가격차이에 기반한 트렌드 거래 전략

저자:차오장, 날짜: 2024-02-02 18:00:55태그:

전반적인 설명

이 트렌드 트레이딩 전략은 가격 이각 신호를 기반으로 합니다. 가격 이각 신호를 탐지하기 위해 RSI, MACD, 스토카스틱스 등 여러 지표와 확인하기 위해 머레이 수학 오시레이터 등을 사용합니다. 가격 이각 신호가 나타나고 오시레이터가 현재 트렌드 방향을 확인 할 때 입력됩니다.

전략 논리

이 전략의 핵심은 가격 분산 이론이다. 가격이 새로운 최고치를 달성하지만 지표가 그렇지 않으면 하향 분산으로 간주됩니다. 가격이 새로운 최저치를 인쇄하지만 지표가 그렇지 않으면 상승 분산입니다. 이것은 잠재적 인 트렌드 반전을 신호합니다. 전략은 트레이드 신호를 확인하기 위해 프랙탈 신호와 오시레이터를 결합합니다.

특히, 입국 조건은 다음과 같습니다.

- 정규/숨겨진 가격의 오차를 감지

- 머리 수학 오시일레이터는 대응 트렌드 구역에 있습니다.

오시레이터가 중간선을 넘을 때 출구

이점 분석

이 전략의 장점은 다음과 같습니다.

- 격차를 사용하여 잠재적 인 반전 지점을 감지합니다.

- 오시일레이터로 계속되는 트렌드를 확인하고 가짜 브레이크를 피합니다.

- 유연한 매개 변수 및 지표 조합

- 트렌드 추적과 리스크 관리

- 명확한 논리 규칙, 최적화 할 수있는 많은 공간

위험 분석

주요 위험은 다음과 같습니다.

- 다른 신호가 잘못된 신호일 수도 있습니다.

- 오시레이터 매개 변수가 잘못되면 거래가 빠질 수 있습니다.

- 과도한 일방적 지위는 큰 손실 위험을 초래합니다.

- 높은 변동성 기간 동안 거래 빈도 및 미끄러짐 비용 증가

스톱 로스, 포지션 사이즈, 위험 감소를 위한 매개 변수 최적화를 제안합니다.

최적화 방향

몇 가지 더 많은 최적화:

- 동적 매개 변수 최적화를 위한 기계 학습 알고리즘을 추가

- 트레일링 스톱 손실, 평균 진정한 범위 중지 등과 같은 더 고급 스톱 손실 기술을 도입

- 신호와 노이즈 비율을 향상시키기 위해 더 많은 지표와 필터를 통합하십시오.

- 트렌드를 더 잘 판단하기 위해 오시레이터 매개 변수를 자동 조정합니다.

- 리스크 관리 개선, 최대 유출 한도를 설정 등

요약

이 전략은 잠재적인 역전을 조기에 발견하기 위해 가격 분산 개념과 트렌드 분석 도구를 통합합니다. 적절한 위험 관리 향상으로, 좋은 위험 조정 수익을 얻을 수 있습니다. 기계 학습 기반의 추가 최적화는 더 안정적인 알파로 이어질 수 있습니다.

