Strategi Mengikuti Trend Breakout Momentum

Gambaran keseluruhan

Strategi ini menggunakan pelbagai petunjuk teknikal untuk mengenal pasti arah trend, untuk mengesan apabila trend berlaku, dan untuk mendapatkan keuntungan tambahan.

Prinsip Strategi

Menggunakan saluran Donchian untuk menentukan arah trend keseluruhan. Apabila harga menembusi saluran ini, pastikan bahawa trend berubah.

Hull Moving Average membantu menentukan arah trend. Indikator ini sensitif terhadap perubahan harga dan dapat mengesan perubahan trend lebih awal.

Sistem separuh orbit menghantar isyarat beli dan jual. Sistem ini berdasarkan saluran harga dan julat pergerakan sebenar rata-rata, untuk mengelakkan penembusan palsu.

Apabila saluran Donchian, petunjuk Hull dan sistem separuh orbit menghantar isyarat pada masa yang sama, keputusan tren berlaku pecah momentum yang kuat, ketika ini masuk ke dalam lapangan.

Syarat kedudukan rata: Apabila petunjuk di atas menghantar isyarat pembalikan, tentukan trend pembalikan dan segera hentikan kerugian.

Analisis kelebihan

Kombinasi pelbagai petunjuk, kehakiman yang lebih baik. Saluran Donchian menentukan asas, petunjuk Hull dan separuh orbit menentukan perincian, dan memahami titik perubahan yang tepat dalam trend.

Bergerak untuk terlibat dalam penembusan, mengejar keuntungan tambahan. Masuk hanya apabila trend berlaku penembusan kuat, mengelakkan terjebak dalam gegaran.

Hentikan kerugian dengan ketat untuk memastikan keselamatan dana. Apabila indikator memberi isyarat terbalik, hentikan kerugian dengan segera untuk mengelakkan kerugian berkembang.

Pengaturan parameter fleksibel, sesuai dengan pelbagai jenis pasaran. Parameter seperti panjang saluran, julat turun naik boleh disesuaikan, untuk mengoptimumkan untuk kitaran yang berbeza.

Ia mudah difahami dan dilaksanakan, dan boleh dikuasai oleh pemula. Kombinasi indikator dan syarat mudah difahami dan mudah diprogramkan.

Analisis risiko

Melewatkan peluang awal trend. Masuk lewat, kenaikan awal tidak dapat ditangkap.

Kejatuhan penembusan memutar balik kerugian. Kejatuhan penembusan dan pembalikan boleh berlaku selepas masuk, menyebabkan kerugian.

Penunjuk menghantar isyarat yang salah. Penghakiman penunjuk mungkin salah kerana parameter yang tidak betul.

Jumlah dagangan terhad. Hanya masuk apabila terdapat penembusan trend yang jelas, dan jumlah dagangan tahunan terhad.

Arah pengoptimuman

Mengoptimumkan kombinasi parameter. Mengetes pelbagai parameter untuk mencari kombinasi terbaik.

Menambah syarat penarikan balik linear stop loss. Mengelakkan stop loss terlalu awal dan kehilangan peluang trend.

Tambah penapis untuk penunjuk lain seperti MACD, KDJ dan penilaian tambahan untuk mengurangkan isyarat yang salah.

Optimumkan tempoh transaksi. Parameter untuk tempoh masa yang berbeza boleh dioptimumkan.

Meningkatkan kecekapan penggunaan dana. Meningkatkan kecekapan penggunaan dana melalui leverage, pelaburan tetap dan sebagainya.

ringkaskan

Strategi ini menggabungkan pelbagai petunjuk untuk menilai masa trend berlaku momentum pecah, dengan mengesan trend yang telah terbentuk untuk mencapai keuntungan yang lebih besar. Sistem kawalan risiko yang ketat, penyesuaian parameter yang fleksibel untuk menyesuaikan diri dengan keadaan pasaran yang berbeza. Walaupun frekuensi perdagangan rendah, tetapi setiap perdagangan berusaha untuk mendapatkan pulangan yang tinggi.

