개요

이 전략은 평평한 이동 평균을 사용하여 평평한 가격대를 구성하고, 여러 가지 평평한 이동 평균을 통합하여 실시간으로 추세를 필터링하는 기능을 구현합니다.

전략 원칙

- 평평한 가격대를 구축하여 평평한 이동 평균을 사용하여 가격 변화를 추적하여 가격 변화에 대한 평평한 추적을 구현합니다.

- 정책은 EMA, SMMA, KAMA 등과 같은 다양한 종류의 이동 평균을 입력하여 평평한 이동 평균의 계산 유형으로 지원합니다.

- 이러한 이동 평균을 1-5번의 중첩 평준화를 지원하여 더 평평한 가격대를 얻습니다.

- 가격의 변화를 더 잘 포착하기 위해 가격과 이동 평균 사이의 브린 띠를 사용하는 것을 지원합니다.

- 추가된 이동 평균 필터를 활성화하여, 흔들림을 더 잘 필터링하여 트렌드 방향을 식별할 수 있습니다. 필터는 또한 여러 가지 이동 평균 유형을 지원합니다.

- 형태 인식 지표와 결합하여 구매/판매 신호를 자동으로 인식할 수 있다.

이 전략은 평평한 가격대를 구축하여 가격 트렌드를 포착하고, 이동 평균 필터를 통합하여 트렌드 방향을 확인하는 전형적인 트렌드 추적 전략에 속한다. 파라미터를 조정함으로써 다양한 품종의 다른 주기적인 시장 환경에 유연하게 적응할 수 있다.

전략적 이점

- 가격대를 구성하면 가격 변화의 흐름을 더 부드럽게 추적할 수 있고, 놓친 기회를 효과적으로 줄일 수 있다.

- 여러 가지 이동 평균 유형을 지원하여 다양한 주기 및 품종에 따라 적절한 이동 평균을 선택할 수 있으며, 전략의 적응성을 향상시킵니다.

- 1~5배의 평평한 중첩은 가격 변화를 추적하는 능력을 크게 향상시키고 트렌드 전환점을 더 정확하게 잡을 수 있습니다.

- 이동 평균 필터는 유효하지 않은 신호를 효과적으로 줄이고 승률을 높일 수 있다.

- 이동 평균의 길이를 조정하여 다른 시간 주기에 적응할 수 있으며, 심지어 여러 시간 프레임으로 검증할 수 있어 전략의 효과를 더욱 향상시킬 수 있다.

- 검정색 유리 디스플레이를 지원하여 가격대를 명확하고 직관적으로 관찰할 수 있습니다.

전략적 위험

- 장기적인 경향을 추적하는 것이 강하지만, 단기적인 변동에 대한 추적과 반응은 열악하며, 충격적인 상황에서는 더 많은 무효 신호를 생성하기 쉽다.

- 급격한 가격 변동과 급격한 가격 변동 속에서, 평평한 이동 평균은 약간의 지연성을 가질 수 있으며, 가장 좋은 진입 시기를 놓칠 수 있다.

- 다중 중첩된 이동 평균은 가격 변화를 너무 부드럽게 만들 수 있으며, 이는 구매자 및 판매자 지점을 식별하지 못하게합니다.

- 만약 활성화된 이동 평균 길이 변수가 잘못 설정되면, 많은 가짜 신호가 생성될 수 있다.

해결책:

- 이동 평균의 길이를 적절히 줄여서 가격 변화에 대한 반응을 가속화하십시오.

- 겹치는 횟수를 조정하여 지나치게 부드러운 것을 줄일 수 있습니다.

- 최적화 및 테스트 이동 평균 조합, 최적의 파라미터를 선택하십시오.

- 다른 지표와 결합하여 여러 시간 프레임 검증을 통해 가짜 신호 비율을 줄일 수 있습니다.

전략 최적화 방향

- 이동 평균 타입의 조합을 테스트하여 최적의 파라미터를 선택하십시오.

- 테스트는 이동 평균 길이 변수를 최적화하여 보다 넓은 품종과 시간 주기에도 적용한다.

