バンドパスコンボ戦略

作者: リン・ハーンチャオチャン,日付: 2024-02-01 10:45:12タグ:

概要

これは2つの要因 - 逆転と帯域通過 - によって駆動されるコンボ戦略で,多要素の重複を達成し,異なる市場状況に適応します.

戦略の論理

この戦略は2つのサブ戦略で構成されています.

-

123 逆転戦略: 閉じる価格が2日連続で下がり,今日の閉じる価格が前2日の最低価格を突破し,9日ストカスタスティックオシレータの速い線がスローラインを越えると,ロング.閉じる価格が2日連続で上昇し,今日の閉じる価格が前2日の最高価格を下回り,高速線がスローラインを下回ると,ショート.

-

バンドパスフィルター: 特定の期間でバンドパス指標を計算し, 限界値を超えるとロング, 下になるとショートします.

両方の戦略が長シグナルを出せばロングポジションを取ります 両方とも短シグナルを出せばショートポジションを取ります そうでなければすべてのポジションをクリアします

利点

- 二重要因によって動いて,様々な市場状況に適応し,制度を超えて収益性がある

- 123 リバースは,レンジ・バインド市場でのリバースの機会を把握する

- バンドパスのフィルタ トレンドする市場の動向

- 組み合わせた信号は,誤った取引を検証し,回避します.

リスク

- 不適切なパラメータは,過剰取引を引き起こす可能性があります

- 不安定な市場では多重損失が発生する可能性があります

- トランザクションコストを監視する必要がある

強化

- バンドパス計算を最適化するためにバンドパスフィルターパラメータを調整する

- 123の逆転パラメータを調整して,長/短逆転の識別を最適化します.

- 単一の取引におけるストップ損失をコントロール損失に追加する

概要

この戦略は,マルチファクター駆動量的な取引を達成するために,逆転とトレンド要因を統合する. 双要素検証は,誤った取引の確率を軽減し,戦略をさまざまな市場でうまく機能させる. パラメータチューニングとストップロスのさらなる改善は,戦略の安定性と収益性を向上させる.

