개요

트리플 모드 쇼크 트레이딩 전략은 여러 기술 지표의 조합을 기반으로 한 단선 트레이딩 전략이다. 이 전략은 슈퍼 트렌드 지표, SSL 혼성 평균선 및 개선된 QQE 지표를 결합하여 안정적인 거래 신호를 형성한다. 디지털 통화 및 주식과 같은 높은 변동성이있는 거래 품종에 적합하며 특히 돌파구 이후에는 좋은 성능을 나타냅니다.

원칙

출입 신호

“이봐, 이봐, 이봐.

- 슈퍼 트렌드는 무에서 넘어가고 있습니다.

- SSL 혼합 기본 라인 상의 종결 가격

- QQE 개량판은 파란색 ((多頭)

빈 창고 입점:

- 슈퍼 트렌드는

- SSL 혼합 기본 라인 하향 경유

- QQE 개량판은 빨간색 (공백)

출구 신호

장항 출전: 슈퍼 트렌드는 다변화

공백으로 돌아간 슈퍼 트렌드

상쇄

%의 손실, ATR의 손실 또는 최근 최저 가격의 손실을 선택할 수 있습니다.

정지 수익률을 설정하여 정지 가격을 자동으로 계산합니다.

자금 관리

자금 관리 로직을 사용 하 여 선택 하 여 위치 크기 제어

지도

- 슈퍼 트렌드 라인을 그리기, SSL 혼합均線通道

- EMA 평행선을 그리는 선택

- 포지션 개시, 중지, 중지 라인을 그리기

- 다중 공백점 상장 표기

장점

- 다중 지표 조합, 안정적인 거래 신호를 형성

슈퍼 트렌드, SSL 혼합 평균선 및 QQE 개선 버전 지표와 결합하여 서로 다른 지표가 서로 검증되어 가짜 돌파구를 필터링하여 고품질 거래 신호를 형성합니다.

- 변동성 품종에 적합한 흔들림 거래

전략은 단선 거래 방식을 채택하여 단선 가격 변동을 포착하는 데 초점을 맞추고 있다. 슈퍼 트렌드는 가격 트렌드를 효과적으로 추적하고, SSL 혼합 평균선은 지지 압력 수준을 명확하게 식별할 수 있으며, 둘은 동요 상황에서 수익을 얻을 수 있다.

- 여러 종류의 손해 방지 방법을 선택할 수 있습니다

중지 손실은 비율, ATR 값 또는 근래 극한 값을 선택할 수 있습니다. 停止 은 수익률을 설정할 수 있습니다. 資金 管理는 포지션을 제어 할 수 있습니다.

- 명확한 지도

전략 지도는 명확하고 직관적으로 중지 손실, 중지 선의 수준을 보여줍니다. 포지션 개설 선의 표시는 거래 신호를 쉽게 식별합니다.

위험과 최적화

- 소액 손실이 발생할 수 있습니다.

단선거래로 인해 일반적인 소규모 손실을 완전히 피할 수 없습니다. 적당히 손해제도를 완화하고 자금관리 논리를 최적화 할 수 있습니다.

- 가짜 침입 위험

가격이 가짜 브레이크가 발생하면 잘못된 신호가 형성될 수 있다. 가짜 브레이크를 필터링하기 위해 다른 주기의 EMA를 테스트하거나, 트렌드 식별 지표 파라미터를 최적화할 수 있다.

- 감시 지표의 실패 위험

기본 지표가 작동하지 않으면 여러 가지 오류 신호가 발생합니다. 지표의 유효성을 주기적으로 확인하고 문제를 발견하고 조기에 조정하십시오.

- 재측정주기를 최적화

현재 재검토 주기는 고정된 기간으로, 품종의 다른 시장주기를 대응할 수 없다. 계약주인의 거래 기간에 대응하는 최적화를 권장한다.

