개요

이 전략은 이동 평균을 기반으로 한 간단한 트렌드 추적 전략이다. 이 전략은 서로 다른 주기의 이동 평균의 크기의 관계를 비교하여 현재의 트렌드 방향을 판단하고, 트렌드의 지속 기간을 판단한다. 단기 평균이 아래로 올라간다면 더 많이 하고, 단기 평균이 위로 내려간다면 공백을 한다. 동시에, 전략은 위험을 제어하기 위해 중단점과 정지점을 설정한다.

전략 원칙

이 전략은 4개의 다른 주기의 이동 평균을 사용한다: 5일선, 10일선, 15일선, 그리고 25일선. 이 4개의 평균선은 MA1, MA2, MA3, 그리고 MA4라고 불린다. 이 중, MA1은 가장 짧고, MA4는 가장 길다.

MA1>MA2>MA3>MA4일 때, 가격이 상승 추세에 있다는 것을 나타냅니다. 이 때 더 많이; MA1다.

오더와 오브로의 개시 조건은 동시에 ATR 중지 손실 필터를 충족해야 합니다. 즉, ATR 값이 ATR의 40주기 간단한 이동 평균보다 크면 가격 변동이 시간 후에 잘못된 신호를 발산하는 것을 피할 수 있습니다.

전략적 이점

이 전략은 다음과 같은 장점을 가지고 있습니다.

- 이 아이디어는 이해하기 쉽고, 실행하기 쉽습니다.

- 다중 이동 평균을 사용하여 트렌드 방향을 결정하십시오.

- 한 거래의 최대 손실을 효과적으로 제어할 수 있는 스톱 스톱 손실 지점을 설정한다.

- ATR 차단 필터는 가격 변동이 1시간이 지나면 잘못된 신호를 방출할 수 있다.

위험 분석

이 전략에는 다음과 같은 위험도 있습니다.

- 시장의 큰 흔들림은 잘못된 신호를 유발할 수 있습니다.

- 매개 변수 설정 (평균 주기 등) 이 잘못되면 전략 효과가 떨어질 수 있다.

- 기본 사항과 중요한 소식이 가격에 미치는 영향을 고려하지 않습니다.

이러한 위험을 줄이기 위해, 적절한 최적화 매개 변수, 또는 정책 안정성을 높이기 위해 다른 필터 조건을 추가 할 수 있습니다.

최적화 방향

이 전략의 최적화 방향은 다음과 같습니다.

- 다른 이동 평균 주기 변수 조합을 테스트하여 최적의 변수를 찾습니다.

- MACD, KDJ 등과 같은 다른 기술 지표 필터를 추가하여 신호 신뢰성을 판단한다.

- 거래량 필터링을 늘리고, 거래량이 커질 때만 거래한다.

- 다양한 품종의 변수 차이에 따라 세세한 분식 품종의 변수를 최적화한다.

- 기계 학습 알고리즘 판단 신호를 증가 시키십시오.

요약하다

이 전략은 전체적으로 비교적 간단한 트렌드 추적 전략으로, 이동 평균을 통해 트렌드 방향을 판단하고, 합리적인 스톱 스톱 스로스를 설정하여 위험 수준을 제어한다. 전략 최적화 공간은 여전히 넓으며, 매개 변수 조정, 필터 추가 등의 수단으로 전략 안정성과 수익성을 더욱 향상시킬 수 있다.

