개요

이 전략은 전통적인 평평선 거래 전략에 기반하여, 초점 균형 표 지표를 사용하여 다공간 방향을 판단합니다. 이 전략은 가격 돌파구와 평평선 교차 신호를 결합하여 잠재적인 추세 반전 지점을 식별하고, 낮은 위험 거래 기회를 잡습니다.

전략 원칙

1시 균형 표에는 전환선, 기준선, 지연선 및 선도선이 포함되어 있습니다. 전환선에서 기준선을 통과하거나 아래로 통과 할 때 황금 포크 사다리 신호가 발생합니다. 가격 돌파구 클라우드 내의 하락 추세는 입문 신호로, 기준선과 선도선으로 구성된 클라우드 내의 스톱 로드입니다.

구체적으로 말하면, 다중 입수 신호는 전환 라인에 기준선을 통과하고 구름 속의 상단 라인을 뚫었다. 다중 입수 후, 가격이 구름 속의 하단 라인을 넘어간다면 손실을 멈추고 퇴출한다. 공허 입수와 손실을 멈추는 규칙은 비슷하다.

우위 분석

전통적인 이동 평균 전략에 비해 이 전략은 다음과 같은 장점이 있습니다.

- 일시 균형 표는 가격 운동 동향 판단과 결합하여 가짜 돌파구가 잘못된 신호를 생성하는 것을 방지합니다.

- 클라우드 내의 모바일 스톱로스, 신속한 스톱로스 제어 위험

- 매개 변수를 조정하여 다른 주기 및 시장 환경에 적응할 수 있습니다.

위험 분석

이 전략의 주요 위험은 다음과 같습니다.

- 트렌드 반전의 위험. 진입을 뚫고 다시 진입할 수 있는 가격의 충격으로 인해 수익이 발생하지 않는다.

- 돌파 가짜 신호 위험. 가격의 단기 조정 보완이 돌파 신호로 잘못 판단될 수 있다.

- 매개 변수 최적화 위험. 다른 매개 변수는 다른 주기에서 적용되며, 테스트 조정이 필요합니다.

대응방법:

- 이동식 상쇄 및 부분 상쇄를 사용한다.

- 더 높은 주기 판단과 함께, 짧은 선 소음을 피한다.

- 다중 집합 변수 회귀 선택 집합 parameter optimization

최적화 방향

이 정책은 다음과 같은 측면에서 최적화될 수 있습니다.

- 가짜 신호를 탐지할 수 있는 기계 학습을 강화합니다.

- 적응형 이동 스톱을 사용하여 자동으로 스톱 거리를 조정

- 변수 적응 최적화 find optimal parameters

요약하다

이 전략은 전반적으로 신뢰할 수 있고, 낮은 위험의 트렌드 추적 전략이다. 단순한 평균선 전략에 비해, 첫눈에 평형표 지표 판단을 결합하여 일부 잡음 신호를 필터링 할 수 있다. 클라우드 내의 이동 스톱로스로 위험 감수성이 강하다. 추가적인 최적화를 통해 더 안정적인 초과 수익을 얻을 수 있다.