- 품종 적응성을 최적화

다양한 품종 데이터 특성에 맞게 미세하게 조정할 수 있는 전략 매개 변수, 장단 포지션 승률을 높일 수 있다. 단계적 최적화 방법을 적용하여 다양한 매개 변수가 전략에 미치는 영향을 비교하는 것이 좋습니다.

요약하다

이 전략은 여러 지표들을 조합하여 거래 신호를 형성하고, 가짜 브레이크를 효과적으로 필터링하고, 변동성이 높은 디지털 통화와 개인 주식에 적합하다. 동시에 여러 가지 스톱 스톱 방식을 제공하며, 사용에 유연하다. 전반적으로 이 전략은 안정적인 거래 신호를 형성하고, 중·단계 변동 상황에서 더 나은 수익을 얻을 수 있다. 추가적인 최적화를 통해, 다양한 거래 품목에 대한 최적화 파라미터를 향상시킬 수 있다.

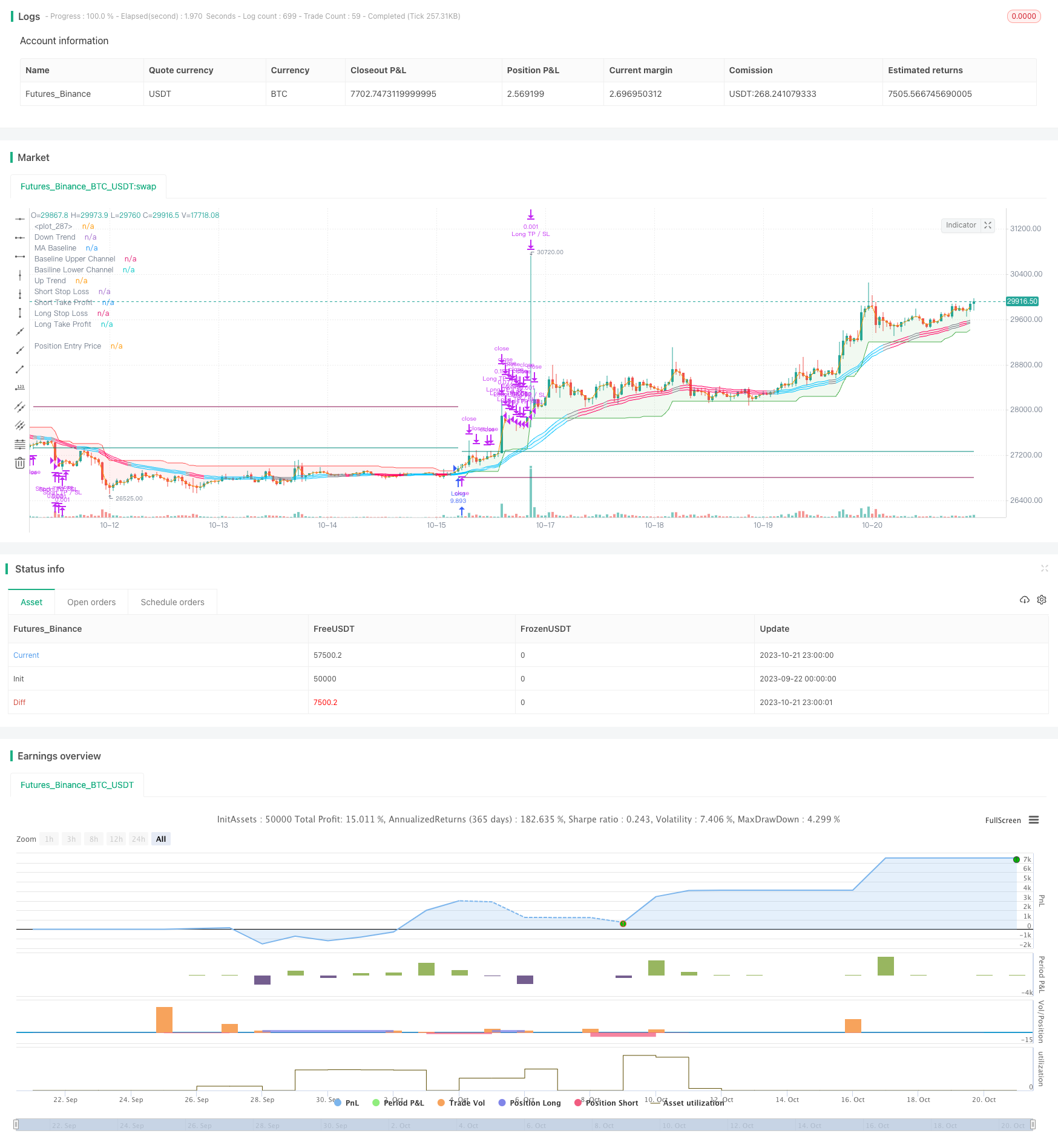

/*backtest

start: 2023-09-22 00:00:00

end: 2023-10-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// Thanks to myncrypto, jason5480, kevinmck100

// @version=5

strategy(title = '[D] SuperTrend + SSL Hybrid + QQE MOD',

shorttitle = '[D] SSQ Strategy',

overlay = true,

pyramiding = 0,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_value = 0.1,

initial_capital = 100000,

max_bars_back = 500,

max_lines_count = 150,

max_labels_count = 300)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Time, Direction, Etc - Basic Settings Inputs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// 1. Time: Based on UTC +09:00

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inTime = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool (defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool (defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Filter - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// 3. Use Filters? What Filters?

//// 3-1. ATR Filter

i_ATRFilterOn = input.bool (defval = false , title = "ATR Filter On?", tooltip = "ATR Filter On? Order will not be made unless filter condition is fulfilled", inline = "1", group = "Filters")

i_ATRFilterLen = input.int (defval = 14, title = "Length for ATR Filter", minval = 1 , maxval = 100 , step = 1 , tooltip = "", inline = "2", group = "Filters")

i_ATRSMALen = input.int (defval = 40, title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "2", group = "Filters")

bool ATRFilter = ta.atr(i_ATRFilterLen) >= ta.sma(ta.atr(length = i_ATRFilterLen), i_ATRSMALen) ? true : false

