결합된 이동 평균 및 무한 충동 반응 라인 전략

저자:차오장날짜: 2024-01-23 15:46:48태그:

전반적인 설명

이것은 이동 평균, 무한 충동 반응 라인 (IIR) 및 적응형 선형 이동 평균 (ALMA) 을 사용하는 양적 전략입니다. 전략은 거래자에게 풍부한 거래 신호를 제공하기 위해 여러 지표의 조합을 가지고 있습니다.

전략 원칙

전략의 주요 구성 요소는 다음과 같습니다.

-

간단한 이동 평균 (SMA), ALMA 및 IIR의 조합을 사용하여 거래 진입 시점으로 이들 사이의 교차 신호를 감지합니다.

-

서로 다른 기간을 가진 3 개의 IIR를 사용하여 가격이 압축 상태에 있는지 여부를 결정하기 위해 그 사이의 거리를 계산하십시오. 압축 상태는 변동성이 감소하고 종종 중요한 가격 변화를 예고합니다.

-

IIR의 기울기를 판단하면 기울기가 상승할 때 녹색이고 떨어질 때 파란색입니다.

-

SMA 사이의 거리가 넓어지고 있는지 계산합니다. 그렇다면,

fan 확장을 나타내는 특별한 표시를 만들어, 일반적으로 가격이 트렌드 상태에 들어가는 것을 의미합니다. -

상대적 강도 지수 (RSI) 의 과잉 구매 및 과잉 판매 신호를 결합하여 거래 신호를 보완합니다.

위의 섹션의 사용을 결합함으로써 전략은 비교적 포괄적이고 풍부한 거래 입점, 판단 및 출구 신호를 제공할 수 있습니다.

이점 분석

이 전략의 가장 큰 장점은 추세 판단과 변동성 비율과 과잉 구매/ 과잉 판매 상태를 모두 고려하여 거래 결정을 위한 다차원적 참조를 제공하는 종합 지표가 포괄적이고 풍부하다는 것입니다.

또 다른 장점은 매개 변수와 지표가 조정되고 최적화되기 쉽기 때문에 사용자가 자신의 필요에 따라 관련 지표와 매개 변수를 활성화 할 수 있다는 것입니다.

리스크 관리의 관점에서 이 전략은 빠른 평균과 느린 이동 평균을 모두 고려하여 가격 변동으로 인한 잘못된 신호의 가능성을 줄입니다.

위험 분석

이 전략의 주요 위험은 다음과 같습니다.

-

너무 복잡해서 쉽게 지표들 사이의 충돌과 부적절한 매개 변수 조합은 과도한 부착으로 이어질 수 있습니다.

-

여러 이동 평균 시스템을 채택하는 것은 여전히 심각한 시장 불안 (대 경제 사건과 같은 경우) 의 경우 큰 손실을 초래합니다.

-

적당한 심층 백테스팅은 실제 거래에서 생존 편견 위험을 초래할 수 있습니다.

실제로는 위험 관리에주의를 기울이고 포지션 크기를 적절히 조정해야합니다. 또한 전략의 실질적 효과를 보장하기 위해 더 긴 시간 프레임과 더 큰 데이터 세트를 통해 여러 백테스트를 수행해야합니다.

전략 최적화

이 전략의 복잡하고 많은 매개 변수를 고려할 때, 향후 최적화는 다음과 같은 측면에서 이루어질 수 있습니다.

-

지표 선택을 단순화하고, 낮은 상관관계나 충돌을 가진 지표를 제거합니다.

-

시장 특성을 더 잘 맞추기 위해 IIR 이동 평균의 선택을 최적화합니다.

-

크로스오버 신호의 안정성을 높이기 위해 빠르고 느린 이동 평균의 조합을 최적화합니다.

-

판단에 도움이 되는 머신 러닝 모델을 늘리고 전략의 적응성을 향상시켜야 합니다.

