여러 보조 RSI 지표 전략

저자:차오장, 날짜: 2023-12-06 11:57:29태그:

전반적인 설명

이 전략은 RSI 지표를 사용하여 과소매와 과소매 조건을 식별하고 MACD, 스토카스틱 지표 등과 같은 여러 보조 요인을 결합한 거래를 수행합니다. 이 전략의 목표는 단기 반전 기회를 포착하는 것입니다. 그것은 평균 반전 전략에 속합니다.

어떻게 작동 합니까?

이 전략의 핵심 논리는 주로 RSI 지표에 의존하여 시장이 과소매 또는 과소매 상태에 있는지 여부를 결정합니다. RSI 지표가 설정된 과소매 한계를 초과하면 시장이 과소매 될 수 있다는 신호입니다. 전략은 이 시점에서 단장을 선택할 것입니다. RSI가 과소매 한계 이하로 떨어지면 시장이 과소매 될 수 있음을 나타냅니다. 이 경우 전략은 길게 갈 것입니다. 한 극단적 조건에서 다른 극단적 조건으로 전환하는 동안 단기 거래 기회를 포착함으로써 전략은 이익을 얻기를 희망합니다.

또한, 전략은 MACD, 스토카스틱 지표와 같은 여러 보조 요인을 포함합니다. 이러한 보조 요인의 역할은 잠재적으로 잘못된 긍정적 인 거래 신호를 필터링하는 것입니다. RSI 지표가 신호를 유발하고 보조 요인이 또한 신호를 승인 할 때만 전략이 실제 거래 조치를 취할 것입니다. 여러 요소 사이의 이러한 협업은 전략에서 생성되는 거래 신호의 신뢰성을 향상시켜 안정성을 향상시킬 수 있습니다.

이점 분석

이 전략의 가장 큰 장점은 신호 품질을 향상시키기 위해 다중 요인 확인 메커니즘을 통해 실현 된 높은 캡처 효율입니다. 구체적으로 다음 측면에 반영됩니다.

- RSI 지표 자체는 시장 체제와 과도한 조건을 식별 할 수있는 강력한 능력을 가지고 있습니다.

- 다중 인자 확인을 위한 여러 보조 도구의 도움으로 신호 품질이 향상되고 많은 양의 거짓 양성이 필터링됩니다.

- 전략은 매개 변수에 민감하지 않으며 최적화하기가 쉽습니다.

위험 과 해결책

이 전략과 관련된 위험은 여전히 존재하며, 주로 두 가지 측면에 집중됩니다.

- 실패한 반전 위험. 반전 신호 자체는 통계적 중재 기회에 의존하고 있으며, 개별적인 실패한 반전의 확률이 여전히 있습니다. 우리는 포지션 크기를 줄이거나 스톱 손실을 설정함으로써 위험을 제어 할 수 있습니다.

- 상승 추세에서의 손실 위험. 전략은 여전히 주로 반대이며, 상승 추세 시장에서 필연적으로 특정 손실로 이어집니다. 이것은 주요 추세를 정확하게 판단해야합니다. 필요한 경우 불리한 시장 환경을 건너뛰기 위해 수동 개입이 도입 될 수 있습니다.

최적화 방향

이 전략은 앞으로 다음과 같은 측면을 최적화해야 합니다.

- 최적의 매개 변수 조합을 찾기 위해 다른 제품에서 테스트하십시오. 매우 민감하지는 않지만 다른 제품에 대한 최상의 매개 변수를 찾는 것이 좋습니다.

- 적응력 있는 출구 메커니즘을 도입합니다. 동적 정지, 시간 정지 등과 같은 접근 방식을 테스트하여 전략이 진화하는 시장에 더 적응 할 수 있습니다.

- 기계 학습 모델을 통합합니다. 모델은 전략의 승률을 향상시키기 위해 역전 성공 확률을 추정하도록 훈련 할 수 있습니다.

결론

결론적으로, 이것은 단기 평균 회귀 전략이다. 과잉 구매 / 과잉 판매 조건을 측정하는 RSI의 기능을 활용하고 다중 요소 확인을위한 여러 보조 도구를 결합함으로써 신호 품질이 향상됩니다. 전략은 높은 캡처 효율성과 좋은 안정성을 가지고 있습니다. 최종 수익성을 위해 추가 테스트와 최적화를받을 자격이 있습니다.