//// 3-2. EMA Filter

i_EMAFilterOn = input.bool (defval = false , title = "EMA Filter On?", tooltip = "EMA Filter On? Order will not be made unless filter condition is fulfilled", inline = "3", group = "Filters")

i_EMALen = input.int (defval = 200, title = "EMA Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "EMA Length", inline = "4", group = "Filters")

bool longEMAFilter = close >= ta.ema(source = close, length = i_EMALen) ? true : false

bool shortEMAFilter = close <= ta.ema(source = close, length = i_EMALen) ? true : false

plot(i_EMAFilterOn ? ta.ema(source = close, length = i_EMALen) : na, title = "EMA Filter", color = color.new(color = color.orange , transp = 0), linewidth = 1)

//// 3-3. ADX Filter

////3-4. DMI Filter (Uses same ADX Length)

i_ADXFilterOn = input.bool (defval = false , title = "ADX Filter On?", tooltip = "ADX Filter On? Order will not be made unless filter condition is fulfilled", inline = "5", group = "Filters")

i_DMIFilterOn = input.bool (defval = false , title = "DMI Filter On?", tooltip = "DMI (Directional Moving Index) Filter On? Order will not be made unless filter condition is fulfilled", inline = "6", group = "Filters")

i_ADXLength = input.int (defval = 20, title = "ADX Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ADX Length", inline = "7", group = "Filters")

i_ADXThreshold = input.int (defval = 25, title = "ADX Threshold", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ADX should be bigger than threshold", inline = "8", group = "Filters")

//// 3-4. SuperTrend Filter

// i_superTrendFilterOn = input.bool (defval = false , title = "Super Trend Filter On?", tooltip = "Super Trend Filter On? Order will not be made unless filter condition is fulfilled", inline = "9", group = "Filters")

// i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "10", group = "Filters")

// i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "11", group = "Filters")