-

글로벌 지표와의 상관관계를 최적화하여 트렌드 판단의 성공률을 향상시킵니다.

결론

유연한 조합 및 지표 최적화를 통해이 전략은 시장 상태를 비교적 포괄적으로 반영하고 거래 결정에 다차원적 인 지원을 제공할 수 있습니다. 그러나 여전히 실제 거래 및 데이터 오버 피팅의 위험이 있습니다. 우리는 여전히 시장 변화에 적응하기 위해 전략을 지속적으로 최적화하고 조정해야합니다.

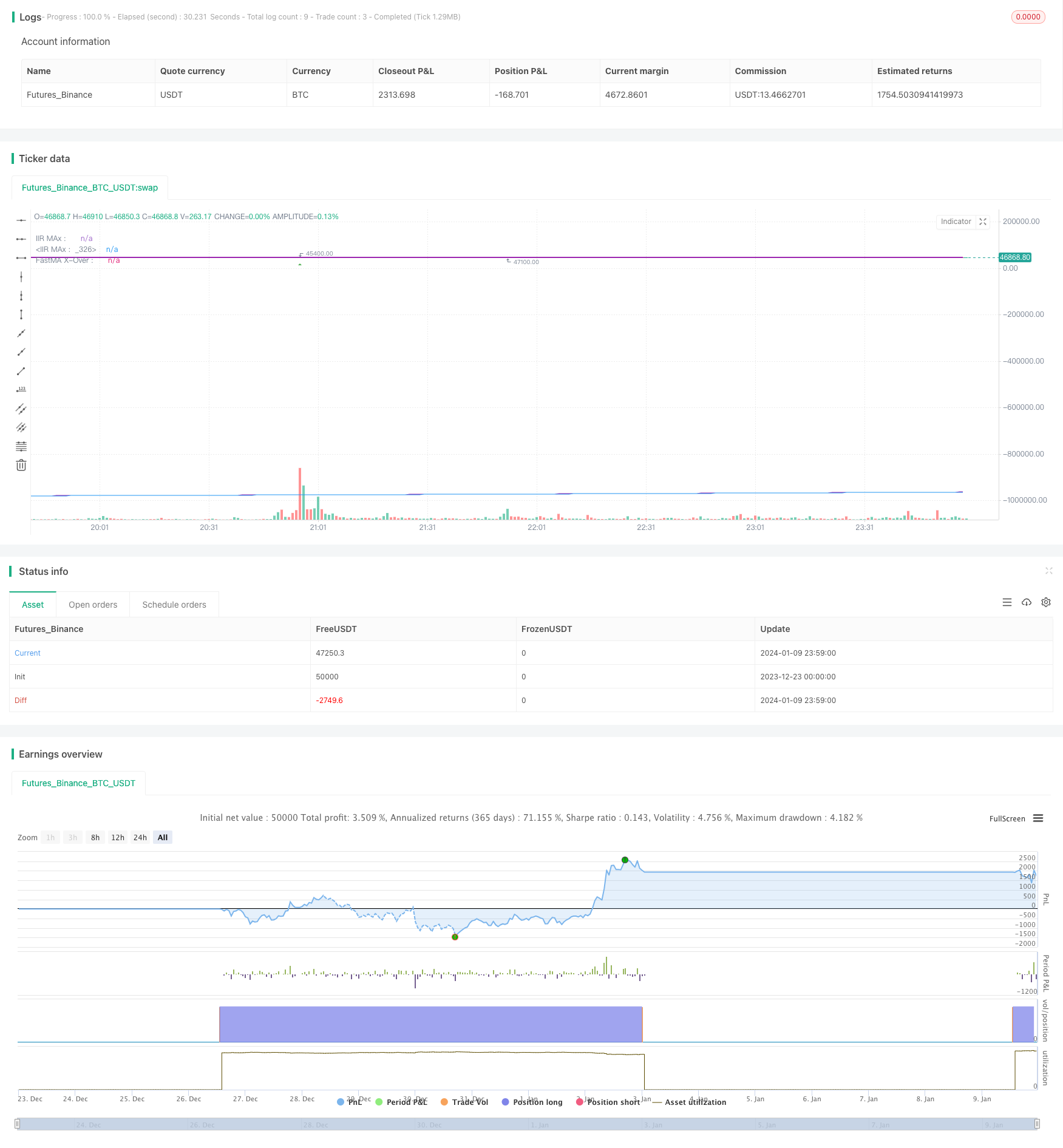

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-10 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//The plotchar UP/DOWN Arrows is the crossover of the fastest MA and fastest IIR MAs

//

//The dots at the bottom are the two simple averages crossing over

//

//The count over/under the candles is the count of bars that the SMAs on their

//respective resolution are fanning out.

//

//The colored background indicates a squeeze, lime=kinda tight : green=very tight squeeze. based on the 3 IIRs

//

//To answer my own question in a forum, looking at the code, i couldn't figure out how to get it from another timeframe

//and run the same calculations with the same results. My answer in the end was to scale the chosen MA length

//in the corresponding CurrentPeriod/ChosenMAPeriod proportion. This results in the same line in the same place when browsing through the

//different time resolutions. Somebody might find this invaluable

//

//The counts are for MA's fanning out, or going parabolic. Theres IIRs, Almas, one done of the other. A lot.

//The arrows above and below bars are from standard RSI numbers for OB/OS

//

//The IIRs changes color depending on their slope, which can be referenced easily with a variable.

//

//The backgrond on a bar-by-bar basis is colored when 2 sets of moving averages are in a squeeze, aka

//when price is consolidating.

//

//This aims to help the trader combine conditions and entry criteria of the trade and explore these options visually.

//They detail things from all time-frames on the current one. I prefer it because of the fractal nature of price-action, both large and small,

//either yesterday or last year. For best results, go long in short-term trades when the long-term trend is also up.

//and other profitable insights. This is also a great example of an automation algorith.

//

//The pretty ribbon is my script called 'Trading With Colors'. Use them together for fanciest results. 55/233 is my Fib Cross (golden/death) Compare it to the classic 50/200 if

