SSL 하이브리드 출구 화살표 양자 전략

저자:차오장, 날짜: 2023-12-06 15:54:12태그:

전반적인 설명

SSL 하이브리드 출구 화살표 양자 전략 (SSL Hybrid Exit Arrow Quant Strategy) 은 이동 평균과 최대/최저 가격 지표에 기반한 단기적인 양적 거래 전략이다. 이 전략은 QQE 지표로 필터로 입력 및 출구 지점을 결정하기 위해 SSL 하이브리드 지표의 EXIT 화살표를 활용하고 ATR 지표로 스톱 로스 및 추가 포지션을 계산한다. 이 전략은 시장 변동성에 민감하고 엄격한 위험 통제를 가진 투자자에게 적합하다.

전략 논리

이 전략은 SSL 하이브리드 지표의 EXIT 화살표를 사용하여 엔트리 포인트를 결정합니다. EXIT 화살표 위에는 EXIT 고점이 있으며, 그 아래에 EXIT 저점이 있습니다. 폐쇄 가격이 EXIT 고점을 넘을 때 판매 신호가 생성되며, 종료 가격이 EXIT 저점을 넘을 때 구매 신호가 생성됩니다.

신호 신뢰성을 향상시키기 위해 QQE 지표는 보조 필터 조건으로 도입됩니다. EXIT 화살표로 생성된 신호는 QQE 지표가 같은 방향으로 있을 때만 실행됩니다.

이 전략은 위험을 제어하기 위해 스톱 로스 및 애드온 포지션을 계산하기 위해 ATR 배수를 사용합니다. 쇼트 포지션의 스톱 로스는 클로즈 가격 + ATR × 1.8입니다. 롱 포지션의 스톱 로스는 클로즈 가격

각 부가 포지션은 자체적인 스톱 로스를 가지고 있습니다. 포지션 크기의 20%를 가진 첫 번째 랩은 스톱 로스 수준에 도달하면 스톱 로스를 멈추게 되며 나머지 포지션은 계속 유지됩니다.

장점

- EXIT 화살표에서 수익을 창출하고 적시에 스톱 로스를 통해 위험을 효과적으로 제어합니다.

- QQE 필터는 신호 정확성을 향상시킵니다.

- 더 정확한 위험 통제를 위해 시장 변동성을 기반으로 동적 스톱 로스 및 추가 포지션을 계산하기 위해 ATR 지표를 사용

- 부가형 부가 포지션을 통해 트렌드를 최대한 활용합니다.

위험성

- 수익성 있는 포지션의 부분적 스톱 손실은 나머지 포지션을 추가 스톱 손실에 노출시킬 수 있습니다. 전체 수익 취득 또는 기본 기반 스톱 손실을 고려하십시오.

- 시장 변동성에 대한 감수성의 차이점 EXIT 화살표와 QQE 사이에는 충돌 신호가 발생할 수 있습니다. 신호 충돌을 줄이기 위해 매개 변수를 조정해야합니다.

- 과도하게 공격적인 부가 포지션은 상위와 덤핑 바닥을 추구하고 있습니다. 포지션 크기는 시장 조건에 맞아야합니다.

최적화 방향

- P/B 비율, P/E 비율, 배당 수익률과 같은 기본 지표들을 포함시켜 기본 지표에 기반한 수익률을 높여야 합니다.

- QQE 매개 변수를 EXIT 화살표와 신호를 맞추도록 조정합니다.

- 다양한 시장에서 시장 정서에 따라 부가율을 줄여야 합니다.

- 최대 사용량, 위험/이익 비율 등에 기초한 최적의 매개 변수 집합을 테스트합니다.

요약

이 전략은 SSL 하이브리드 지표의 EXIT 화살표를 신호의 핵심으로 사용하고 QQE 및 ATR 지표를 필터와 스톱 로지로 사용합니다. 수익 복합화는 팩트 된 추가 포지션을 통해 달성됩니다. 단기 시장 트렌드를 추적하는 데 적합한 단기 정량 전략입니다. 전략은 인수 감축 및 위험 완화 기능을 갖추고 있지만 신호 충돌 및 상위 / 바닥을 추격하는 것과 같은 위험을 주목해야합니다. 기본 기반의 수익을 취하고 오스실레이션 시장을 결정하고 추가 비율을 줄이면서 더 신중하게 할 때 이 전략의 수익 잠재력을 더욱 확장 할 수 있습니다.

