개요

이 전략은 동적 거래자 지수 (TDI) 지표와 가격 행동 채널 (PAC) 지표에 기반하며, 부린 밴드 채널, 상대적으로 강한 지수 (RSI) 및 MACD 지표와 결합하여 트렌드 추적 시스템을 구현한다.

이 전략은 주로 트렌드를 발견하고 트렌드 방향에 중대한 변화가 있을 때 거래 신호를 생성합니다. 이 전략은 신호의 재생률과 신호 품질을 향상시키기 위해 여러 지표를 결합합니다.

전략 원칙

이 전략의 핵심은 TDI 지표이다. TDI는 여러 개의 하위 지표로 구성되어 있으며, 주로 다음을 포함한다:

- 상대적으로 강한 지수 (RSI): 반응 가격의 강도

- 부린 벨트 통로: 반응 가격 변동 범위

- RSI 가격 선: RSI의 간단한 이동 평균, RSI의 가격 추세에 반응

- RSI 트레이드 신호 라인: RSI의 또 다른 간단한 이동 평균, 트레이드 신호를 생성하기 위한

RSI 가격 라인과 RSI 거래 신호 라인이 황금 을 가로질러 나타나면 구매 신호로; 두 라인이 황금 사망 을 가로질러 나타나면 판매 신호로. 거래 신호 라인이 중선을 가로질러 나타나면 약한 신호를 생성합니다.

또한, 전략은 가격 동작 채널 지표를 결합한다. 이 지표는 시간 주기 내의 최고 가격, 최저 가격을 기반으로 가격 채널을 산출한다. 가격이 채널 상단 또는 하단으로 접근 할 때, 반전 기회가있을 수 있음을 나타냅니다.

잘못된 보고를 필터링하기 위해, 전략은 MACD 지표도 도입했다. MACD 기둥 색이 거래 신호 방향과 일치하는 경우에만 입문 신호를 유발한다.

전략적 이점

이 전략은 단일 지표에 비해 여러 지표의 장점을 통합합니다.

- TDI 지표는 트렌드 변화에 민감합니다.

- 가격 동작 경로는 지지와 압박을 명확하게 나타냅니다.

- MACD는 잘못된 보고를 효과적으로 필터링할 수 있습니다.

또한, 이동 평균과 같은 트렌드 추적 지표에 비해, TDI는 트렌드 반전에 더 민감하며, 불필요한 손실을 줄일 수 있다.

이 전략은 또한 다양한 시장 환경에 적응하기 위해 변수를 조정할 수 있습니다.

전략적 위험

- 다중 지표 중첩, 변수 조정 복잡

- 거래 빈도가 너무 높아서 거래 비용과 점유율 위험이 증가할 수 있습니다.

- 반전 인식은 100% 정확하지 않으며, 한 방향으로 계속되는 가격을 놓칠 수 있습니다.

- 실물 거래의 가격 변동은 재측정보다 훨씬 복잡하고 신호 효과는 복제하기 어렵습니다.

단위 손실을 줄이기 위해 스톱 레저를 확장할 수 있다. 최적화 변수 조합은 신호 품질을 향상시킵니다. 적절한 입시 조건의 완화는 거래 빈도를 감소시킵니다.

최적화 방향

- TDI의 각 변수를 조정하여 최적의 조합을 찾습니다.

- 가격 행동 통로의 길이를 조정하고 지원 저항을 최적화합니다.

- MACD 변수를 조정하여 입시 필터 효과를 최적화합니다.

- 포지션 관리 및 이동 중지 전략을 추가

요약하다

이 전략은 종합적으로 여러 지표를 사용하여 추세와 역전 기회를 판단한다. 다양한 품종에 적응하기 위해 파라미터를 조정할 수 있다. 약간의 실전 가치가 있지만, 신호 효과는 완벽에 가깝지만 여전히 약간의 어려움이 있다. 복잡한 다변화 실盘에서 신중하게 사용하도록 권장한다.