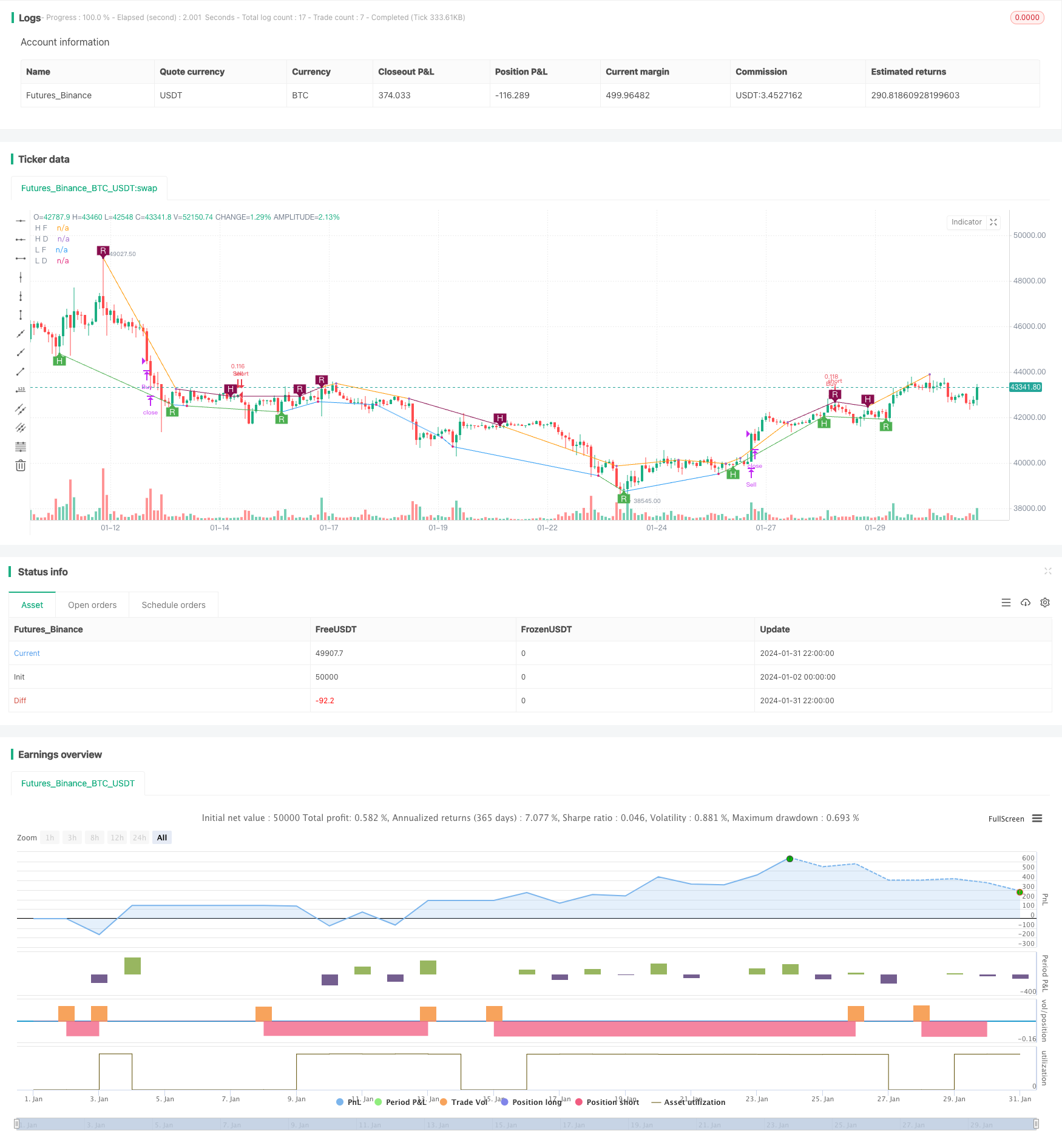

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//

// Title: [STRATEGY][UL]Price Divergence Strategy V1

// Author: JustUncleL

// Date: 23-Oct-2016

// Version: v1.0

//

// Description:

// A trend trading strategy the uses Price Divergence detection signals, that

// are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based).

//

// *** USE AT YOUR OWN RISK ***

//

// Mofidifications:

// 1.0 - original

//

// References:

// Strategy Based on:

// - [RS]Price Divergence Detector V2 by RicardoSantos

// - UCS_Murrey's Math Oscillator by Ucsgears

// Some Code borrowed from:

// - "Strategy Code Example by JayRogers"

// Information on Divergence Trading:

// - http://www.babypips.com/school/high-school/trading-divergences

//

strategy(title='[STRATEGY][UL]Price Divergence Strategy v1.0', pyramiding=0, overlay=true, initial_capital=10000, calc_on_every_tick=false,

currency=currency.USD,default_qty_type=strategy.percent_of_equity,default_qty_value=10)

// || General Input:

method = input(title='Method (0=rsi, 1=macd, 2=stoch, 3=volume, 4=acc/dist, 5=fisher, 6=cci):', defval=1, minval=0, maxval=6)

SHOW_LABEL = input(title='Show Labels', type=bool, defval=true)

SHOW_CHANNEL = input(title='Show Channel', type=bool, defval=false)

uHid = input(true,title="Use Hidden Divergence in Strategy")

uReg = input(true,title="Use Regular Divergence in Strategy")

// || RSI / STOCH / VOLUME / ACC/DIST Input:

rsi_smooth = input(title='RSI/STOCH/Volume/ACC-DIST/Fisher/cci Smooth:', defval=5)

// || MACD Input:

macd_src = input(title='MACD Source:', defval=close)

macd_fast = input(title='MACD Fast:', defval=12)

macd_slow = input(title='MACD Slow:', defval=26)

macd_smooth = input(title='MACD Smooth Signal:', defval=9)

// || Functions:

f_top_fractal(_src)=>_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and _src[2] > _src[0]

f_bot_fractal(_src)=>_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and _src[2] < _src[0]

f_fractalize(_src)=>f_top_fractal(_src) ? 1 : f_bot_fractal(_src) ? -1 : 0

// ||••> START MACD FUNCTION

f_macd(_src, _fast, _slow, _smooth)=>

_fast_ma = sma(_src, _fast)

_slow_ma = sma(_src, _slow)

_macd = _fast_ma-_slow_ma

_signal = ema(_macd, _smooth)

_hist = _macd - _signal

// ||<•• END MACD FUNCTION

// ||••> START ACC/DIST FUNCTION

f_accdist(_smooth)=>_return=sma(cum(close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume), _smooth)