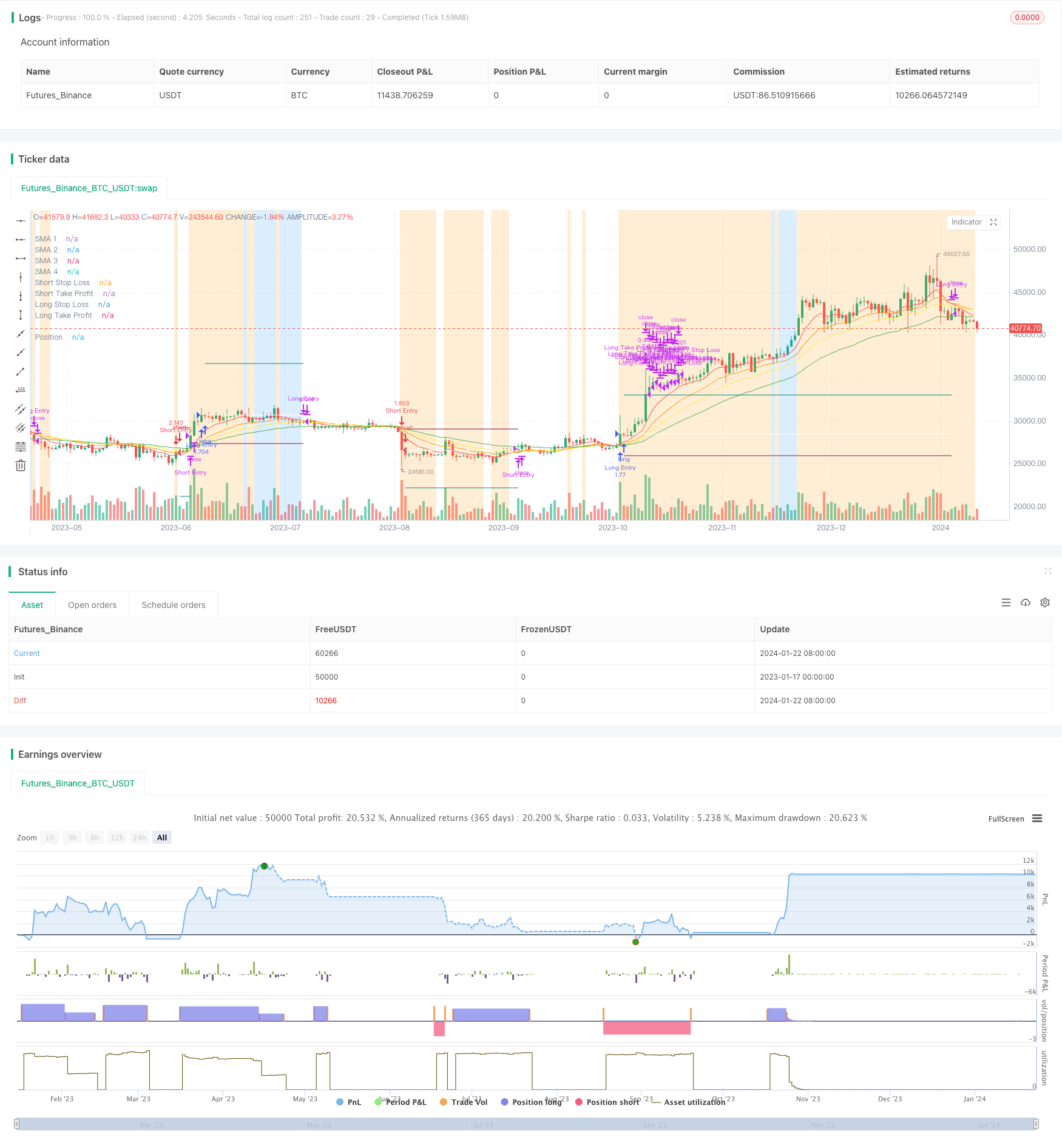

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// @version=5

// # ========================================================================= #

// # | STRATEGY |

// # ========================================================================= #

strategy(title = 'MA Simple Strategy with SL & TP & ATR Filters',

shorttitle = 'MA Strategy',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_type = strategy.commission.percent,

commission_value = 0.1,

initial_capital = 100000,

max_lines_count = 150,

max_labels_count = 300)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

c_timeCond = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// 3. Use Filters? What Filters?

i_ATRFilterOn = input.bool(defval = true , title = "ATR Filter On?", tooltip = "ATR Filter On?", inline = "ATR Filter", group = "Filters")

i_ATRSMALen = input.int(defval = 40 , title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "ATR Filter", group = "Filters")

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: normal? or trailing?

//// If trailing, always trailing or trailing after take profit order executed?

i_useSLTP = input.bool(defval = true, title = "Enable SL & TP?", tooltip = "", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

i_tslEnabled = input.bool(defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

// i_tslAfterTP = input.bool(defval = true , title = "Enable Trailing SL after TP?", tooltip = "Enable Trailing SL after TP?", inline = "Trailing SL Execution", group = "Shared Inputs")

i_slType = input.string(defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR"], tooltip = "Stop Loss based on %? ATR?", inline = "Stop Loss Type", group = "Shared Inputs")

i_slATRLen = input.int(defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "Stop Loss ATR", group = "Shared Inputs")

i_tpType = input.string(defval = "R:R", title = "Take Profit Type", options = ["Percent", "ATR", "R:R"], tooltip = "Take Profit based on %? ATR? R-R ratio?", inline = "Take Profit Type", group = "Shared Inputs")

//// 3-2. Inputs for Quantity

i_tpQuantityPerc = input.float(defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position when tp target is met.', group = 'Shared Inputs')

// 4. Inputs for Long Stop Loss & Long Take Profit

i_slPercentLong = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_tpPercentLong = input.float(defval = 3, title = "TP Percent", tooltip = "Long Stop Loss && Take Profit Percent?", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_slATRMultLong = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpATRMultLong = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Long Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultLong * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultLong * ATR (i_tpATRLen)", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpRRratioLong = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Long Stop Loss / Take Profit")

