Strategi Pasangan Dwi Trek Pembalikan Momentum

Gambaran keseluruhan

Strategi ini menggunakan pelbagai indikator teknikal untuk mewujudkan pembalikan momentum dengan pasangan dua landasan, membentuk isyarat perdagangan. Strategi ini menggunakan titik pembalikan keputusan bentuk 123, membentuk isyarat pasangan dengan indikator CSI ergodic, untuk mewujudkan trend. Strategi ini bertujuan untuk menangkap trend garis pendek tengah, untuk mendapatkan keuntungan yang lebih tinggi.

Prinsip Strategi

Strategi ini terdiri daripada dua bahagian:

- 123, titik balik penghakiman bentuk

- ergodic CSI penunjuk menghasilkan isyarat pasangan

123 bentuk penghakiman adalah melalui 3 garis K terkini untuk menilai hubungan harga penutupan harga. Logik penghakiman khusus adalah: Jika kedua-dua garis K terdahulu dan satu garis penutupan kemudian naik, dan kedua-dua indikator stoch laju-lambat semasa berada di bawah 50, maka ia adalah isyarat untuk membeli. Jika kedua-dua garis K terdahulu dan satu garis penutupan berikutnya jatuh, dan kedua-dua indikator stoch laju dan perlahan semasa berada di atas 50, isyarat untuk menjual.

Indeks CSI ergodic mengambil kira pelbagai faktor seperti harga, gelombang sebenar, dan indikator trend, untuk menilai pergerakan pasaran secara menyeluruh, menghasilkan kawasan membeli dan menjual. Tanda beli dihasilkan apabila indikator berada di atas kawasan beli dan tanda jual dihasilkan apabila di bawah kawasan jual.

Akhirnya, isyarat pembalikan 123 bentuk dengan isyarat orbit CSI ergodic dikendalikan dengan cara yang sama, menghasilkan isyarat strategi akhir.

Kelebihan Strategik

- Menangkap Trend Garis Pendek, Potensi Keuntungan Lebih Besar

- Penghakiman bentuk terbalik, yang berkesan untuk menangkap titik perubahan

- Perpaduan dua laluan untuk mengurangkan isyarat palsu

Risiko Strategik

- Keadaan pasaran saham mungkin bertukar dan menyebabkan kemerosotan

- Keadaan yang bertukar-tukar mudah terjejas oleh pasaran yang bergolak

- Ruang untuk mengoptimumkan parameter terhad, kesan berubah-ubah

Arah pengoptimuman

- Optimumkan parameter untuk meningkatkan keberkesanan keuntungan strategi

- Meningkatkan logik stop loss dan mengurangkan kerugian tunggal

- Menggabungkan model pelbagai faktor untuk meningkatkan kualiti pilihan saham

ringkaskan

Strategi ini dapat mengesan trend garis pendek dalam pasangan dengan cara membalikkan bentuknya dan berpasangan dengan dua jalur. Ia mempunyai tahap kestabilan dan keuntungan yang lebih tinggi berbanding dengan satu petunjuk teknikal. Langkah seterusnya adalah untuk mengoptimumkan parameter lebih lanjut dan menambah modul stop loss dan pilihan saham untuk mengurangkan penarikan balik dan meningkatkan kesan keseluruhan.