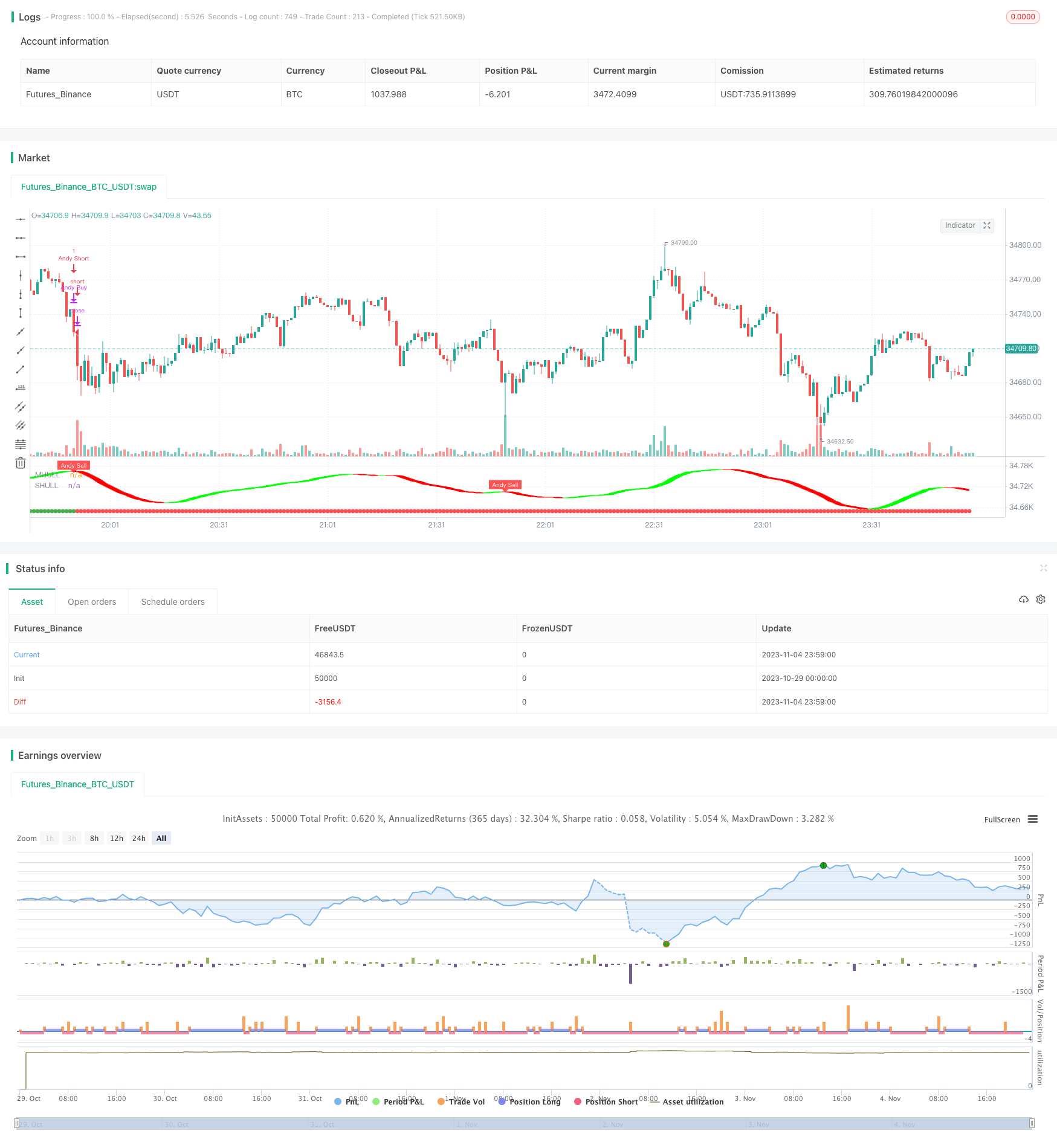

/*backtest

start: 2023-10-29 00:00:00

end: 2023-11-05 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kgynofomo

// @version=5

strategy(title="[Salavi] | Andy Super Pro Strategy",overlay = true)

//Doinchian Trend Ribbon

dlen = input.int(defval=30, minval=10)

dchannel(len) =>

float hh = ta.highest(len)

float ll = ta.lowest(len)

int trend = 0

trend := close > hh[1] ? 1 : close < ll[1] ? -1 : nz(trend[1])

trend

dchannelalt(len, maintrend) =>

float hh = ta.highest(len)

float ll = ta.lowest(len)

int trend = 0

trend := close > hh[1] ? 1 : close < ll[1] ? -1 : nz(trend[1])

maintrend == 1 ? trend == 1 ? #00FF00ff : #00FF009f : maintrend == -1 ? trend == -1 ? #FF0000ff : #FF00009f : na

maintrend = dchannel(dlen)

donchian_bull = maintrend==1

donchian_bear = maintrend==-1

//Hulls

src = input(hlc3, title='Source')

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(55, title='Length')

lengthMult = input(1.0, title='Length multiplier ')

useHtf = false

htf = '240'

switchColor = true

candleCol = false

visualSwitch = true

thicknesSwitch = 1

transpSwitch = 40

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

_hull = Mode(modeSwitch, src, int(length * lengthMult))

HULL = useHtf ? request.security(syminfo.ticker, htf, _hull) : _hull

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = switchColor ? HULL > HULL[2] ? #00ff00 : #ff0000 : #ff9800

hull_bull = HULL > HULL[2]

bull_start = hull_bull and hull_bull[1]==false

hull_bear = HULL < HULL[2]

bear_start = hull_bear and hull_bear[1]==false

barcolor(color=candleCol ? switchColor ? hullColor : na : na)

//halftrend

amplitude = input(title='Amplitude', defval=2)

channelDeviation = input(title='Channel Deviation', defval=2)

// showArrows = input(title='Show Arrows', defval=true)

