SSL Hybrid Exit Arrow Quant Strategy

Penulis:ChaoZhang, Tarikh: 2023-12-06 15:54:12Tag:

Ringkasan

Strategi Quant Arrow Keluaran Hibrid SSL adalah strategi perdagangan kuantitatif jangka pendek berdasarkan purata bergerak dan penunjuk harga maksimum / minimum. Ia menggunakan anak panah EXIT dari penunjuk hibrid SSL untuk menentukan titik masuk dan keluar, dengan penunjuk QQE sebagai penapis, dan mengira stop loss dan kedudukan tambahan dengan penunjuk ATR. Strategi ini sesuai untuk pelabur yang sensitif terhadap turun naik pasaran dan mempunyai kawalan risiko yang ketat.

Logika Strategi

Strategi ini menggunakan anak panah EXIT dari penunjuk hibrid SSL untuk menentukan titik masuk. Di atas anak panah EXIT adalah titik tinggi EXIT, dan di bawahnya adalah titik rendah EXIT. Isyarat jual dihasilkan apabila harga penutupan melintasi di bawah titik tinggi EXIT, dan isyarat beli dihasilkan apabila harga penutupan melintasi di atas titik rendah EXIT.

Untuk meningkatkan kebolehpercayaan isyarat, penunjuk QQE diperkenalkan sebagai keadaan penapis tambahan. Isyarat yang dihasilkan oleh anak panah EXIT hanya dilaksanakan apabila penunjuk QQE berada dalam arah yang sama.

Untuk mengawal risiko, strategi ini menggunakan kelipatan ATR untuk mengira stop loss dan kedudukan tambahan. Stop loss untuk kedudukan pendek adalah harga penutupan + ATR × 1.8. Stop loss untuk kedudukan panjang adalah harga penutupan

Setiap kumpulan kedudukan tambahan mempunyai stop loss sendiri. Kumpulan pertama sebanyak 20% daripada saiz kedudukan akan berhenti kehilangan apabila mencapai tahap stop loss, sementara kedudukan yang selebihnya terus dipegang.

Kelebihan

- Keuntungan daripada anak panah EXIT dan kawalan risiko yang berkesan dengan stop loss yang tepat pada masanya

- Penapis QQE meningkatkan ketepatan isyarat

- Menggunakan penunjuk ATR untuk mengira kedudukan stop loss dinamik dan kedudukan tambahan berdasarkan turun naik pasaran untuk kawalan risiko yang lebih tepat

- Manfaatkan sepenuhnya trend melalui kedudukan tambahan berpasangan

Risiko

- Mengambil keuntungan keseluruhan atau stop loss berasaskan asas boleh dianggap.

- Perbezaan dalam kepekaan terhadap turun naik pasaran antara anak panah EXIT dan QQE boleh menyebabkan isyarat bertentangan. Parameter harus diselaraskan untuk mengurangkan konflik isyarat.

- Posisi tambahan yang terlalu agresif cenderung mengejar puncak dan membuang bahagian bawah.

Arahan pengoptimuman

- Menggabungkan penunjuk asas seperti nisbah P / B, nisbah P / E dan hasil dividen untuk tahap mengambil keuntungan berdasarkan asas.

- Sesuaikan parameter QQE untuk menyelaraskan isyarat dengan anak panah EXIT.

- Mengurangkan nisbah tambahan berdasarkan sentimen pasaran di pasaran yang berbeza.

- Uji set parameter optimum berdasarkan penggunaan maksimum, nisbah risiko-balasan, dll.

Ringkasan

Strategi ini menggunakan anak panah EXIT dari penunjuk hibrid SSL sebagai inti isyarat, dengan penunjuk QQE dan ATR sebagai penapis dan untuk stop loss. Pengumpulan keuntungan dicapai melalui kedudukan tambahan yang disatukan. Ini adalah strategi kuantitatif jangka pendek yang sesuai untuk mengesan trend pasaran jangka pendek. Strategi ini mempunyai kawalan penarikan dan keupayaan mengurangkan risiko, tetapi risiko seperti konflik isyarat dan mengejar puncak / menghancurkan bahagian bawah harus diperhatikan. Menggabungkan pengambilan keuntungan berdasarkan asas dan lebih berhati-hati ketika menentukan pasaran berayun dan mengurangkan nisbah tambahan dapat memperluaskan potensi keuntungan strategi ini.