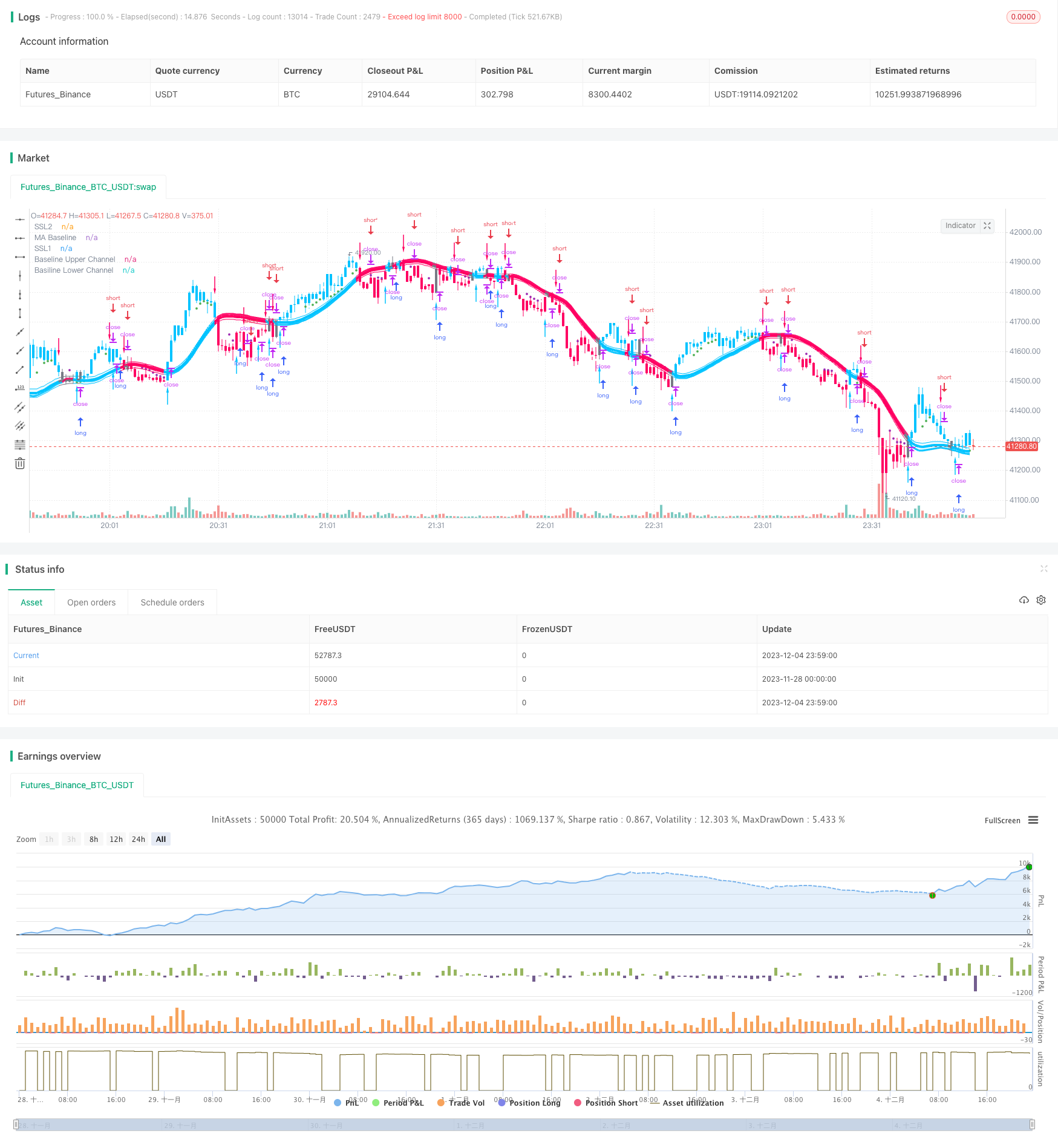

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-05 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

args: [["TradeAmount",2,358374]]

*/

//@version=4

// Strategy based on the SSL Hybrid indicator by Mihkel00

// Designed for the purpose of back testing

// Strategy:

