概要

これは,動力とトレンドを組み合わせた取引戦略で,複数の指数である移動平均 (EMA),相対的に強い指数 (RSI) とランダムな指数 (ストキャスティック) を使って市場の傾向と動力を識別します.この戦略は,ダイナミックな止損,利益目標,ストップ・ロスの追跡機能を含む,平均リアル波幅 (ATR) に基づくリスク管理システムを統合し,リスクベースのポジション管理方法を採用します.

戦略原則

戦略は,5つの異なる周期のEMAを使用し,トレンドの方向を決定します. 短い周期のEMAが長い周期のEMAの上にあり,上昇傾向として認識されます. 逆に,下降傾向です. RSIは動力を確認するために使用され,異なる入場と出場の値が設定されます.

戦略的優位性

- 多重確認メカニズム:トレンドと動力の指標を組み合わせて,偽信号のリスクを低減する

- ダイナミックなリスク管理:市場の波動性に基づく自己適応のストップ・ロズと利益目標の調整

- スマートポジション管理:リスクと波動性に応じて取引規模を自動的に調整する

- 完全利益保護:トラッキングのストップ・ロックの利用で既に利益を得ている

- フレキシブルな退場メカニズム: 複数の条件の組み合わせにより タイムリーな退場を保証する

- 低リスクの露出:取引ごとに最大1%の損失

戦略リスク

- 横盤市場における多均線システムは,頻繁に偽信号を生じさせる可能性がある

- 滑落リスク:高波動期は,実際の実行価格が予想から外れている可能性がある

- 資金管理のリスク: 単一の損失を制限するものの,連続的な損失は資金に大きな影響を与える可能性があります.

- パラメータ最適化のリスク:過度の最適化は過適合につながる可能性がある

- 技術指標の遅れ:平均線と振動器は,一定の遅れがある

戦略最適化の方向性

- 市場環境フィルター:波動率フィルターを追加し,波動が大きいときに戦略パラメータを調整する

- タイムフィルター:異なる時間帯の市場特性に合わせて取引パラメータを調整する

- 動的パラメータ調整:市場の状況に基づいてEMA周期と指標の減值を自動的に調整する

- 取引量確認の増強:取引量分析を追加して信号の信頼性を向上させる

- 退出メカニズムを最適化: より優れた追跡ストップ・ローズ倍数の研究

- 機械学習の導入: 機械学習による最適化パラメータの選択

要約する

この戦略は,複数の技術指標と完善したリスク管理システムを組み合わせることで,包括的な取引ソリューションを提供します. 戦略の核心的な優位性は,複数のフィルタリング機構とダイナミックなリスク管理にありますが,特定の市場特性に合わせて最適化する必要があります. 戦略の成功実施には,継続的な監視と調整が必要で,特に異なる市場環境下でのパラメータの適応性が必要です.

