双移動平均線 タイムフレーム間の取引戦略

作者: リン・ハーンチャオチャン開催日:2024年2月4日15時03分41秒タグ:

概要

この戦略は,2つの異なるタイプの移動平均線を計算して,2つの異なる時間枠で買取・売出信号を生成する.これは非常に良いサンドボックス戦略であり,異なるタイプの移動平均線と異なる時間枠の組み合わせを実験するために使用できます.

戦略の原理

この戦略は,2つの移動平均線,即ち,快移動平均線と遅移動平均線を使用する. 快移動平均線の時間枠は,グラフの時間枠よりも大きいまたは同等である. 快移動平均線が上方からゆっくり移動平均線を突破したとき,買い信号が発生し,快移動平均線が下方からゆっくり移動平均線を突破したとき,売り信号が発生する.

ユーザは,SMA,EMA,KAMAなどの様々なタイプの移動平均線を選択し,時間枠が異なるようにすることができます.

優位性分析

この戦略の最大の利点は,パラメータ実験の異なる組み合わせを非常に簡単に調整し,最適なパラメータ設定を探すことである.

ユーザは2つの移動平均線の種類,時間長,時間枠を自由に選択することができ,システムはリアルタイムで計算して結果を表示します. これは,単一のパラメータをテストするよりもはるかに簡単な組み合わせ戦略です.

また,戦略には,リスクを軽減し,利益率を向上させるための,停止損失抑制機能が組み込まれています.

リスク分析

この戦略の最大のリスクは,パラメータの設定が正しくないことが,取引信号があまりにも頻繁になる可能性があることであり,それによって取引コストとスライドポイントの損失が増加することである.

さらに,双移動平均線自体は偽信号を生むことが容易であり,パラメータが正しく選択されていない場合,買取信号は信頼できない可能性があります.

これらのリスクは,パラメータを最適化したり,他の指標を組み合わせたりすることで軽減できます.

優化方向

二重移動平均線に基づく他の指標の組み合わせを考慮し,フィルタリングを行うこともできる.例えば,RSIは,買い売り信号を確認し,偽信号を減らす.

また,移動平均線のパラメータトレーニングを最適化して最適なパラメータ組み合わせを見つけることを試みることもできます.また,機械学習方法を使用してパラメータを動的に最適化することを検討することもできます.

概要

この戦略は,非常に良い二次移動平均実験サンドボックスである. その利点は,最適な取引戦略を見つけるために,異なるパラメータの組み合わせを迅速に繰り返すことができる. もちろん,いくつかのパラメータを誤って設定するリスクもあります. これは他の指標の組み合わせを組み込むことでリスクを軽減するためにフィルタリングする必要があります. この戦略を継続的に最適化すれば,より良い取引結果が得られる可能性が高い.