// - Enters both long and short trades based on SSL1 crossing the baseline

// - Stop Loss calculated based on ATR multiplier

// - Take Profit calculated based on 2 ATR multipliers and exits percentage of position on TP1 and TP2

//

// Credits:

// SSL Hybrid Mihkel00 https://www.tradingview.com/u/Mihkel00/

// -------------------------------- SSL HYBRID ---------------------------------

strategy("SSL Exit Arrow Strategy", overlay=true)

show_Baseline = input(title="Show Baseline", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

show_SSL1 = input(title="Show SSL1", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

show_atr = input(title="Show ATR bands", type=input.bool, defval=false, group="SSL Hybrid Indicator Settings")

//ATR

atrlen = input(14, "ATR Period", group="SSL Hybrid Indicator Settings")

mult = input(1, "ATR Multi", step=0.1, group="SSL Hybrid Indicator Settings")

smoothing = input(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"], group="SSL Hybrid Indicator Settings")

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input(title="SSL1 / Baseline Type", type=input.string, defval="HMA", options=["SMA","EMA","DEMA","TEMA","LSMA","WMA","MF","VAMA","TMA","HMA", "JMA", "Kijun v2", "EDSMA","McGinley"], group="SSL Hybrid Indicator Settings")

len = input(title="SSL1 / Baseline Length", defval=60, group="SSL Hybrid Indicator Settings")

SSL2Type = input(title="SSL2 / Continuation Type", type=input.string, defval="JMA", options=["SMA","EMA","DEMA","TEMA","WMA","MF","VAMA","TMA","HMA", "JMA","McGinley"], group="SSL Hybrid Indicator Settings")

len2 = input(title="SSL 2 Length", defval=5, group="SSL Hybrid Indicator Settings")

//

SSL3Type = input(title="EXIT Type", type=input.string, defval="HMA", options=["DEMA","TEMA","LSMA","VAMA","TMA","HMA","JMA", "Kijun v2", "McGinley", "MF"], group="SSL Hybrid Indicator Settings")

len3 = input(title="EXIT Length", defval=15, group="SSL Hybrid Indicator Settings")

src = input(title="Source", type=input.source, defval=close, group="SSL Hybrid Indicator Settings")

//

tema(src, len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

(3 * ema1) - (3 * ema2) + ema3

kidiv = input(defval=1,maxval=4, title="Kijun MOD Divider", group="SSL Hybrid Indicator Settings")

jurik_phase = input(title="* Jurik (JMA) Only - Phase", type=input.integer, defval=3, group="SSL Hybrid Indicator Settings")

jurik_power = input(title="* Jurik (JMA) Only - Power", type=input.integer, defval=1, group="SSL Hybrid Indicator Settings")

volatility_lookback = input(10, title="* Volatility Adjusted (VAMA) Only - Volatility lookback length", group="SSL Hybrid Indicator Settings")

//MF

beta = input(0.8,minval=0,maxval=1,step=0.1, title="Modular Filter, General Filter Only - Beta", group="SSL Hybrid Indicator Settings")

feedback = input(false, title="Modular Filter Only - Feedback", group="SSL Hybrid Indicator Settings")

z = input(0.5,title="Modular Filter Only - Feedback Weighting",step=0.1, minval=0, maxval=1, group="SSL Hybrid Indicator Settings")

//EDSMA

ssfLength = input(title="EDSMA - Super Smoother Filter Length", type=input.integer, minval=1, defval=20, group="SSL Hybrid Indicator Settings")

ssfPoles = input(title="EDSMA - Super Smoother Filter Poles", type=input.integer, defval=2, options=[2, 3], group="SSL Hybrid Indicator Settings")

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = sqrt(2) * PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(arg)

c2 = b1

c3 = -pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

get3PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(1.738 * arg)

c1 = pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ma(type, src, len) =>

float result = 0

if type=="TMA"

result := sma(sma(src, ceil(len / 2)), floor(len / 2) + 1)

if type=="MF"

ts=0.,b=0.,c=0.,os=0.