// 5. Inputs for Short Stop Loss & Short Take Profit

i_slPercentShort = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_tpPercentShort = input.float(defval = 3, title = "TP Percent", tooltip = "Short Stop Loss && Take Profit Percent?", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_slATRMultShort = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpATRMultShort = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Short Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultShort * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultShort * ATR (i_tpATRLen)", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpRRratioShort = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Short Stop Loss / Take Profit")

// 6. Inputs for logic

i_MAType = input.string(defval = "RMA", title = "MA Type", options = ["SMA", "EMA", "WMA", "HMA", "RMA", "VWMA", "SWMA", "ALMA", "VWAP"], tooltip = "Choose MA Type", inline = "MA Type", group = 'Strategy')

i_MA1Len = input.int(defval = 5, title = 'MA 1 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA2Len = input.int(defval = 10, title = 'MA 2 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA3Len = input.int(defval = 15, title = 'MA 3 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA4Len = input.int(defval = 25, title = 'MA 4 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_ALMAOffset = input.float(defval = 0.7 , title = "ALMA Offset Value", tooltip = "The Value of ALMA offset", inline = "ALMA Input", group = 'Strategy')

i_ALMASigma = input.float(defval = 7 , title = "ALMA Sigma Value", tooltip = "The Value of ALMA sigma", inline = "ALMA Input", group = 'Strategy')

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

bool i_ATRFilter = ta.atr(length = i_slATRLen) >= ta.sma(source = ta.atr(length = i_slATRLen), length = i_ATRSMALen) ? true : false

// calculate Technical Indicators for the Logic

getMAValue (source, length, almaOffset, almaSigma) =>

switch i_MAType

'SMA' => ta.sma(source = source, length = length)

'EMA' => ta.ema(source = source, length = length)

'WMA' => ta.wma(source = source, length = length)

'HMA' => ta.hma(source = source, length = length)

'RMA' => ta.rma(source = source, length = length)

'SWMA' => ta.swma(source = source)

'ALMA' => ta.alma(series = source, length = length, offset = almaOffset, sigma = almaSigma)

'VWMA' => ta.vwma(source = source, length = length)

'VWAP' => ta.vwap(source = source)

=> na

float c_MA1 = getMAValue(close, i_MA1Len, i_ALMAOffset, i_ALMASigma)

float c_MA2 = getMAValue(close, i_MA2Len, i_ALMAOffset, i_ALMASigma)

float c_MA3 = getMAValue(close, i_MA3Len, i_ALMAOffset, i_ALMASigma)

float c_MA4 = getMAValue(close, i_MA4Len, i_ALMAOffset, i_ALMASigma)

// Logic: 정배열 될 떄 들어가

var ma1Color = color.new(color.red, 0)

plot(series = c_MA1, title = 'SMA 1', color = ma1Color, linewidth = 1, style = plot.style_line)

var ma2Color = color.new(color.orange, 0)

plot(series = c_MA2, title = 'SMA 2', color = ma2Color, linewidth = 1, style = plot.style_line)

var ma3Color = color.new(color.yellow, 0)

plot(series = c_MA3, title = 'SMA 3', color = ma3Color, linewidth = 1, style = plot.style_line)

var ma4Color = color.new(color.green, 0)

plot(series = c_MA4, title = 'SMA 4', color = ma4Color, linewidth = 1, style = plot.style_line)

bool openLongCond = (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool openShortCond = (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

bool openLong = i_longEnabled and openLongCond and (not i_ATRFilterOn or i_ATRFilter)

bool openShort = i_shortEnabled and openShortCond and (not i_ATRFilterOn or i_ATRFilter)

openLongCondColor = openLongCond ? color.new(color = color.blue, transp = 80) : na

bgcolor(color = openLongCondColor)

ATRFilterColor = i_ATRFilter ? color.new(color = color.orange, transp = 80) : na

bgcolor(color = ATRFilterColor)

bool enterLong = openLong and not (strategy.opentrades.size(strategy.opentrades-1) > 0)

bool enterShort = openShort and not (strategy.opentrades.size(strategy.opentrades-1) < 0)

bool closeLong = i_longEnabled and (c_MA1[1] >= c_MA2[1] and c_MA2[1] >= c_MA3[1] and c_MA3[1] >= c_MA4[1]) and not (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool closeShort = i_shortEnabled and (c_MA1[1] <= c_MA2[1] and c_MA2[1] <= c_MA3[1] and c_MA3[1] <= c_MA4[1]) and not (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

// # ========================================================================= #

// # Position, Status Conrtol

// # ========================================================================= #

// longisActive: New Long || Already Long && not closeLong, short is the same

bool longIsActive = enterLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool shortIsActive = enterShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// before longTPExecution: no trailing SL && after longTPExecution: trailing SL starts