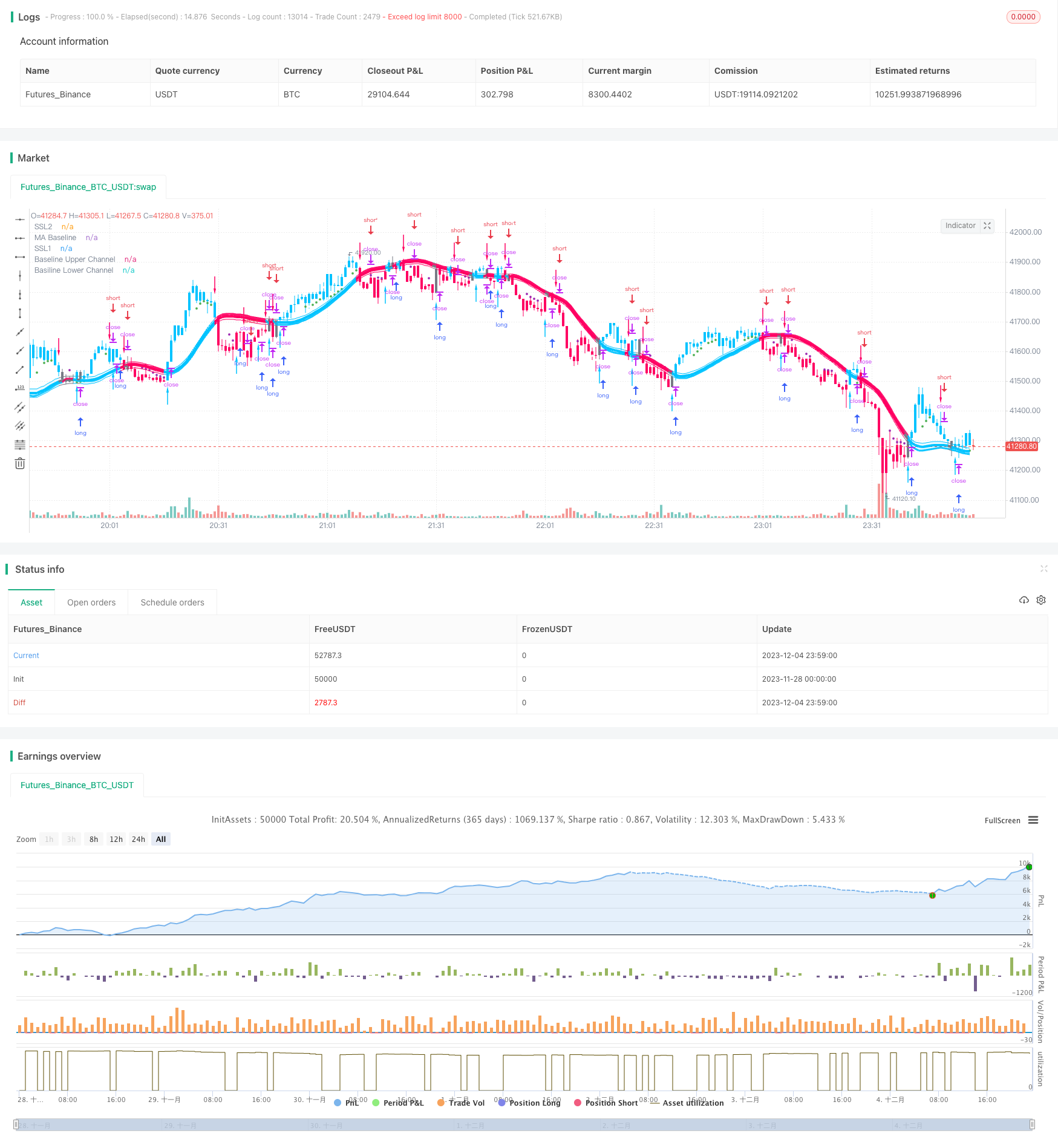

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-05 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

args: [["TradeAmount",2,358374]]

*/

//@version=4

// Strategy based on the SSL Hybrid indicator by Mihkel00

// Designed for the purpose of back testing

// Strategy:

// - Enters both long and short trades based on SSL1 crossing the baseline

// - Stop Loss calculated based on ATR multiplier

// - Take Profit calculated based on 2 ATR multipliers and exits percentage of position on TP1 and TP2

//

// Credits:

// SSL Hybrid Mihkel00 https://www.tradingview.com/u/Mihkel00/

// -------------------------------- SSL HYBRID ---------------------------------

strategy("SSL Exit Arrow Strategy", overlay=true)

show_Baseline = input(title="Show Baseline", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

show_SSL1 = input(title="Show SSL1", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

show_atr = input(title="Show ATR bands", type=input.bool, defval=false, group="SSL Hybrid Indicator Settings")