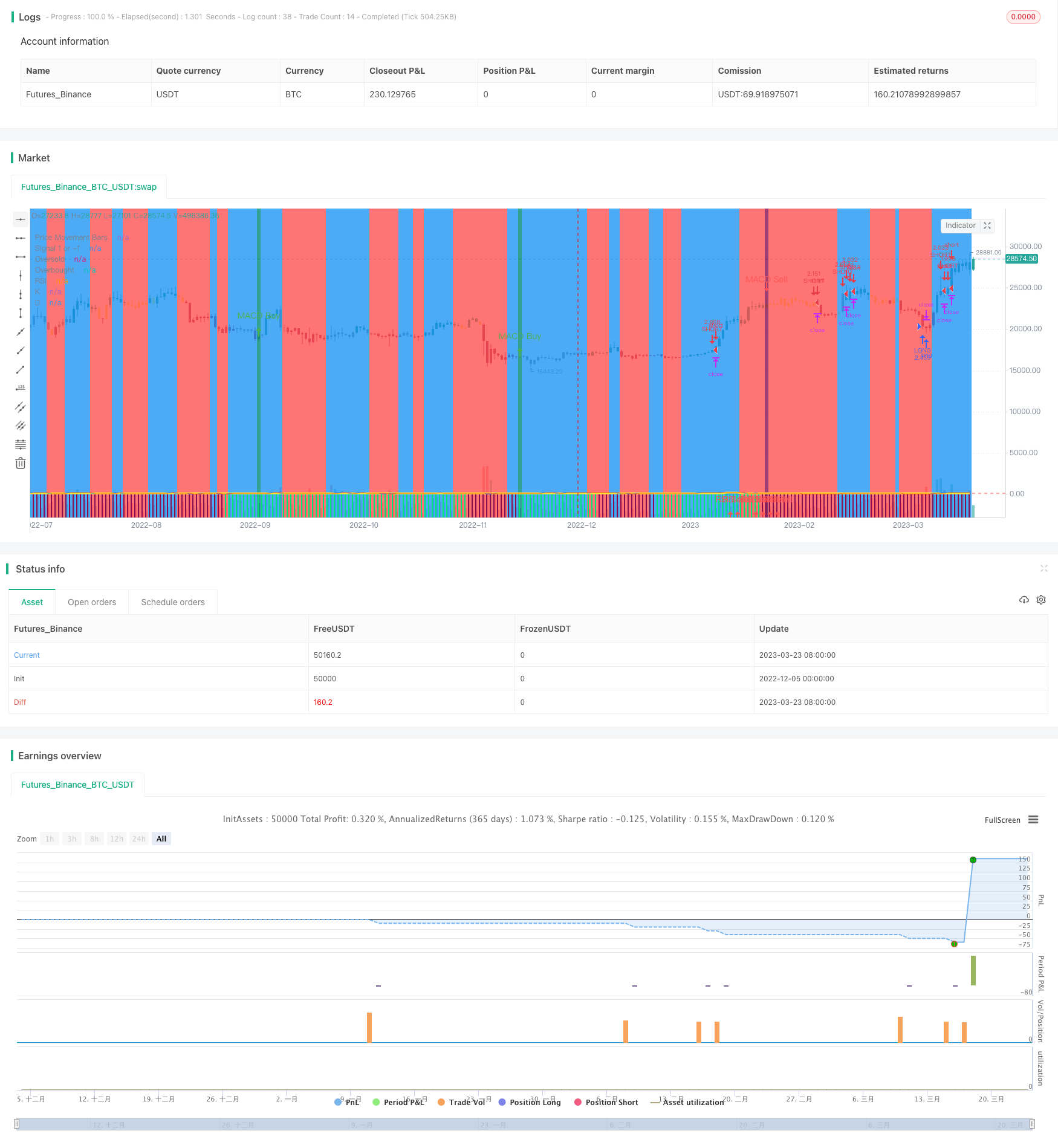

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='Ain1',title='All in One Strategy', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = #0094FF

dcolor = #FF6A00

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "Start Time", type = input.time)

window() => true

// Strategy Selection - Long, Short, or Both

strat = input(title="Strategy", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

// RSI and Stochastic Inputs

length = input(14, "RSI Length", minval=1)

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Define f_print function to show key recommendations for RSI

// f_print(_text) =>

// // Create label on the first bar.