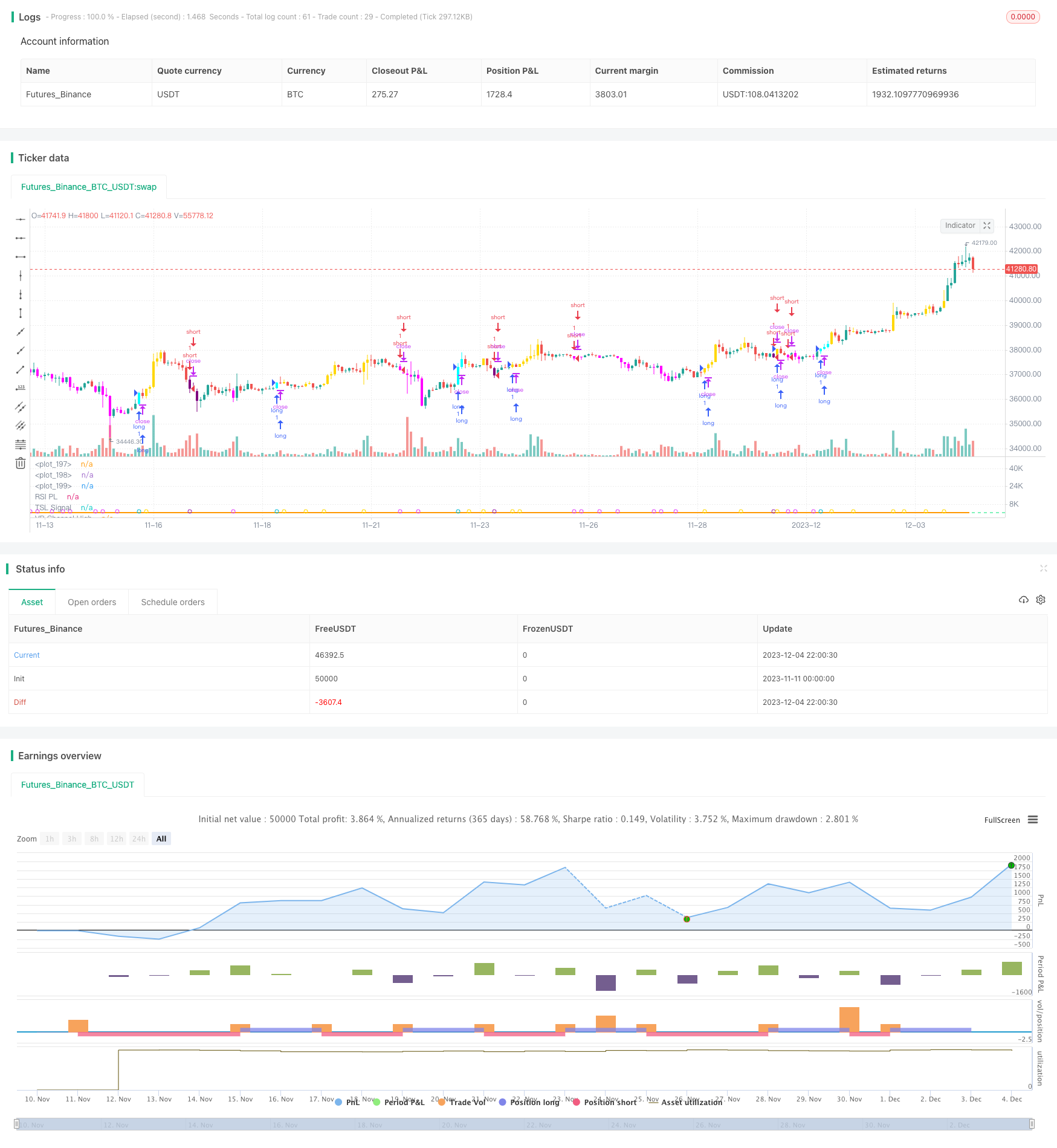

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

strategy("[BACKTEST]Traders Dynamic Index Indicator Alert by JustUncleL", shorttitle="[BACKTEST]TDIALT")

//

// author: JustUncleL

// date: 10-Oct-2019

//

// Description:

// This script is a "strategy" version of the "Traders Dynamic Index Indicator Alert v0.1 by JustUncleL"

// made available for backtesting to help optimize settings.

//

// This is a Trend following system utilising the Traders Dynamic Index (TDI),

// Price Action Channel (PAC) and Heikin Ashi candles.

// About while ago I came across the use of TDI in "E.A.S.Y. Method" that I found in

// forexfactory forums: http://www.forexfactory.com/attachment.php?attachmentid=686629&d=1303831008

// and I was able to set up a chart based on the specifications by using Kurbelklaus scripts.

