Strategi penapisan purata bergerak berganda

Penulis:ChaoZhang, Tarikh: 2023-11-27 17:03:08Tag:

Ringkasan

Ini adalah strategi yang menggunakan purata bergerak dan Bollinger Bands untuk penilaian trend, digabungkan dengan penapisan pecah dan prinsip-prinsip stop loss.

Prinsip Strategi

Strategi ini terdiri daripada bahagian utama berikut:

-

Penghakiman trend: Gunakan MACD untuk menilai trend harga dan membezakan trend menaik dan menurun.

-

Penapisan julat: Gunakan Bollinger Bands untuk menilai julat turun naik harga dan menapis isyarat yang tidak menembusi julat.

-

Pengesahan purata bergerak berganda: EMA pantas dan EMA perlahan membentuk purata bergerak berganda untuk mengesahkan isyarat trend. Isyarat beli dihasilkan hanya apabila EMA pantas > EMA perlahan.

-

Mekanisme Stop Loss: Tetapkan titik stop loss. Tutup kedudukan apabila harga menembusi titik stop loss ke arah yang tidak menguntungkan.

Logik untuk isyarat masuk adalah:

- MACD menilai trend menaik

- Harga pecah melalui rel atas Bollinger Bands

- EMA pantas lebih tinggi daripada EMA perlahan

Apabila ketiga-tiga syarat dipenuhi pada masa yang sama, isyarat beli dihasilkan.

Terdapat dua jenis kedudukan penutupan, mengambil keuntungan dan berhenti kerugian. titik mengambil keuntungan adalah harga kemasukan dikalikan dengan peratusan tertentu, dan titik berhenti kerugian adalah harga kemasukan dikalikan dengan peratusan tertentu. apabila harga memecahkan mana-mana titik, posisi ditutup.

Analisis Kelebihan

Kelebihan strategi ini ialah:

- Boleh menangkap perubahan trend dengan tepat pada masanya dengan lebih sedikit traceback.

- Mengurangkan isyarat palsu dengan menapis dengan purata bergerak berganda, meningkatkan kualiti isyarat.

- Mekanisme stop loss berkesan mengawal kerugian tunggal.

- Ruang pengoptimuman parameter yang besar yang boleh diselaraskan ke keadaan optimum.

Analisis Risiko

Terdapat juga beberapa risiko dalam strategi ini:

- Isyarat palsu yang dihasilkan di pasaran sampingan boleh membawa kepada kerugian.

- Tetapan stop loss yang tidak betul boleh menyebabkan kerugian yang tidak perlu.

- Parameter yang tidak sesuai boleh mengakibatkan prestasi strategi yang buruk.

Untuk menangani risiko ini, strategi boleh dioptimumkan dengan menyesuaikan parameter, menetapkan kedudukan stop loss, dll.

Arahan pengoptimuman

Strategi ini boleh dioptimumkan dalam aspek berikut:

- Sesuaikan panjang purata bergerak berganda untuk mencari kombinasi parameter yang optimum.

- Uji kaedah stop loss yang berbeza, seperti trailing stop loss, oscillating stop loss, dll.

- Uji parameter MACD untuk mencari tetapan optimum.

- Gunakan pembelajaran mesin untuk pengoptimuman parameter automatik.

- Tambah syarat tambahan kepada isyarat penapis.

Dengan menguji tetapan parameter yang berbeza dan menilai pulangan dan nisbah Sharpe, keadaan optimum strategi dapat dijumpai.

Kesimpulan

Ini adalah strategi kuantitatif yang menggunakan penghakiman trend, penapisan julat, pengesahan purata bergerak berganda dan idea-idea stop loss. Ia dapat menentukan arah trend dengan berkesan dan mencapai keseimbangan antara pemaksiman keuntungan dan kawalan risiko. Melalui pengoptimuman parameter, pembelajaran mesin dan cara lain, strategi mempunyai ruang yang besar untuk peningkatan untuk mencapai hasil yang lebih baik.