// longTPExecution qunatity should be less than 100%

bool longTPExecuted = false

bool shortTPExecuted = false

// # ========================================================================= #

// # Long Stop Loss Logic

// # ========================================================================= #

float openAtr = ta.valuewhen(enterLong or enterShort, ta.atr(i_slATRLen), 0)

f_getLongSL (source) =>

switch i_slType

'Percent' => source * (1 - (i_slPercentLong/100))

'ATR' => source - i_slATRMultLong * openAtr

=> na

var float c_longSLPrice = na

c_longSLPrice := if (longIsActive)

if (enterLong)

f_getLongSL(close)

else

c_stopPrice = f_getLongSL(i_tslEnabled ? high : strategy.opentrades.entry_price(trade_num = strategy.opentrades - 1))

math.max(c_stopPrice, nz(c_longSLPrice[1]))

else

na

// # ========================================================================= #

// # Short Stop Loss Logic

// # ========================================================================= #

f_getShortSL (source) =>

switch i_slType

'Percent' => source * (1 + (i_slPercentShort)/100)

'ATR' => source + i_slATRMultShort * openAtr

=> na

var float c_shortSLPrice = na

c_shortSLPrice := if (shortIsActive)

if (enterShort)

f_getShortSL (close)

else

c_stopPrice = f_getShortSL(i_tslEnabled ? low : strategy.opentrades.entry_price(strategy.opentrades - 1))

math.min(c_stopPrice, nz(c_shortSLPrice[1], 999999.9))

else

na

// # ========================================================================= #

// # Long Take Profit Logic

// # ========================================================================= #

f_getLongTP () =>

switch i_tpType

'Percent' => close * (1 + (i_tpPercentLong/100))

'ATR' => close + i_tpATRMultLong * openAtr

'R:R' => close + i_tpRRratioLong * (close - f_getLongSL(close))

=> na

var float c_longTPPrice = na

c_longTPPrice := if (longIsActive and not longTPExecuted)

if (enterLong)

f_getLongTP()

else

nz(c_longTPPrice[1], f_getLongTP())

else

na

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= c_longTPPrice)

// # ========================================================================= #

// # Short Take Profit Logic

// # ========================================================================= #

f_getShortTP () =>

switch i_tpType

'Percent' => close * (1 - (i_tpPercentShort/100))

'ATR' => close - i_tpATRMultShort * openAtr

'R:R' => close - i_tpRRratioShort * (close - f_getLongSL(close))

=> na

var float c_shortTPPrice = na

c_shortTPPrice := if (shortIsActive and not shortTPExecuted)

if (enterShort)

f_getShortTP()

else

nz(c_shortTPPrice[1], f_getShortTP())

else

na

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= c_shortTPPrice)

// # ========================================================================= #

// # Make Orders

// # ========================================================================= #

if (c_timeCond)

if (enterLong)

strategy.entry(id = "Long Entry", direction = strategy.long , comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

if (enterShort)

strategy.entry(id = "Short Entry", direction = strategy.short , comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

if (closeLong)

strategy.close(id = 'Long Entry', comment = 'Close Long', alert_message = 'Long: Closed at market price')

if (closeShort)

strategy.close(id = 'Short Entry', comment = 'Close Short', alert_message = 'Short: Closed at market price')

if (longIsActive and i_useSLTP)

strategy.exit(id = 'Long Take Profit / Stop Loss', from_entry = 'Long Entry', qty_percent = i_tpQuantityPerc, limit = c_longTPPrice, stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long Stop Loss', from_entry = 'Long Entry', stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (shortIsActive and i_useSLTP)

strategy.exit(id = 'Short Take Profit / Stop Loss', from_entry = 'Short Entry', qty_percent = i_tpQuantityPerc, limit = c_shortTPPrice, stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short Stop Loss', from_entry = 'Short Entry', stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

// # ========================================================================= #

// # Plot

// # ========================================================================= #

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

var stopLossColor = color.new(color.maroon, 0)

plot(series = c_longSLPrice, title = 'Long Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortSLPrice, title = 'Short Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

longTPExecutedColor = longTPExecuted ? color.new(color = color.green, transp = 80) : na

//bgcolor(color = longTPExecutedColor)

shortTPExecutedColor = shortTPExecuted ? color.new(color = color.red, transp = 80) : na

//bgcolor(color = shortTPExecutedColor)

// isPositionOpenedColor = strategy.opentrades.size(strategy.opentrades-1) != 0 ? color.new(color = color.yellow, transp = 90) : na

// bgcolor(color = isPositionOpenedColor)

var takeProfitColor = color.new(color.teal, 0)

plot(series = c_longTPPrice, title = 'Long Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortTPPrice, title = 'Short Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)