//you get bored. I believe it simply works better, at least for Crypto.

//

//Evidently, I am a day-trader. But this yields higher profits on larger time-frames anyways, so do play around with it. Find what works for you.

//Thanks and credit for code snippets goes to:

//matryskowal

//ChrisMoody, probably twice

//Alex Orekhov (everget)

//author=LucF and midtownsk8rguy, for PineCoders

//If you use code from this, real quick search for perhaps the original and give them a shoutout too. I may have missed something

//Author: Sean Duffy

//@version=4

strategy(title = "Combination Parabolic MA/IIR/ALMA Strategy",

shorttitle = "MA-QuickE",

overlay = true )

// calc_on_order_fills = true,

// calc_on_every_tick = true,

// Input Variables

showFIBMAs = input(false, type=input.bool, title="═══════════════ Show Fibby MAs ═══════════════")

maRes = input(960, type=input.integer, title="MA-Cross Resolution")

mal1 = input(8, type=input.integer, title="MA#1 Length")

mal2 = input(13, type=input.integer, title="MA#2 Length")

mal3 = input(34, type=input.integer, title="MA#3 Length")

loosePercentClose = input(1.1, type=input.float, title="SMA LooseSqueeze Percent")

showIIRs = input(false, type=input.bool, title="═══════════════════ Show IIRs ═══════════════════")

iirRes = input(60, type=input.integer, title="IIR Resolution")

percentClose = input(title="IIR Squeeze PercentClose", type=input.float, defval=.8)

iirlength1 = input(title="IIR Length 1", type=input.integer, defval=34)

iirlength2 = input(title="IIR Length 2", type=input.integer, defval=144)//input(title="ATR Period", type=input.integer, defval=1)

iirlength3 = input(title="IIR Length 3", type=input.integer, defval=720)//input(title="ATR Period", type=input.integer, defval=1)

showIIR1 = input(true, type=input.bool, title="Show IIR1")

showIIR2 = input(true, type=input.bool, title="Show IIR2")

showIIR3 = input(true, type=input.bool, title="Show IIR3")

showCounts = input(true, type=input.bool, title="═════════════ Show Parabolic MA Counts ════════════")

showSignals = input(true, type=input.bool, title="══════════════ Show Buy/Sell Signals ══════════════")

showBackground = input(true, type=input.bool, title="══════════════ Show Background Colors ══════════════")