//----

alpha = 2/(len+1)

a = feedback ? z*src + (1-z)*nz(ts[1],src) : src

//----

b := a > alpha*a+(1-alpha)*nz(b[1],a) ? a : alpha*a+(1-alpha)*nz(b[1],a)

c := a < alpha*a+(1-alpha)*nz(c[1],a) ? a : alpha*a+(1-alpha)*nz(c[1],a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta*b+(1-beta)*c

lower = beta*c+(1-beta)*b

ts := os*upper+(1-os)*lower

result := ts

if type=="LSMA"

result := linreg(src, len, 0)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid=ema(src,len)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

result := mid+avg(vol_up,vol_down)

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

if type=="Kijun v2"

kijun = avg(lowest(len), highest(len))//, (open + close)/2)

conversionLine = avg(lowest(len/kidiv), highest(len/kidiv))

delta = (kijun + conversionLine)/2

result :=delta

if type=="McGinley"

mg = 0.0

ema = ema(src, len)

mg := na(mg[1]) ? ema : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

if type=="EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2

? get2PoleSSF(avgZeros, ssfLength)

: get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = stdev(ssf, len)

scaledFilter = stdev != 0

? ssf / stdev

: 0

alpha = 5 * abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true, group="SSL Hybrid Indicator Settings")

multy = input(0.2, step=0.05, title="Base Channel Multiplier", group="SSL Hybrid Indicator Settings")

Keltma = ma(maType, src, len)

range = useTrueRange ? tr : high - low

rangema = ema(range, len)

upperk =Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open*1

close_pos = close*1

difference = abs(close_pos-open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

plotshape(candlesize_violation, color=color.new(color.white, transp=0), size=size.tiny,style=shape.diamond, location=location.top, title="Candle Size > 1xATR")

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = crossover(close, sslExit)

base_cross_Short = crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title="Color Bars", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.rgb(0, 195, 255, transp=0), colordown=color.rgb(255, 0, 98, transp=0),title="Exit Arrows", maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color.new(color_bar, transp=0), linewidth=4, title='MA Baseline')

DownPlot = plot( show_SSL1 ? sslDown : na, title="SSL1", linewidth=3, color=color.new(color_ssl1, transp=10))

barcolor(show_color_bar ? color_bar : na)

up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title="Baseline Upper Channel")

low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title="Basiline Lower Channel")

fill(up_channel, low_channel, color=color.new(color_bar, transp=90))

////SSL2 Continiuation from ATR

atr_crit = input(0.9, step=0.1, title="Continuation ATR Criteria", group="SSL Hybrid Indicator Settings")

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

LongPlot = plot(sslDown2, title="SSL2", linewidth=2, color=color.new(atr_fill, transp=0), style=plot.style_circles, display=display.none)

u = plot(show_atr ? upper_band : na, "+ATR", color=color.new(color.white, transp=80), display=display.none)

l = plot(show_atr ? lower_band : na, "-ATR", color=color.new(color.white, transp=80), display=display.none)

// ---------------------------- QQE MOD INDICATOR ------------------------------

RSI_Period = input(6, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(3, title='Fast QQE Factor')

ThreshHold = input(3, title="Thresh-hold")

rsi_src = input(close, title="RSI Source")

Wilders_Period = RSI_Period * 2 - 1

Rsi = rsi(rsi_src, RSI_Period)

RsiMa = ema(Rsi, SF)

AtrRsi = abs(RsiMa[1] - RsiMa)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

dar = ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ?

max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ?

min(shortband[1], newshortband) : newshortband

cross_1 = cross(longband[1], RSIndex)

trend := cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

////////////////////

length = input(50, minval=1, title="Bollinger Length")

bb_mult = input(0.35, minval=0.001, maxval=5, step=0.1, title="BB Multiplier")

basis = sma(FastAtrRsiTL - 50, length)

dev = bb_mult * stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

rsi_ma_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

////////////////////////////////////////////////////////////////

RSI_Period2 = input(6, title='RSI Length')

SF2 = input(5, title='RSI Smoothing')

QQE2 = input(1.61, title='Fast QQE2 Factor')

ThreshHold2 = input(3, title="Thresh-hold")

src2 = input(close, title="RSI Source")

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = rsi(src2, RSI_Period2)

RsiMa2 = ema(Rsi2, SF2)

AtrRsi2 = abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ema(AtrRsi2, Wilders_Period2)

dar2 = ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ?

max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ?