//ATR

atrlen = input(14, "ATR Period", group="SSL Hybrid Indicator Settings")

mult = input(1, "ATR Multi", step=0.1, group="SSL Hybrid Indicator Settings")

smoothing = input(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"], group="SSL Hybrid Indicator Settings")

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input(title="SSL1 / Baseline Type", type=input.string, defval="HMA", options=["SMA","EMA","DEMA","TEMA","LSMA","WMA","MF","VAMA","TMA","HMA", "JMA", "Kijun v2", "EDSMA","McGinley"], group="SSL Hybrid Indicator Settings")

len = input(title="SSL1 / Baseline Length", defval=60, group="SSL Hybrid Indicator Settings")

SSL2Type = input(title="SSL2 / Continuation Type", type=input.string, defval="JMA", options=["SMA","EMA","DEMA","TEMA","WMA","MF","VAMA","TMA","HMA", "JMA","McGinley"], group="SSL Hybrid Indicator Settings")

len2 = input(title="SSL 2 Length", defval=5, group="SSL Hybrid Indicator Settings")

//

SSL3Type = input(title="EXIT Type", type=input.string, defval="HMA", options=["DEMA","TEMA","LSMA","VAMA","TMA","HMA","JMA", "Kijun v2", "McGinley", "MF"], group="SSL Hybrid Indicator Settings")

len3 = input(title="EXIT Length", defval=15, group="SSL Hybrid Indicator Settings")

src = input(title="Source", type=input.source, defval=close, group="SSL Hybrid Indicator Settings")

//

tema(src, len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

(3 * ema1) - (3 * ema2) + ema3

kidiv = input(defval=1,maxval=4, title="Kijun MOD Divider", group="SSL Hybrid Indicator Settings")

jurik_phase = input(title="* Jurik (JMA) Only - Phase", type=input.integer, defval=3, group="SSL Hybrid Indicator Settings")

jurik_power = input(title="* Jurik (JMA) Only - Power", type=input.integer, defval=1, group="SSL Hybrid Indicator Settings")

volatility_lookback = input(10, title="* Volatility Adjusted (VAMA) Only - Volatility lookback length", group="SSL Hybrid Indicator Settings")

//MF

beta = input(0.8,minval=0,maxval=1,step=0.1, title="Modular Filter, General Filter Only - Beta", group="SSL Hybrid Indicator Settings")

feedback = input(false, title="Modular Filter Only - Feedback", group="SSL Hybrid Indicator Settings")

z = input(0.5,title="Modular Filter Only - Feedback Weighting",step=0.1, minval=0, maxval=1, group="SSL Hybrid Indicator Settings")

//EDSMA

ssfLength = input(title="EDSMA - Super Smoother Filter Length", type=input.integer, minval=1, defval=20, group="SSL Hybrid Indicator Settings")

ssfPoles = input(title="EDSMA - Super Smoother Filter Poles", type=input.integer, defval=2, options=[2, 3], group="SSL Hybrid Indicator Settings")

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = sqrt(2) * PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(arg)

c2 = b1

c3 = -pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

get3PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(1.738 * arg)

c1 = pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ma(type, src, len) =>

float result = 0

if type=="TMA"

result := sma(sma(src, ceil(len / 2)), floor(len / 2) + 1)

if type=="MF"

ts=0.,b=0.,c=0.,os=0.

//----

alpha = 2/(len+1)

a = feedback ? z*src + (1-z)*nz(ts[1],src) : src

//----

b := a > alpha*a+(1-alpha)*nz(b[1],a) ? a : alpha*a+(1-alpha)*nz(b[1],a)

c := a < alpha*a+(1-alpha)*nz(c[1],a) ? a : alpha*a+(1-alpha)*nz(c[1],a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta*b+(1-beta)*c

lower = beta*c+(1-beta)*b

ts := os*upper+(1-os)*lower

result := ts

if type=="LSMA"

result := linreg(src, len, 0)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid=ema(src,len)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

result := mid+avg(vol_up,vol_down)

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

if type=="Kijun v2"

kijun = avg(lowest(len), highest(len))//, (open + close)/2)

conversionLine = avg(lowest(len/kidiv), highest(len/kidiv))

delta = (kijun + conversionLine)/2

result :=delta

if type=="McGinley"

mg = 0.0

ema = ema(src, len)

mg := na(mg[1]) ? ema : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

if type=="EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2

? get2PoleSSF(avgZeros, ssfLength)