/*backtest

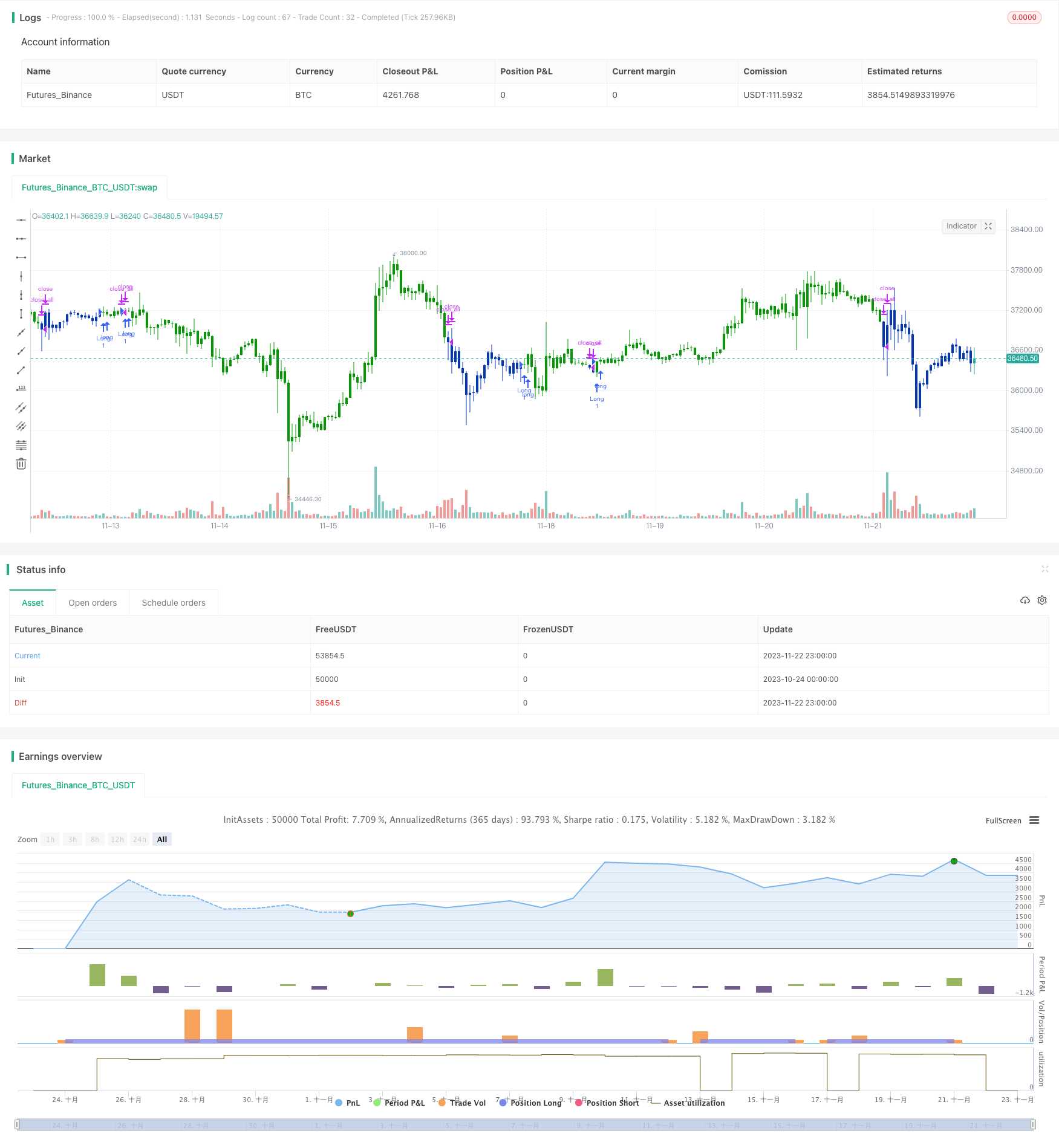

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 22/07/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship between

// price and momentum in step-by-step examples. From this grounding, he then looks

// at the deficiencies in other oscillators and introduces some innovative techniques,

// including a fresh twist on Stochastics. On directional issues, he analyzes the

// intricacies of ADX and offers a unique approach to help define trending and

// non-trending periods.

// This indicator plots Ergotic CSI and smoothed Ergotic CSI to filter out noise.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fADX(Len) =>

up = change(high)

down = -change(low)

trur = rma(tr, Len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, Len) / trur)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, Len) / trur)

sum = plus + minus

100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), Len)

ECSI(r,Length,BigPointValue,SmthLen,SellZone,BuyZone) =>

pos = 0

source = close

K = 100 * (BigPointValue / sqrt(r) / (150 + 5))

xTrueRange = atr(1)

xADX = fADX(Length)

xADXR = (xADX + xADX[1]) * 0.5

nRes = iff(Length + xTrueRange > 0, K * xADXR * xTrueRange / Length,0)

xCSI = iff(close > 0, nRes / close, 0)

xSMA_CSI = sma(xCSI, SmthLen)

pos := iff(xSMA_CSI > BuyZone, 1,

iff(xSMA_CSI <= SellZone, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Ergodic CSI", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

r = input(32, minval=1)

LengthECSI = input(1, minval=1)

BigPointValue = input(1.0, minval=0.00001)

SmthLen = input(5, minval=1)

SellZone = input(0.06, minval=0.00001)

BuyZone = input(0.02, minval=0.001)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posECSI = ECSI(r,LengthECSI,BigPointValue,SmthLen,SellZone,BuyZone)

pos = iff(posReversal123 == 1 and posECSI == 1 , 1,

iff(posReversal123 == -1 and posECSI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )