.string(defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR"], tooltip = "Stop Loss based on %? ATR?", inline = "Stop Loss Type", group = "Shared Inputs")

i_slATRLen = input.int(defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "Stop Loss ATR", group = "Shared Inputs")

i_tpType = input.string(defval = "R:R", title = "Take Profit Type", options = ["Percent", "ATR", "R:R"], tooltip = "Take Profit based on %? ATR? R-R ratio?", inline = "Take Profit Type", group = "Shared Inputs")

//// 3-2. Inputs for Quantity

i_tpQuantityPerc = input.float(defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position when tp target is met.', group = 'Shared Inputs')

// 4. Inputs for Long Stop Loss & Long Take Profit

i_slPercentLong = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_tpPercentLong = input.float(defval = 3, title = "TP Percent", tooltip = "Long Stop Loss && Take Profit Percent?", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_slATRMultLong = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpATRMultLong = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Long Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultLong * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultLong * ATR (i_tpATRLen)", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpRRratioLong = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Long Stop Loss / Take Profit")

// 5. Inputs for Short Stop Loss & Short Take Profit

i_slPercentShort = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_tpPercentShort = input.float(defval = 3, title = "TP Percent", tooltip = "Short Stop Loss && Take Profit Percent?", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_slATRMultShort = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpATRMultShort = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Short Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultShort * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultShort * ATR (i_tpATRLen)", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpRRratioShort = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Short Stop Loss / Take Profit")

// 6. Inputs for logic

i_MAType = input.string(defval = "RMA", title = "MA Type", options = ["SMA", "EMA", "WMA", "HMA", "RMA", "VWMA", "SWMA", "ALMA", "VWAP"], tooltip = "Choose MA Type", inline = "MA Type", group = 'Strategy')

i_MA1Len = input.int(defval = 5, title = 'MA 1 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA2Len = input.int(defval = 10, title = 'MA 2 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA3Len = input.int(defval = 15, title = 'MA 3 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA4Len = input.int(defval = 25, title = 'MA 4 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_ALMAOffset = input.float(defval = 0.7 , title = "ALMA Offset Value", tooltip = "The Value of ALMA offset", inline = "ALMA Input", group = 'Strategy')

i_ALMASigma = input.float(defval = 7 , title = "ALMA Sigma Value", tooltip = "The Value of ALMA sigma", inline = "ALMA Input", group = 'Strategy')

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

bool i_ATRFilter = ta.atr(length = i_slATRLen) >= ta.sma(source = ta.atr(length = i_slATRLen), length = i_ATRSMALen) ? true : false

// calculate Technical Indicators for the Logic

getMAValue (source, length, almaOffset, almaSigma) =>

switch i_MAType

'SMA' => ta.sma(source = source, length = length)

'EMA' => ta.ema(source = source, length = length)

'WMA' => ta.wma(source = source, length = length)

'HMA' => ta.hma(source = source, length = length)

'RMA' => ta.rma(source = source, length = length)

'SWMA' => ta.swma(source = source)

'ALMA' => ta.alma(series = source, length = length, offset = almaOffset, sigma = almaSigma)

'VWMA' => ta.vwma(source = source, length = length)

'VWAP' => ta.vwap(source = source)

=> na

float c_MA1 = getMAValue(close, i_MA1Len, i_ALMAOffset, i_ALMASigma)

float c_MA2 = getMAValue(close, i_MA2Len, i_ALMAOffset, i_ALMASigma)

float c_MA3 = getMAValue(close, i_MA3Len, i_ALMAOffset, i_ALMASigma)

float c_MA4 = getMAValue(close, i_MA4Len, i_ALMAOffset, i_ALMASigma)

// Logic: 정배열 될 떄 들어가

var ma1Color = color.new(color.red, 0)

plot(series = c_MA1, title = 'SMA 1', color = ma1Color, linewidth = 1, style = plot.style_line)

var ma2Color = color.new(color.orange, 0)

plot(series = c_MA2, title = 'SMA 2', color = ma2Color, linewidth = 1, style = plot.style_line)

var ma3Color = color.new(color.yellow, 0)

plot(series = c_MA3, title = 'SMA 3', color = ma3Color, linewidth = 1, style = plot.style_line)

var ma4Color = color.new(color.green, 0)

plot(series = c_MA4, title = 'SMA 4', color = ma4Color, linewidth = 1, style = plot.style_line)

bool openLongCond = (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool openShortCond = (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

bool openLong = i_longEnabled and openLongCond and (not i_ATRFilterOn or i_ATRFilter)

bool openShort = i_shortEnabled and openShortCond and (not i_ATRFilterOn or i_ATRFilter)

openLongCondColor = openLongCond ? color.new(color = color.blue, transp = 80) : na

bgcolor(color = openLongCondColor)

ATRFilterColor = i_ATRFilter ? color.new(color = color.orange, transp = 80) : na

bgcolor(color = ATRFilterColor)

bool enterLong = openLong and not (strategy.opentrades.size(strategy.opentrades-1) > 0)

bool enterShort = openShort and not (strategy.opentrades.size(strategy.opentrades-1) < 0)

bool closeLong = i_longEnabled and (c_MA1[1] >= c_MA2[1] and c_MA2[1] >= c_MA3[1] and c_MA3[1] >= c_MA4[1]) and not (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool closeShort = i_shortEnabled and (c_MA1[1] <= c_MA2[1] and c_MA2[1] <= c_MA3[1] and c_MA3[1] <= c_MA4[1]) and not (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

