Qullamaggie Breakout V2 Strategi

Penulis:ChaoZhang, Tarikh: 2023-10-24 16:30:32Tag:

Ringkasan

Strategi ini menggabungkan kelebihan strategi penembusan dan trend-mengikut strategi berhenti untuk menangkap isyarat sokongan / rintangan pecah pada jangka masa yang lebih lama sambil menggunakan purata bergerak untuk penembusan stop loss untuk memperoleh keuntungan ke arah trend jangka panjang sambil mengawal risiko.

Logika Strategi

-

Strategi ini mula-mula mengira pelbagai purata bergerak dengan parameter yang berbeza untuk penentuan trend, sokongan / rintangan dan kehilangan berhenti.

-

Ia kemudian mengenal pasti titik tertinggi dan terendah tertinggi dalam tempoh tertentu sebagai zon pecah sokongan / rintangan. Isyarat beli dan jual dihasilkan apabila harga memecahkan tahap ini.

-

Strategi ini membeli apabila harga memecahkan di atas tertinggi tertinggi dan menjual apabila harga memecahkan di bawah terendah.

-

Selepas masuk, paras terendah yang paling rendah digunakan sebagai stop loss awal untuk kedudukan.

-

Sebaik sahaja kedudukan menjadi menguntungkan, stop loss bertukar ke belakang purata bergerak. Apabila harga pecah di bawah purata bergerak, stop ditetapkan pada yang terendah lilin itu.

-

Ini membolehkan kedudukan untuk mengunci keuntungan sambil memberikannya ruang yang cukup untuk mengikuti trend.

-

Strategi ini juga menggabungkan julat sebenar purata untuk penapisan untuk memastikan hanya penembusan julat yang betul diambil untuk mengelakkan penembusan yang diperpanjang.

Analisis Kelebihan

-

Menggabungkan kelebihan strategi breakout dan trailing stop.

-

Boleh membeli breakout mengikut trend jangka panjang untuk kebarangkalian yang lebih tinggi.

-

Strategi hentian menyusul melindungi kedudukan sambil membenarkan ruang yang cukup untuk berlari.

-

Penapisan ATR mengelakkan penyebaran jangka panjang yang tidak baik.

-

Perdagangan automatik yang sesuai untuk mengikuti separuh masa.

-

Parameter purata bergerak yang boleh disesuaikan.

-

Mekanisme penghentian yang fleksibel.

Analisis Risiko

-

Strategi pelarian terdedah kepada risiko pelarian palsu.

-

Volatiliti yang cukup diperlukan untuk menjana isyarat, mungkin gagal dalam pasaran bergelombang.

-

Beberapa pelarian mungkin terlalu singkat untuk ditangkap. Jangka masa yang lebih pendek mungkin mendedahkan lebih banyak peluang.

-

Hentian yang terlalu kerap boleh dihentikan di pasaran yang berbeza. hentian yang lebih luas boleh membantu.

-

Penapisan ATR mungkin terlepas beberapa perdagangan berpotensi. tetapan penapisan yang lebih rendah boleh membantu.

Arahan pengoptimuman

-

Uji kombinasi purata bergerak yang berbeza untuk parameter optimum.

-

Menjelajahi pengesahan pecah yang berbeza seperti saluran, corak candlestick dan lain-lain.

-

Cuba mekanisme berhenti yang berbeza untuk mencari stop loss yang terbaik.

-

Mengoptimumkan strategi pengurusan wang seperti skor kedudukan.

-

Tambah penapis penunjuk teknikal untuk meningkatkan kualiti isyarat.

-

Uji keberkesanan di pelbagai produk.

-

Menggabungkan algoritma pembelajaran mesin untuk meningkatkan prestasi strategi.

Kesimpulan

Strategi ini menggabungkan falsafah strategi berhenti breakout dan trend-mengikut trend. Dengan penentuan trend yang betul, ia mengoptimumkan potensi keuntungan sambil mengekalkan risiko terkawal. Kuncinya adalah mencari set parameter yang optimum dan menggabungkan pengurusan wang yang berhati-hati. Penambahbaikan lanjut boleh menjadikan ini menjadi trend yang kukuh mengikut metodologi.