- 다른 평준화 과정을 시도해 가장 좋은 평형점을 찾아보세요.

- 브린 밴드를 추가해 보시면 됩니다.

- 다른 이동 평균을 필터로 테스트하십시오.

- 다른 지표와 함께 다중 시간 프레임 검증을 수행하십시오.

요약하다

이 전략은 전형적인 트렌드 추적 전략에 속하며, 평평한 이동 평균대를 구성하여 가격 트렌드를 지속적으로 추적하고, 보조 필터와 결합하여 무효 신호를 피한다. 전략의 장점은 평평한 가격대를 구성하여 가격 트렌드의 전환을 더 잘 포착 할 수 있다는 것이다. 동시에 약간의 후퇴 위험도 존재한다. 매개 변수 최적화 및 지표 최적화를 통해 전략 효과를 지속적으로 향상시킬 수 있으며, 추가 연구를 할 가치가 있다.

전략 소스 코드

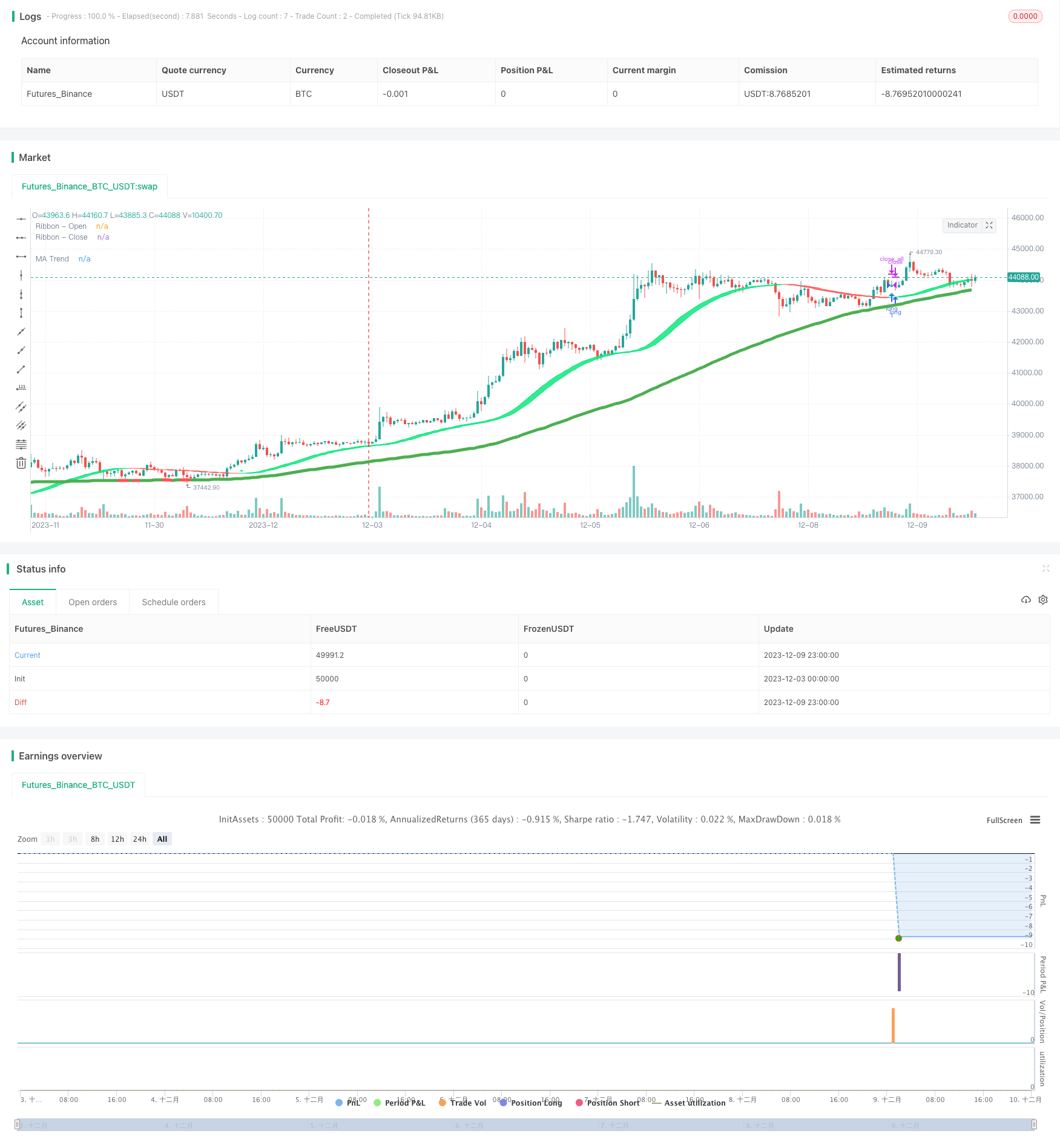

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Copyright (c) 2007-present Jurik Research and Consulting. All rights reserved.

// Copyright (c) 2018-present, Alex Orekhov (everget)

// Thanks to everget for code for more advanced moving averages

// Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy script may be freely distributed under the MIT license.

strategy( title="Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy", overlay=true )

// ---- CONSTANTS ----

lsmaOffset = 1

almaOffset = 0.85

almaSigma = 6

phase = 2

power = 2

// ---- GLOBAL FUNCTIONS ----

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

// The general form of the weights of the (2m + 1)-term Henderson Weighted Moving Average

getWeight(m, j) =>

numerator = 315 * (pow(m + 1, 2) - pow(j, 2)) * (pow(m + 2, 2) - pow(j, 2)) * (pow(m + 3, 2) - pow(j, 2)) * (3 * pow(m + 2, 2) - 11 * pow(j, 2) - 16)

denominator = 8 * (m + 2) * (pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 9) * (4 * pow(m + 2, 2) - 25)

denominator != 0

? numerator / denominator

: 0

hwma(src, termsNumber) =>

sum = 0.0

weightSum = 0.0

termMult = (termsNumber - 1) / 2

for i = 0 to termsNumber - 1

weight = getWeight(termMult, i - termMult)

sum := sum + nz(src[i]) * weight

weightSum := weightSum + weight

sum / weightSum

get_jurik(length, phase, power, src)=>

phaseRatio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (length - 1) / (0.45 * (length - 1) + 2)