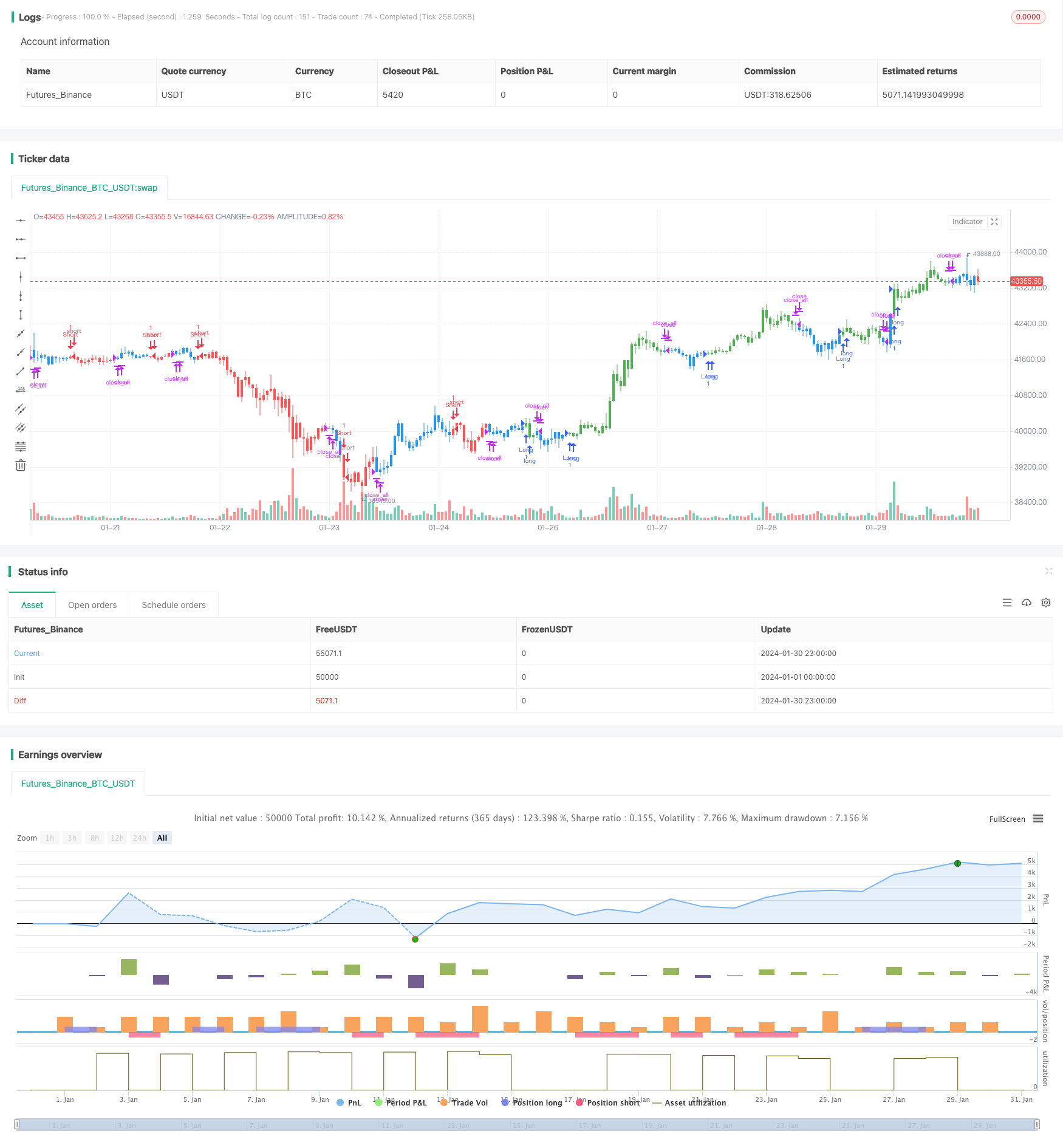

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/05/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Bandpass_Filter(Length, Delta, TriggerLevel) =>

xPrice = hl2

beta = cos(3.14 * (360 / Length) / 180)

gamma = 1 / cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - sqrt(gamma * gamma - 1)

BP = 0.0

pos = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos := iff(BP > TriggerLevel, 1,

iff(BP <= TriggerLevel, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bandpass Filter", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthBF = input(20, minval=1)

Delta = input(0.5)

TriggerLevel = input(0)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBandpass_Filter = Bandpass_Filter(LengthBF, Delta, TriggerLevel)

pos = iff(posReversal123 == 1 and posBandpass_Filter == 1 , 1,

iff(posReversal123 == -1 and posBandpass_Filter == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

もっと

- イチモク・クラウド・トレンド 戦略をフォローする

- 長期取引戦略 ボリンジャー帯 %B インディケーター

- 三重移動平均チャネル戦略 耐えてキャンドルスタイクラインから貴重な情報を採掘する

- イン・ヤング・ハンガー・マン戦略

- トレイリングストップ損失パーセント戦略

- トリプル・ムービング・メアディア・トレンド 戦略をフォロー

- ストップ・ロスの移動平均取引戦略を追跡する

- 二重指標 戦略をフォローする平均逆転傾向

- ストップ損失追跡戦略のダイナミック価格チャネル

- ダイナミックストップ・ロスのボリンガー・バンド戦略

- 動的移動平均のクロスオーバー戦略

- EMAのクロスオーバートレンド 戦略をフォローする

- RSIとSMAに基づく短期取引戦略

- モメントブレイク・イントラデイ・トレーディング・戦略

- KDJ ゴールデンクロス ロングエントリー戦略

- 隠された機会における 突破嵐戦略

- クロスタイムフレームモメント追跡戦略

- 戦略に従って移動平均傾向

- 複数のタイムフレームにおけるピボットスーパートレンド戦略

- 定量的なキャンドルスタイクパターンとトレンド 戦略をフォローする