: get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = stdev(ssf, len)

scaledFilter = stdev != 0

? ssf / stdev

: 0

alpha = 5 * abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true, group="SSL Hybrid Indicator Settings")

multy = input(0.2, step=0.05, title="Base Channel Multiplier", group="SSL Hybrid Indicator Settings")

Keltma = ma(maType, src, len)

range = useTrueRange ? tr : high - low

rangema = ema(range, len)

upperk =Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open*1

close_pos = close*1

difference = abs(close_pos-open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

plotshape(candlesize_violation, color=color.new(color.white, transp=0), size=size.tiny,style=shape.diamond, location=location.top, title="Candle Size > 1xATR")

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = crossover(close, sslExit)

base_cross_Short = crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title="Color Bars", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.rgb(0, 195, 255, transp=0), colordown=color.rgb(255, 0, 98, transp=0),title="Exit Arrows", maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color.new(color_bar, transp=0), linewidth=4, title='MA Baseline')

DownPlot = plot( show_SSL1 ? sslDown : na, title="SSL1", linewidth=3, color=color.new(color_ssl1, transp=10))

barcolor(show_color_bar ? color_bar : na)

up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title="Baseline Upper Channel")

low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title="Basiline Lower Channel")

fill(up_channel, low_channel, color=color.new(color_bar, transp=90))

////SSL2 Continiuation from ATR

atr_crit = input(0.9, step=0.1, title="Continuation ATR Criteria", group="SSL Hybrid Indicator Settings")

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

LongPlot = plot(sslDown2, title="SSL2", linewidth=2, color=color.new(atr_fill, transp=0), style=plot.style_circles, display=display.none)

u = plot(show_atr ? upper_band : na, "+ATR", color=color.new(color.white, transp=80), display=display.none)

l = plot(show_atr ? lower_band : na, "-ATR", color=color.new(color.white, transp=80), display=display.none)

// ---------------------------- QQE MOD INDICATOR ------------------------------

RSI_Period = input(6, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(3, title='Fast QQE Factor')

ThreshHold = input(3, title="Thresh-hold")

rsi_src = input(close, title="RSI Source")

Wilders_Period = RSI_Period * 2 - 1

Rsi = rsi(rsi_src, RSI_Period)

RsiMa = ema(Rsi, SF)

AtrRsi = abs(RsiMa[1] - RsiMa)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

dar = ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ?

max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ?

min(shortband[1], newshortband) : newshortband

cross_1 = cross(longband[1], RSIndex)

trend := cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

////////////////////

length = input(50, minval=1, title="Bollinger Length")

bb_mult = input(0.35, minval=0.001, maxval=5, step=0.1, title="BB Multiplier")

basis = sma(FastAtrRsiTL - 50, length)

dev = bb_mult * stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

rsi_ma_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

////////////////////////////////////////////////////////////////

RSI_Period2 = input(6, title='RSI Length')

SF2 = input(5, title='RSI Smoothing')

QQE2 = input(1.61, title='Fast QQE2 Factor')

ThreshHold2 = input(3, title="Thresh-hold")

src2 = input(close, title="RSI Source")

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = rsi(src2, RSI_Period2)

RsiMa2 = ema(Rsi2, SF2)

AtrRsi2 = abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ema(AtrRsi2, Wilders_Period2)

dar2 = ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ?

max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ?

min(shortband2[1], newshortband2) : newshortband2

cross_2 = cross(longband2[1], RSIndex2)

trend2 := cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver :

RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

qqe_line = FastAtrRsi2TL - 50

qqe_blue_bar = Greenbar1 and Greenbar2 == 1

qqe_red_bar = Redbar1 and Redbar2 == 1

// ----------------------------------STRATEGY ----------------------------------

atr_length = input(title="ATR Length", type=input.integer, defval=14, inline="1", group="Strategy Back Test Settings")

atr = atr(atr_length)

// Back test time range

from_date = input(title="From", type=input.time, defval=timestamp("01 Aug 2021 00:00 +0100"), inline="1", group="Date Range")

to_date = input(title="To", type=input.time, defval=timestamp("01 Sep 2021 00:00 +0100"), inline="1", group="Date Range")

in_date = true

// Strategy entry and exit settings

// Should use SSL as a filter for position side

use_ssl_filter = input(title="SSL Flip as Filter", type=input.bool, defval=false, inline="1", group="Entry Settings")

// Should use SSL as a filter for position side

use_qqe_filter = input(title="QQE MOD as Filter (Please add QQE MOD indicator to your chart separately)", type=input.bool, defval=false, inline="2", group="Entry Settings")

