EMA + AROON + ASH

저자:차오장, 날짜: 2022-05-10 10:34:06태그:EMA아론아쉬

Jh. " 각 지표에 대한 크레딧은 그들에게 속합니다. 나는 단지 몇 가지 추가 옵션, 설정, 등을 추가하기 위해 변경, 또한 PineScript 5에 모든 코드를 업데이트했습니다.

=== 전략 === 기본 설정은 이미 트레이드 킹이 요구하는 대로, 그래서 당신은 아무것도 변경할 필요가 없습니다. FOR LONGS (녹색 배경에는 LONG 항목이 표시됩니다.)

- 가격은 EMA보다 높아야 합니다.

- 올린 아론 크로스오버

- 부일시 절대 강도 히스토그램 라인은 베어시 라인의 위쪽에 있어야 합니다.

SHORTS (붉은 배경에는 SHORT 항목이 표시됩니다.)

- 가격은 EMA보다 낮아야 합니다.

- 베어리쉬 아론 크로스오버

- 하향 절대 강도 히스토그램 라인은 상승선 위에 있어야 합니다.

더 많은 정보를 얻기 위해 트레이드 킹의 유튜브 채널을 확인하십시오.

=== 일반 개선 === 파인스크립트 5로 업그레이드 몇 가지 성능 개선.

=== 개인 메모 === 이 전략의 저자는 5M 차트를 권장하지만 4H는 가장 좋습니다.

이 스크립트를 구성하는 지표의 저자와 이 전략을 만든 TRADE KING에게 다시 한 번 감사드립니다.

백테스트

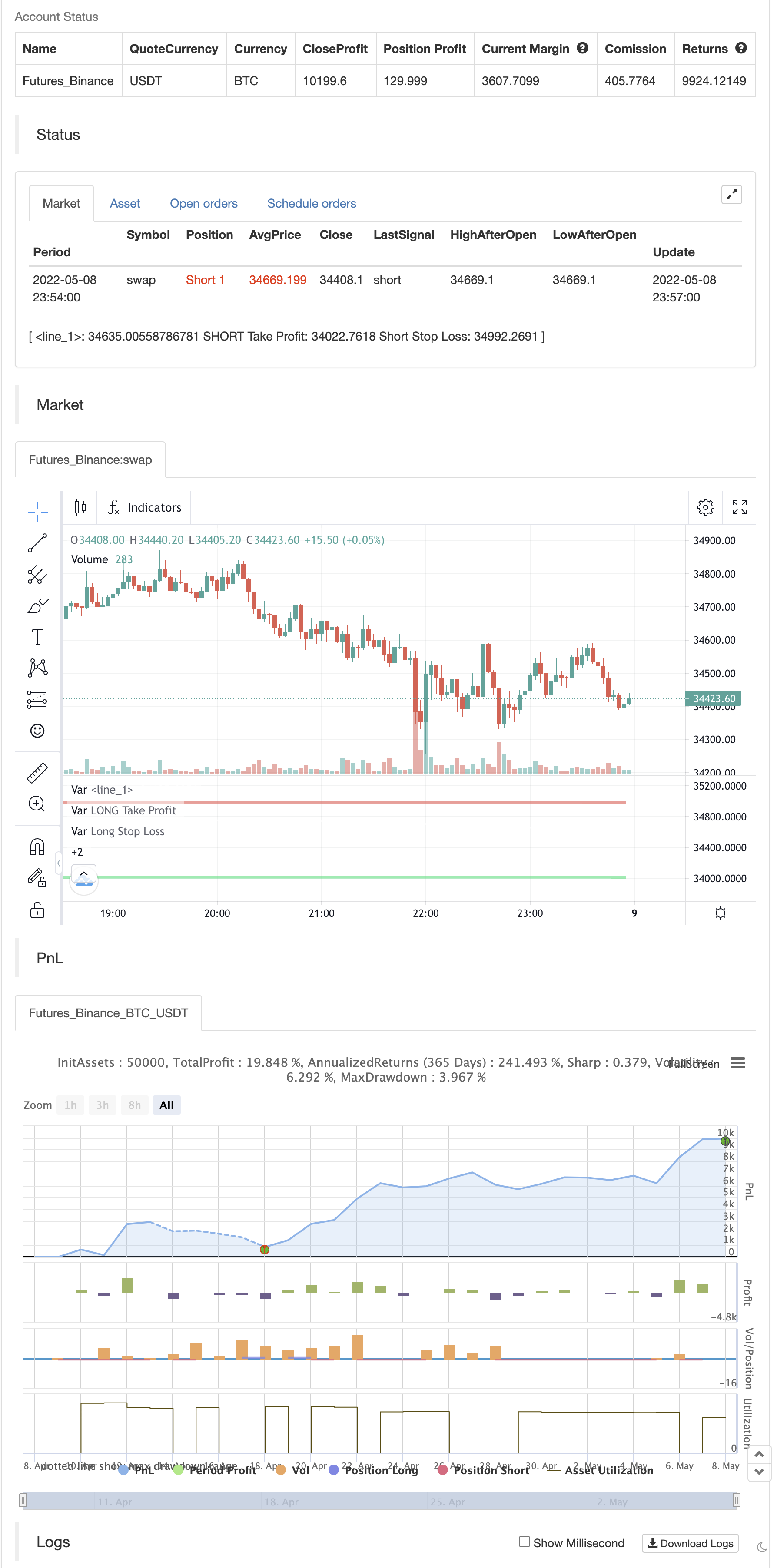

/*backtest

start: 2022-04-09 00:00:00

end: 2022-05-08 23:59:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © JoseMetal