// ||<•• END ACC/DIST FUNCTION

// ||••> START FISHER FUNCTION

f_fisher(_src, _window)=>

_h = highest(_src, _window)

_l = lowest(_src, _window)

_value0 = .66 * ((_src - _l) / max(_h - _l, .001) - .5) + .67 * nz(_value0[1])

_value1 = _value0 > .99 ? .999 : _value0 < -.99 ? -.999 : _value0

_fisher = .5 * log((1 + _value1) / max(1 - _value1, .001)) + .5 * nz(_fisher[1])

// ||<•• END FISHER FUNCTION

method_high = method == 0 ? rsi(high, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(high, rsi_smooth) :

method == 6 ? cci(high, rsi_smooth) :

na

method_low = method == 0 ? rsi(low, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(low, rsi_smooth) :

method == 6 ? cci(low, rsi_smooth) :

na

fractal_top = f_fractalize(method_high) > 0 ? method_high[2] : na

fractal_bot = f_fractalize(method_low) < 0 ? method_low[2] : na

high_prev = valuewhen(fractal_top, method_high[2], 1)

high_price = valuewhen(fractal_top, high[2], 1)

low_prev = valuewhen(fractal_bot, method_low[2], 1)

low_price = valuewhen(fractal_bot, low[2], 1)

regular_bearish_div = fractal_top and high[2] > high_price and method_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and method_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and method_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and method_low[2] < low_prev

plot(title='H F', series=fractal_top ? high[2] : na, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='L F', series=fractal_bot ? low[2] : na, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='H D', series=fractal_top ? high[2] : na, style=circles, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plot(title='L D', series=fractal_bot ? low[2] : na, style=circles, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plotshape(title='+RBD', series=not SHOW_LABEL ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='+HBD', series=not SHOW_LABEL ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='-RBD', series=not SHOW_LABEL ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

plotshape(title='-HBD', series=not SHOW_LABEL ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

// Code borrowed from UCS_Murrey's Math Oscillator by Ucsgears

// - UCS_MMLO

// Inputs

length = input(100, minval = 10, title = "MMLO Look back Length")

quad = input(2, minval = 1, maxval = 4, step = 1, title = "Mininum Quadrant for MMLO Support")

mult = 0.125

// Donchanin Channel

hi = highest(high, length)

lo = lowest(low, length)

range = hi - lo

multiplier = (range) * mult

midline = lo + multiplier * 4

oscillator = (close - midline)/(range/2)

a = oscillator > 0

b = oscillator > 0 and oscillator > mult*2

c = oscillator > 0 and oscillator > mult*4

d = oscillator > 0 and oscillator > mult*6

z = oscillator < 0

y = oscillator < 0 and oscillator < -mult*2

x = oscillator < 0 and oscillator < -mult*4

w = oscillator < 0 and oscillator < -mult*6

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 100, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => ((uReg and regular_bullish_div) or (uHid and hidden_bullish_div)) and (quad==1? a[1]: quad==2?b[1]: quad==3?c[1]: quad==4?d[1]: false)// functions can be used to wrap up and work out complex conditions

exitLong() => oscillator <= 0

strategy.entry(id = "Buy", long = true, when = enterLong() )// use function or simple condition to decide when to get in

strategy.close(id = "Buy", when = exitLong() )// ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => ((uReg and regular_bearish_div) or (uHid and hidden_bearish_div)) and (quad==1? z[1]: quad==2?y[1]: quad==3?x[1]: quad==4?w[1]: false)

exitShort() => oscillator >= 0

strategy.entry(id = "Sell", long = false, when = enterShort())

strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//EOF

더 많은

- 트렌드 라이딩 RSI 스윙 캡처 전략

- 이중 레일 패러볼릭 SAR 볼링거 밴드 전략

- 삼배 기하급수적 이동 평균 이익 취득 및 중지 손실 전략

- 돈치안 채널 너비 거래 전략

- 최적화된 이동 평균 크로스오버 전략

- 격리 대역 오시슬레이션 추적 전략

- 이중 돈치안 채널 탈출 전략

- CRSI 이동평균 전략

- 자기 적응형 양자 그리드 거래 전략

- 멀티 타임프레임 이치모쿠, MACD 및 DMI 결합 전략

- 슈퍼트렌드 비트코인 장선 전략

- 이동 평균 및 촛불 패턴을 가진 트렌드를 따르는 전략

- 이치모쿠 클라우드 브레이크와 ADX 인덱스에 기반한 양적 거래 전략

- 볼링거 밴드와 이동 평균의 조합 전략

- 게으른 곰 압축 모멘텀 전략

- 트렌드 예측 이중 이동 평균 전략

- 이중 이동 평균 역전 전략

- 이중 돌파구 이동 평균 거래 전략

- 눈부신 볼트 트렌드 전략

- VRSI 및 MARSI 전략