min(shortband2[1], newshortband2) : newshortband2

cross_2 = cross(longband2[1], RSIndex2)

trend2 := cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver :

RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

qqe_line = FastAtrRsi2TL - 50

qqe_blue_bar = Greenbar1 and Greenbar2 == 1

qqe_red_bar = Redbar1 and Redbar2 == 1

// ----------------------------------STRATEGY ----------------------------------

atr_length = input(title="ATR Length", type=input.integer, defval=14, inline="1", group="Strategy Back Test Settings")

atr = atr(atr_length)

// Back test time range

from_date = input(title="From", type=input.time, defval=timestamp("01 Aug 2021 00:00 +0100"), inline="1", group="Date Range")

to_date = input(title="To", type=input.time, defval=timestamp("01 Sep 2021 00:00 +0100"), inline="1", group="Date Range")

in_date = true

// Strategy entry and exit settings

// Should use SSL as a filter for position side

use_ssl_filter = input(title="SSL Flip as Filter", type=input.bool, defval=false, inline="1", group="Entry Settings")

// Should use SSL as a filter for position side

use_qqe_filter = input(title="QQE MOD as Filter (Please add QQE MOD indicator to your chart separately)", type=input.bool, defval=false, inline="2", group="Entry Settings")

// DCA Settings

dca1_atr_multiplier = input(title="DCA1 ATR Multiplier", type=input.float, defval=0.1, step=0.1, inline="3", group="Entry Settings")

dca1_exit_percentage = input(title="DCA1 Exit Percentage", type=input.integer, defval=20, step=1, maxval=100, inline="3", group="Entry Settings")

dca2_atr_multiplier = input(title="DCA2 ATR Multiplier", type=input.float, defval=0.3, step=0.1, inline="4", group="Entry Settings")

dca2_exit_percentage = input(title="DCA2 Exit Percentage", type=input.integer, defval=40, step=1, maxval=100, inline="4", group="Entry Settings")

dca3_atr_multiplier = input(title="DCA3 ATR Multiplier", type=input.float, defval=0.7, step=0.1, inline="5", group="Entry Settings")

dca3_exit_percentage = input(title="DCA3 Exit Percentage", type=input.integer, defval=40, step=1, maxval=100, inline="5", group="Entry Settings")

// Stop-Loss Settings

sl_atr_multiplier = input(title="SL ATR Multiplier", type=input.float, defval=1.8, step=0.1, inline="2", group="Exit Settings")

var long_sl = float(na)

var long_dca1 = float(na)

var long_dca2 = float(na)

var long_dca3 = float(na)

var short_sl = float(na)

var short_dca1 = float(na)

var short_dca2 = float(na)

var short_dca3 = float(na)

is_open_long = strategy.position_size > 0

is_open_short = strategy.position_size < 0

var in_ssl_long = false

var in_ssl_short = false

var ssl_long_entry = false

var ssl_short_entry = false

var ssl_long_exit = false

var ssl_short_exit = false

var did_prev_bar_ssl_flip = false

ssl_long = use_ssl_filter ? close > sslDown : true

ssl_short = use_ssl_filter ? close < sslDown : true

qqe_long = use_qqe_filter ? (qqe_blue_bar and qqe_line > 0) : true

qqe_short = use_qqe_filter ? (qqe_red_bar and qqe_line < 0) : true

ssl_long_entry := ssl_long and qqe_long and codiff == 1

ssl_short_entry := ssl_short and qqe_short and codiff == -1

ssl_long_exit := codiff == -1

ssl_short_exit := codiff == 1

remaining_percent = 100

var total_tokens = strategy.equity * 0.10 / close

dca1_percent = dca1_exit_percentage <= remaining_percent ? dca1_exit_percentage : remaining_percent

remaining_percent -= dca1_percent

entry_1 = total_tokens * (dca1_percent / 100)

dca2_percent = dca2_exit_percentage <= remaining_percent ? dca2_exit_percentage : remaining_percent

remaining_percent -= dca2_percent

entry_2 = total_tokens * (dca2_percent / 100)

dca3_percent = dca3_exit_percentage <= remaining_percent ? dca3_exit_percentage : remaining_percent

remaining_percent -= dca3_percent

entry_3 = total_tokens * (dca3_percent / 100)

