EMA/ADX/VOL - Pembunuh Kripto

Strategi perdagangan kuantitatif untuk masuk menggunakan EMA untuk menentukan arah trend, ADX untuk menentukan kekuatan trend, dan penapisan jumlah dagangan

Prinsip

Strategi ini mula-mula menggunakan EMA rata-rata lima tempoh yang berbeza untuk menentukan arah trend harga, apabila semua EMA rata-rata lima naik, ia dianggap sebagai tren multi-kepala, dan apabila semua EMA rata-rata lima jatuh, ia dianggap sebagai tren kosong.

Kemudian menggunakan indikator ADX untuk menilai kekuatan dan kelemahan trend, apabila garis DI + lebih tinggi daripada garis DI dan nilai ADX melebihi setinggi ditetapkan, ia dinilai sebagai pergerakan multi-arah yang kuat, dan apabila garis DI lebih tinggi daripada garis DI + dan nilai ADX melebihi setinggi ditetapkan, ia dinilai sebagai pergerakan kosong.

Pada masa yang sama, untuk membuat pengesahan tambahan dengan menggunakan jumlah transaksi yang pecah, diperlukan jumlah transaksi K Line semasa yang lebih besar daripada kelipatan rata-rata kitaran tertentu, untuk mengelakkan masuk ke dalam kedudukan yang salah dalam jumlah yang rendah.

Keputusan komprehensif mengenai arah trend, kekuatan trend, dan jumlah dagangan membentuk logik perdagangan bertopeng dan kosong dalam strategi ini.

Kelebihan

Menggunakan sistem EMA rata-rata untuk menentukan arah trend lebih dipercayai daripada EMA rata-rata tunggal.

Menggunakan indikator ADX untuk menilai kekuatan dan kelemahan trend, untuk mengelakkan salah masuk apabila tiada trend yang jelas.

Mekanisme penapisan jumlah urus niaga, memastikan sokongan jumlah urus niaga yang mencukupi, meningkatkan kebolehpercayaan strategi.

Dalam kes ini, ia adalah lebih baik untuk membuat keputusan yang lebih tepat dan lebih dipercayai.

Terdapat lebih banyak parameter strategi, dan anda boleh terus meningkatkan kesan strategi dengan mengoptimumkan parameter.

Risiko dan penyelesaian

Dalam keadaan gegaran, penilaian EMA, ADX dan lain-lain mungkin memberi isyarat yang salah, yang menyebabkan kerugian yang tidak perlu, parameter boleh disesuaikan dengan sewajarnya, atau penambahan penunjuk lain untuk penilaian tambahan.

Syarat penapisan jumlah dagangan terlalu ketat dan mungkin kehilangan peluang pasaran, parameter penapisan jumlah dagangan boleh dikurangkan dengan sewajarnya.

Frekuensi dagangan yang dihasilkan oleh strategi mungkin lebih tinggi, perlu berhati-hati dengan pengurusan dana dan mengawal saiz kedudukan tunggal dengan betul.

Arah pengoptimuman

Uji kombinasi parameter yang berbeza untuk mencari parameter terbaik dan meningkatkan kesan strategi.

Menambah petunjuk lain, seperti MACD, KDJ dan lain-lain dalam kombinasi dengan EMA dan ADX, untuk membentuk keputusan pembukaan kedudukan yang lebih komprehensif.

Menambah strategi hentikan kerugian untuk mengawal risiko lebih jauh.

Mengoptimumkan strategi pengurusan kedudukan untuk pengurusan dana yang lebih saintifik.

ringkaskan

Strategi ini mengambil kira arah trend harga, kekuatan trend dan maklumat jumlah perdagangan secara menyeluruh, membentuk peraturan pembukaan kedudukan, ke tahap tertentu mengelakkan kesilapan yang biasa dan mempunyai kebolehpercayaan yang kuat. Namun, masih perlu memperbaiki sistem strategi dengan pengoptimuman parameter, pilihan penunjuk dan kawalan risiko untuk meningkatkan lagi kesannya. Secara keseluruhan, kerangka strategi ini mempunyai potensi pengembangan dan ruang pengoptimuman yang besar.