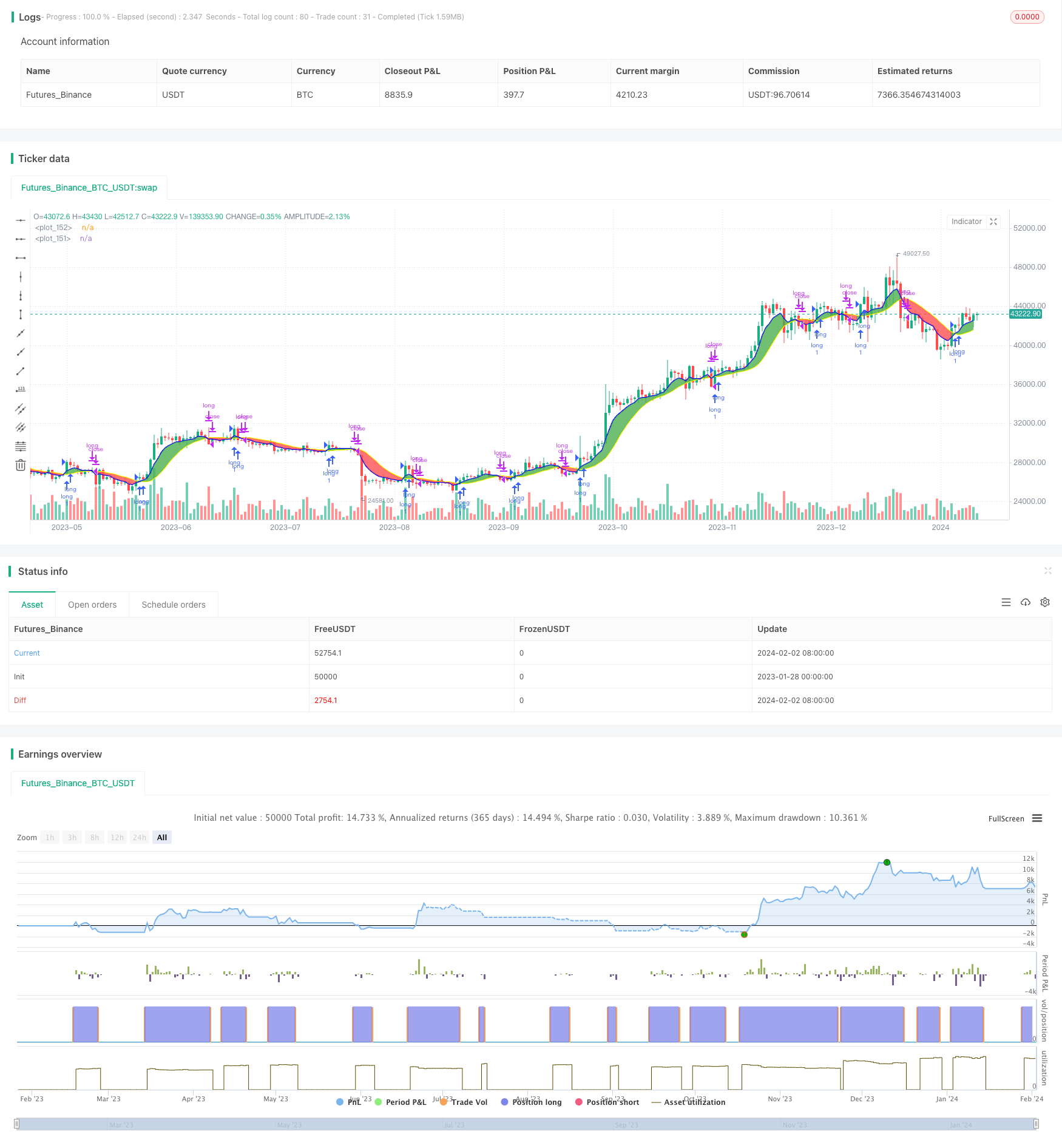

/*backtest

start: 2023-01-28 00:00:00

end: 2024-02-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License https://creativecommons.org/licenses/by-sa/4.0/

// © dman103

// A moving averages SandBox strategy where you can experiment using two different moving averages (like KAMA, ALMA, HMA, JMA, VAMA and more) on different time frames to generate BUY and SELL signals, when they cross.

// Great sandbox for experimenting with different moving averages and different time frames.

//

// == How to use ==

// We select two types of moving averages on two different time frames:

//

// First is the FAST moving average that should be at the same time frame or higher.

// Second is the SLOW moving average that should be on the same time frame or higher.

// When FAST moving average cross over the SLOW moving average we have a BUY signal (for LONG)

// When FAST moving average cross under the SLOW moving average we have a SELL signal (for SHORT)

// WARNING: Using a lower time frame than your chart time frame will result in unrealistic results in your backtesting and bar replay.

// == NOTES ==

// You can select BOTH, LONG, SHORT or NONE in the strategy settings.

// You can also enable Stop Loss and Take Profit.

// More sandboxes to come, Follow to get notified.