alpha = pow(beta, power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

variant(src, type, len ) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = vwma(src, len) // Volume Weighted

v7 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v9 = linreg(src, len, lsmaOffset) // Least Squares

v10 = alma(src, len, almaOffset, almaSigma) // Arnaud Legoux

v11 = kama(src, len) // KAMA

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v13 = t3(src, len) // T3

v14 = ema1+(ema1-ema2) // Zero Lag Exponential

v15 = hwma(src, len) // Henderson Moving average thanks to @everget

ahma = 0.0

ahma := nz(ahma[1]) + (src - (nz(ahma[1]) + nz(ahma[len])) / 2) / len //Ahrens Moving Average

v16 = ahma

v17 = get_jurik( len, phase, power, src)

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="VWMA"?v6 :

type=="SMMA"?v7 : type=="Hull"?v8 : type=="LSMA"?v9 : type=="ALMA"?v10 : type=="KAMA"?v11 :

type=="T3"?v13 : type=="ZEMA"?v14 : type=="HWMA"?v15 : type=="AHMA"?v16 : type=="JURIK"?v17 : v1

smoothMA(o, h, l, c, maLoop, type, len) =>

ma_o = 0.0

ma_h = 0.0

ma_l = 0.0

ma_c = 0.0

if maLoop == 1

ma_o := variant(o, type, len)

ma_h := variant(h, type, len)

ma_l := variant(l, type, len)

ma_c := variant(c, type, len)

if maLoop == 2

ma_o := variant(variant(o ,type, len),type, len)

ma_h := variant(variant(h ,type, len),type, len)

ma_l := variant(variant(l ,type, len),type, len)

ma_c := variant(variant(c ,type, len),type, len)

if maLoop == 3

ma_o := variant(variant(variant(o ,type, len),type, len),type, len)

ma_h := variant(variant(variant(h ,type, len),type, len),type, len)

ma_l := variant(variant(variant(l ,type, len),type, len),type, len)

ma_c := variant(variant(variant(c ,type, len),type, len),type, len)

if maLoop == 4

ma_o := variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len)

if maLoop == 5

ma_o := variant(variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len),type, len)