/*backtest

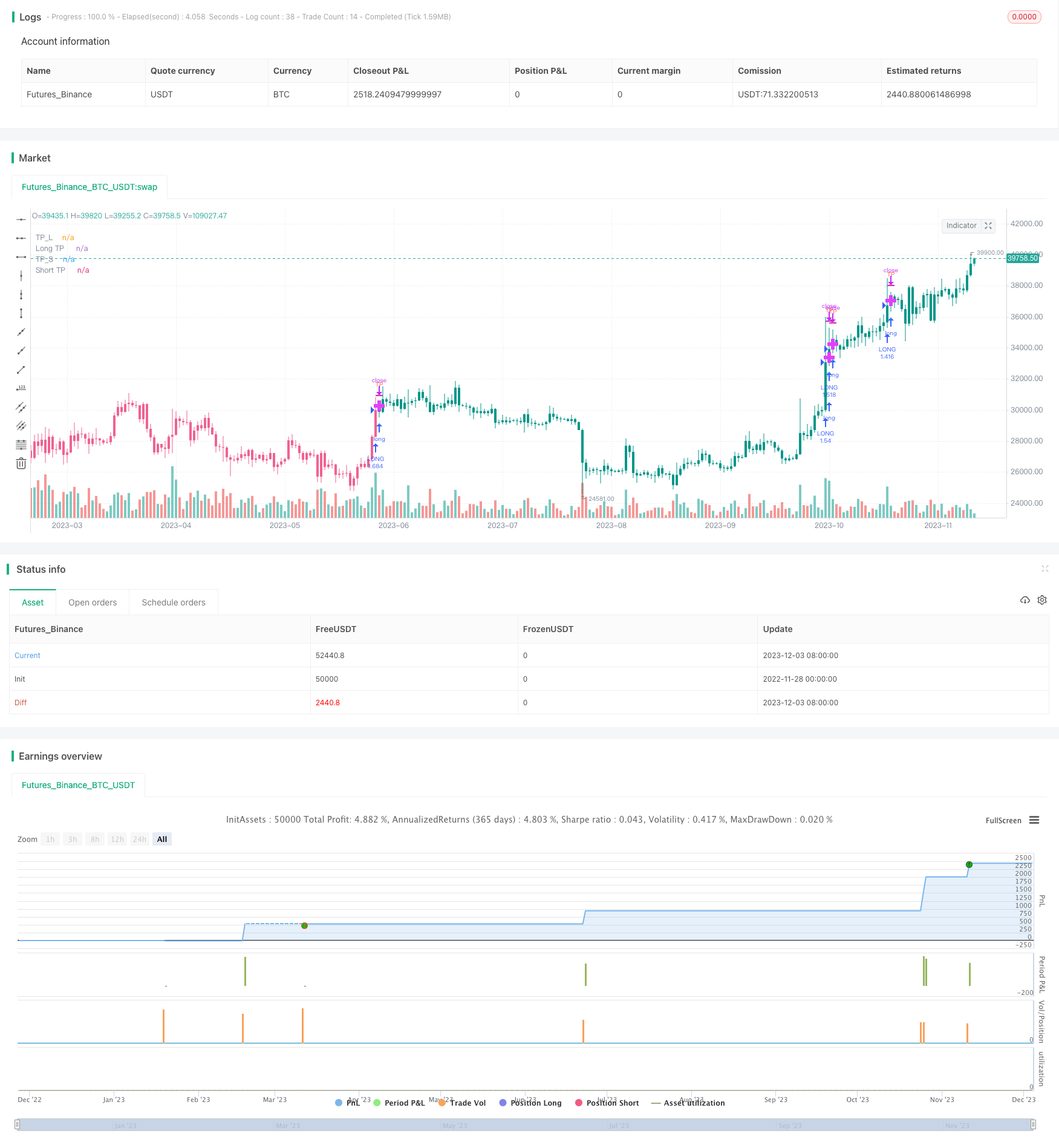

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BabehDyo

//@version=4

strategy("EMA/ADX/VOL-CRYPTO KILLER [15M]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

//SOURCE =============================================================================================================================================================================================================================================================================================================

src = input(open, title=" Source")

// Inputs ========================================================================================================================================================================================================================================================================================================

//ADX --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="ADX")

ADX_len = input(21, title=" Adx Length", type=input.integer, minval = 1, group="ADX")

th = input(20, title=" Adx Treshold", type=input.float, minval = 0, step = 0.5, group="ADX")

//EMA--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length_ema1 = input(8, title=" 1-EMA Length", minval=1)

Length_ema2 = input(13, title=" 2-EMA Length", minval=1)

Length_ema3 = input(21, title=" 3-EMA Length", minval=1)

Length_ema4 = input(34, title=" 4-EMA Length", minval=1)