// ADX and DI Thanks to @BeikabuOyaji

int len = i_ADXLength

float th = i_ADXThreshold

TR = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DMPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DMMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTR = 0.0

SmoothedTR := nz(SmoothedTR[1]) - nz(SmoothedTR[1]) / len + TR

SmoothedDMPlus = 0.0

SmoothedDMPlus := nz(SmoothedDMPlus[1]) - nz(SmoothedDMPlus[1]) / len + DMPlus

SmoothedDMMinus = 0.0

SmoothedDMMinus := nz(SmoothedDMMinus[1]) - nz(SmoothedDMMinus[1]) / len + DMMinus

DIPlus = SmoothedDMPlus / SmoothedTR * 100

DIMinus = SmoothedDMMinus / SmoothedTR * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(source = DX, length = len)

// plot(DIPlus, color=color.new(color.green, 0), title='DI+')

// plot(DIMinus, color=color.new(color.red, 0), title='DI-')

// plot(ADX, color=color.new(color.navy, 0), title='ADX')

// hline(th, color=color.white)

bool ADXFilter = ADX > th ? true : false

bool longDMIFilter = DIPlus >= DIMinus ? true : false

bool shortDMIFilter = DIPlus <= DIMinus ? true : false

// Calculate Super Trend for Filter

// i_superTrendFilterOn = input.bool (defval = false , title = "Super Trend Filter On?", tooltip = "Super Trend Filter On? Order will not be made unless filter condition is fulfilled", inline = "9", group = "Filters")

// i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "10", group = "Filters")

// i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "11", group = "Filters")

// [supertrend, direction] = ta.supertrend(factor = i_superTrendATRFactor, atrPeriod = i_superTrendATRLen)

// bodyMiddle = plot((open + close) / 2, display=display.none)

// upTrend = plot(i_superTrendFilterOn ? direction < 0 ? supertrend : na : na, "Up Trend", color = color.green, style=plot.style_linebr)

// downTrend = plot(i_superTrendFilterOn ? direction < 0 ? na : supertrend : na, "Down Trend", color = color.red, style=plot.style_linebr)

// fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

// fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

// bool longSTFilter = direction <= 0

// bool shortSTFilter = direction >= 0

// Filter

bool longFilterFilled = (not i_ATRFilterOn or ATRFilter) and (not i_EMAFilterOn or longEMAFilter) and (not i_ADXFilterOn or ADXFilter) and (not i_DMIFilterOn or longDMIFilter) // and (not i_superTrendFilterOn or longSTFilter)

bool shortFilterFilled = (not i_ATRFilterOn or ATRFilter) and (not i_EMAFilterOn or shortEMAFilter) and (not i_ADXFilterOn or ADXFilter) and (not i_DMIFilterOn or shortDMIFilter) // and (not i_superTrendFilterOn or shortSTFilter)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Strategy Logic (Entry & Exit Condition) - Inputs, Indicators for Strategy

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//// Indicators

// Inputs for Strategy Indicators

//// 1. Super Trend

i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "1", group = "1: SuperTrend")

i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "2", group = "1: SuperTrend")

[supertrend, direction] = ta.supertrend(factor = i_superTrendATRFactor, atrPeriod = i_superTrendATRLen)

//// 2. SSL Hybrid Baseline

i_useTrueRange = input.bool (defval = true, title = "use true range for Keltner Channel?", tooltip = "", inline = "1", group = "2: SSL Hybrid")

i_maType = input.string (defval ='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'VAMA', 'TMA', 'HMA', 'McGinley'], inline="2", group = "2: SSL Hybrid")

i_len = input.int (defval =30, title='Baseline Length', inline="2", group = "2: SSL Hybrid")

i_multy = input.float (defval = 0.2, title='Base Channel Multiplier', minval = 0, maxval = 100, step=0.05, inline="3", group = "2: SSL Hybrid")

i_volatility_lookback = input.int (defval =10, title='Volatility lookback length(for VAMA)', inline='4',group="2: SSL Hybrid")