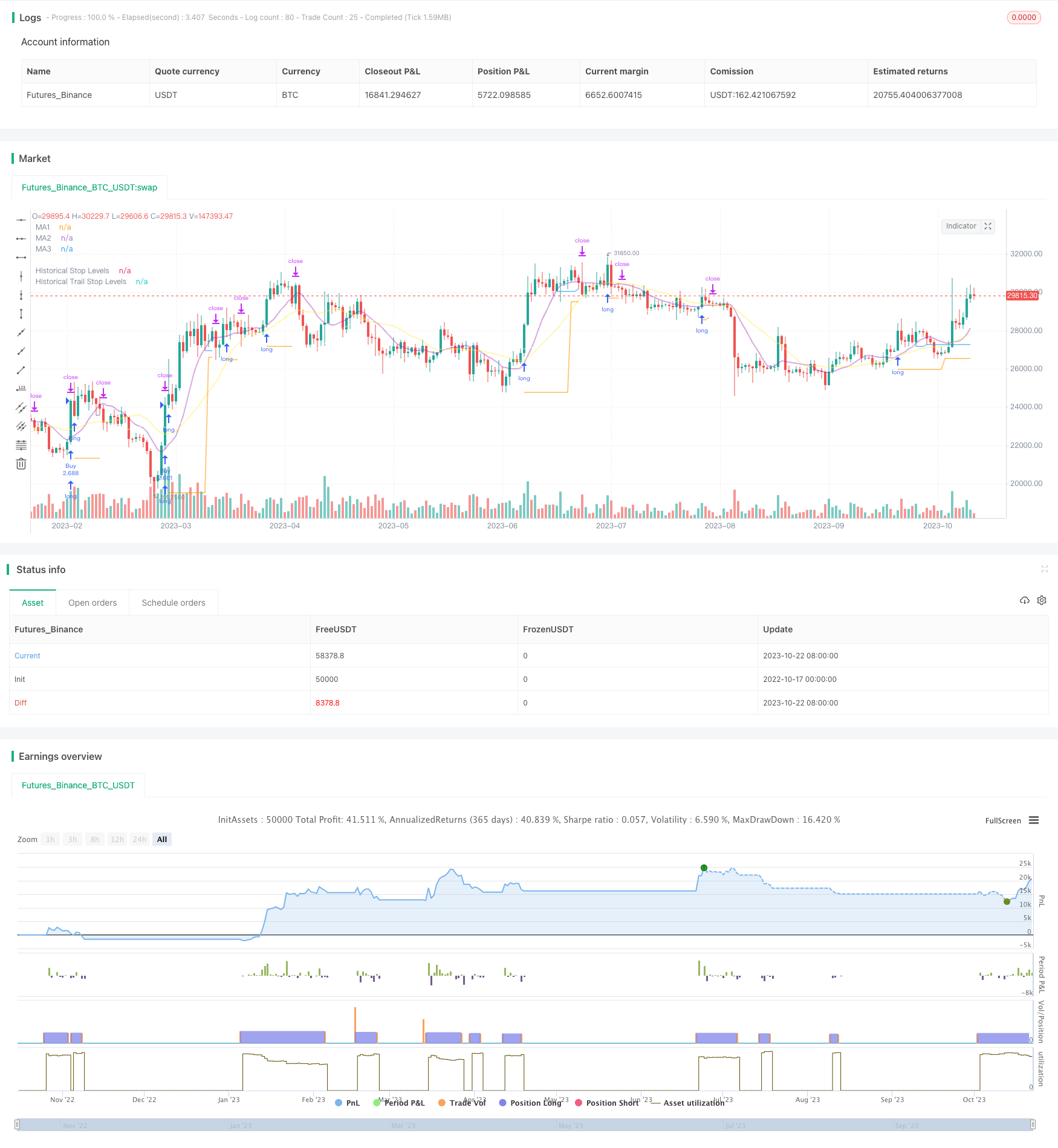

/*backtest

start: 2022-10-17 00:00:00

end: 2023-10-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © millerrh

// The intent of this strategy is to buy breakouts with a tight stop on smaller timeframes in the direction of the longer term trend.

// Then use a trailing stop of a close below either the 10 MA or 20 MA (user choice) on that larger timeframe as the position

// moves in your favor (i.e. whenever position price rises above the MA).

// Option of using daily ADR as a measure of finding contracting ranges and ensuring a decent risk/reward.

// (If the difference between the breakout point and your stop level is below a certain % of ATR, it could possibly find those consolidating periods.)

// V2 - updates code of original Qullamaggie Breakout to optimize and debug it a bit - the goal is to remove some of the whipsaw and poor win rate of the

// original by incorporating some of what I learned in the Breakout Trend Follower script.

//@version=4

strategy("Qullamaggie Breakout V2", overlay=true, initial_capital=100000, currency='USD', calc_on_every_tick = true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// === BACKTEST RANGE ===

Start = input(defval = timestamp("01 Jan 2019 06:00 +0000"), title = "Backtest Start Date", type = input.time, group = "backtest window and pivot history")

Finish = input(defval = timestamp("01 Jan 2100 00:00 +0000"), title = "Backtest End Date", type = input.time, group = "backtest window and pivot history")

// Inputs

showPivotPoints = input(title = "Show Historical Pivot Points?", type = input.bool, defval = false, group = "backtest window and pivot history",

tooltip = "Toggle this on to see the historical pivot points that were used. Change the Lookback Periods to adjust the frequency of these points.")

htf = input(defval="D", title="Timeframe of Moving Averages", type=input.resolution, group = "moving averages",

tooltip = "Allows you to set a different time frame for the moving averages and your trailing stop.

The default behavior is to identify good tightening setups on a larger timeframe

(like daily) and enter the trade on a breakout occuring on a smaller timeframe, using the moving averages of the larger timeframe to trail your stop.")

maType = input(defval="SMA", options=["EMA", "SMA"], title = "Moving Average Type", group = "moving averages")

ma1Length = input(defval = 10, title = "1st Moving Average Length", minval = 1, group = "moving averages")

ma2Length = input(defval = 20, title = "2nd Moving Average Length", minval = 1, group = "moving averages")

ma3Length = input(defval = 50, title = "3rd Moving Average Length", minval = 1, group = "moving averages")

useMaFilter = input(title = "Use 3rd Moving Average for Filtering?", type = input.bool, defval = true, group = "moving averages",

tooltip = "Signals will be ignored when price is under this slowest moving average. The intent is to keep you out of bear periods and only

buying when price is showing strength or trading with the longer term trend.")

trailMaInput = input(defval="1st Moving Average", options=["1st Moving Average", "2nd Moving Average"], title = "Trailing Stop", group = "stops",

tooltip = "Initial stops after entry follow the range lows. Once in profit, the trade gets more wiggle room and

stops will be trailed when price breaches this moving average.")

trailMaTF = input(defval="Same as Moving Averages", options=["Same as Moving Averages", "Same as Chart"], title = "Trailing Stop Timeframe", group = "stops",

tooltip = "Once price breaches the trail stop moving average, the stop will be raised to the low of that candle that breached. You can choose to use the

chart timeframe's candles breaching or use the same timeframe the moving averages use. (i.e. if daily, you wait for the daily bar to close before setting

your new stop level.)")

currentColorS = input(color.new(color.orange,50), title = "Current Range S/R Colors: Support", type = input.color, group = "stops", inline = "lineColor")

currentColorR = input(color.new(color.blue,50), title = " Resistance", type = input.color, group = "stops", inline = "lineColor")

// Pivot lookback

lbHigh = 3

lbLow = 3

// MA Calculations (can likely move this to a tuple for a single security call!!)

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

ma1 = security(syminfo.tickerid, htf, ma(maType, close, ma1Length))

ma2 = security(syminfo.tickerid, htf, ma(maType, close, ma2Length))

ma3 = security(syminfo.tickerid, htf, ma(maType, close, ma3Length))

plot(ma1, color=color.new(color.purple, 60), style=plot.style_line, title="MA1", linewidth=2)

plot(ma2, color=color.new(color.yellow, 60), style=plot.style_line, title="MA2", linewidth=2)

plot(ma3, color=color.new(color.white, 60), style=plot.style_line, title="MA3", linewidth=2)

// === USE ADR FOR FILTERING ===

// The idea here is that you want to buy in a consolodating range for best risk/reward. So here you can compare the current distance between

// support/resistance vs. the ADR and make sure you aren't buying at a point that is too extended.

useAdrFilter = input(title = "Use ADR for Filtering?", type = input.bool, defval = false, group = "adr filtering",

tooltip = "Signals will be ignored if the distance between support and resistance is larger than a user-defined percentage of ADR (or monthly volatility

in the stock screener). This allows the user to ensure they are not buying something that is too extended and instead focus on names that are consolidating more.")

adrPerc = input(defval = 120, title = "% of ADR Value", minval = 1, group = "adr filtering")

tableLocation = input(defval="Bottom", options=["Top", "Bottom"], title = "ADR Table Visibility", group = "adr filtering",

tooltip = "Place ADR table on the top of the pane, the bottom of the pane, or off.")

adrValue = security(syminfo.tickerid, "D", sma((high-low)/abs(low) * 100, 21)) // Monthly Volatility in Stock Screener (also ADR)

adrCompare = (adrPerc * adrValue) / 100

// === PLOT SWING HIGH/LOW AND MOST RECENT LOW TO USE AS STOP LOSS EXIT POINT ===

ph = pivothigh(high, lbHigh, lbHigh)

pl = pivotlow(low, lbLow, lbLow)

highLevel = valuewhen(ph, high[lbHigh], 0)

lowLevel = valuewhen(pl, low[lbLow], 0)

barsSinceHigh = barssince(ph) + lbHigh

barsSinceLow = barssince(pl) + lbLow

timeSinceHigh = time[barsSinceHigh]

timeSinceLow = time[barsSinceLow]

//Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

pvthis = fixnan(ph)

pvtlos = fixnan(pl)

hipc = change(pvthis) != 0 ? na : color.new(color.maroon, 0)

lopc = change(pvtlos) != 0 ? na : color.new(color.green, 0)

// Display Pivot lines

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=-lbHigh, title="Top Levels")

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=0, title="Top Levels 2")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=-lbLow, title="Bottom Levels")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=0, title="Bottom Levels 2")

// BUY AND SELL CONDITIONS

buyLevel = valuewhen(ph, high[lbHigh], 0) //Buy level at Swing High

// Conditions for entry

stopLevel = float(na) // Define stop level here as "na" so that I can reference it in the ADR calculation before the stopLevel is actually defined.

buyConditions = (useMaFilter ? buyLevel > ma3 : true) and

(useAdrFilter ? (buyLevel - stopLevel[1]) < adrCompare : true)

buySignal = crossover(high, buyLevel) and buyConditions

// Trailing stop points - when price punctures the moving average, move stop to the low of that candle - Define as function/tuple to only use one security call

trailMa = trailMaInput == "1st Moving Average" ? ma1 : ma2

f_getCross() =>

maCrossEvent = crossunder(low, trailMa)

maCross = valuewhen(maCrossEvent, low, 0)

maCrossLevel = fixnan(maCross)

maCrossPc = change(maCrossLevel) != 0 ? na : color.new(color.blue, 0) //Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

[maCrossEvent, maCross, maCrossLevel, maCrossPc]

crossTF = trailMaTF == "Same as Moving Averages" ? htf : ""

[maCrossEvent, maCross, maCrossLevel, maCrossPc] = security(syminfo.tickerid, crossTF, f_getCross())

plot(showPivotPoints ? maCrossLevel : na, color = maCrossPc, linewidth=1, offset=0, title="Ma Stop Levels")

// == STOP AND PRICE LEVELS ==

inPosition = strategy.position_size > 0

buyLevel := inPosition ? buyLevel[1] : buyLevel

stopDefine = valuewhen(pl, low[lbLow], 0) //Stop Level at Swing Low

inProfit = strategy.position_avg_price <= stopDefine[1]

// stopLevel := inPosition ? stopLevel[1] : stopDefine // Set stop loss based on swing low and leave it there

stopLevel := inPosition and not inProfit ? stopDefine : inPosition and inProfit ? stopLevel[1] : stopDefine // Trail stop loss until in profit

trailStopLevel = float(na)

// trying to figure out a better way for waiting on the trail stop - it can trigger if above the stopLevel even if the MA hadn't been breached since opening the trade

notInPosition = strategy.position_size == 0

inPositionBars = barssince(notInPosition)

maCrossBars = barssince(maCrossEvent)

trailCross = inPositionBars > maCrossBars

// trailCross = trailMa > stopLevel

trailStopLevel := inPosition and trailCross ? maCrossLevel : na

plot(inPosition ? stopLevel : na, style=plot.style_linebr, color=color.new(color.orange, 50), linewidth = 2, title = "Historical Stop Levels", trackprice=false)

plot(inPosition ? trailStopLevel : na, style=plot.style_linebr, color=color.new(color.blue, 50), linewidth = 2, title = "Historical Trail Stop Levels", trackprice=false)

// == PLOT SUPPORT/RESISTANCE LINES FOR CURRENT CHART TIMEFRAME ==

// Use a function to define the lines

// f_line(x1, y1, y2, _color) =>

// var line id = na

// line.delete(id)

// id := line.new(x1, y1, time, y2, xloc.bar_time, extend.right, _color)

// highLine = f_line(timeSinceHigh, highLevel, highLevel, currentColorR)

// lowLine = f_line(timeSinceLow, lowLevel, lowLevel, currentColorS)

// == ADR TABLE ==

tablePos = tableLocation == "Top" ? position.top_right : position.bottom_right

var table adrTable = table.new(tablePos, 2, 1, border_width = 3)

lightTransp = 90

avgTransp = 80

heavyTransp = 70

posColor = color.rgb(38, 166, 154)

negColor = color.rgb(240, 83, 80)

volColor = color.new(#999999, 0)

f_fillCellVol(_table, _column, _row, _value) =>

_transp = abs(_value) > 7 ? heavyTransp : abs(_value) > 4 ? avgTransp : lightTransp

_cellText = tostring(_value, "0.00") + "%\n" + "ADR"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(volColor, _transp), text_color = volColor, width = 6)

srDistance = (highLevel - lowLevel)/highLevel * 100

f_fillCellCalc(_table, _column, _row, _value) =>

_c_color = _value >= adrCompare ? negColor : posColor

_transp = _value >= adrCompare*0.8 and _value <= adrCompare*1.2 ? lightTransp :

_value >= adrCompare*0.5 and _value < adrCompare*0.8 ? avgTransp :

_value < adrCompare*0.5 ? heavyTransp :

_value > adrCompare*1.2 and _value <= adrCompare*1.5 ? avgTransp :

_value > adrCompare*1.5 ? heavyTransp : na

_cellText = tostring(_value, "0.00") + "%\n" + "Range"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(_c_color, _transp), text_color = _c_color, width = 6)

if barstate.islast

f_fillCellVol(adrTable, 0, 0, adrValue)

f_fillCellCalc(adrTable, 1, 0, srDistance)

// f_fillCellVol(adrTable, 0, 0, inPositionBars)

// f_fillCellCalc(adrTable, 1, 0, maCrossBars)

// == STRATEGY ENTRY AND EXIT ==

strategy.entry("Buy", strategy.long, stop = buyLevel, when = buyConditions)

stop = stopLevel > trailStopLevel ? stopLevel : close[1] > trailStopLevel and close[1] > trailMa ? trailStopLevel : stopLevel

strategy.exit("Sell", from_entry = "Buy", stop=stop)

- Strategi Pembalikan Pivot SuperTrend Dipertingkatkan

- Momentum Strategy Arbitrage Analisis Ujian Belakang

- Strategi Bollinger Bands Pembalikan Purata

- Strategi Dagangan Purata Bergerak Regresi Linear

- Strategi Penapis Bandpass Dual

- Strategi Dagangan Pasar Rintisan Rata-rata Bergerak Dua

- Bollinger Band Fitting Strategi

- Bull dan Bear Power Backtest Strategi

- Strategi Crossover Purata Bergerak

- Strategi Pelanggaran Momentum Stochastic

- Strategi Pembebasan Berdasarkan Saluran Camarilla

- Pergi dengan Trend Moving Average Crossover Strategi

- Strategi Penembusan Trend Bulanan

- Strategi Indeks Volatiliti DEMA

- Tren Mengikuti Strategi

- Strategi Crossover Stochastic Multi Timeframe

- Strategi Dagangan Pengesanan Purata Bergerak

- SMA Menembusi RSI Golden Cross Death Cross Strategi Dagangan

- Mengikuti Strategi Supertrend

- Strategi Gabungan Volatiliti Pembalikan Trend