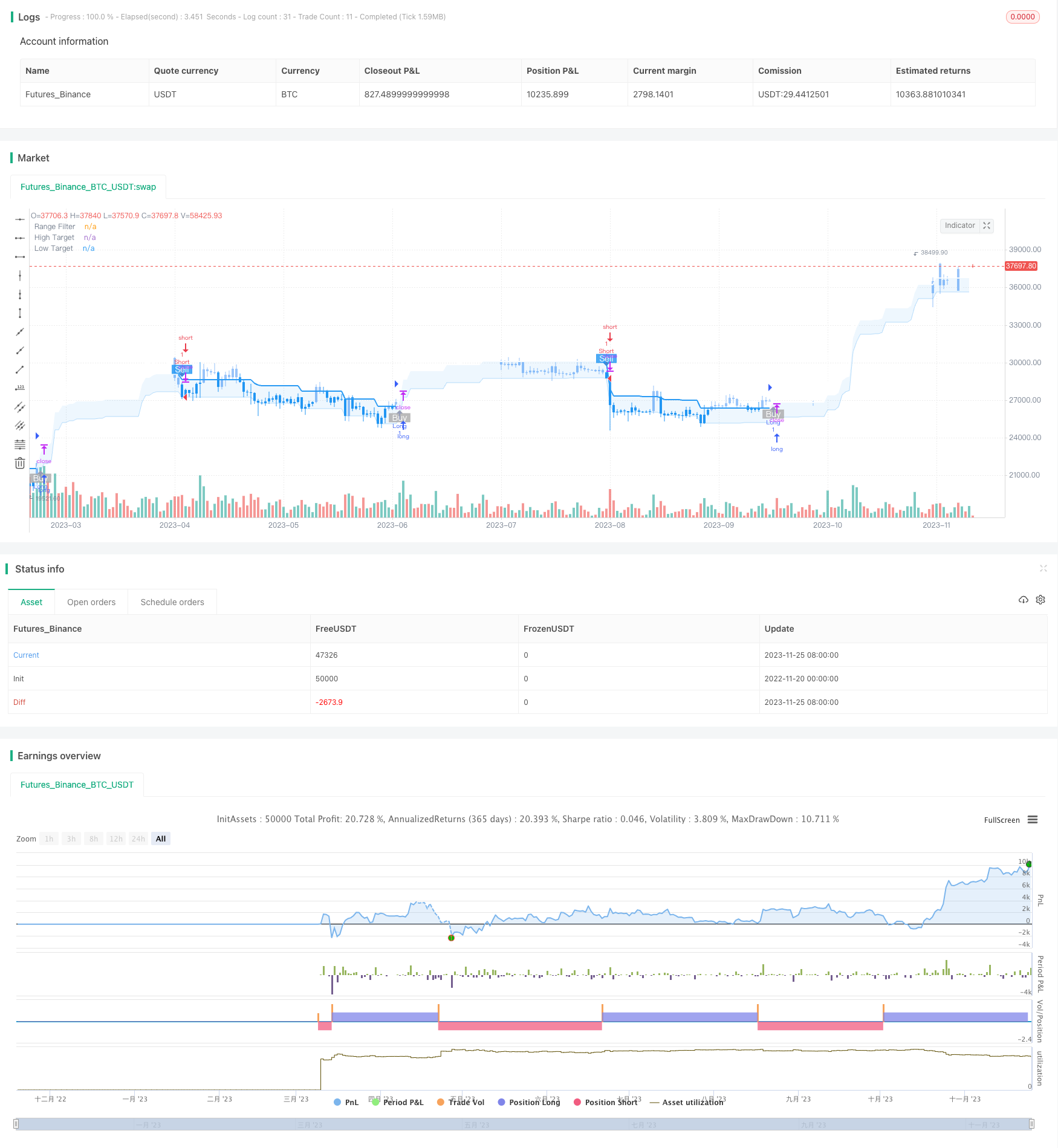

/*backtest

start: 2022-11-20 00:00:00

end: 2023-11-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Range Filter Buy and Sell Strategies", shorttitle="Range Filter Strategies", overlay=true,pyramiding = 5)

// Original Script > @DonovanWall

// Adapted Version > @guikroth

//

// Updated PineScript to version 5

// Republished by > @tvenn

// Strategizing by > @RonLeigh

//////////////////////////////////////////////////////////////////////////

// Settings for 5min chart, BTCUSDC. For Other coin, change the parameters

//////////////////////////////////////////////////////////////////////////

SS = input.bool(false,"Percentage Take Profit Stop Loss")

longProfitPerc = input.float(title='LongProfit(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

shortProfitPerc = input.float(title='ShortProfit(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

longLossPerc = input.float(title='LongStop(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

shortLossPerc = input.float(title='ShortStop(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

// Color variables

upColor = color.white

midColor = #90bff9

downColor = color.blue

// Source

src = input(defval=close, title="Source")

// Sampling Period

// Settings for 5min chart, BTCUSDC. For Other coin, change the paremeters

per = input.int(defval=100, minval=1, title="Sampling Period")

// Range Multiplier

mult = input.float(defval=3.0, minval=0.1, title="Range Multiplier")

// Smooth Average Range

smoothrng(x, t, m) =>

wper = t * 2 - 1

avrng = ta.ema(math.abs(x - x[1]), t)

smoothrng = ta.ema(avrng, wper) * m

smoothrng

smrng = smoothrng(src, per, mult)

// Range Filter

rngfilt(x, r) =>

rngfilt = x

rngfilt := x > nz(rngfilt[1]) ? x - r < nz(rngfilt[1]) ? nz(rngfilt[1]) : x - r :

x + r > nz(rngfilt[1]) ? nz(rngfilt[1]) : x + r

rngfilt

filt = rngfilt(src, smrng)

// Filter Direction

upward = 0.0

upward := filt > filt[1] ? nz(upward[1]) + 1 : filt < filt[1] ? 0 : nz(upward[1])

downward = 0.0

downward := filt < filt[1] ? nz(downward[1]) + 1 : filt > filt[1] ? 0 : nz(downward[1])