// var _label = label(na),

// label.delete(_label),

// _label := label.new(

// time + (time-time[1]),

// ohlc4,

// _text,

// xloc.bar_time,

// yloc.price,

// color(na),

// label.style_none,

// color.gray,

// size.large,

// text.align_left

// )

// Display highest and lowest RSI values

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 5 to cnt by 5

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// f_print("Recommended RSI Settings:" + "\nOverbought = " + tostring(RSI_high) + "\nOversold = " + tostring(RSI_low))

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

// Price Movement Inputs

look_back = input(9,"Look Back Bars")

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// EMA and SMA Background Inputs

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

// MACD Inputs

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

useXRSI = input(false, "Use RSI crossing back, select only one")

useMACD = input(false, "Use MACD Only, select only one")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

bgcolor(showZones ? ( ruleState==1 ? color.blue : ruleState==-1 ? color.red : color.gray ) : na , title=" Bullish/Bearish Zones", transp=95)

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,look_back)

l_low = lowest(low_source ,look_back)

stoch = stoch(RSI, RSI, RSI, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", transp=80, color=kcolor)

dp = plot(showStoch ? d : na, "D", transp=80, color=dcolor)

fill(kp, dp, color = signalColor, title="K-D", transp=88)

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

// -------------- Add Price Movement to Strategy for better visualization -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fill(over, under, color=#9915FF, transp=90, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = 80

connor_os = 20

ma3 = sma(close,3)

ma20 = sma(close, 20)

ma50 = sma(close, 50)

erection = ((((close[1]-close[2])/close[2]) + ((close[0]-close[1])/close[1]))/2)*100

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma20 > ma50 and open > ma3 and RSI >= connor_ob and erection <=4 and window()

RSI_BUY = ma20 < ma50 and ma3 > close and RSI <= connor_os and window()

// Color Definition

col = useCRSI ? (close > ma20 and close < ma3 and RSI <= connor_os ? color.lime : close < ma20 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

// Shape Plots

plotshape(showRSIBS ? RSI_BUY: na, title = "RSI Buy", style = shape.arrowup, text = "RSI Buy", location = location.bottom, color=color.green, textcolor=color.green, size=size.small)

plotshape(showRSIBS ? RSI_SELL: na, title = "RSI Sell", style = shape.arrowup, text = "RSI Sell", location = location.bottom, color=color.red, textcolor=color.red, size=size.small)

// MACD as another complement to RSI strategy

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = crossover(macdLine, signalLine) and macdLine<0 and RSI<RSI_low and window()

MACDSell = crossunder(macdLine, signalLine) and macdLine>0 and RSI>RSI_high and window()

plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

bgcolor(showMACD ? (MACDBuy ? color.teal : MACDSell ? color.maroon : na) : na, title ="MACD Signals", transp=50)

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and window()

RSI_OB = crossover(RSI, overbought) and window()

XRSI_OS = crossover(RSI, oversold) and window()

RSI_OS = crossunder(RSI, oversold) and window()

// Strategy Entry and Exit with built in Risk Management

GoLong = strat_val > -1 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

GoShort = strat_val < 1 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

convert_percent_to_points(percent) =>

strategy.position_size != 0 ? round(percent * strategy.position_avg_price / syminfo.mintick) : float(na)

setup_percent(percent) =>

convert_percent_to_points(percent)

if (GoLong)

strategy.entry("LONG", strategy.long)

strategy.exit(id="Exit Long", from_entry = "LONG", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseLong = strategy.position_size > 0 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

if (GoShort)

strategy.entry("SHORT", strategy.short)

strategy.exit(id="Exit Short", from_entry = "SHORT", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseShort = strat_val < 1 and strategy.position_size < 0 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")

- 모멘텀 가격 채널 오픈 및 종료 전략

- 시장 트렌드 가이드와 함께 향상된 이동 평균 크로스오버 전략

- 동적 촛불 빅 양 라인 거래 전략

- SSL 하이브리드 출구 화살표 양자 전략

- 이중 이동 평균 ADX 타이밍 전략

- BB 비율 지수 추세 감소 전략

- MACD 볼링거 거북이 거래 전략

- 트리플 슈퍼 트렌드 및 스톡 RSI 전략

- 1%의 수익 이동 평균 크로스 전략

- 가중화된 양적 이동평균 크로스오버 거래 전략

- 이중 이동 평균 크로스오버 트렌드 전략

- 반전 볼링거 밴드 전략

- 적응 가능한 ATR-ADX 트렌드 전략 V2

- 이중 요인 주기 거래 전략

- 평균 최상위 최상위 최하위 낮은 스윙어 전략

- 오스실레이션 돌파구 - 시장 구조 변화 전략

- 동력 지수 ETF 트렌드 전략

- 가격 반전을 기반으로 한 TTM Falcon 오시레이터 반전 전략

- 하이브리드 이동 평균 브레이크 토크 트레이딩 전략

- 이동평균 전략을 따르는 낮은 주파수 푸리에 변환 트렌드