Supertrend Crodl

Penulis:ChaoZhang, Tarikh: 2022-05-13 17:38:34Tag:SMAEMASMMAWMAVWMA

Penunjuk ini menggunakan supertrend dengan 3 input yang berbeza sebagai pengesahan serta 200 EMA yang akan memberi kita data untuk trend naik atau turun. maka ia mencari penunjuk stok untuk mengesahkan jika terdapat salib di bawah 30 untuk panjang dan di atas 70 untuk pendek.

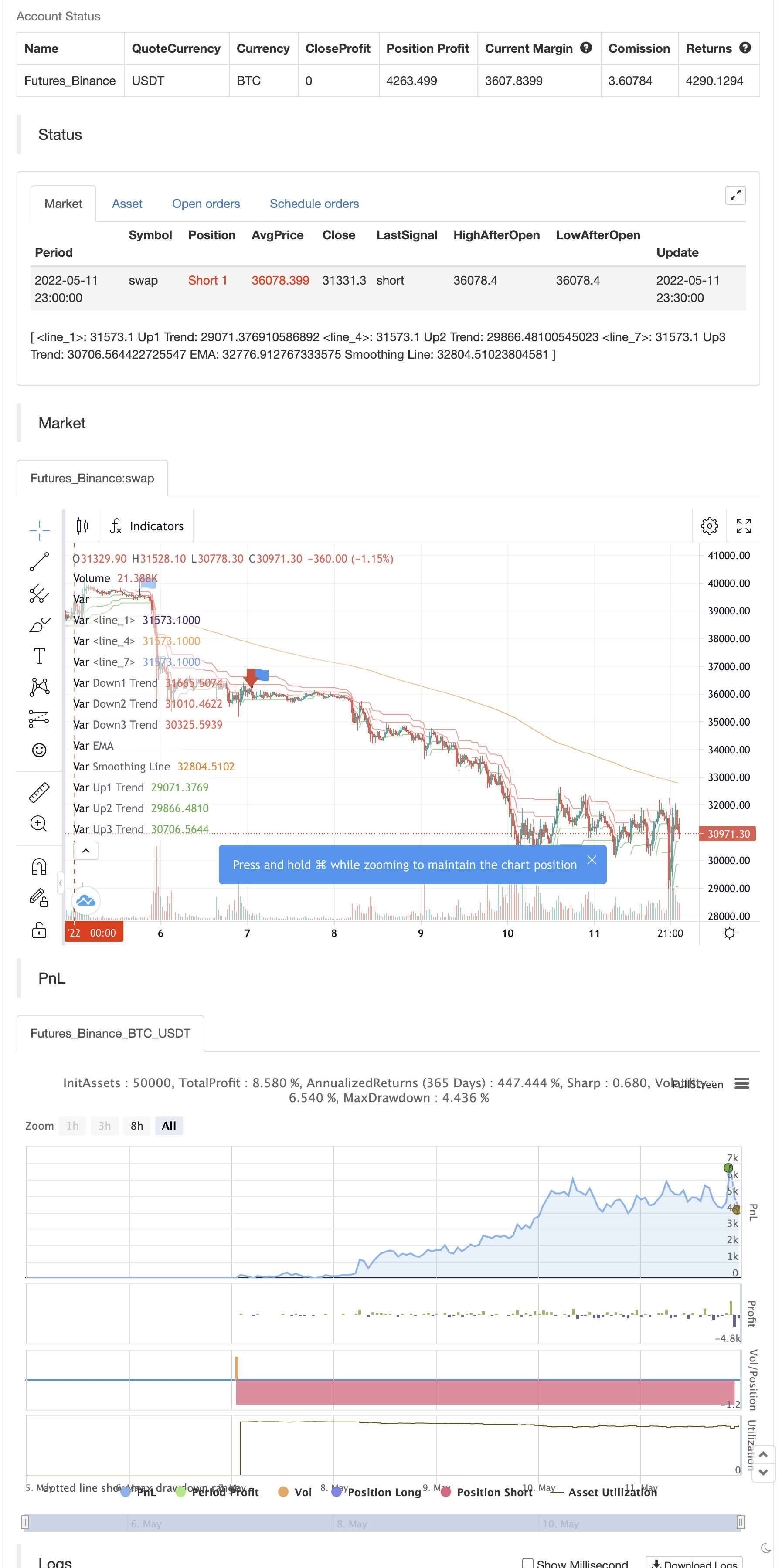

Ujian belakang

/*backtest

start: 2022-05-05 00:00:00

end: 2022-05-11 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Visit Crodl.com for our Premium Indicators

// https://tradingbot.crodl.com to use our free tradingview bot to automate any indicator.

