Strategi Penembusan SuperTrend Jangka Masa

Penulis:ChaoZhang, Tarikh: 2023-11-24 10:27:52Tag:

Ringkasan

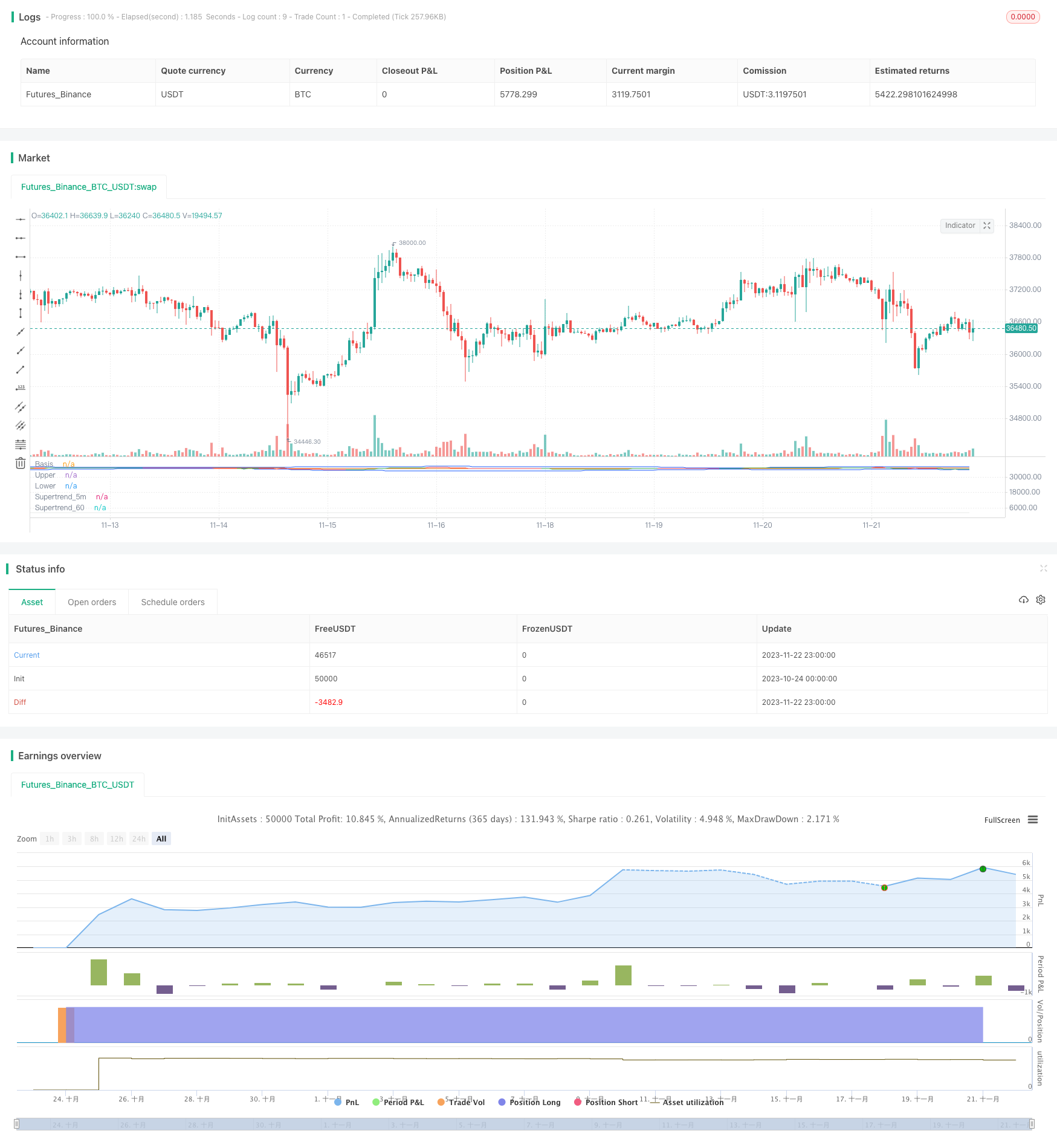

Strategi ini menggabungkan penunjuk SuperTrend merentasi pelbagai bingkai masa dan Bollinger Bands untuk mengenal pasti arah trend dan tahap sokongan / rintangan utama, dan memasuki perdagangan pada pecah semasa turun naik.

Logika Strategi

Fungsi Skrip Pine tersuaipine_supertrend()dilaksanakan untuk mengira SuperTrend merentasi jangka masa yang berbeza (contohnya 1 minit dan 5 minit) dan menentukan arah trend jangka masa yang lebih besar.