전략 소스 코드

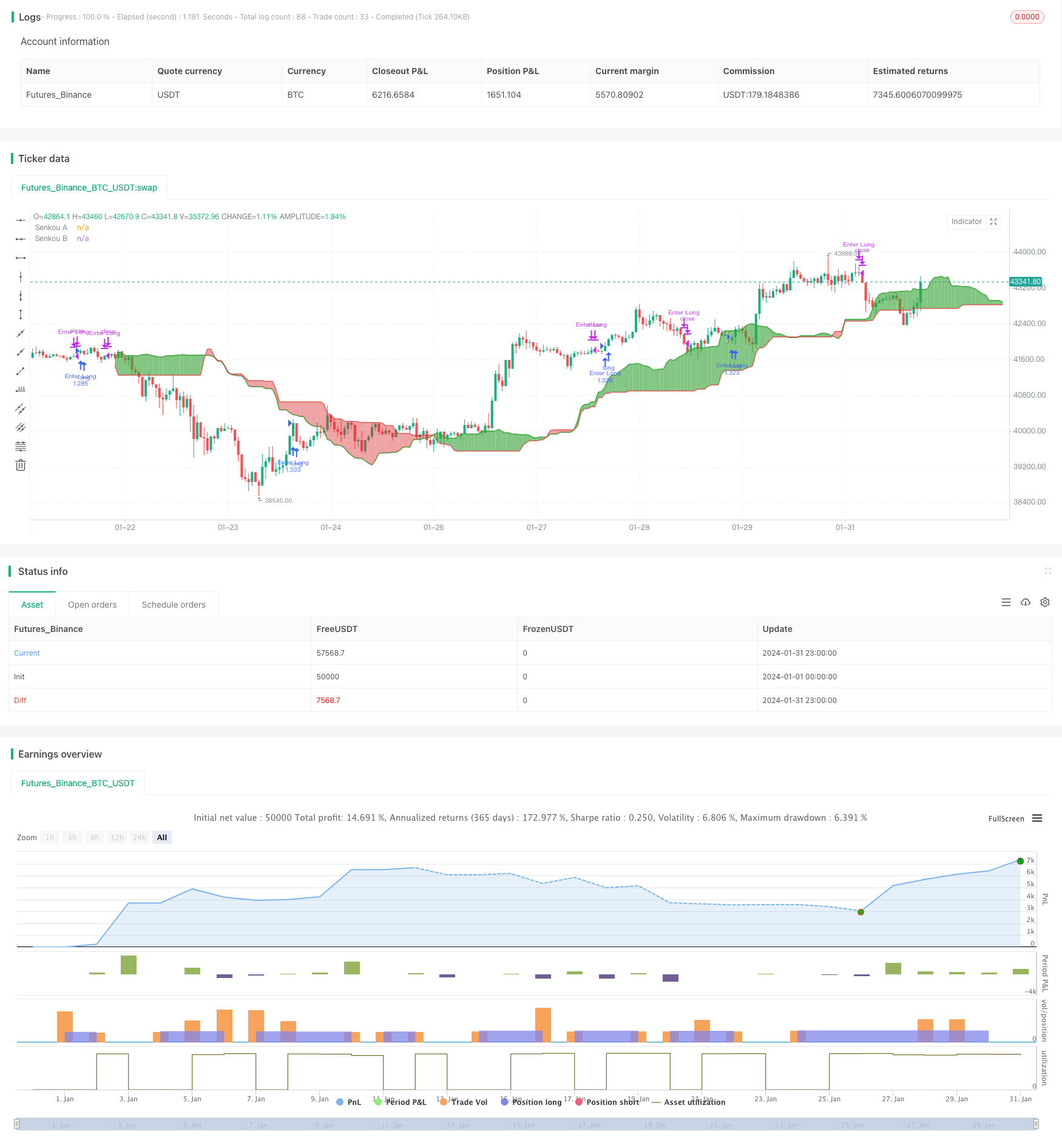

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// -----------------------------------------------------------------------------

// Copyright © 2024 Skyrex, LLC. All rights reserved.

// -----------------------------------------------------------------------------

// Version: v2

// Release: Jan 19, 2024

strategy(title = "Advanced Ichimoku Clouds Strategy Long and Short",

shorttitle = "Ichimoku Strategy Long and Short",

overlay = true,

format = format.inherit,

pyramiding = 1,

calc_on_order_fills = false,

calc_on_every_tick = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0)

// Trading Period Settings

lookBackPeriodStart = input(title="Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "Trading Period")

lookBackPeriodStop = input(title="Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "Trading Period")

// Trading Mode

tradingMode = input.string("Long", "Trading Mode", options = ["Long", "Short"], group = "Position side")

// Long Mode Signal Options

entrySignalOptionsLong = input.string("Bullish All", "Select Entry Signal (Long)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

exitSignalOptionsLong = input.string("Bearish Weak", "Select Exit Signal (Long)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

// Short Mode Signal Options

entrySignalOptionsShort = input.string("None", "Select Entry Signal (Short)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

exitSignalOptionsShort = input.string("None", "Select Exit Signal (Short)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

// Risk Management Settings

takeProfitPct = input.float(7, "Take Profit, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

stopLossPct = input.float(3.5, "Stop Loss, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

// Indicator Settings

tenkanPeriods = input.int(9, "Tenkan", minval=1, group="Indicator Settings")

kijunPeriods = input.int(26, "Kijun", minval=1, group="Indicator Settings")

chikouPeriods = input.int(52, "Chikou", minval=1, group="Indicator Settings")

displacement = input.int(26, "Offset", minval=1, group="Indicator Settings")

// Display Settings

showTenkan = input(false, "Show Tenkan Line", group = "Display Settings")

showKijun = input(false, "Show Kijun Line", group = "Display Settings")

showSenkouA = input(true, "Show Senkou A Line", group = "Display Settings")

showSenkouB = input(true, "Show Senkou B Line", group = "Display Settings")

showChikou = input(false, "Show Chikou Line", group = "Display Settings")