//@version=5

indicator("Crodl's Supertrend", overlay=true, timeframe="", timeframe_gaps=true)

atrPeriod1 = input(12, "ATR1 Length")

factor1 = input.float(3.0, "Factor1", step = 0.01)

[supertrend1, direction1] = ta.supertrend(factor1, atrPeriod1)

bodyMiddle1 = plot((open + close) / 2, display=display.none)

upTrend1 = plot(direction1 < 0 ? supertrend1 : na, "Up1 Trend", color = color.green, style=plot.style_linebr)

downTrend1 = plot(direction1 < 0? na : supertrend1, "Down1 Trend", color = color.red, style=plot.style_linebr)

atrPeriod2 = input(11, "ATR2 Length")

factor2 = input.float(2.0, "Factor2", step = 0.01)

[supertrend2, direction2] = ta.supertrend(factor2, atrPeriod2)

bodyMiddle2 = plot((open + close) / 2, display=display.none)

upTrend2 = plot(direction2 < 0 ? supertrend2 : na, "Up2 Trend", color = color.green, style=plot.style_linebr)

downTrend2 = plot(direction2 < 0? na : supertrend2, "Down2 Trend", color = color.red, style=plot.style_linebr)

atrPeriod3 = input(10, "ATR3 Length")

factor3 = input.float(1.0, "Factor3", step = 0.01)

[supertrend3, direction3] = ta.supertrend(factor3, atrPeriod3)

bodyMiddle3 = plot((open + close) / 2, display=display.none)

upTrend3 = plot(direction3 < 0 ? supertrend3 : na, "Up3 Trend", color = color.green, style=plot.style_linebr)

downTrend3 = plot(direction3 < 0? na : supertrend3, "Down3 Trend", color = color.red, style=plot.style_linebr)

len = input.int(200, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

out = ta.ema(src, len)

plot(out, title="EMA", color=color.white,linewidth=2, offset=offset)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(out, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, offset=offset, display=display.none)

//////

l = input(13, title='Length')

l_ma = input(7, title='MA Length')

t = math.sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = ta.sma(t, l_ma)

//////

periodK = input.int(14, title="%K Length", minval=1)

smoothK = input.int(1, title="%K Smoothing", minval=1)

periodD = input.int(3, title="%D Smoothing", minval=1)

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

stochbuy= float(k) < 30 and ta.crossover(k,d)

stochsell=float(k) > 70 and ta.crossover(d,k)

long =(( ((direction1 < 0 and direction2 < 0 ) or (direction2 < 0 and direction3 < 0 ) and (direction1 < 0 or direction3 < 0 ) )and open > out) and t > 0) and stochbuy

short=(( ((direction1 > 0 and direction2 > 0 ) or (direction2 > 0 and direction3 > 0 ) and (direction1 > 0 or direction3 > 0 ) )and open < out) and t < 0) and stochsell

plotshape(long, title = "Long Signal", location=location.belowbar, style=shape.labelup, color=color.green, textcolor=color.white, size=size.small, text="Long")

plotshape(short, title = "Short Signal", location=location.abovebar, style=shape.labeldown, color=color.red, textcolor=color.white, size=size.small, text="Short")

alertcondition(long, title='Long Signal', message=' Buy')

alertcondition(short, title='Short Signal', message=' Sell')

if long

strategy.entry("Enter Long", strategy.long)

else if short

strategy.entry("Enter Short", strategy.short)

Kandungan berkaitan

- SSS

- Blinken telah merampas strategi pelacakan pergerakan

- Strategi perdagangan jalur turun naik pelbagai lapisan

- RSI Perbezaan dengan Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- Strategi pengukur pergerakan melintasi dua garis rata

- Strategi pelacakan trend dan kadar turun naik

- Strategi pengesanan trend persimpangan linear berbilang kitaran

- Strategi penyeberangan purata bergerak untuk menyesuaikan diri

- Strategi OCC R5.1

- 2 Pengesanan Arah Rata-rata Bergerak Warna

Lebih lanjut

- Selamat datang di BEARMARKET [30 MIN]

- Sidboss

- Titik Pivot Tinggi Rangka Masa Multi Rendah

- Ghosts Trend Tracking Strategy Database

- Ghoul Trend Track Strategi Perpustakaan Perniagaan

- Strategi Pengesanan Tren Hantu

- Oscillator Pelangi

- Contoh Pengukuran Posisi Lorong Ekuiti

- Persembahan KLineChart

- Villa Dinamic Pivot Supertrend Strategi

- RSI oleh zdmre

- FTL - Penapis Julat X2 + EMA + UO

- BRAHMASTRA

- Band Mobo

- SAR + 3SMMA dengan SL & TP

- SSS

- Templat Isyarat Pelancaran Bulan [Indikator]

- HALFTREND + HEMA + SMA (Strategi Isyarat Palsu)

- RSI Perbezaan dengan Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- RSI dan BBand oversold pada masa yang sama