Trend Saluran Purata Bergerak Tiga Berikutan Strategi

Penulis:ChaoZhang, Tarikh: 2023-11-06 16:58:57Tag:

Ringkasan

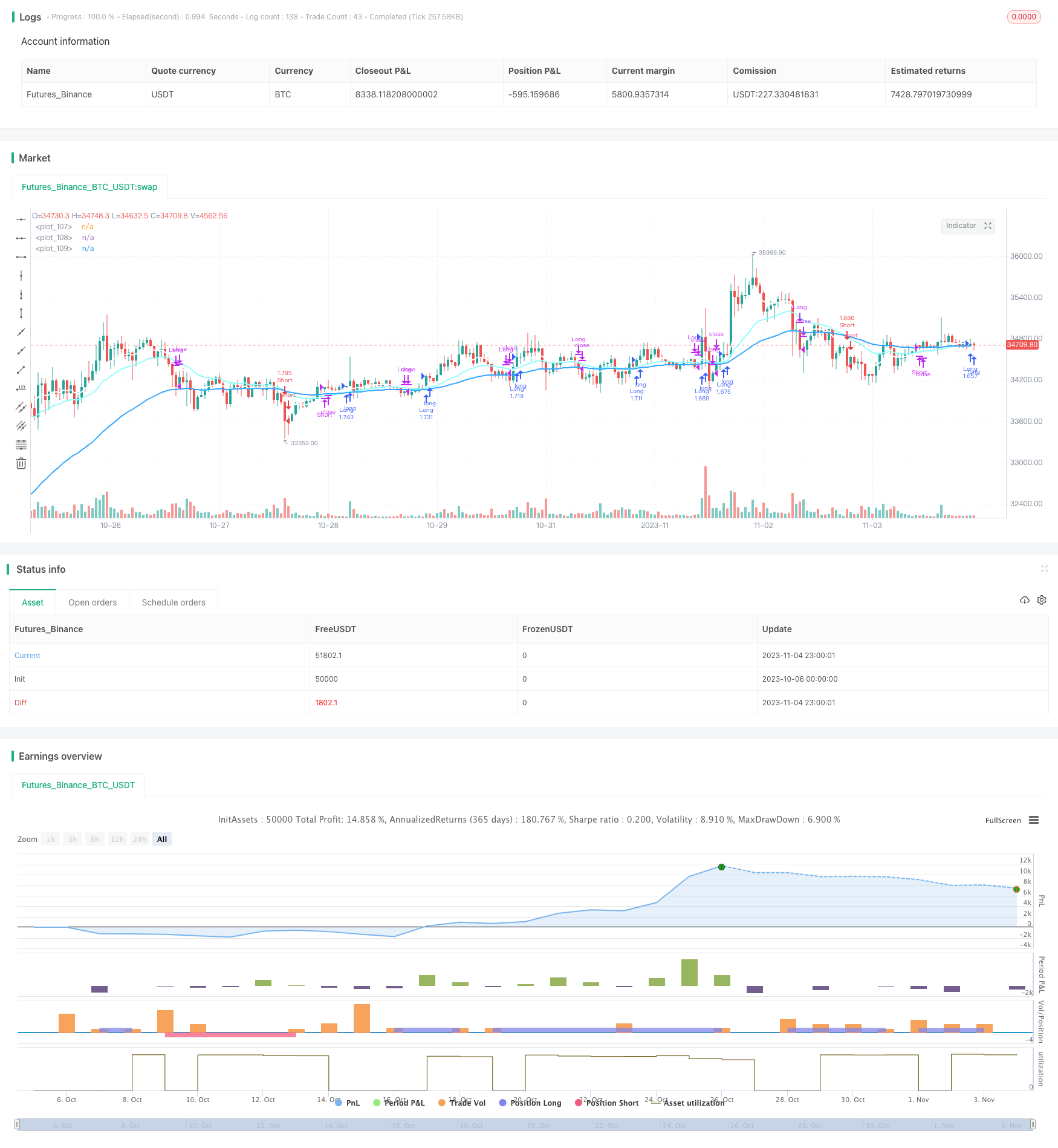

Strategi ini menggunakan gabungan tiga purata bergerak untuk menentukan arah trend berdasarkan urutan purata bergerak, supaya dapat mencapai trend berikut. Pergi panjang apabila purata bergerak pantas, purata bergerak sederhana, dan purata bergerak perlahan disusun mengikut urutan; pergi pendek apabila purata bergerak perlahan, purata bergerak sederhana, dan purata bergerak pantas disusun mengikut urutan.

Prinsip Strategi

Strategi ini menggunakan tiga purata bergerak dengan tempoh yang berbeza, termasuk purata bergerak pantas, purata bergerak sederhana, dan purata bergerak perlahan.

Syarat kemasukan:

- Lama: Apabila MA cepat > MA sederhana > MA perlahan, pasaran dianggap berada dalam trend menaik, pergi lama.

- Pendek: Apabila MA perlahan < MA sederhana < MA cepat, pasaran dianggap berada dalam trend menurun, pergi pendek.

Syarat keluar:

- Keluar MA: Tutup kedudukan apabila urutan tiga purata bergerak berbalik.

- Keluar TP/SL: Tetapkan titik keuntungan dan stop loss tetap, seperti 12% untuk TP dan 1% untuk SL, keluar apabila harga mencapai TP atau SL.

Strategi ini mudah dan langsung, menggunakan tiga purata bergerak untuk menentukan arah trend pasaran untuk trend selepas perdagangan, sesuai untuk pasaran dengan trend yang kuat.

Analisis Kelebihan

- Gunakan tiga purata bergerak untuk menentukan trend dan menapis bunyi pasaran.

- Purata bergerak dari tempoh yang berbeza dapat menentukan titik pembalikan trend dengan lebih tepat.

- Menggabungkan penunjuk purata bergerak dan TP / SL tetap untuk menguruskan risiko modal.

- Logik strategi adalah mudah dan intuitif, mudah difahami dan dilaksanakan.

- Parameter tempoh MA boleh dioptimumkan dengan mudah untuk menyesuaikan diri dengan keadaan pasaran kitaran yang berbeza.

Risiko dan Penambahbaikan

- Dalam pasaran kitaran panjang, purata bergerak mungkin mempunyai lebih banyak isyarat palsu, yang membawa kepada kerugian yang tidak perlu.

- Pertimbangkan untuk menambah penunjuk atau penapis lain untuk meningkatkan keuntungan.

- Mengoptimumkan gabungan parameter purata bergerak untuk menyesuaikan diri dengan keadaan pasaran yang lebih luas.

- Gabungkan dengan penunjuk kekuatan trend untuk mengelakkan membeli puncak dan menjual bahagian bawah.

- Tambah hentian automatik untuk mengelakkan kehilangan yang lebih besar.

Kesimpulan

Strategi trend berikut purata bergerak bertiga mempunyai logika yang jelas dan mudah difahami, menggunakan purata bergerak untuk menentukan arah trend untuk trend sederhana selepas perdagangan. Kelebihannya adalah mudah dilaksanakan, dan menyesuaikan parameter tempoh MA dapat disesuaikan dengan keadaan pasaran kitaran yang berbeza. Walau bagaimanapun, terdapat juga risiko isyarat palsu tertentu, yang boleh diperbaiki dengan menambahkan penunjuk atau keadaan lain untuk mengurangkan kerugian yang tidak perlu dan meningkatkan keuntungan strategi. Secara keseluruhan, strategi ini sesuai untuk pemula yang berminat dalam perdagangan trend untuk belajar dan berlatih.

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Jompatan

//@version=5

strategy('Strategy Triple Moving Average', overlay=true, initial_capital = 1000, commission_value=0.04, max_labels_count=200)

//INPUTS

mov_ave = input.string(defval="EMA", title='Moving Average type:', options= ["EMA", "SMA"])

period_1 = input.int(9, title='Period 1', inline="1", group= "============== Moving Average Inputs ==============")

period_2 = input.int(21, title='Period 2', inline="2", group= "============== Moving Average Inputs ==============")

period_3 = input.int(50, title='Period 3', inline="3", group= "============== Moving Average Inputs ==============")

source_1 = input.source(close, title='Source 1', inline="1", group= "============== Moving Average Inputs ==============")

source_2 = input.source(close, title='Source 2', inline="2", group= "============== Moving Average Inputs ==============")

source_3 = input.source(close, title='Source 3', inline="3", group= "============== Moving Average Inputs ==============")

//EXIT CONDITIONS

exit_ma = input.bool(true, title= "Exit by Moving average condition", group="================ EXIT CONDITIONS ================")

exit_TPSL = input.bool(false, title= "Exit by Take Profit and StopLoss", group="================ EXIT CONDITIONS ================")

TP = input.int(12, title='Take Profit', step=1, group="================ EXIT CONDITIONS ================")

SL = input.int(1, title='Stop Loss', step=1, group="================ EXIT CONDITIONS ================")

plot_TPSL = input.bool(false, title='Show TP/SL lines', group="================ EXIT CONDITIONS ================")

//Date filters

desde = input(defval= timestamp("01 Jan 2023 00:00 -3000"), title="From", inline="12", group= "============= DATE FILTERS =============")

hasta = input(defval= timestamp("01 Oct 2099 00:00 -3000"), title="To ", inline="13", group= "============= DATE FILTERS =============")

enRango = true

//COMMENTS

//entry_long_comment = input.string(defval=" ", title="Entry Long comment: ", inline="14", group="============= COMMENTS =============")

