Trend Fukuiz

Penulis:ChaoZhang, Tarikh: 2022-05-18 10:25:47Tag:RMARSI

Indikator ini berasaskan RSI dari 2 tempoh yang berbeza.

# Pendahuluan ringkas kepada RSI # Indeks kekuatan relatif (RSI) adalah penunjuk momentum yang digunakan dalam analisis teknikal yang mengukur besarnya perubahan harga baru-baru ini untuk menilai keadaan overbought atau oversold dalam harga saham atau aset lain. RSI dipaparkan sebagai osilator (graf garis yang bergerak antara dua ekstrem) dan boleh mempunyai bacaan dari 0 hingga 100.

Tafsiran dan penggunaan tradisional RSI adalah bahawa nilai 70 atau lebih menunjukkan bahawa sekuriti menjadi terlalu banyak dibeli atau terlalu dinilai dan mungkin disiapkan untuk pembalikan trend atau penarikan semula harga.

# Dalam penunjuk ini # Saya melihat bahawa anda boleh menggunakan 2 RSI dengan tempoh yang berbeza untuk mencadangkan trend Bullish dan trend Bearish.

# Keadaan antara RSI pendek dan panjang melintasi # Crossover = Trend Bullish (zon biru) Crossunder = Trend Buruh (zon merah)

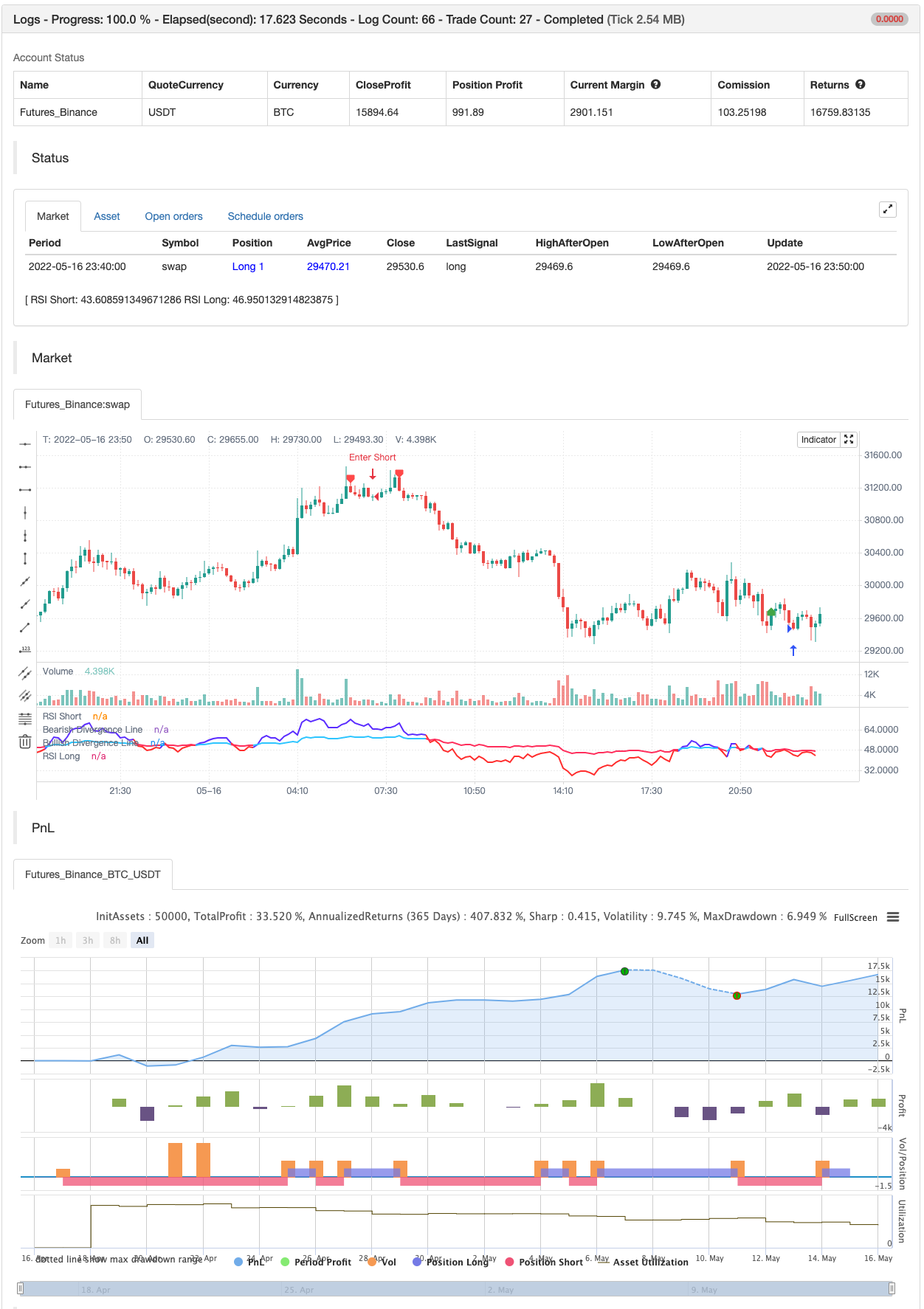

Pengujian belakang

/*backtest

start: 2022-04-17 00:00:00

end: 2022-05-16 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Fukuiz

indicator(title='Fukuiz Trend', shorttitle='Fukuiz Trend', format=format.price, precision=2, timeframe='')