//runStrategy = input(true, type=input.bool, title="══════════════ Run Strategy ══════════════")

debug = input(false, type=input.bool, title="══════════════ Show Debug ══════════════")

barLookbackPeriod = input(title="══ Bar Lookback Period ══", type=input.integer, defval=5)

percentageLookbackPeriod = input(title="══ Percentage Lookback Period ══", type=input.integer, defval=1)

bullcolor = color.green

bearcolor = color.red

color bgcolor = na

var bool slope1Green = na

var bool slope2Green = na

var bool slope3Green = na

var bool buySignal = na

var bool sellSignal = na

var bool bigbuySignal = na

var bool bigsellSignal = na

bool smbuySignal = false

bool smsellSignal = false

var bool insqueeze = na

var bool intightsqueeze = na

var bool infastsqueeze = na

var bool awaitingEntryIn = false

// My counting variables

var int count1 = 0

var float madist1 = 0

var int count2 = 0

var float madist2 = 0

var int sinceSmSignal = 0

var entryPrice = 0.0

var entryBarIndex = 0

var stopLossPrice = 0.0

// var updatedEntryPrice = 0.0

// var alertOpenPosition = false

// var alertClosePosition = false

// var label stopLossPriceLabel = na

// var line stopLossPriceLine = na

positionType = "LONG" // Strategy type, and the only current option

hasOpenPosition = strategy.opentrades != 0

hasNoOpenPosition = strategy.opentrades == 0

strategyClose() =>

if (hasOpenPosition)

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if (hasNoOpenPosition)

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

checkEntry() =>

buysignal = false

if (hasNoOpenPosition)

strategyOpen()

buysignal := true

// if (slope1Green and (trend1Green or trend2Green) and awaitingEntryIn and hasNoOpenPosition)

// strategyOpen()

// buysignal := true

buysignal

checkExit() =>

sellsignal = false

// if (trend1Green == false and trend2Green == false) // to later have quicker exit strategy

// sellsignal := true

// strategyClose()

if (hasOpenPosition)

sellsignal := true

strategyClose()

sellsignal

multiplier(_adjRes, _adjLength) => // returns adjusted length

multiplier = _adjRes/timeframe.multiplier

round(_adjLength*multiplier)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false

ma1 = sma(close, multiplier(maRes, mal1))

ma2 = sma(close, multiplier(maRes, mal2))

ma3 = sma(close, multiplier(maRes, mal3))

madist1 := abs(ma1 - ma2)

madist2 := abs(ma1 - ma3) // check if MA's are fanning/going parabolic

if (ma1 >= ma2 and ma2 >= ma3 and madist1[0] > madist1[1]) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count1 := count1 + 1

else

count1 := 0

if (ma1 <= ma2 and ma2 <= ma3 and madist1[0] > madist1[1]) //<= madist2 and dataB <= dataC) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count2 := count2 + 1

else

count2 := 0

crossoverAB = crossover(ma1, ma2)

crossunderAB = crossunder(ma1, ma2)

plot(showFIBMAs ? ma1 : na, linewidth=3)

plot(showFIBMAs ? ma2 : na)

plot(showFIBMAs ? ma3 : na)