[ma_o, ma_h, ma_l, ma_c]

smoothHA( o, h, l, c ) =>

hao = 0.0

hac = ( o + h + l + c ) / 4

hao := na(hao[1])?(o + c / 2 ):(hao[1] + hac[1])/2

hah = max(h, max(hao, hac))

hal = min(l, min(hao, hac))

[hao, hah, hal, hac]

// ---- Main Ribbon ----

haSmooth = input(true, title=" Use HA as source ? " )

length = input(11, title=" MA1 Length", minval=1, maxval=1000)

maLoop = input(3, title=" Nr. of MA1 Smoothings ", minval=1, maxval=5)

type = input("EMA", title="MA Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

haSmooth2 = input(true, title=" Use HA as source ? " )

// ---- Trend ----

ma_use = input(true, title=" ----- Use MA Filter ( For Lower Timeframe Swings / Scalps ) ? ----- " )

ma_source = input(defval = close, title = "MA - Source", type = input.source)

ma_length = input(100,title="MA - Length", minval=1 )

ma_type = input("SMA", title="MA - Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

ma_useHA = input(defval = false, title = "Use HA Candles as Source ?")

ma_rsl = input(true, title = "Use Rising / Falling Logic ?" )

// ---- BODY SCRIPT ----

[ ha_open, ha_high, ha_low, ha_close ] = smoothHA(open, high, low, close)

_open_ma = haSmooth ? ha_open : open

_high_ma = haSmooth ? ha_high : high

_low_ma = haSmooth ? ha_low : low

_close_ma = haSmooth ? ha_close : close

[ _open, _high, _low, _close ] = smoothMA( _open_ma, _high_ma, _low_ma, _close_ma, maLoop, type, length)

[ ha_open2, ha_high2, ha_low2, ha_close2 ] = smoothHA(_open, _high, _low, _close)

_open_ma2 = haSmooth2 ? ha_open2 : _open

_high_ma2 = haSmooth2 ? ha_high2 : _high

_low_ma2 = haSmooth2 ? ha_low2 : _low

_close_ma2 = haSmooth2 ? ha_close2 : _close

ribbonColor = _close_ma2 > _open_ma2 ? color.lime : color.red

p_open = plot(_open_ma2, title="Ribbon - Open", color=ribbonColor, transp=70)

p_close = plot(_close_ma2, title="Ribbon - Close", color=ribbonColor, transp=70)

fill(p_open, p_close, color = ribbonColor, transp = 40 )

// ----- FILTER

ma = 0.0

if ma_use == true

ma := variant( ma_useHA ? ha_close : ma_source, ma_type, ma_length )

maFilterShort = ma_use ? ma_rsl ? falling(ma,1) : ma_useHA ? ha_close : close < ma : true

maFilterLong = ma_use ? ma_rsl ? rising(ma,1) : ma_useHA ? ha_close : close > ma : true

colorTrend = rising(ma,1) ? color.green : color.red

plot( ma_use ? ma : na, title="MA Trend", color=colorTrend, transp=80, transp=70, linewidth = 5)

long = crossover(_close_ma2, _open_ma2 ) and maFilterLong

short = crossunder(_close_ma2, _open_ma2 ) and maFilterShort

closeAll = cross(_close_ma2, _open_ma2 )

plotshape( short , title="Short", color=color.red, transp=80, style=shape.triangledown, location=location.abovebar, size=size.small)

plotshape( long , title="Long", color=color.lime, transp=80, style=shape.triangleup, location=location.belowbar, size=size.small)

//* Backtesting Period Selector | Component *//

//* Source: https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod() and long

strategy.entry( "long", strategy.long )

if testPeriod() and short

strategy.entry( "short", strategy.short )

if closeAll

strategy.close_all( when = closeAll )