// Can also act as indicator by settings 'What trades should be taken' to 'NONE'

//@version=4

strategy("Multi MA MTF SandBox Strategy","Multi MA SandBox",overlay=true)

tradeType = input("LONG", title="What trades should be taken:", options=["LONG", "SHORT", "BOTH", "NONE"])

fast_title = input(true, title='---------------- Fast Moving Average (BLUE)----------------', type=input.bool)

ma_select1 = input(title="First Slow moving average", defval="EMA", options=["SMA", "EMA", "WMA", "HMA", "JMA", "KAMA", "TMA", "VAMA", "SMMA", "DEMA" , "VMA", "WWMA", "EMA_NO_LAG", "TSF","ALMA"])

resma_fast = input(title="First Time Frame", type=input.resolution, defval="")

lenma_fast = input(title="First MA Length", type=input.integer, defval=6)

slow_title = input(true, title='---------------- Slow Moving Average (YELLOW)----------------', type=input.bool)

ma_select2 = input(title="Second Fast moving average", defval="JMA", options=["SMA", "EMA", "WMA", "HMA", "JMA", "KAMA", "TMA", "VAMA", "SMMA", "DEMA" , "VMA", "WWMA", "EMA_NO_LAG", "TSF","ALMA"])

resma_slow = input(title="Second time frame", type=input.resolution, defval="")

lenma_slow = input(title="Second MA length", type=input.integer, defval=14)

settings = input(true, title='---------------- Other Settings ----------------', type=input.bool)

lineWidth = input(2,title="Line Width")

colorTransparency=input(50,title="Color Transparency",step=10,minval=0,maxval=100)

color_fast=input(color.blue,type=input.color)

color_slow=input(color.yellow,type=input.color)

fillColor = input(title="Fill Color", type=input.bool, defval=true)

IndicatorSettings = input(true, title='---------------- Indicators Settings ----------------', type=input.bool)

offset=input(title="Alma Offset (only for ALMA)",defval=0.85, step=0.05)

volatility_lookback =input(title="Volatility lookback (only for VAMA)",defval=12)

i_fastAlpha = input(1.25,"KAMA's alpha (only for KAMA)", minval=1,step=0.25)

fastAlpha = 2.0 / (i_fastAlpha + 1)

slowAlpha = 2.0 / (31)

///////Moving Averages

MA_selector(src, length,ma_select) =>

ma = 0.0

if ma_select == "SMA"

ma := sma(src, length)

ma

if ma_select == "EMA"

ma := ema(src, length)

ma

if ma_select == "WMA"

ma := wma(src, length)

ma

if ma_select == "HMA"

ma := hma(src,length)

ma

if ma_select == "JMA"

beta = 0.45*(length-1)/(0.45*(length-1)+2)

alpha = beta

tmp0 = 0.0, tmp1 = 0.0, tmp2 = 0.0, tmp3 = 0.0, tmp4 = 0.0

tmp0 := (1-alpha)*src + alpha*nz(tmp0[1])

tmp1 := (src - tmp0[0])*(1-beta) + beta*nz(tmp1[1])

tmp2 := tmp0[0] + tmp1[0]

tmp3 := (tmp2[0] - nz(tmp4[1]))*((1-alpha)*(1-alpha)) + (alpha*alpha)*nz(tmp3[1])

tmp4 := nz(tmp4[1]) + tmp3[0]

ma := tmp4

ma

if ma_select == "KAMA"

momentum = abs(change(src, length))

volatility = sum(abs(change(src)), length)

efficiencyRatio = volatility != 0 ? momentum / volatility : 0

smoothingConstant = pow((efficiencyRatio * (fastAlpha - slowAlpha)) + slowAlpha, 2)

var kama = 0.0

kama := nz(kama[1], src) + smoothingConstant * (src - nz(kama[1], src))

ma:=kama

ma

if ma_select == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if ma_select == "VMA"

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

ma := VAR

ma

if ma_select == "WWMA"

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

ma := WWMA

ma

if ma_select == "EMA_NO_LAG"

EMA1= ema(src,length)

EMA2= ema(EMA1,length)

Difference= EMA1 - EMA2

ma := EMA1 + Difference

ma

if ma_select == "TSF"