// Fast Squeese Check WORK IN PROGRESS

//

float singlePercent = close / 100

if max(madist1, madist2) <= singlePercent*loosePercentClose

bgcolor := color.yellow

infastsqueeze := true

else

infastsqueeze := false

// IIR MOVING AVERAGE

f(a) => a[0] // fixes mutable error

iirma(iirlength, iirsrc) =>

cf = 2*tan(2*3.14159*(1/iirlength)/2)

a0 = 8 + 8*cf + 4*pow(cf,2) + pow(cf,3)

a1 = -24 - 8*cf + 4*pow(cf,2) + 3*pow(cf,3)

a2 = 24 - 8*cf - 4*pow(cf,2) + 3*pow(cf,3)

a3 = -8 + 8*cf - 4*pow(cf,2) + pow(cf,3)

//----

c = pow(cf,3)/a0

d0 = -a1/a0

d1 = -a2/a0

d2 = -a3/a0

//----

out = 0.

out := nz(c*(iirsrc + iirsrc[3]) + 3*c*(iirsrc[1] + iirsrc[2]) + d0*out[1] + d1*out[2] + d2*out[3],iirsrc)

f(out)

iirma1 = iirma(multiplier(iirRes, iirlength1), close)

iirma2 = iirma(multiplier(iirRes, iirlength2), close)

iirma3 = iirma(multiplier(iirRes, iirlength3), close)

// adjusts length for current resolution now, length is lengthened/shortened accordingly, upholding exact placement of lines

// iirmaD1 = security(syminfo.tickerid, tostring(iirRes), iirma1, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD2 = security(syminfo.tickerid, tostring(iirRes), iirma2, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD3 = security(syminfo.tickerid, tostring(iirRes), iirma3, barmerge.gaps_on, barmerge.lookahead_on)

slope1color = slope1Green ? color.lime : color.blue

slope2color = slope2Green ? color.lime : color.blue

slope3color = slope3Green ? color.lime : color.blue

plot(showIIR1 and showIIRs ? iirma1 : na, title="IIR1", color=slope1color, linewidth=2, transp=30)

plot(showIIR2 and showIIRs ? iirma2 : na, title="IIR2", color=slope2color, linewidth=3, transp=30)

plot(showIIR3 and showIIRs ? iirma3 : na, title="IIR3", color=slope3color, linewidth=4, transp=30)

// checks slope of IIRs to create a boolean variable and and color it differently

if (iirma1[0] >= iirma1[1])

slope1Green := true

else

slope1Green := false

if (iirma2[0] >= iirma2[1])

slope2Green := true

else

slope2Green := false

if (iirma3[0] >= iirma3[1])

slope3Green := true

else

slope3Green := false

// calculate space between IIRs and then if the price jumps above both

//float singlePercent = close / 100 // = a single percent

var float distIIR1 = na

var float distIIR2 = na

distIIR1 := abs(iirma1 - iirma2)

distIIR2 := abs(iirma1 - iirma3)

if (distIIR1[0] < percentClose*singlePercent and close[0] >= iirma1[0])

if close[0] >= iirma2[0] and close[0] >= iirma3[0]

bgcolor := color.green

insqueeze := true

intightsqueeze := true

else

bgcolor := color.lime

insqueeze := true

intightsqueeze := false

else

insqueeze := false

intightsqueeze := false

// if (true)//sinceSmSignal > 0) // cutting down on fastest MAs noise

// sinceSmSignal := sinceSmSignal + 1

// if (crossoverAB)

// //checkEntry()

// //smbuySignal := true

// sinceSmSignal := 0

// if (crossunderAB) // and all NOT greennot (slope1Green and slope2Green and slope3Green)

// //checkExit()

// //smsellSignal := true

// sinceSmSignal := 0

// else

// sinceSmSignal := sinceSmSignal + 1

f_draw_infopanel(_x, _y, _line, _text, _color)=>

_rep_text = ""

for _l = 0 to _line

_rep_text := _rep_text + "\n"

_rep_text := _rep_text + _text

var label _la = na

label.delete(_la)