// However, I found that the alerts were being generated one or two bars too late,

// so I was not successful using it with Binary Options. Later I found a variation of the

// method in the forums which generates alerts a bit earlier, so this indicator is a

// variation of that early detection version.

// The indicator can optionally use Heikin Ashi candles only for all it's calculations,

// I would recommend viewing the chart with normal Heikin Ashi candles, these

// smooth out the trends and makes them more visible.

//

// I found that this metod it works OK with currency pairs or commodities.

// It also seems to work well with 5min+ timeframe charts,

// and for Binary Options I would suggest expiry of 2 to 6 candles.

//

// ALERT GENERATION:

// =================

//

// The TDI (Traders Dynamic Index)

// -------------------------------

// Volatility Band VB(34), color: Blue, buffer: UpZone, DnZone

// Relative Strength Index RSI(13)

// RSI PRICE LINE (2), color: Green, buffer: mab

// RSI TRADE SIGNAL LINE (7), color: Red, buffer: mbb

// MARKET BASE LINE MID VB(34), color: Orange, buffer: mid

//

// Indicator SignalLevels:

// -----------------------

// RSI_OversoldLevel : 22 (normally: 32)

// RSI_OverboughtLevel : 78 (normally: 68)

//

// Alert Conditions:

// -----------------

// Strong Buy (yellow): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel &&

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE> MARKET BASE LINE

// Medium Buy (aqua): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && RSI> MARKET BASE LINE && TRADE SIGNAL LINE< MARKET BASE LINE

// Weak Buy (blue): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE<MARKET BASE LINE && RSI< MARKET BASE LINE

//

// Strong Sell (fuchsia): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE< MARKET BASE LINE

// Medium Sell (purple): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && RSI< MARKET BASE LINE && TRADE SIGNAL LINE> MARKET BASE LINE

// Weak Sell (black): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE> MARKET BASE LINE && RSI> MARKET BASE LINE

//

// HIGH LEVEL FILTER (Overbought): RSI>=RSI_OverboughtLevel or MACD Histogram not green

// LOW LEVEL FILTER (Oversold): RSI<=RSI_OversoldLevel or MACD Histogram not red

//

// Hints on How to use:

// --------------------

// - When a Medium or Strong alert is generated and MACD histogram colour matches the direction

// of the alert, then place trade in direction of alert candle and MACD.

// - Use the multi-Hull MA's for trend direction confirmation.

// - Best positions occur near the MACD(8,16,1) Histogram crossing the zero line.

// - The optional coloured Dots along the bottom of the indicator represent the first alert

// of this type that was generated in this sequence.

// - It is advisable to trade in the direction of the main trend as indicated the HULL MA red cloud:

// if red cloud underneath PAC then BULLISH trend, if red cloud above PAC then BEARISH trend.

// - Selecting the HeiKin Ashi candles does affect the MACD and MA caculations, so if you select

// normal candles the result chart will change. Although the TDI calculations and alerts will stay the

// same.

// - When using the Heikin Ashi candles, a good buy entry is indicated by long top wick and no bottom wick

// for bull (green) candles and good sell entry is indicated by long bottom wick and no top wick for

// bear (red) candles.

// - When the MACD histogram is flat and close to zero line,

// this indicates a ranging market, do NOT trade when this occurs.

// - When the PAC channel on the main chart is spread apart widely, this is an indication

// of extreme volitity and choppy chart, do NOT try to trade during these periods.

// A choppy chart is also indicated by Heikin Ashi candles with long wicks on both sides

// of the candles.

// - You can specify what strength level Alerts are generated (default 2):

// Level (1) means only generate Strong Alerts only.

// Level (2) means generate Strong and Medium Alerts.

// Level (3) means generate Strong, Medium and Weak Alerts.

//

// Modifications:

// --------------

// 11-Oct-2019

// - Strategy Version for backtesting created.

// - Converted to Pinescript V4

//

// 1.3 7-Aug-2017

// - Modified Alertcondition code so that it only signals on the last completed alerted

// candle. This should prevent some false alerts and multiple alerts being generated.

// When setting alarms I suggest using Frequency "Once per bar (on condition)" to get

// the earliest signal possible.

// - Added optional alert long/short spikes that only occur on the first Long or Short// Original code @author LazyBear for basic TDI indicator.

// signals.