//@version=5

//

//== Constantes

c_verde_radiactivo = color.rgb(0, 255, 0, 0)

c_verde = color.rgb(0, 128, 0, 0)

c_verde_oscuro = color.rgb(0, 80, 0, 0)

c_rojo_radiactivo = color.rgb(255, 0, 0, 0)

c_rojo = color.rgb(128, 0, 0, 0)

c_rojo_oscuro = color.rgb(80, 0, 0, 0)

//== Funciones

//== Declarar estrategia y período de testeo

//strategy("EMA + AROON + ASH (TRADE KING's STRATEGY)", shorttitle="EMA + AROON + ASH (TRADE KING's STRATEGY)", overlay=true, initial_capital=10000, pyramiding=0, default_qty_value=10, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.00075, max_labels_count=500, max_bars_back=1000)

//fecha_inicio = input.time(timestamp("1 Jan 2000"), title="• Start date", group="Test period", inline="periodo_de_pruebas")

vela_en_fecha = true

posicion_abierta = strategy.position_size != 0

LONG_abierto = strategy.position_size > 0

SHORT_abierto = strategy.position_size < 0

//== Condiciones de entrada y salida de estrategia

GRUPO_P = "Positions"

P_permitir_LONGS = input.bool(title="¿LONGS?", group=GRUPO_P, defval=true)

P_permitir_SHORTS = input.bool(title="¿SHORTS?", group=GRUPO_P, defval=true)

GRUPO_TPSL = "TP y SL"

TPSL_TP_pivot_lookback = input.int(title="• SL lookback for pivot / Mult. TP", group=GRUPO_TPSL, defval=20, minval=1, step=1, inline="tp_sl")

TPSL_SL_mult = input.float(title="", group=GRUPO_TPSL, defval=2.0, minval=0.1, step=0.2, inline="tp_sl")

//== Inputs de indicadores

// EMA

GRUPO_EMA = "Exponential Moving Average (EMA)"

EMA_length = input.int(200, minval=1, title="Length", group=GRUPO_EMA)

EMA_src = input(close, title="Source", group=GRUPO_EMA)

EMA = ta.ema(EMA_src, EMA_length)

// Aroon

GRUPO_Aroon = "Aroon"

Aroon_length = input.int(title="• Length", group=GRUPO_Aroon, defval=20, minval=1)

Aroon_upper = 100 * (ta.highestbars(high, Aroon_length+1) + Aroon_length) / Aroon_length

Aroon_lower = 100 * (ta.lowestbars(low, Aroon_length+1) + Aroon_length) / Aroon_length

// ASH

GRUPO_ASH = "Absolute Strength Histogram v2 | jh"

ASH_Length = input(9, title='Period of Evaluation', group=GRUPO_ASH)

ASH_Smooth = input(3, title='Period of Smoothing', group=GRUPO_ASH)

ASH_src = input(close, title='Source')

ASH_Mode = input.string(title='Indicator Method', defval='RSI', options=['RSI', 'STOCHASTIC', 'ADX'])

ASH_ma_type = input.string(title='MA', defval='WMA', options=['ALMA', 'EMA', 'WMA', 'SMA', 'SMMA', 'HMA'])

ASH_alma_offset = input.float(defval=0.85, title='* Arnaud Legoux (ALMA) Only - Offset Value', minval=0, step=0.01)

ASH_alma_sigma = input.int(defval=6, title='* Arnaud Legoux (ALMA) Only - Sigma Value', minval=0)

_MA(type, src, len) =>

float result = 0

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'SMMA' // Smoothed

w = ta.wma(src, len)

result := na(w[1]) ? ta.sma(src, len) : (w[1] * (len - 1) + src) / len

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'ALMA' // Arnaud Legoux

result := ta.alma(src, len, ASH_alma_offset, ASH_alma_sigma)

result

result

Price1 = _MA('SMA', ASH_src, 1)

Price2 = _MA('SMA', ASH_src[1], 1)

// RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

// STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ASH_Length)

Bears1 = ta.highest(Price1, ASH_Length) - Price1

// ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ASH_Mode == 'RSI' ? Bulls0 : ASH_Mode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ASH_Mode == 'RSI' ? Bears0 : ASH_Mode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = _MA(ASH_ma_type, Bulls, ASH_Length)

AvgBears = _MA(ASH_ma_type, Bears, ASH_Length)

SmthBulls = _MA(ASH_ma_type, AvgBulls, ASH_Smooth)