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

ma := TSF

ma

if ma_select =="VAMA" // Volatility Adjusted from @fractured

mid=ema(src,length)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

ma := mid+avg(vol_up,vol_down)

ma

if ma_select == "SMMA"

smma = float (0.0)

smaval=sma(src, length)

smma := na(smma[1]) ? smaval : (smma[1] * (length - 1) + src) / length

ma := smma

if ma_select == "DEMA"

e1 = ema(src, length)

e2 = ema(e1, length)

ma := 2 * e1 - e2

ma

if ma_select == "ALMA"

ma := alma(src, length,offset, 6)

ma

ma

// Calculate EMA

ma_fast = MA_selector(close, lenma_fast,ma_select1)

ma_slow = MA_selector(close, lenma_slow,ma_select2)

maFastStep = security(syminfo.tickerid, resma_fast, ma_fast)

maSlowStep = security(syminfo.tickerid, resma_slow, ma_slow)

ma1_plot=plot(maFastStep, color=color_fast,linewidth=lineWidth,transp=colorTransparency)

ma2_plot=plot(maSlowStep, color=color_slow,linewidth=lineWidth,transp=colorTransparency)

colors=ma_fast>ma_slow ? color.green : color.red

fill(ma1_plot,ma2_plot, color=fillColor? colors: na,transp=colorTransparency+15)

closeStatus = strategy.openprofit > 0 ? "win" : "lose"

////////Long Rules

long = crossover(maFastStep,maSlowStep) and (tradeType == "LONG" or tradeType == "BOTH")

longClose =crossunder(maFastStep,maSlowStep)//and falling(maSlowStep,1)

///////Short Rules

short =crossunder(maFastStep,maSlowStep) and (tradeType == "SHORT" or tradeType == "BOTH")

shortClose = crossover(maFastStep,maSlowStep)

longShape= crossover(maFastStep,maSlowStep) and tradeType == "NONE"

shortShape = crossunder(maFastStep,maSlowStep) and tradeType == "NONE"

plotshape(longShape, style=shape.triangleup,location=location.belowbar, color=color.lime,size=size.small)

plotshape(shortShape,style=shape.triangledown,location=location.abovebar, color=color.red,size=size.small)

// === Stop LOSS ===

useStopLoss = input(false, title='----- Add Stop Loss / Take profit -----', type=input.bool)

sl_inp = input(2.5, title='Stop Loss %', type=input.float, step=0.1)/100

tp_inp = input(5, title='Take Profit %', type=input.float, step=0.1)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

stop_level_short = strategy.position_avg_price * (1 + sl_inp)

take_level_short = strategy.position_avg_price * (1 - tp_inp)

if (long)

strategy.entry("long", strategy.long)

if (short)

strategy.entry("short", strategy.short)

strategy.close ("long", when = longClose, comment=closeStatus)

strategy.close ("short", when = shortClose, comment=closeStatus)

if (useStopLoss)

strategy.exit("Stop Loss/Profit Long","long", stop=stop_level, limit=take_level,comment =closeStatus )

strategy.exit("Stop Loss/Profit Short","short", stop=stop_level_short, limit=take_level_short, comment = closeStatus)

- 動力価格上昇の暗号通貨戦略

- 多因子モデルに基づく動力取引戦略

- 双方向自適化 ブリンベルトトレンド追跡戦略

- RSIの破綻戦略を改善する ストップ・ダスト・ストップ

- RSIとブリンズベースでの量化取引戦略

- SMAとローリングトレンドラインに基づく量化取引戦略

- Bollinger Bands と RSI を組み合わせる取引戦略

- ピタゴグラフMACD指標はトレンド追跡戦略から逸脱する

- 双指数のストーチャスティック RSIとEMAの取引戦略

- 平均線交差に基づく長線追いかける戦略

- ブリン・ベルトの突破に基づく量化取引戦略

- 多周期SMA指標に基づくトレンド追跡戦略

- 市場多空力の基盤でイチモククラウドの突破戦略

- 多指標ベースの動的均線による量化取引戦略

- リボ戦略は,リテスト区間のCoral Trend指標に基づいています.

- 動力変動 横軸取引戦略

- 動力に基づいた突破取引戦略

- RSIの変動を捕捉する戦略