// 1.2 5-Aug-2017:

// - Added new alerts for Buy and Sell (Long and Short) signals seperately.

// - Upgraded to version 3 Pinescript.

// - Added work around patch for opaque bar colouring issue.

//

// 1.1 - Modified code so when viewing Top chart with Heikin Ashi candles, calculations

// are still based on standard candles, unless Heikin Ashi calculation option selected.

//

// 0.2 - Simplified MACD direction calculation to use just rising/falling.

// 0.1 - Oroginal Version

// References:

// -----------

// Traders Dynamic Index [LazyBear]

// KK_Traders Dynamic Index_Bar Highlighting by Kurbelklaus

// KK_Price Action Channel (TDI BH) by Kurbelklaus

// http://www.forexfactory.com/attachment.php?attachmentid=686629&d=1303831008

// http://www.forexstrategiesresources.com/trading-system-metatrader-4-iv/504-traders-dynamic-index-how-to-use/

// http://www.forexfactory.com/showthread.php?t=460148

// http://www.forexstrategiesresources.com/scalping-forex-strategies-ii/205-scalping-with-tdi-real-macd-stochrainbow/

//

// -----------------------------------------------------------------------------

// Copyright 2016, 2017, 2019 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

lengthrsi = input(13)

lengthband = input(34)

lengthrsipl = input(2)

lengthtradesl = input(7)

lenH = input(5, minval=1, title="Price Action Channel Length")

lenL = lenH

rsiOSL = input(22, minval=0, maxval=49, title="RSI Oversold Level")

rsiOBL = input(78, minval=51, maxval=100, title="RSI Overbought Level")

strength = input(2, minval=1, maxval=3, step=1, title="Strength Level: (1)Strong (2)Medium (3)All")

sgb = input(false, title="Check Box To Turn Bars Gray")

sbr = input(true, title="Highlight TDI Alert Bars")

sal = input(true, title="Show Alert Condition Status")

uha = input(false, title="Use Heikin Ashi Candles for Calculations")

//

// Constants colours that include fully non-transparent option.

blue100 = #0000FFFF

aqua100 = #00FFFFFF

fuchsia100 = #FF00FFFF

purple100 = #800080FF

gray100 = #808080FF

gold100 = #FFD700FF

white100 = #FFFFFFFF

black100 = #000000FF

gold = #FFD700

// Use only Heikinashi Candles for all calculations or use Standard Candles for calculations.

security_1 = security(heikinashi(syminfo.tickerid), timeframe.period, close)

security_2 = security(syminfo.ticker, timeframe.period, close)

srcClose = uha ? security_1 : security_2

security_3 = security(heikinashi(syminfo.tickerid), timeframe.period, open)

security_4 = security(syminfo.ticker, timeframe.period, open)

srcOpen = uha ? security_3 : security_4

security_5 = security(heikinashi(syminfo.tickerid), timeframe.period, high)

security_6 = security(syminfo.ticker, timeframe.period, high)

srcHigh = uha ? security_5 : security_6

security_7 = security(heikinashi(syminfo.tickerid), timeframe.period, low)

security_8 = security(syminfo.ticker, timeframe.period, low)

srcLow = uha ? security_7 : security_8

//

r = rsi(srcClose, lengthrsi)

ma = sma(r, lengthband)

offs = 1.6185 * stdev(r, lengthband)

upZone = ma + offs

dnZone = ma - offs

mid = (upZone + dnZone) / 2

mab = sma(r, lengthrsipl)

mbb = sma(r, lengthtradesl)

//

hline(rsiOSL, color=color.red, linewidth=1)

hline(50, color=color.black, linewidth=1)

hline(rsiOBL, color=color.lime, linewidth=1)

// Plot the TDI

upl = plot(upZone, color=color.blue, title="VB Channel High", linewidth=2)

dnl = plot(dnZone, color=color.blue, title="VB Channel Low", linewidth=2)

midl = plot(mid, color=color.orange, linewidth=2, title="MBL")

mabl = plot(mab, color=color.green, linewidth=2, title="RSI PL")

mbbl = plot(mbb, color=color.red, linewidth=2, title="TSL Signal")

//

//create RSI TSL cloud to indicate trend direction.

fill(mabl, mbbl, color=mab > mbb ? color.green : color.red, transp=90)