Bollinger Bands Band atas/bawah bertindak sebagai saluran. Breakout menandakan arah trend. Tutup di atas band atas menandakan pecah menaik. Tutup di bawah band bawah menandakan kerosakan menurun.

Isyarat kemasukan:

Panjang: Tutup > Garis Atas DAN Tutup > SuperTrend (ganda TF) Pendek: Tutup < Band Lower AND Tutup < SuperTrend (multiple TF)

Keluar:

Keluar panjang: Tutup < 5m SuperTrend Keluar Pendek: Tutup > 5m SuperTrend

Jadi ia bertujuan untuk menangkap penyebaran rangsangan antara SuperTrend dan BB dalam momentum yang tidak menentu.

Analisis Kelebihan

- Menggunakan SuperTrend merentasi bingkai masa untuk menentukan arah trend keyakinan tinggi

- BB Band bertindak sebagai tahap sokongan / rintangan utama untuk mengelakkan pecah palsu

- SuperTrend bertindak sebagai stop loss dinamik untuk mengawal risiko

Analisis Risiko

- SuperTrend boleh tertinggal titik perubahan dan pembalikan trend

- Parameter BB yang kurang optimum boleh menyebabkan terlalu banyak atau sedikit perdagangan

- Jurang malam yang tajam atau peristiwa berita boleh memukul stop loss

Pengurangan Risiko:

- Tambah lebih banyak penunjuk untuk mengesahkan isyarat dan mengelakkan pecah palsu

- Mengoptimumkan parameter BB untuk keseimbangan terbaik

- Memperluas penyangga stop loss untuk menampung jurang

Peluang Peningkatan

- Uji penunjuk trend lain seperti KDJ MACD untuk pengesahan isyarat tambahan

- Tambah model ML untuk kebarangkalian pecah

- Penyesuaian parameter untuk set parameter optimum

Kesimpulan

Strategi ini menggabungkan kekuatan SuperTrend dan Bollinger Bands menggunakan analisis jangka masa silang dan penembusan saluran untuk perdagangan kebarangkalian tinggi. Ia berkesan mengawal risiko dan dapat menjana keuntungan yang baik dalam instrumen yang tidak menentu. Pengoptimuman dan kombinasi penunjuk lanjut boleh meningkatkan prestasi.

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ambreshc95

//@version=5

strategy("Comodity_SPL_Strategy_01", overlay=false)

// function of st

// [supertrend, direction] = ta.supertrend(3, 10)

// plot(direction < 0 ? supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(direction > 0 ? supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

// VWAP

// src_vwap = input(title = "Source", defval = hlc3, group="VWAP Settings")

// [_Vwap,stdv,_] = ta.vwap(src_vwap,false,1)

// plot(_Vwap, title="VWAP", color = color.rgb(0, 0, 0))

// The same on Pine Script®

pine_supertrend(factor, atrPeriod,len_ma) =>

h= ta.sma(high,len_ma)

l= ta.sma(low,len_ma)

hlc_3 = (h+l)/2

src = hlc_3

atr = ta.atr(atrPeriod)

upperBand = src + factor * atr

lowerBand = src - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

lowerBand := lowerBand > prevLowerBand or close[1] < prevLowerBand ? lowerBand : prevLowerBand

upperBand := upperBand < prevUpperBand or close[1] > prevUpperBand ? upperBand : prevUpperBand

int direction = na

float superTrend = na

prevSuperTrend = superTrend[1]

if na(atr[1])

direction := 1

else if prevSuperTrend == prevUpperBand

direction := close > upperBand ? -1 : 1

else

direction := close < lowerBand ? 1 : -1

superTrend := direction == -1 ? lowerBand : upperBand

[superTrend, direction]

len_ma_given = input(75, title="MA_SMA_ST")

[Pine_Supertrend, pineDirection] = pine_supertrend(3, 10,len_ma_given)

// plot(pineDirection < 0 ? Pine_Supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(pineDirection > 0 ? Pine_Supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

//

// Define Supertrend parameters

atrLength = input(10, title="ATR Length")

factor = input(3.0, title="Factor")

// // Calculate Supertrend

[supertrend, direction] = ta.supertrend(factor, atrLength)

st_color = supertrend > close ? color.red : color.green

// // Plot Supertrend

// plot(supertrend, "Supertrend", st_color)

//

// BB Ploting

length = input.int(75, minval=1)

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.5, minval=0.001, maxval=50, title="StdDev")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// h= ta.sma(high,60)

// l= ta.sma(low,60)

// c= sma(close,60)

// hlc_3 = (h+l)/2

// supertrend60 = request.security(syminfo.tickerid, supertrend)

// // Define timeframes for signals

tf1 = input(title="Timeframe 1", defval="1")

tf2 = input(title="Timeframe 2",defval="5")