_la := label.new(

x=_x, y=_y,

text=_rep_text, xloc=xloc.bar_time, yloc=yloc.price,

color=color.black, style=label.style_labelup, textcolor=_color, size=size.normal)

posx = timenow + round(change(time)*60)

posy = highest(50)

// CONSTRUCTION ZONE

// TODO: program way to eliminate noise and false signals

// MAYBEDO: program it to differentiate between a moving average bump and a cross

// I think the best way would be to calculate the tangent line... OR

// Take the slope of both going back a couple bars and if it's close enough, its a bounce off

// and an excellent entry signal

// program in quickest exit, 2 bars next to eachother both closing under, as to avoid a single wick from

// prompting to close the trade

// Some other time, have it move SMA up or down depending on whether trending up or down. Then use those MA crosses

//THIS CHECKS THE SLOPE FROM CURRENT PRICE TO BACK 10 BARS

checkSlope(_series) => (_series[0]/_series[10])*100 // it now returns it as a percentage

doNewX = input(true, type=input.bool, title="══════════ Show misc MA Cross Strategy ══════════")

iirX = input(555, title="IIRx Length: ", type=input.integer)

iirXperiod = input(30, title="IIRx Period/TF: ", type=input.integer)

iirX2 = input(13, title="IIRx2 Length: ", type=input.integer)

iirX2period = input(5, title="IIRx2 Period/TF: ", type=input.integer) //15

almaXperiod = input(defval=15, title="Alma of IIR1 Period: ", type=input.integer)

almaXalpha = input(title="Alma Alpha Value: ", defval=.7, maxval=.95, type=input.float) // dont forget to try .99

almaXsigma = input(title="Alma Sigma Value: ", defval=500, type=input.float)

iirmaOTF = iirma(multiplier(iirXperiod, iirX), close)

iirma2OTF = iirma(multiplier(iirX2period, iirX2), close)

smaOTF = alma(iirmaOTF, almaXperiod, almaXalpha, almaXsigma) // maybe dont touch, its precise // I took the ALMA of the IIRMA, and i hope thats not cheating ;)

// I could have removed this. the multiplier function adjusts the length to fit the current timeframe while displaying the same

// smaXOTF = security(syminfo.tickerid, smaXperiod, smaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaXOTF = security(syminfo.tickerid, iirXperiod, iirmaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaX2OTF = security(syminfo.tickerid, iirX2period, iirma2OTF, barmerge.gaps_on, barmerge.lookahead_on)

plot(doNewX ? smaOTF : na, title="FastMA X-Over : ", color=color.blue, linewidth=1, transp=40)

plot(doNewX ? iirmaOTF : na, title="IIR MAx : ", color=color.purple, linewidth=1, transp=30)

plot(doNewX ? iirma2OTF : na, title="IIR MAx : ", color=color.purple, linewidth=2, transp=20)

iirma2Up = checkSlope(iirma2OTF) > 0 // just another slope up/down variable.

//calculate spaces between averages

distiiralma = abs(iirmaOTF - smaOTF)

crossoverFast = crossover(iirmaOTF, smaOTF) // and (iirmaOTF[1] <= smaOTF[1])

crossunderFast = crossunder(iirmaOTF, smaOTF) // and (iirmaOTF[1] >= smaOTF[1])

if (crossoverFast and iirma2Up == true and infastsqueeze == false and intightsqueeze == false) // and (count1 != 0))// or close[0] < (lowest(barLookbackPeriod) + singlePercent*3))) // must be at most a few percent up from a recent low. Avoid buying highs :P

buySignal := true

strategyOpen()

// if (slope1Green and slope2Green and slope3Green and infastsqueeze == false)

// checkEntry()

if (crossunderFast)

sellSignal := true

checkExit()

// I feel like I didn't cite the OG author for this panel correctly. I hope I did, but there are extentions of his/her work in multiple places.