// Target Bands

hband = filt + smrng

lband = filt - smrng

// Colors

filtcolor = upward > 0 ? upColor : downward > 0 ? downColor : midColor

barcolor = src > filt and src > src[1] and upward > 0 ? upColor :

src > filt and src < src[1] and upward > 0 ? upColor :

src < filt and src < src[1] and downward > 0 ? downColor :

src < filt and src > src[1] and downward > 0 ? downColor : midColor

filtplot = plot(filt, color=filtcolor, linewidth=2, title="Range Filter")

// Target

hbandplot = plot(hband, color=color.new(upColor, 70), title="High Target")

lbandplot = plot(lband, color=color.new(downColor, 70), title="Low Target")

// Fills

fill(hbandplot, filtplot, color=color.new(upColor, 90), title="High Target Range")

fill(lbandplot, filtplot, color=color.new(downColor, 90), title="Low Target Range")

// Bar Color

barcolor(barcolor)

// Break Outs

longCond = bool(na)

shortCond = bool(na)

longCond := src > filt and src > src[1] and upward > 0 or

src > filt and src < src[1] and upward > 0

shortCond := src < filt and src < src[1] and downward > 0 or

src < filt and src > src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

// alertcondition(longCondition, title="Buy alert on Range Filter", message="Buy alert on Range Filter")

// alertcondition(shortCondition, title="Sell alert on Range Filter", message="Sell alert on Range Filter")

// alertcondition(longCondition or shortCondition, title="Buy and Sell alert on Range Filter", message="Buy and Sell alert on Range Filter")

////////////// 副

sensitivity = input(150, title='Sensitivity')

fastLength = input(20, title='FastEMA Length')

slowLength = input(40, title='SlowEMA Length')

channelLength = input(20, title='BB Channel Length')

multt = input(2.0, title='BB Stdev Multiplier')

DEAD_ZONE = nz(ta.rma(ta.tr(true), 100)) * 3.7

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, multt) =>

basis = ta.sma(source, length)

dev = multt * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, multt) =>

basis = ta.sma(source, length)

dev = multt * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength)) * sensitivity

e1 = calc_BBUpper(close, channelLength, multt) - calc_BBLower(close, channelLength, multt)

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

duoad = trendUp > 0 and trendUp > e1

kongad = trendDown > 0 and trendDown > e1

duo = longCondition and duoad

kong = shortCondition and kongad

//Alerts

plotshape(longCondition and trendUp > e1 and trendUp > 0 , title="Buy Signal", text="Buy", textcolor=color.white, style=shape.labelup, size=size.small, location=location.belowbar, color=color.new(#aaaaaa, 20))

plotshape(shortCondition and trendDown > e1 and trendDown > 0 , title="Sell Signal", text="Sell", textcolor=color.white, style=shape.labeldown, size=size.small, location=location.abovebar, color=color.new(downColor, 20))

if longCondition and trendUp > e1 and trendUp > 0

strategy.entry('Long',strategy.long, comment = "buy" )

if shortCondition and trendDown > e1 and trendDown > 0

strategy.entry('Short',strategy.short, comment = "sell" )

longlimtPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortlimtPrice = strategy.position_avg_price * (1 - shortProfitPerc)

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

if (strategy.position_size > 0) and SS == true

strategy.exit(id="Long",comment_profit = "Profit",comment_loss = "StopLoss", stop=longStopPrice,limit = longlimtPrice)

if (strategy.position_size < 0) and SS == true

strategy.exit(id="Short",comment_profit = "Profit",comment_loss = "StopLoss", stop=shortStopPrice,limit = shortlimtPrice)

- Trend Mengikuti Strategi Berdasarkan Saluran Keltner

- Strategi RSI Moving Average Crossover

- strategi perdagangan momentum breakout

- Strategi Dagangan Kuantitatif Multi-faktor RSI dan CCI yang Dinamis

- Strategi Trend Kuantitatif Super Z

- Strategi corak candlestick

- Strategi Stop Loss Pembalikan Momentum CK

- Strategi Penembusan Osilasi Purata Bergerak Berganda

- Momentum Gelas Garis Purata Bergerak dan Garis Purata Bergerak Strategi Crossover

- Strategi Perdagangan Crossover Purata Bergerak

- Strategi harga purata bergerak silang

- Tidak ada strategi perdagangan saluran SSL yang tidak masuk akal

- Strategi Perbezaan Momentum Moving Average

- Strategi Penembusan Crossover Rata-rata Bergerak Berganda

- Strategi Dagangan Kuantitatif Frekuensi Tinggi Penapis Ganda

- Strategi Dagangan Kuantitatif Berdasarkan Penunjuk RSI

- Trend Mengikut Strategi Berdasarkan Purata Bergerak

- Empat Petunjuk Strategi Pembalikan Momentum

- RSI MACD London Strategi Perdagangan Bitcoin

- Strategi Ujian Kembali Pemutus Tinggi Rendah