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

f_ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

result

//// 2-1. SSL Hybrid Keltner Baseline Channel

BBMC = f_ma (i_maType, close, i_len) // BaseLone

Keltma = f_ma (i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

//// 3. QQE MOD, thanks to Mihkel100

RSI_Period = input.int (defval = 6, title = 'RSI Length', inline = "1", group = "3: QQE MOD")

SF = input.int (defval = 5, title = 'RSI Smoothing', inline = "2", group = "3: QQE MOD")

QQE = input.float (defval = 3, title = 'Fast QQE Factor', inline = "3", group = "3: QQE MOD")

ThreshHold = input.int (defval = 3, title = 'Thresh-hold', inline = "4", group = "3: QQE MOD")

src = input (defval = close, title='RSI Source')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(src, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

////////////////////

length = input.int (defval = 50, minval = 1, title = 'Bollinger Length', group = "3: QQE MOD")

mult = input.float (defval = 0.35, minval = 0.01, maxval = 5, step = 0.1, title = 'BB Multiplier', group = "3: QQE MOD")

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = mult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

//

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

//

// Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1)

////////////////////////////////////////////////////////////////

RSI_Period2 = input.int (defval = 6, title = 'RSI 2 Length', group = "3: QQE MOD")

SF2 = input.int (defval = 5, title = 'RSI Smoothing', group = "3: QQE MOD")

QQE2 = input.float (defval = 1.61, title = 'Fast QQE2 Factor', group = "3: QQE MOD")

ThreshHold2 = input.int (defval = 3, title = 'Thresh-hold', group = "3: QQE MOD")

src2 = input (defval = close, title = 'RSI Source', group = "3: QQE MOD")

//

//

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

//

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

//

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

// Plot: Indicators

//// 1. Super Trend

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0 ? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

//// 2. SSL Hybrid

var bullSSLColor = #00c3ff

var bearSSLColor = #ff0062

// color_bar = color.new(color = close > upperk ? bullSSLColor : close < lowerk ? bearSSLColor : color.gray, transp = 0)

// i_show_color_bar = input.bool(defval = true , title = "Color Bars")

// barcolor(i_show_color_bar ? color_bar : na)

plot(series = BBMC, title = 'MA Baseline', color = color_bar, linewidth = 1, style = plot.style_line)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

//// 3. QQE MOD: No Plotting because of overlay option

// plot(FastAtrRsi2TL - 50, title='QQE Line', color=color.new(color.white, 0), linewidth=2)

// plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

// plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

// plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

////// Entry, Exit

// Long, Short Logic with Indicator

bool longSTCond = direction[1] >= 0 and direction <= 0

bool shortSTCond = direction[1] <= 0 and direction >= 0

bool longSSLCond = close > upperk

bool shortSSLCond = close < lowerk

bool longQQECond = Greenbar1 and Greenbar2 == 1

bool shortQQECond = Redbar1 and Redbar2 == 1

// Basic Cond + Long, Short Entry Condition

bool longCond = (i_longEnabled and inTime) and (longSTCond and longSSLCond and longQQECond)

bool shortCond = (i_shortEnabled and inTime) and (shortSTCond and shortSSLCond and shortQQECond)

// Basic Cond + Long, Short Exit Condition

bool closeLong = (i_longEnabled) and (shortSTCond)

bool closeShort = (i_shortEnabled) and (longSTCond)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Position Control

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Long, Short Entry Condition + Not entered Position Yet

bool openLong = longCond and not (strategy.opentrades.size(strategy.opentrades - 1) > 0) and longFilterFilled

bool openShort = shortCond and not (strategy.opentrades.size(strategy.opentrades - 1) < 0) and shortFilterFilled

bool enteringTrade = openLong or openShort

float entryBarIndex = bar_index

// Long, Short Entry Fulfilled or Already Entered

bool inLong = openLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool inShort = openShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Stop Loss - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//// Use SL? TSL?