//color//

colorwhite = #FFFFFF

colorblue = #6633FF

colorred = #FF3333

colorblue2 = #33CCFF

colorpink = #FF3366

//Fuction//

len = input.int(24, minval=1, title='RSI Short')

len2 = input.int(100, minval=1, title='RSI Long')

src = input(open, 'Source')

up = ta.rma(math.max(ta.change(src), 0), len)

down = ta.rma(-math.min(ta.change(src), 0), len)

up2 = ta.rma(math.max(ta.change(src), 0), len2)

down2 = ta.rma(-math.min(ta.change(src), 0), len2)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

rsi2 = down2 == 0 ? 100 : up2 == 0 ? 0 : 100 - 100 / (1 + up2 / down2)

Bullish = rsi > rsi2

Bearish = rsi < rsi2

Fukuizcolor = Bullish ? color.new(colorblue,0) : Bearish ? color.new(colorred,0) : na

Fukuizcolor2 = Bullish ? color.new(colorblue2,0) : Bearish ? color.new(colorpink,0) : na

Fukuizcolor3 = Bullish ? color.new(colorblue,75) : Bearish ? color.new(colorred,75) : na

//Plot//

l1 = plot(rsi, 'RSI Short', color=Fukuizcolor, linewidth=2, style=plot.style_line)

l2 = plot(rsi2, 'RSI Long', color=Fukuizcolor2, linewidth=2, style=plot.style_line)

band2 = hline(50, 'Middle Band', color=#FFCC99)

band1 = hline(70, 'Upper Band', color=#FFCC99)

band0 = hline(30, 'Lower Band', color=#FFCC99)

fill(band1, band0, color.new(#0946CA, 90), title='Background')

fill(l1, l2, color=Fukuizcolor3, title='Trend Background')

//DIVERGENCE//

lbR = input(title='Pivot Lookback Right', defval=5)

lbL = input(title='Pivot Lookback Left', defval=5)

rangeUpper = input(title='Max of Lookback Range', defval=60)

rangeLower = input(title='Min of Lookback Range', defval=5)

plotBull = input(title='Bullish Divergence', defval=true)

plotBear = input(title='Bearish Divergence', defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = ta.rsi(src, len)

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(plFound ? osc[lbR] : na, offset=-lbR, title='Bullish Divergence Line', linewidth=2, color=bullCond ? bullColor : noneColor,display=display.none)

plotshape(bullCond ? osc[lbR] : na, offset=-lbR, title='Bullish Divergence Label', text=' Bull ', style=shape.labelup, location=location.absolute, color=color.new(bullColor, 0), textcolor=color.new(textColor, 0))

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(phFound ? osc[lbR] : na, offset=-lbR, title='Bearish Divergence Line', linewidth=2, color=bearCond ? bearColor : noneColor,display=display.none)

plotshape(bearCond ? osc[lbR] : na, offset=-lbR, title='Bearish Divergence Label', text=' Bear ', style=shape.labeldown, location=location.absolute, color=color.new(bearColor, 0), textcolor=color.new(textColor, 0))

if bullCond

strategy.entry("Enter Long", strategy.long)

else if bearCond

strategy.entry("Enter Short", strategy.short)

- Strategi Piramid Pintar Berbilang Indikator

- Strategi dagangan indeks yang kuat dan lemah yang bertindih pada pelbagai peringkat

- Scalping EMA ADX RSI dengan Beli / Jual

- Super Scalper - 5 minit 15 minit

- VAWSI dan strategi pembalikan trend berterusan yang digabungkan dengan sistem analisis komprehensif pelbagai indikator yang mengira panjang dinamik

- Strategi perdagangan kuantitatif parameter dinamik RSI yang dibantu dengan melintasi pelbagai garisan

- RSI Dinamik Strategi Dagangan Bintang Masa Pemilihan Pintar

- Strategi perdagangan semula jadi yang digabungkan dengan MACD dan RSI

- Strategi perdagangan kuantitatif dengan pengesanan trend silang dinamik dengan pelbagai pengesahan

- Strategi RSI terhadap indeks yang lemah dan kuat

- CM MACD Indikator Sesuai - Kerangka Masa Berbilang - V2

- HODL LINE

- 2 Pengesanan Arah Rata-rata Bergerak Warna

- Scalping PullBack Tool R1

- Strategi Beli&Jual bergantung kepada AO+Stoch+RSI+ATR

- EMA TREND CLOUD

- Rasio Tenaga Arah RedK Volume-Pengcepat

- Donchian Breakout tiada cat semula

- Bar Momentum RedK

- SuperJump Turn Back Bollinger Band

- BOT Johny

- SSL Hibrid

- Keluar Chandelier

- Risotto

- EMA Cloud Intraday Strategi

- Titik Pivot Supertrend

- Supertrend+4 bergerak

- ZigZag berasaskan momentum

- VuManChu Cipher B + Strategi Perbezaan

- Konsep Dual SuperTrend