// I could have gotten it confused.

if (debug)

f_draw_infopanel(posx, posy, 18, "distiiralma from IIR: " + tostring(distiiralma), color.lime)

//f_draw_infopanel(posx, posy, 16, "distiirs: " + tostring(distiirX1), color.lime)

f_draw_infopanel(posx, posy, 14, "Value of iirmaOTF: " + tostring(iirmaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slope X: " + tostring(abs(100 - checkSlope(iirmaOTF))), color.lime)

f_draw_infopanel(posx, posy, 12, "value of smaOTF: " + tostring(smaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slopeAlma: " + tostring(abs(100 - checkSlope(smaOTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

// I kept this separate because it discludes the calculations. Its hard to hold a train of thought while fishing for the right section

bgcolor(showBackground ? bgcolor : na)

plotshape(showSignals ? buySignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.blue, transp=60)

plotshape(showSignals ? sellSignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.red, transp=60)

plotchar(showSignals and smbuySignal, title="smBuy", location=location.belowbar, char='↑', size=size.tiny, color=color.green, transp=0)

plotchar(showSignals and smsellSignal, title="smSell", location=location.abovebar, char='↓', size=size.tiny, color=color.orange, transp=0)

// can not display a variable. Can only match the count to a corresponding plotchar

// to display a non-constant variable, use the debug box, which was so kindly offered up by our community.

plotchar(showCounts and count1==1, title='', char='1', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==2, title='', char='2', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==3, title='', char='3', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==4, title='', char='4', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==5, title='', char='5', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==6, title='', char='6', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==7, title='', char='7', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==8, title='', char='8', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==9, title='', char='9', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1>=10, title='', char='$', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count2==1, title='', char='1', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==2, title='', char='2', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==3, title='', char='3', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==4, title='', char='4', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==5, title='', char='5', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==6, title='', char='6', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==7, title='', char='7', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==8, title='', char='8', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==9, title='', char='9', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2>=10, title='', char='$', location=location.abovebar, color=#e91e63, transp=0)

showRSIind = input(true, type=input.bool, title="═══════════════════ Show RSI Arrows ═══════════════════")

// Get user input

rsiSource = input(title="RSI Source", type=input.source, defval=close)

rsiLength = input(title="RSI Length", type=input.integer, defval=14)

rsiOverbought = input(title="RSI Overbought Level", type=input.integer, defval=80)

rsiOversold = input(title="RSI Oversold Level", type=input.integer, defval=20)

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

isRsiOB = rsiValue >= rsiOverbought

isRsiOS = rsiValue <= rsiOversold

// Plot signals to chart

plotshape(isRsiOB, title="Overbought", location=location.abovebar, color=color.red, transp=0, style=shape.triangledown)

plotshape(isRsiOS, title="Oversold", location=location.belowbar, color=color.green, transp=0, style=shape.triangleup)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false

- 이 전략은 양방향 적응 범위 필터링 모멘텀 추적 전략입니다

- 이중 이동 평균 트렌드 추적 전략

- 힘의 돌파구 전략

- RSI CCI Williams%R 양적 거래 전략

- 역동적 위험 조정 동력 거래 전략

- 동력 이동 평균 크로스오버 거래 전략

- 볼링거 대역 제한 시장 제작자 전략

- 장기 이동평균 크로스오버 렌코 전략

- 신규 거래에 대한 온라인 감시

- 양방향 트렌드 추적 렌코 거래 전략

- 슈퍼트렌드 추적 전략

- 다중 지표 트렌드 역전 거래 전략

- 비트코인과 금의 이중 격차 전략

- MACD와 RSI의 크로스오버 전략

- 모멘텀 풀백 전략

- 이동 평균 크로스오버 전략

- 오시슬레이션과 함께 수익 그리드 전략

- 이동평균에 기초한 오스실레이션 돌파 전략

- 지그자그 패턴 인식 단기 거래 전략

- 윌리엄스 VIX와 DEMA를 기반으로 시간 프레임에 걸쳐 변동성 및 트렌드 추적 전략