// Calculate Price Action Channel (PAC)

smmaH = 0.0

smmaL = 0.0

sma_1 = sma(srcHigh, lenH)

smmaH := na(smmaH[1]) ? sma_1 : (smmaH[1] * (lenH - 1) + srcHigh) / lenH

sma_2 = sma(srcLow, lenL)

smmaL := na(smmaL[1]) ? sma_2 : (smmaL[1] * (lenL - 1) + srcLow) / lenL

//

umacd = input(false, title="Use MACD Filtering")

fastMA = input(title="MACD Fast MA Length", type=input.integer, defval=8, minval=2)

slowMA = input(title="MACD Slow MA Length", type=input.integer, defval=16, minval=7)

signal = input(title="MACD Signal Length", type=input.integer, defval=1, minval=1)

//

//

[currMacd, _, _] = macd(srcClose[0], fastMA, slowMA, signal)

rising_1 = rising(currMacd, 2)

falling_1 = falling(currMacd, 2)

macdH = currMacd > 0 ? rising_1 ? color.green : color.red :

falling_1 ? color.red : color.green

//

// Bar - Highlighting based on indication strength

long = (not umacd or macdH == color.green) and mab > mbb and mab < rsiOBL and

mab > rsiOSL and srcHigh > smmaH and srcClose > srcOpen ?

mbb > mid ? 1 : mab > mid and mbb < mid ? 2 : mab < mid and mbb < mid ? 3 : 0 : 0

short = (not umacd or macdH == color.red) and mab < mbb and mab < rsiOBL and

mab > rsiOSL and srcLow < smmaL and srcClose < srcOpen ?

mbb < mid ? 1 : mab < mid and mbb > mid ? 2 : mab > mid and mbb > mid ? 3 : 0 : 0

//

// Find the right Bar colour if enabled.

bcolor = not sbr ? na : long == 1 ? gold100 :

long == 2 and strength > 1 ? aqua100 : long == 3 and strength > 2 ? blue100 :

short == 1 ? fuchsia100 : short == 2 and strength > 1 ? purple100 :

short == 3 and strength > 2 ? black100 : sgb ? gray100 : na

//

barcolor(color=bcolor, title="Bars Colours")

//

//

// === ALERT conditions

//

// create alerts only once per sequence type.

//

longCond = long > 0 and long != long[1] and long <= strength

shortCond = short > 0 and short != short[1] and short <= strength

// show dot only when alert condition is met and bar closed.

plotshape(sal and (longCond[1] or shortCond[1]), title="Alert Indicator", location=location.bottom,

color=long[1] == 1 ? gold : long[1] == 2 ? color.aqua : long[1] == 3 ? color.blue : short[1] == 1 ? color.fuchsia : short[1] == 2 ? color.purple : short[1] == 3 ? color.black : na,

transp=0, style=shape.circle, offset=-1)

//

// === /ALERT conditions.

// === STRATEGY ===

tradeType = input("BOTH", title="What trades should be taken : ", options=["LONG", "SHORT", "BOTH", "NONE"])

// stop loss

slPoints = input(defval=0, title="Initial Stop Loss Points (zero to disable)", minval=0)

tpPoints = input(defval=0, title="Initial Target Profit Points (zero for disable)", minval=0)

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

testStartYear = input(2018, "Backtest Start Year", minval=1980)

testStartMonth = input(1, "Backtest Start Month", minval=1, maxval=12)

testStartDay = input(1, "Backtest Start Day", minval=1, maxval=31)

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, "Backtest Stop Year", minval=1980)

testStopMonth = input(12, "Backtest Stop Month", minval=1, maxval=12)

testStopDay = input(31, "Backtest Stop Day", minval=1, maxval=31)

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//

//set up exit parameters

TP = tpPoints > 0 ? tpPoints : na

SL = slPoints > 0 ? slPoints : na

// Make sure we are within the bar range, Set up entries and exit conditions

if testPeriod() and tradeType != "NONE"

strategy.entry("long", strategy.long, when=longCond == true and tradeType != "SHORT")

strategy.entry("short", strategy.short, when=shortCond == true and tradeType != "LONG")

strategy.close("long", when=shortCond == true and tradeType == "LONG")

strategy.close("short", when=longCond == true and tradeType == "SHORT")

strategy.exit("XL", from_entry="long", profit=TP, loss=SL)

strategy.exit("XS", from_entry="short", profit=TP, loss=SL)

// === /STRATEGY ===

//EOF