i_useSLTP = input.bool (defval = true, title = "Enable SL & TP?", tooltip = "", inline = "1", group = "Stop Loss")

i_tslEnabled = input.bool (defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "1", group = "Stop Loss")

// i_breakEvenAfterTP = input.bool (defval = false, title = 'Enable Break Even After TP?', tooltip = 'When Take Profit price target is hit, move the Stop Loss to the entry price (or to a more strict price defined by the Stop Loss %/ATR Multiplier).', inline = '2', group = 'Stop Loss / Take Profit')

//// Sl Options

i_slType = input.string (defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "3", group = "Stop Loss")

i_slATRLen = input.int (defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "4", group = "Stop Loss")

i_slATRMult = input.float (defval = 3, title = "ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "4", group = "Stop Loss")

i_slPercent = input.float (defval = 3, title = "Percent", tooltip = "", inline = "5", group = "Stop Loss")

i_slLookBack = input.int (defval = 30, title = "Lowest Price Before Entry", group = "Stop Loss", inline = "6", minval = 30, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// Functions for Stop Loss

float openAtr = ta.valuewhen(condition = enteringTrade, source = ta.atr(i_slATRLen), occurrence = 0)

float openLowest = ta.valuewhen(condition = openLong, source = ta.lowest(low, i_slLookBack), occurrence = 0)

float openHighest = ta.valuewhen(condition = openShort, source = ta.highest(high, i_slLookBack), occurrence = 0)

f_getLongSLPrice(source) =>

switch i_slType

"Percent" => source * (1 - (i_slPercent/100))

"ATR" => source - (i_slATRMult * openAtr)

"Previous LL / HH" => openLowest

=> na

f_getShortSLPrice(source) =>

switch i_slType

"Percent" => source * (1 + (i_slPercent/100))

"ATR" => source + (i_slATRMult * openAtr)

"Previous LL / HH" => openHighest

=> na

// Calculate Stop Loss

var float longSLPrice = na

var float shortSLPrice = na

bool longTPExecuted = false

bool shortTPExecuted = false

longSLPrice := if (inLong and i_useSLTP)

if (openLong)

f_getLongSLPrice (close)

else

// 1. Trailing Stop Loss

if i_tslEnabled

stopLossPrice = f_getLongSLPrice (high)

math.max(stopLossPrice, nz(longSLPrice[1]))

// 2. Normal StopLoss

else

nz(source = longSLPrice[1], replacement = 0)

else

na

shortSLPrice := if (inShort and i_useSLTP)

if (openShort)

f_getShortSLPrice (close)

else

// 1. Trailing Stop Loss

if i_tslEnabled

stopLossPrice = f_getShortSLPrice (low)

math.min(stopLossPrice, nz(shortSLPrice[1]))

// 2. Normal StopLoss

else

nz(source = shortSLPrice[1], replacement = 999999.9)

else

na

// Plot: Stop Loss of Long, Short Entry

var longSLPriceColor = color.new(color.maroon, 0)

plot(series = longSLPrice, title = 'Long Stop Loss', color = longSLPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

var shortSLPriceColor = color.new(color.maroon, 0)

plot(series = shortSLPrice, title = 'Short Stop Loss', color = shortSLPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Take Profit - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_useTPExit = input.bool (defval = true, title = "Use Take Profit?", tooltip = "", inline = "1", group = "Take Profit")

i_RRratio = input.float (defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "2", group = "Take Profit")

i_tpQuantityPerc = input.float (defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position closed when tp target is met.', inline="34", group = 'Take Profit')

var float longTPPrice = na

var float shortTPPrice = na

f_getLongTPPrice() =>

close + i_RRratio * math.abs (close - f_getLongSLPrice (close))

f_getShortTPPrice() =>

close - i_RRratio * math.abs(close - f_getShortSLPrice (close))

longTPPrice := if (inLong and i_useSLTP)

if (openLong)

f_getLongTPPrice ()

else

nz(source = longTPPrice[1], replacement = f_getLongTPPrice ())

else

na

shortTPPrice := if (inShort and i_useSLTP)

if (openShort)

f_getShortTPPrice ()

else

nz(source = shortTPPrice[1], replacement = f_getShortTPPrice ())

else

na

// Plot: Take Profit of Long, Short Entry

var longTPPriceColor = color.new(color.teal, 0)

plot(series = longTPPrice, title = 'Long Take Profit', color = longTPPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

var shortTPPriceColor = color.new(color.teal, 0)

plot(series = shortTPPrice, title = 'Short Take Profit', color = shortTPPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