ストラテジーソースコード

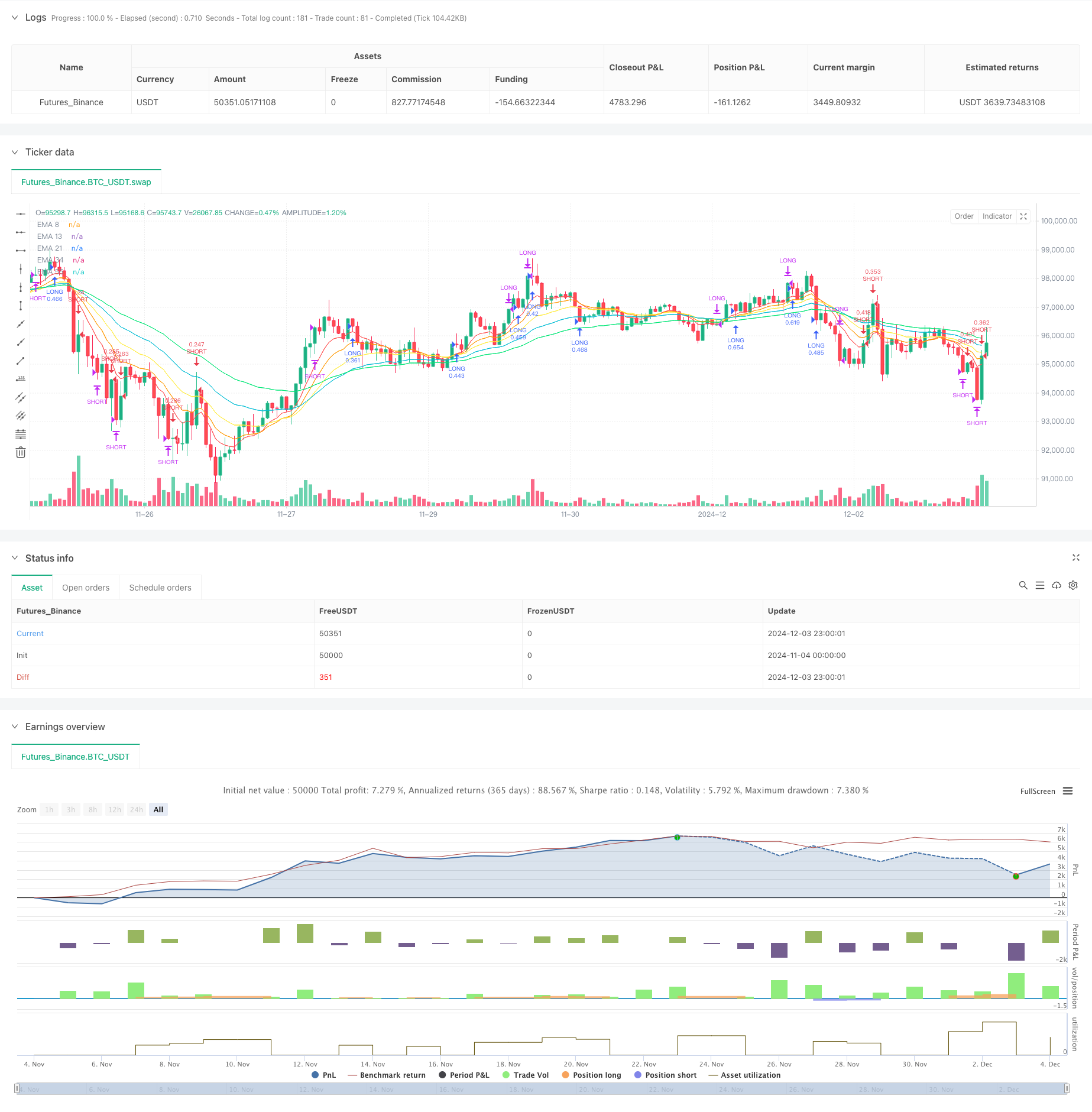

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined Strategy (Modernized)", overlay = true)

//----------//

// MOMENTUM //

//----------//

ema8 = ta.ema(close, 8)

ema13 = ta.ema(close, 13)

ema21 = ta.ema(close, 21)

ema34 = ta.ema(close, 34)

ema55 = ta.ema(close, 55)

// Plotting EMAs for visualization

plot(ema8, color=color.red, title="EMA 8", linewidth=1)

plot(ema13, color=color.orange, title="EMA 13", linewidth=1)

plot(ema21, color=color.yellow, title="EMA 21", linewidth=1)

plot(ema34, color=color.aqua, title="EMA 34", linewidth=1)

plot(ema55, color=color.lime, title="EMA 55", linewidth=1)

longEmaCondition = ema8 > ema13 and ema13 > ema21 and ema21 > ema34 and ema34 > ema55

exitLongEmaCondition = ema13 < ema55

shortEmaCondition = ema8 < ema13 and ema13 < ema21 and ema21 < ema34 and ema34 < ema55

exitShortEmaCondition = ema13 > ema55

// ---------- //

// OSCILLATORS //

// ----------- //

rsi = ta.rsi(close, 14)

longRsiCondition = rsi < 70 and rsi > 40

exitLongRsiCondition = rsi > 70

shortRsiCondition = rsi > 30 and rsi < 60

exitShortRsiCondition = rsi < 30

// Stochastic

k = ta.stoch(close, high, low, 14)

d = ta.sma(k, 3)

longStochasticCondition = k < 80

exitLongStochasticCondition = k > 95

shortStochasticCondition = k > 20

exitShortStochasticCondition = k < 5

//----------//

// STRATEGY //

//----------//

// ATR for dynamic stop loss and take profit

atr = ta.atr(14)

stopLossMultiplier = 2

takeProfitMultiplier = 4

stopLoss = atr * stopLossMultiplier

takeProfit = atr * takeProfitMultiplier

// Trailing stop settings

trailStopMultiplier = 1.5

trailOffset = atr * trailStopMultiplier

// Risk management: dynamic position sizing

riskPerTrade = 0.01 // 1% risk per trade

positionSize = strategy.equity * riskPerTrade / stopLoss

longCondition = longEmaCondition and longRsiCondition and longStochasticCondition and strategy.position_size == 0

exitLongCondition = (exitLongEmaCondition or exitLongRsiCondition or exitLongStochasticCondition) and strategy.position_size > 0

if (longCondition)

strategy.entry("LONG", strategy.long, qty=positionSize)

strategy.exit("Take Profit Long", "LONG", stop=close - stopLoss, limit=close + takeProfit, trail_offset=trailOffset)

if (exitLongCondition)

strategy.close("LONG")

shortCondition = shortEmaCondition and shortRsiCondition and shortStochasticCondition and strategy.position_size == 0

exitShortCondition = (exitShortEmaCondition or exitShortRsiCondition or exitShortStochasticCondition) and strategy.position_size < 0

if (shortCondition)

strategy.entry("SHORT", strategy.short, qty=positionSize)

strategy.exit("Take Profit Short", "SHORT", stop=close + stopLoss, limit=close - takeProfit, trail_offset=trailOffset)

if (exitShortCondition)

strategy.close("SHORT")