// Function to convert percentage to price points based on entry price

pctToPoints(pct) =>

strategy.position_avg_price * pct / 100

// Colors and Transparency Level

transparencyLevel = 90

colorGreen = color.new(#36a336, 23)

colorRed = color.new(#d82727, 47)

colorTenkanViolet = color.new(#9400D3, 0)

colorKijun = color.new(#fdd8a0, 0)

colorLime = color.new(#006400, 0)

colorMaroon = color.new(#8b0000, 0)

colorGreenTransparent = color.new(colorGreen, transparencyLevel)

colorRedTransparent = color.new(colorRed, transparencyLevel)

// Ichimoku Calculations

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = math.avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement - 1]

displacedSenkouB = senkouB[displacement - 1]

// Plot Ichimoku Lines

plot(showTenkan ? tenkan : na, color=colorTenkanViolet, title = "Tenkan", linewidth=2)

plot(showKijun ? kijun : na, color=colorKijun, title = "Kijun", linewidth=2)

plot(showChikou ? close : na, offset=-displacement, color = colorLime, title = "Chikou", linewidth=1)

p1 = plot(showSenkouA ? senkouA : na, offset=displacement - 1, color=colorGreen, title = "Senkou A", linewidth=2)

p2 = plot(showSenkouB ? senkouB : na, offset=displacement - 1, color=colorRed, title = "Senkou B", linewidth=2)

fill(p1, p2, color=senkouA > senkouB ? colorGreenTransparent : colorRedTransparent)

// Signal Calculations

bullishSignal = ta.crossover(tenkan, kijun)

bearishSignal = ta.crossunder(tenkan, kijun)

bullishSignalValues = bullishSignal ? tenkan : na

bearishSignalValues = bearishSignal ? tenkan : na

strongBullishSignal = bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB

neutralBullishSignal = ((bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB))

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB

neutralBearishSignal = ((bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB))

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

// Functions to determine entry and exit conditions for Long and Short

isEntrySignalLong() =>

entryCondition = false

if entrySignalOptionsLong == "None"

entryCondition := false

else if entrySignalOptionsLong == "Bullish Strong"

entryCondition := strongBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral"

entryCondition := neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Weak"

entryCondition := weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Neutral"

entryCondition := strongBullishSignal or neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral and Weak"

entryCondition := neutralBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Weak"

entryCondition := strongBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish All"

entryCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

entryCondition

isExitSignalLong() =>

exitCondition = false

if exitSignalOptionsLong == "None"

exitCondition := false

else if exitSignalOptionsLong == "Bearish Strong"

exitCondition := strongBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral"

exitCondition := neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Weak"

exitCondition := weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Neutral"

exitCondition := strongBearishSignal or neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral and Weak"

exitCondition := neutralBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Weak"

exitCondition := strongBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish All"

exitCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

exitCondition

isEntrySignalShort() =>

entryCondition = false

if entrySignalOptionsShort == "None"

entryCondition := false

else if entrySignalOptionsShort == "Bearish Strong"

entryCondition := strongBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral"

entryCondition := neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Weak"

entryCondition := weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Neutral"

entryCondition := strongBearishSignal or neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral and Weak"

entryCondition := neutralBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Weak"

entryCondition := strongBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish All"

entryCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

entryCondition

isExitSignalShort() =>

exitCondition = false

if exitSignalOptionsShort == "None"

exitCondition := false

else if exitSignalOptionsShort == "Bullish Strong"

exitCondition := strongBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral"

exitCondition := neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Weak"

exitCondition := weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Neutral"

exitCondition := strongBullishSignal or neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral and Weak"

exitCondition := neutralBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Weak"

exitCondition := strongBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish All"

exitCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

exitCondition

// Strategy logic for entries and exits

if true

if tradingMode == "Long"

takeProfitLevelLong = strategy.position_avg_price * (1 + takeProfitPct / 100)

stopLossLevelLong = strategy.position_avg_price * (1 - stopLossPct / 100)

if isEntrySignalLong()

strategy.entry("Enter Long", strategy.long)

if (takeProfitPct > 0 and close >= takeProfitLevelLong) or (stopLossPct > 0 and close <= stopLossLevelLong) or (exitSignalOptionsLong != "None" and isExitSignalLong())

strategy.close("Enter Long", comment="Exit Long")

else if tradingMode == "Short"

takeProfitLevelShort = strategy.position_avg_price * (1 - takeProfitPct / 100)

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPct / 100)

if isEntrySignalShort()

strategy.entry("Enter Short", strategy.short)

if (takeProfitPct > 0 and close <= takeProfitLevelShort) or (stopLossPct > 0 and close >= stopLossLevelShort) or (exitSignalOptionsShort != "None" and isExitSignalShort())

strategy.close("Enter Short", comment="Exit Short")