//exit_long_comment = input.string(defval=" ", title="Exit Long comment: ", inline="15", group="============= COMMENTS =============")

//entry_short_comment = input.string(defval=" ", title="Entry Short comment:", inline="16", group="============= COMMENTS =============")

//exit_short_comment = input.string(defval=" ", title="Exit Short comment: ", inline="17", group="============= COMMENTS =============")

//============================================================

//Selecting Moving average type

ma1 = mov_ave == "EMA" ? ta.ema(source_1, period_1) : ta.sma(source_1, period_1)

ma2 = mov_ave == "EMA" ? ta.ema(source_2, period_2) : ta.sma(source_2, period_2)

ma3 = mov_ave == "EMA" ? ta.ema(source_3, period_3) : ta.sma(source_3, period_3)

//============================================================

//Entry Long condition: Grouped Moving average from: (ma fast > ma middle > ma slow)

long_condition = (ma1 > ma2) and (ma2 > ma3)

//Entry Short condition: Grouped Moving average from: (ma fast < ma middle < ma slow)

short_condition = (ma1 < ma2) and (ma2 < ma3)

//============================================================

cantidad = strategy.equity / close

comprado_long = strategy.position_size > 0

comprado_short = strategy.position_size < 0

var long_profit_price = 0.0

var long_stop_price = 0.0

var short_profit_price = 0.0

var short_stop_price = 0.0

//============================================================

//ENTRY LONG

if not comprado_long and not comprado_short and long_condition and not long_condition[1] and enRango

strategy.entry('Long', strategy.long, qty=cantidad, comment= "Entry Long")

if exit_TPSL

long_profit_price := close * (1 + TP/100)

long_stop_price := close * (1 - SL/100)

else

long_profit_price := na

long_stop_price := na

//============================================================

//ENTRY SHORT

if not comprado_long and not comprado_short and short_condition and not short_condition[1] and enRango

strategy.entry('Short', strategy.short, qty=cantidad, comment= "Entry Short")

if exit_TPSL

short_profit_price := close * (1 - TP/100)

short_stop_price := close * (1 + SL/100)

else

short_profit_price := na

short_stop_price := na

//============================================================

//EXIT LONG

if comprado_long and exit_ma and long_condition[1] and not long_condition

strategy.close('Long', comment='Exit-Long(MA)')

if comprado_long and exit_TPSL

strategy.exit('Long', limit=long_profit_price, stop=long_stop_price, comment='Exit-Long(TP/SL)')

//============================================================

//EXIT SHORT

if comprado_short and exit_ma and short_condition[1] and not short_condition

strategy.close('Short', comment='Exit-Short(MA)')

if comprado_short and exit_TPSL

strategy.exit('Short', limit=short_profit_price, stop=short_stop_price, comment='Exit-Short(TP/SL)')

//============================================================

//PLOTS

plot(ma1, linewidth=2, color=color.rgb(255, 255, 255))

plot(ma2, linewidth=2, color=color.rgb(144, 255, 252))

plot(ma3, linewidth=2, color=color.rgb(49, 167, 255))

//Plot Take Profit line

plot(plot_TPSL ? comprado_long ? long_profit_price : comprado_short ? short_profit_price : na : na, color=color.new(color.lime, 30), style= plot.style_linebr)

//Plot StopLoss line

plot(plot_TPSL ? comprado_long ? long_stop_price : comprado_short ? short_stop_price : na : na, color=color.new(color.red, 30), style= plot.style_linebr)

- Strategi Pembalikan Momentum RSI

- Turtle Breakout EMA Cross Strategi

- Strategi RSI Moving Average Crossover

- Awan Ichimoku tanpa Offset dengan Strategi Penapis RSI

- Strategi Stochastic Berganda

- EMAC Eksponensial Moving Average Cross Optimized Strategy

- Bollinger Band Breakout Strategi

- Strategi Dagangan Reversi Gaussian

- Strategi Trend Naga Terbang

- Memintas Strategi Purata Bergerak

- Strategi SSL berganda dengan EMA Stop Loss

- Strategi Loopback Kijun

- Strategi Perdagangan Crossover Purata Bergerak

- Strategi Super Ichi

- CBMA Bollinger Bands Breaker Strategi

- Strategi Pembalikan Bidirectional dan Momentum Moving Average

- Strategi Perdagangan Julat RSI

- Strategi Pengembalian Bulanan Bipolar

- Strategi Dagangan Momentum Purata Bergerak Berbilang Jangka Masa

- Trend Berikutan Strategi Perdagangan Crossover Purata Bergerak