Length_ema5 = input(55, title=" 5-EMA Length", minval=1)

// Range Filter ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

per_ = input(15, title=" Period", minval=1, group = "Range Filter")

mult = input(2.6, title=" mult.", minval=0.1, step = 0.1, group = "Range Filter")

// Volume ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

volume_f = input(3.2, title=" Volume mult.", minval = 0, step = 0.1, group="Volume")

sma_length = input(20, title=" Volume lenght", minval = 1, group="Volume")

volume_f1 = input(1.9, title=" Volume mult. 1", minval = 0, step = 0.1, group="Volume")

sma_length1 = input(22, title=" Volume lenght 1", minval = 1, group="Volume")

//TP PLOTSHAPE -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tp_long0 = input(0.9, title=" % TP Long", type = input.float, minval = 0, step = 0.1, group="Target Point")

tp_short0 = input(0.9, title=" % TP Short", type = input.float, minval = 0, step = 0.1, group="Target Point")

// SL PLOTSHAPE ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

sl0 = input(4.2, title=" % Stop loss", type = input.float, minval = 0, step = 0.1, group="Stop Loss")

//INDICATORS =======================================================================================================================================================================================================================================================================================================

//ADX-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

//EMA-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

xPrice = close

EMA1 = ema(xPrice, Length_ema1)

EMA2 = ema(xPrice, Length_ema2)

EMA3 = ema(xPrice, Length_ema3)

EMA4 = ema(xPrice, Length_ema4)

EMA5 = ema(xPrice, Length_ema5)

L_ema = EMA1 < close and EMA2 < close and EMA3 < close and EMA4 < close and EMA5 < close

S_ema = EMA1 > close and EMA2 > close and EMA3 > close and EMA4 > close and EMA5 > close

// Range Filter ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool L_RF = na, var bool S_RF = na

Range_filter(_src, _per_, _mult)=>

var float _upward = 0.0

var float _downward = 0.0

wper = (_per_*2) - 1

avrng = ema(abs(_src - _src[1]), _per_)

_smoothrng = ema(avrng, wper)*_mult

_filt = _src

_filt := _src > nz(_filt[1]) ? ((_src-_smoothrng) < nz(_filt[1]) ? nz(_filt[1]) : (_src-_smoothrng)) : ((_src+_smoothrng) > nz(_filt[1]) ? nz(_filt[1]) : (_src+_smoothrng))

_upward := _filt > _filt[1] ? nz(_upward[1]) + 1 : _filt < _filt[1] ? 0 : nz(_upward[1])

_downward := _filt < _filt[1] ? nz(_downward[1]) + 1 : _filt > _filt[1] ? 0 : nz(_downward[1])

[_smoothrng,_filt,_upward,_downward]

[smoothrng, filt, upward, downward] = Range_filter(src, per_, mult)

hband = filt + smoothrng

lband = filt - smoothrng

L_RF := high > hband and upward > 0

S_RF := low < lband and downward > 0

// Volume -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Volume_condt = volume > sma(volume,sma_length)*volume_f

Volume_condt1 = volume > sma(volume,sma_length1)*volume_f1

//STRATEGY ==========================================================================================================================================================================================================================================================================================================

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

L_1 = L_adx and Volume_condt and L_RF and L_ema

S_1 = S_adx and Volume_condt and S_RF and S_ema

L_2 = L_adx and L_RF and L_ema and Volume_condt1

S_2 = S_adx and S_RF and S_ema and Volume_condt1

L_basic_condt = L_1 or L_2

S_basic_condt = S_1 or S_2

longCond := L_basic_condt

shortCond := S_basic_condt

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

//POSITION PRICE-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

last_open_longCondition := longCondition ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition ? sum_long/nLongs : shortCondition ? sum_short/nShorts : na

//TP---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool long_tp = na, var bool short_tp = na

var int last_long_tp = na, var int last_short_tp = na

var bool Final_Long_tp = na, var bool Final_Short_tp = na

var bool Final_Long_sl0 = na, var bool Final_Short_sl0 = na

var bool Final_Long_sl = na, var bool Final_Short_sl = na

var int last_long_sl = na, var int last_short_sl = na

tp_long = ((nLongs > 1) ? tp_long0 / nLongs : tp_long0) / 100

tp_short = ((nShorts > 1) ? tp_short0 / nShorts : tp_short0) / 100

long_tp := high > (fixnan(Position_Price) * (1 + tp_long)) and in_longCondition

short_tp := low < (fixnan(Position_Price) * (1 - tp_short)) and in_shortCondition