if did_prev_bar_ssl_flip

did_prev_bar_ssl_flip := false

position_value = abs(strategy.position_size * close)

if in_ssl_long

label.new(x=bar_index, y=close, xloc=xloc.bar_index, yloc=yloc.abovebar, text=tostring(position_value), style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=close, xloc=xloc.bar_index, yloc=yloc.belowbar, text=tostring(position_value), style=label.style_label_up, size=size.tiny)

if ssl_long_exit

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.close(id="LongEntry1", comment="Close Long1")

strategy.close(id="LongEntry2", comment="Close Long2")

strategy.close(id="LongEntry3", comment="Close Long3")

in_ssl_long := false

in_ssl_short := false

if ssl_short_exit

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

strategy.close(id="ShortEntry1", comment="Close Short1")

strategy.close(id="ShortEntry2", comment="Close Short2")

strategy.close(id="ShortEntry3", comment="Close Short3")

in_ssl_long := false

in_ssl_short := false

if ssl_long_entry and in_date and not in_ssl_long

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

if in_ssl_short

strategy.close(id="ShortEntry1", comment="Close Short1")

strategy.close(id="ShortEntry2", comment="Close Short2")

strategy.close(id="ShortEntry3", comment="Close Short3")

in_ssl_long := true

in_ssl_short := false

did_prev_bar_ssl_flip := true

long_sl := close - (atr * sl_atr_multiplier)

long_dca1 := close - (atr * dca1_atr_multiplier)

long_dca2 := close - (atr * dca2_atr_multiplier)

long_dca3 := close - (atr * dca3_atr_multiplier)

strategy.entry("LongEntry1", strategy.long, limit=long_dca1)

strategy.entry("LongEntry2", strategy.long, limit=long_dca2)

strategy.entry("LongEntry3", strategy.long, limit=long_dca3)

strategy.exit("LongExit1", "LongEntry1", stop=long_sl)

strategy.exit("LongExit2", "LongEntry2", stop=long_sl)

strategy.exit("LongExit3", "LongEntry3", stop=long_sl)

if ssl_short_entry and in_date and not in_ssl_short

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

if in_ssl_long

strategy.close(id="LongEntry1", comment="Close Long1")

strategy.close(id="LongEntry2", comment="Close Long2")

strategy.close(id="LongEntry3", comment="Close Long3")

in_ssl_short := true

in_ssl_long := false

did_prev_bar_ssl_flip := true

short_sl := close + (atr * sl_atr_multiplier)

short_dca1 := close + (atr * dca1_atr_multiplier)

short_dca2 := close + (atr * dca2_atr_multiplier)

short_dca3 := close + (atr * dca3_atr_multiplier)

strategy.entry("ShortEntry1", strategy.short, limit=short_dca1)

strategy.entry("ShortEntry2", strategy.short, limit=short_dca2)

strategy.entry("ShortEntry3", strategy.short, limit=short_dca3)

strategy.exit("ShortExit1", "ShortEntry1", stop=short_sl)

strategy.exit("ShortExit2", "ShortEntry2", stop=short_sl)

strategy.exit("ShortExit3", "ShortEntry3", stop=short_sl)

- EMA와 함께하는 전략에 따른 경향

- 이중 반전 비율 변화 바 양적 전략

- MA 트렌드 필터와 함께 볼링거 밴드 역전

- RSI 기반의 양적 거래 전략

- 다중 이동 평균 크로스오버 거래 전략

- 이동 평균 크로스오버 전략

- 자동차 S/R 브레이크업 전략

- 모멘텀 가격 채널 오픈 및 종료 전략

- 시장 트렌드 가이드와 함께 향상된 이동 평균 크로스오버 전략

- 동적 촛불 빅 양 라인 거래 전략

- 이중 이동 평균 ADX 타이밍 전략

- BB 비율 지수 추세 감소 전략

- MACD 볼링거 거북이 거래 전략

- 트리플 슈퍼 트렌드 및 스톡 RSI 전략

- 1%의 수익 이동 평균 크로스 전략

- 가중화된 양적 이동평균 크로스오버 거래 전략

- 여러 보조 RSI 지표 전략

- 이중 이동 평균 크로스오버 트렌드 전략

- 반전 볼링거 밴드 전략

- 적응 가능한 ATR-ADX 트렌드 전략 V2