// tf3 = input(title="Timeframe 3",defval="30")

// // // Calculate Supertrend on multiple timeframes

supertrend_60 = request.security(syminfo.tickerid, tf1, Pine_Supertrend)

supertrend_5m = request.security(syminfo.tickerid, tf2, supertrend)

// supertrend3 = request.security(syminfo.tickerid, tf3, supertrend)

// // Plot Supertrend_60

st_color_60 = supertrend_60 > close ? color.rgb(210, 202, 202, 69) : color.rgb(203, 211, 203, 52)

plot(supertrend_60, "Supertrend_60", st_color_60)

// // Plot Supertrend_5m

st_color_5m = supertrend_5m > close ? color.red : color.green

plot(supertrend_5m, "Supertrend_5m", st_color_5m)

ma21 = ta.sma(close,21)

// rsi = ta.rsi(close,14)

// rsima = ta.sma(rsi,14)

// Define the Indian Standard Time (IST) offset from GMT

ist_offset = 5.5 // IST is GMT+5:30

// Define the start and end times of the trading session in IST

// start_time = timestamp("GMT", year, month, dayofmonth, 10, 0) + ist_offset * 60 * 60

// end_time = timestamp("GMT", year, month, dayofmonth, 14, 0) + ist_offset * 60 * 60

// Check if the current time is within the trading session

// in_trading_session = timenow >= start_time and timenow <= end_time

in_trading_session = not na(time(timeframe.period, "0945-1430"))

// bgcolor(inSession ? color.silver : na)

out_trading_session = not na(time(timeframe.period, "1515-1530"))

// // // Define buy and sell signals

buySignal = close>upper and close > supertrend_5m and close > supertrend_60 and close > ma21 and in_trading_session //close > supertrend and

sellSignal = close<lower and close < supertrend_5m and close < supertrend_60 and close < ma21 and in_trading_session //close < supertrend and

var bool long_position = false

var bool long_exit = false

var float long_entry_price = 0

var float short_entry_price = 0

if buySignal and not long_position

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_label_up, color = color.green, size = size.small)

long_position := true

strategy.entry("Buy",strategy.long)

long_exit := (close < supertrend_5m)

if long_position and long_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.green, size = size.tiny)

long_position := false

strategy.exit("Exit","Buy",stop = close)

var bool short_position = false

var bool short_exit = false

if sellSignal and not short_position

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_label_down, color = color.red, size = size.small)

short_position := true

strategy.entry("Sell",strategy.short)

short_exit := (close > supertrend_5m)

if short_position and short_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.red, size = size.tiny)

short_position := false

strategy.exit("Exit","Sell", stop = close)

if out_trading_session

long_position := false

strategy.exit("Exit","Buy",stop = close)

short_position := false

strategy.exit("Exit","Sell", stop = close)

// if long_position

// long_entry_price := close[1] + 50//bar_index

// if short_position

// short_entry_price := close[1] - 50//bar_index

// if (long_position and high[1] > long_entry_price)

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_triangledown, color = color.yellow, size = size.tiny)

// if (short_position and low[1] < short_entry_price)

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_triangleup, color = color.yellow, size = size.tiny)

- Strategi Pelaburan Kuantitatif Berdasarkan Tarikh Beli Bulanan

- Strategi Perdagangan Penyimpangan Standard Bertingkat

- Strategi Perdagangan Kepelbagaian Purata Bergerak

- Strategi Crossover EMA

- Strategi Dagangan Crossover EMA Jangka Pendek, Jangka Menengah dan Jangka Panjang

- Trend Mengikut Strategi Berdasarkan Penguraian Siri Masa dan Bollinger Bands Bertimbang Volume

- Strategi Perdagangan Kuantitatif Osilator Harga

- Trend Multi-penunjuk Mengikut Strategi

- CCI Dual Timeframe Trend Mengikut Strategi

- Strategi Pengesanan Trend T3-CCI

- Strategi gabungan purata bergerak pembalikan momentum

- Peningkatan purata bergerak dinamik Strategi Martin

- Kombo Pembalikan Momentum Dual-Rail Strategi Pemadan

- Ichimoku Cloud Quant Strategi

- Adaptive mengambil keuntungan dan strategi berhenti kerugian berdasarkan bingkai masa berganda dan penunjuk momentum

- Strategi Perdagangan Grid RSI Berbilang Tempoh

- Strategi Crossover Purata Bergerak Eksponensial Berganda

- Strategi RSI Purata Bergerak Pengesanan Trend

- Strategi crossover harga penutupan bulanan dan purata bergerak

- Bollinger Bands Breakout trend jangka pendek mengikut Strategi