// showChannels = input(title='Show Channels', defval=true)

var int trend = 0

var int nextTrend = 0

var float maxLowPrice = nz(low[1], low)

var float minHighPrice = nz(high[1], high)

var float up = 0.0

var float down = 0.0

float atrHigh = 0.0

float atrLow = 0.0

float arrowUp = na

float arrowDown = na

atr2 = ta.atr(100) / 2

dev = channelDeviation * atr2

highPrice = high[math.abs(ta.highestbars(amplitude))]

lowPrice = low[math.abs(ta.lowestbars(amplitude))]

highma = ta.sma(high, amplitude)

lowma = ta.sma(low, amplitude)

if nextTrend == 1

maxLowPrice := math.max(lowPrice, maxLowPrice)

if highma < maxLowPrice and close < nz(low[1], low)

trend := 1

nextTrend := 0

minHighPrice := highPrice

minHighPrice

else

minHighPrice := math.min(highPrice, minHighPrice)

if lowma > minHighPrice and close > nz(high[1], high)

trend := 0

nextTrend := 1

maxLowPrice := lowPrice

maxLowPrice

if trend == 0

if not na(trend[1]) and trend[1] != 0

up := na(down[1]) ? down : down[1]

arrowUp := up - atr2

arrowUp

else

up := na(up[1]) ? maxLowPrice : math.max(maxLowPrice, up[1])

up

atrHigh := up + dev

atrLow := up - dev

atrLow

else

if not na(trend[1]) and trend[1] != 1

down := na(up[1]) ? up : up[1]

arrowDown := down + atr2

arrowDown

else

down := na(down[1]) ? minHighPrice : math.min(minHighPrice, down[1])

down

atrHigh := down + dev

atrLow := down - dev

atrLow

ht = trend == 0 ? up : down

var color buyColor = color.blue

var color sellColor = color.red

htColor = trend == 0 ? buyColor : sellColor

// htPlot = plot(ht, title='HalfTrend', linewidth=2, color=htColor)

// atrHighPlot = plot(showChannels ? atrHigh : na, title='ATR High', style=plot.style_circles, color=color.new(sellColor, 0))

// atrLowPlot = plot(showChannels ? atrLow : na, title='ATR Low', style=plot.style_circles, color=color.new(buyColor, 0))

// fill(htPlot, atrHighPlot, title='ATR High Ribbon', color=color.new(sellColor, 90))

// fill(htPlot, atrLowPlot, title='ATR Low Ribbon', color=color.new(buyColor, 90))

HalfTrend_buySignal = not na(arrowUp) and trend == 0 and trend[1] == 1

HalfTrend_sellSignal = not na(arrowDown) and trend == 1 and trend[1] == 0

// plotshape(showArrows and buySignal ? atrLow : na, title='Arrow Up', style=shape.triangleup, location=location.absolute, size=size.tiny, color=color.new(buyColor, 0))

// plotshape(showArrows and sellSignal ? atrHigh : na, title='Arrow Down', style=shape.triangledown, location=location.absolute, size=size.tiny, color=color.new(sellColor, 0))

//ema

filter_ema = ta.ema(close,200)

ema_bull = close>filter_ema

ema_bear = close<filter_ema

atr_length = input.int(7)

atr = ta.atr(atr_length)

atr_rsi_length = input.int(50)

atr_rsi = ta.rsi(atr,atr_rsi_length)

atr_valid = atr_rsi>50

longCondition = bull_start and atr_valid

shortCondition = bear_start and atr_valid

Exit_long_condition = shortCondition

Exit_short_condition = longCondition

if longCondition

strategy.entry("Andy Buy",strategy.long, limit=close,comment="Andy Buy Here")

if Exit_long_condition

strategy.close("Andy Buy",comment="Andy Buy Out")

// strategy.entry("Andy fandan Short",strategy.short, limit=close,comment="Andy 翻單 short Here")

// strategy.close("Andy fandan Buy",comment="Andy short Out")

if shortCondition

strategy.entry("Andy Short",strategy.short, limit=close,comment="Andy short Here")

// strategy.exit("STR","Long",stop=longstoploss)

if Exit_short_condition

strategy.close("Andy Short",comment="Andy short Out")

// strategy.entry("Andy fandan Buy",strategy.long, limit=close,comment="Andy 翻單 Buy Here")

// strategy.close("Andy fandan Short",comment="Andy Buy Out")

inLongTrade = strategy.position_size > 0

inLongTradecolor = #58D68D

notInTrade = strategy.position_size == 0

inShortTrade = strategy.position_size < 0

// bgcolor(color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(close!=0,location = location.bottom,color = inLongTrade?color.green:inShortTrade?color.red:na)

plotshape(longCondition, title='Buy', text='Andy Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(shortCondition, title='Sell', text='Andy Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

Fi1 = plot(MHULL, title='MHULL', color=hullColor, linewidth=thicknesSwitch, transp=50)

Fi2 = plot(SHULL, title='SHULL', color=hullColor, linewidth=thicknesSwitch, transp=50)

fill(Fi1, Fi2, title='Band Filler', color=hullColor, transp=transpSwitch)