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

Final_Long_tp := (long_tp and last_longCondition > nz(last_long_tp[1]) and last_longCondition > nz(last_long_sl[1]))

Final_Short_tp := (short_tp and last_shortCondition > nz(last_short_tp[1]) and last_shortCondition > nz(last_short_sl[1]))

L_tp = iff(Final_Long_tp, fixnan(Position_Price) * (1 + tp_long) , na)

S_tp = iff(Final_Short_tp, fixnan(Position_Price) * (1 - tp_short) , na)

//TP SIGNALS--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tplLevel = (in_longCondition and

(last_longCondition > nz(last_long_tp[1])) and

(last_longCondition > nz(last_long_sl[1])) and not Final_Long_sl[1]) ?

(nLongs > 1) ?

(fixnan(Position_Price) * (1 + tp_long)) : (last_open_longCondition * (1 + tp_long)) : na

tpsLevel = (in_shortCondition and

(last_shortCondition > nz(last_short_tp[1])) and

(last_shortCondition > nz(last_short_sl[1])) and not Final_Short_sl[1]) ?

(nShorts > 1) ?

(fixnan(Position_Price) * (1 - tp_short)) : (last_open_shortCondition * (1 - tp_short)) : na

//SL ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Risk = sl0

Percent_Capital = 99

sl = in_longCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nLongs)))) :

in_shortCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nShorts)))) : sl0

Normal_long_sl = ((in_longCondition and low <= ((1 - (sl / 100)) * (fixnan(Position_Price)))))

Normal_short_sl = ((in_shortCondition and high >= ((1 + (sl / 100)) * (fixnan(Position_Price)))))

last_long_sl := Normal_long_sl ? time : nz(last_long_sl[1])

last_short_sl := Normal_short_sl ? time : nz(last_short_sl[1])

Final_Long_sl := Normal_long_sl and last_longCondition > nz(last_long_sl[1]) and last_longCondition > nz(last_long_tp[1]) and not Final_Long_tp

Final_Short_sl := Normal_short_sl and last_shortCondition > nz(last_short_sl[1]) and last_shortCondition > nz(last_short_tp[1]) and not Final_Short_tp

//RE-ENTRY ON TP-HIT-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Final_Long_tp or Final_Long_sl

CondIni_long := -1

sum_long := 0.0

nLongs := na

if Final_Short_tp or Final_Short_sl

CondIni_short := 1

sum_short := 0.0

nShorts := na

// Colors ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bar_color = in_longCondition ? #009688 : in_shortCondition ? #f06292 : color.orange

barcolor (color = Bar_color)

//PLOTS==============================================================================================================================================================================================================================================================================================================

plot(L_tp, title = "TP_L", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

plot(S_tp, title = "TP_S", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

//Price plots ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plot((nLongs > 1) or (nShorts > 1) ? Position_Price : na, title = "Price", color = in_longCondition ? color.aqua : color.orange, linewidth = 2, style = plot.style_cross)

plot(tplLevel, title="Long TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

plot(tpsLevel, title="Short TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

//PLOTSHAPES----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(Final_Long_tp, title="TP Long Signal", style = shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , text="TP", textcolor=color.red, transp = 0 )

plotshape(Final_Short_tp, title="TP Short Signal", style = shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny , text="TP", textcolor=color.green, transp = 0 )

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.tiny , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , transp = 0 )

// Backtest ==================================================================================================================================================================================================================================================================================================================================

if L_basic_condt

strategy.entry ("LONG", strategy.long )

if S_basic_condt

strategy.entry ("SHORT", strategy.short )

strategy.exit("TP_L", "LONG", profit = (abs((last_open_longCondition * (1 + tp_long)) - last_open_longCondition) / syminfo.mintick), limit = nLongs >= 1 ? strategy.position_avg_price * (1 + tp_long) : na, loss = (abs((last_open_longCondition*(1-(sl/100)))-last_open_longCondition)/syminfo.mintick))

strategy.exit("TP_S", "SHORT", profit = (abs((last_open_shortCondition * (1 - tp_short)) - last_open_shortCondition) / syminfo.mintick), limit = nShorts >= 1 ? strategy.position_avg_price*(1-(tp_short)) : na, loss = (abs((last_open_shortCondition*(1+(sl/100)))-last_open_shortCondition)/syminfo.mintick))

//By BabehDyo