// # ========================================================================= #

// # Position, Status Conrtol

// # ========================================================================= #

// longisActive: New Long || Already Long && not closeLong, short is the same

bool longIsActive = enterLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool shortIsActive = enterShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// before longTPExecution: no trailing SL && after longTPExecution: trailing SL starts

// longTPExecution qunatity should be less than 100%

bool longTPExecuted = false

bool shortTPExecuted = false

// # ========================================================================= #

// # Long Stop Loss Logic

// # ========================================================================= #

float openAtr = ta.valuewhen(enterLong or enterShort, ta.atr(i_slATRLen), 0)

f_getLongSL (source) =>

switch i_slType

'Percent' => source * (1 - (i_slPercentLong/100))

'ATR' => source - i_slATRMultLong * openAtr

=> na

var float c_longSLPrice = na

c_longSLPrice := if (longIsActive)

if (enterLong)

f_getLongSL(close)

else

c_stopPrice = f_getLongSL(i_tslEnabled ? high : strategy.opentrades.entry_price(trade_num = strategy.opentrades - 1))

math.max(c_stopPrice, nz(c_longSLPrice[1]))

else

na

// # ========================================================================= #

// # Short Stop Loss Logic

// # ========================================================================= #

f_getShortSL (source) =>

switch i_slType

'Percent' => source * (1 + (i_slPercentShort)/100)

'ATR' => source + i_slATRMultShort * openAtr

=> na

var float c_shortSLPrice = na

c_shortSLPrice := if (shortIsActive)

if (enterShort)

f_getShortSL (close)

else

c_stopPrice = f_getShortSL(i_tslEnabled ? low : strategy.opentrades.entry_price(strategy.opentrades - 1))

math.min(c_stopPrice, nz(c_shortSLPrice[1], 999999.9))

else

na

// # ========================================================================= #

// # Long Take Profit Logic

// # ========================================================================= #

f_getLongTP () =>

switch i_tpType

'Percent' => close * (1 + (i_tpPercentLong/100))

'ATR' => close + i_tpATRMultLong * openAtr

'R:R' => close + i_tpRRratioLong * (close - f_getLongSL(close))

=> na

var float c_longTPPrice = na

c_longTPPrice := if (longIsActive and not longTPExecuted)

if (enterLong)

f_getLongTP()

else

nz(c_longTPPrice[1], f_getLongTP())

else

na

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= c_longTPPrice)

// # ========================================================================= #

// # Short Take Profit Logic

// # ========================================================================= #

f_getShortTP () =>

switch i_tpType

'Percent' => close * (1 - (i_tpPercentShort/100))

'ATR' => close - i_tpATRMultShort * openAtr

'R:R' => close - i_tpRRratioShort * (close - f_getLongSL(close))

=> na

var float c_shortTPPrice = na

c_shortTPPrice := if (shortIsActive and not shortTPExecuted)

if (enterShort)

f_getShortTP()

else

nz(c_shortTPPrice[1], f_getShortTP())

else

na

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= c_shortTPPrice)

// # ========================================================================= #

// # Make Orders

// # ========================================================================= #

if (c_timeCond)

if (enterLong)

strategy.entry(id = "Long Entry", direction = strategy.long , comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

if (enterShort)

strategy.entry(id = "Short Entry", direction = strategy.short , comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

if (closeLong)

strategy.close(id = 'Long Entry', comment = 'Close Long', alert_message = 'Long: Closed at market price')

if (closeShort)

strategy.close(id = 'Short Entry', comment = 'Close Short', alert_message = 'Short: Closed at market price')

if (longIsActive and i_useSLTP)

strategy.exit(id = 'Long Take Profit / Stop Loss', from_entry = 'Long Entry', qty_percent = i_tpQuantityPerc, limit = c_longTPPrice, stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long Stop Loss', from_entry = 'Long Entry', stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (shortIsActive and i_useSLTP)

strategy.exit(id = 'Short Take Profit / Stop Loss', from_entry = 'Short Entry', qty_percent = i_tpQuantityPerc, limit = c_shortTPPrice, stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short Stop Loss', from_entry = 'Short Entry', stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

// # ========================================================================= #

// # Plot

// # ========================================================================= #

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

var stopLossColor = color.new(color.maroon, 0)

plot(series = c_longSLPrice, title = 'Long Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortSLPrice, title = 'Short Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

longTPExecutedColor = longTPExecuted ? color.new(color = color.green, transp = 80) : na

//bgcolor(color = longTPExecutedColor)

shortTPExecutedColor = shortTPExecuted ? color.new(color = color.red, transp = 80) : na

//bgcolor(color = shortTPExecutedColor)

// isPositionOpenedColor = strategy.opentrades.size(strategy.opentrades-1) != 0 ? color.new(color = color.yellow, transp = 90) : na

// bgcolor(color = isPositionOpenedColor)

var takeProfitColor = color.new(color.teal, 0)

plot(series = c_longTPPrice, title = 'Long Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortTPPrice, title = 'Short Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)