SmthBears = _MA(ASH_ma_type, AvgBears, ASH_Smooth)

difference = math.abs(SmthBulls - SmthBears)

//== Cálculo de condiciones

EMA_alcista = close > EMA

EMA_bajista = close < EMA

Aroon_cruce_alcista = ta.crossover(Aroon_upper, Aroon_lower)

Aroon_cruce_bajista = ta.crossunder(Aroon_upper, Aroon_lower)

ASH_alcista = SmthBulls > SmthBears

ASH_bajista = SmthBulls < SmthBears

//== Entrada (deben cumplirse todas para entrar)

longCondition1 = EMA_alcista

longCondition2 = Aroon_cruce_alcista

longCondition3 = ASH_alcista

long_conditions = longCondition1 and longCondition2 and longCondition3

entrar_en_LONG = P_permitir_LONGS and long_conditions and vela_en_fecha and not posicion_abierta

shortCondition1 = EMA_bajista

shortCondition2 = Aroon_cruce_bajista

shortCondition3 = ASH_bajista

short_conditions = shortCondition1 and shortCondition2 and shortCondition3

entrar_en_SHORT = P_permitir_SHORTS and short_conditions and vela_en_fecha and not posicion_abierta

var LONG_stop_loss = 0.0

var LONG_take_profit = 0.0

var SHORT_stop_loss = 0.0

var SHORT_take_profit = 0.0

//psl = ta.pivotlow(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

//psh = ta.pivothigh(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

psl = ta.lowest(TPSL_TP_pivot_lookback)

psh = ta.highest(TPSL_TP_pivot_lookback)

if (entrar_en_LONG)

LONG_stop_loss := psl - close*0.001

LONG_take_profit := close + ((close - LONG_stop_loss) * TPSL_SL_mult)

strategy.entry("+ Long", strategy.long)

strategy.exit("- Long", "+ Long", limit=LONG_take_profit, stop=LONG_stop_loss)

if (entrar_en_SHORT)

SHORT_stop_loss := psh + close*0.001

SHORT_take_profit := close - ((SHORT_stop_loss - close) * TPSL_SL_mult)

strategy.entry("+ Short", strategy.short)

strategy.exit("- Short", "+ Short", limit=SHORT_take_profit, stop=SHORT_stop_loss)

//== Ploteo en pantalla

// EMA

plot(EMA, color=color.white, linewidth=2)

// Símbolo de entrada (entre o no en compra)

bgcolor = color.new(color.black, 100)

if (entrar_en_LONG or entrar_en_SHORT)

bgcolor := color.new(color.green, 90)

bgcolor(bgcolor)

// Precio de compra, Take Profit, Stop Loss y relleno

avg_position_price_plot = plot(series=posicion_abierta ? strategy.position_avg_price : na, color=color.new(color.white, 25), style=plot.style_linebr, linewidth=2, title="Precio Entrada")

LONG_tp_plot = plot(LONG_abierto and LONG_take_profit > 0.0 ? LONG_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="LONG Take Profit")

LONG_sl_plot = plot(LONG_abierto and LONG_stop_loss > 0.0 ? LONG_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Long Stop Loss")

fill(avg_position_price_plot, LONG_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, LONG_sl_plot, color=color.new(color.maroon, 85))

SHORT_tp_plot = plot(SHORT_abierto and SHORT_take_profit > 0.0 ? SHORT_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="SHORT Take Profit")

SHORT_sl_plot = plot(SHORT_abierto and SHORT_stop_loss > 0.0 ? SHORT_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Short Stop Loss")

fill(avg_position_price_plot, SHORT_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, SHORT_sl_plot, color=color.new(color.maroon, 85))

관련

- Z-Score 트렌드 전략

- CM 스링 샷 시스템

- 동적 구매 입구 전략 EMA 교차와 촛불 몸 침투를 결합

- 동적 지지/저항 거래 전략과 함께 트리플 EMA

- 3EMA

- 시드 보스

- 크로스 플레이

- 범주 필터 구매 및 판매 5분 [전략]

- Strat를 구매/판매

- EMA 트렌드를 따르는 자동 거래 전략

더 많은

- BB-RSI-ADX 입구점

- 헬스-4에마

- 각 공격 후보 라인 표시기

- 키준센 선과 십자가

- AMACD - 모든 이동 평균 컨버전스 디버전스

- MA 하이브리드 BY RAJ

- 다이아몬드 트렌드

- 니크 스톡

- 스톡 슈퍼트르드 ATR 200ma

- MTF RSI & STOCH 전략

- 모멘텀 2.0

- EHMA 범위 전략

- 이동 평균 구매 판매

- 미다스 Mk. II - 최고의 암호화 스윙

- TMA-레거시

- TV의 높고 낮은 전략

- 가장 좋은 트레이딩 뷰 전략

- 빅 스냅퍼 경고 R3.0 + Chaiking 변동성 상태 + TP RSI

데 크롤 스톱 - CCI + EMA와 RSI 크로스 전략