// Plot: Entry Price

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position Entry Price', color = posColor, linewidth = 1, style = plot.style_linebr)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Quantity - Inputs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_useRiskManangement = input.bool (defval = true, title = "Use Risk Manangement?", tooltip = "", inline = "1", group = "Quantity")

i_riskPerTrade = input.float (defval = 3, title = "Risk Per Trade (%)", minval = 0, maxval = 100, step = 0.1, tooltip = "Use Risk Manangement by Quantity Control?", inline = "2", group = "Quantity")

// i_leverage = input.float (defval = 2, title = "Leverage", minval = 0, maxval = 100, step = 0.1, tooltip = "Leverage", inline = "3", group = "Quantity")

float qtyPercent = na

float entryQuantity = na

f_calQtyPerc() =>

if (i_useRiskManangement)

riskPerTrade = (i_riskPerTrade) / 100 // 1번 거래시 3% 손실

stopLossPrice = openLong ? f_getLongSLPrice (close) : openShort ? f_getShortSLPrice (close) : na

riskExpected = math.abs((close-stopLossPrice)/close) // 손절가랑 6% 차이

riskPerTrade / riskExpected // 0 ~ 1

else

1

f_calQty(qtyPerc) =>

math.min (math.max (0.000001, strategy.equity / close * qtyPerc), 1000000000)

// TP Execution

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= longTPPrice)

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= shortTPPrice)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Plot Label, Boxes, Results, Etc

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_showSimpleLabel = input.bool(false, "Show Simple Label for Entry?", group = "Strategy: Drawings", inline = "1", tooltip ="")

i_showLabels = input.bool(true, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(true, "Show Dashboard", group = "Strategy: Drawings", inline = "2", tooltip = "Show Backtest Results. Backtest Dates, Win/Lose Rates, Etc.")

// Plot: Label for Long, Short Entry

var openLongColor = color.new(#2962FF, 0)

var openShortColor = color.new(#FF1744, 0)

var entryTextColor = color.new(color.white, 0)

if (openLong and i_showSimpleLabel)

label.new (x = bar_index, y = na, text = 'Open', yloc = yloc.belowbar, color = openLongColor, style = label.style_label_up, textcolor = entryTextColor)

entryBarIndex := bar_index

if (openShort and i_showSimpleLabel)

label.new (x = bar_index, y = na, text = 'Close', yloc = yloc.abovebar, color = openShortColor, style = label.style_label_down, textcolor = entryTextColor)

entryBarIndex := bar_index

float prevEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

float pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

float prevExitPrice = strategy.closedtrades.exit_price (strategy.closedtrades - 1)

f_enteringTradeLabel(x, y, qty, entryPrice, slPrice, tpPrice, rrRatio, direction) =>

if i_showLabels

labelStr = ("Trade Start"

+ "\nDirection: " + direction

+ "\nRisk Per Trade: " + str.tostring (i_useRiskManangement ? i_riskPerTrade : 100, "#.##") + "%"

+ "\nExpected Risk: " + str.tostring (math.abs((close-slPrice)/close) * 100, "#.##") + "%"

+ "\nEntry Position Qty: " + str.tostring(math.abs(qty * 100), "#.##") + "%"

+ "\nEntry Price: " + str.tostring(entryPrice, "#.##"))

+ "\nStop Loss Price: " + str.tostring(slPrice, "#.##")

+ "\nTake Profit Price: " + str.tostring(tpPrice, "#.##")

+ "\nRisk - Reward Ratio: " + str.tostring(rrRatio, "#.##")

label.new(x = x, y = y, text = labelStr, color = color.new(color.blue, 60) , textcolor = color.white, style = label.style_label_up)

f_exitingTradeLabel(x, y, entryPrice, exitPrice, direction) =>

if i_showLabels

labelStr = ("Trade Result"

+ "\nDirection: " + direction

+ "\nEntry Price: " + str.tostring(entryPrice, "#.##")

+ "\nExit Price: " + str.tostring(exitPrice,"#.##")

+ "\nGain %: " + str.tostring(direction == 'Long' ? -(entryPrice-exitPrice) / entryPrice * 100 : (entryPrice-exitPrice) / entryPrice * 100 ,"#.##") + "%")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Orders

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

if (inTime)

if (openLong)

qtyPercent := f_calQtyPerc()

entryQuantity := f_calQty(qtyPercent)

strategy.entry(id = "Long", direction = strategy.long, qty = entryQuantity, comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

f_enteringTradeLabel(x = bar_index + 1, y = close-3*ta.tr, entryPrice = close, qty = qtyPercent, slPrice = longSLPrice, tpPrice = longTPPrice, rrRatio = i_RRratio, direction = "Long")

if (openShort)

qtyPercent := f_calQtyPerc()

entryQuantity := f_calQty(qtyPercent)

strategy.entry(id = "Short", direction = strategy.short, qty = entryQuantity, comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

f_enteringTradeLabel(x = bar_index + 1, y = close-3*ta.tr, entryPrice = close, qty = qtyPercent, slPrice = shortSLPrice, tpPrice = shortTPPrice, rrRatio = i_RRratio, direction = "Short")

if (closeLong)

strategy.close(id = 'Long', comment = 'Close Long', alert_message = 'Long: Closed at market price')

strategy.position_size > 0 ? f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Long') : na

if (closeShort)

strategy.close(id = 'Short', comment = 'Close Short', alert_message = 'Short: Closed at market price')

strategy.position_size < 0 ? f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Short') : na

if (inLong)

strategy.exit(id = 'Long TP / SL', from_entry = 'Long', qty_percent = i_tpQuantityPerc, limit = longTPPrice, stop = longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long SL', from_entry = 'Long', stop = longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (inShort)

strategy.exit(id = 'Short TP / SL', from_entry = 'Short', qty_percent = i_tpQuantityPerc, limit = shortTPPrice, stop = shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short SL', from_entry = 'Short', stop = shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

if strategy.position_size[1] > 0 and strategy.position_size == 0

f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Long')

if strategy.position_size[1] < 0 and strategy.position_size == 0

f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Short')

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Backtest Result Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// if i_showDashboard

// var bgcolor = color.new(color = color.black, transp = 100)

// var greenColor = color.new(color = #02732A, transp = 0)

// var redColor = color.new(color = #D92332, transp = 0)

// var yellowColor = color.new(color = #F2E313, transp = 0)

// // Keep track of Wins/Losses streaks

// newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// varip int winRow = 0

// varip int lossRow = 0

// varip int maxWinRow = 0

// varip int maxLossRow = 0

// if newWin

// lossRow := 0

// winRow := winRow + 1

// if winRow > maxWinRow

// maxWinRow := winRow

// if newLoss

// winRow := 0

// lossRow := lossRow + 1

// if lossRow > maxLossRow

// maxLossRow := lossRow

// // Prepare stats table

// var table dashTable = table.new(position.top_right, 1, 15, border_width=1)

// if barstate.islastconfirmedhistory

// dollarReturn = strategy.netprofit

// f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

// f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

// _profit = (strategy.netprofit / strategy.initial_capital) * 100

// f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? greenColor : redColor, color.white)

// _numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

// f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? greenColor : redColor, color.white)

// _winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

// f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? redColor : _winRate < 75 ? greenColor : yellowColor, color.white)

// f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? greenColor : redColor, color.white)

// f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

// f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)