// DCA Settings

dca1_atr_multiplier = input(title="DCA1 ATR Multiplier", type=input.float, defval=0.1, step=0.1, inline="3", group="Entry Settings")

dca1_exit_percentage = input(title="DCA1 Exit Percentage", type=input.integer, defval=20, step=1, maxval=100, inline="3", group="Entry Settings")

dca2_atr_multiplier = input(title="DCA2 ATR Multiplier", type=input.float, defval=0.3, step=0.1, inline="4", group="Entry Settings")

dca2_exit_percentage = input(title="DCA2 Exit Percentage", type=input.integer, defval=40, step=1, maxval=100, inline="4", group="Entry Settings")

dca3_atr_multiplier = input(title="DCA3 ATR Multiplier", type=input.float, defval=0.7, step=0.1, inline="5", group="Entry Settings")

dca3_exit_percentage = input(title="DCA3 Exit Percentage", type=input.integer, defval=40, step=1, maxval=100, inline="5", group="Entry Settings")

// Stop-Loss Settings

sl_atr_multiplier = input(title="SL ATR Multiplier", type=input.float, defval=1.8, step=0.1, inline="2", group="Exit Settings")

var long_sl = float(na)

var long_dca1 = float(na)

var long_dca2 = float(na)

var long_dca3 = float(na)

var short_sl = float(na)

var short_dca1 = float(na)

var short_dca2 = float(na)

var short_dca3 = float(na)

is_open_long = strategy.position_size > 0

is_open_short = strategy.position_size < 0

var in_ssl_long = false

var in_ssl_short = false

var ssl_long_entry = false

var ssl_short_entry = false

var ssl_long_exit = false

var ssl_short_exit = false

var did_prev_bar_ssl_flip = false

ssl_long = use_ssl_filter ? close > sslDown : true

ssl_short = use_ssl_filter ? close < sslDown : true

qqe_long = use_qqe_filter ? (qqe_blue_bar and qqe_line > 0) : true

qqe_short = use_qqe_filter ? (qqe_red_bar and qqe_line < 0) : true

ssl_long_entry := ssl_long and qqe_long and codiff == 1

ssl_short_entry := ssl_short and qqe_short and codiff == -1

ssl_long_exit := codiff == -1

ssl_short_exit := codiff == 1

remaining_percent = 100

var total_tokens = strategy.equity * 0.10 / close

dca1_percent = dca1_exit_percentage <= remaining_percent ? dca1_exit_percentage : remaining_percent

remaining_percent -= dca1_percent

entry_1 = total_tokens * (dca1_percent / 100)

dca2_percent = dca2_exit_percentage <= remaining_percent ? dca2_exit_percentage : remaining_percent

remaining_percent -= dca2_percent

entry_2 = total_tokens * (dca2_percent / 100)

dca3_percent = dca3_exit_percentage <= remaining_percent ? dca3_exit_percentage : remaining_percent

remaining_percent -= dca3_percent

entry_3 = total_tokens * (dca3_percent / 100)

if did_prev_bar_ssl_flip

did_prev_bar_ssl_flip := false

position_value = abs(strategy.position_size * close)

if in_ssl_long

label.new(x=bar_index, y=close, xloc=xloc.bar_index, yloc=yloc.abovebar, text=tostring(position_value), style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=close, xloc=xloc.bar_index, yloc=yloc.belowbar, text=tostring(position_value), style=label.style_label_up, size=size.tiny)

if ssl_long_exit

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.close(id="LongEntry1", comment="Close Long1")

strategy.close(id="LongEntry2", comment="Close Long2")

strategy.close(id="LongEntry3", comment="Close Long3")

in_ssl_long := false

in_ssl_short := false

if ssl_short_exit

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

strategy.close(id="ShortEntry1", comment="Close Short1")

strategy.close(id="ShortEntry2", comment="Close Short2")

strategy.close(id="ShortEntry3", comment="Close Short3")

in_ssl_long := false

in_ssl_short := false

if ssl_long_entry and in_date and not in_ssl_long

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

if in_ssl_short

strategy.close(id="ShortEntry1", comment="Close Short1")

strategy.close(id="ShortEntry2", comment="Close Short2")

strategy.close(id="ShortEntry3", comment="Close Short3")

in_ssl_long := true

in_ssl_short := false

did_prev_bar_ssl_flip := true

long_sl := close - (atr * sl_atr_multiplier)

long_dca1 := close - (atr * dca1_atr_multiplier)

long_dca2 := close - (atr * dca2_atr_multiplier)

long_dca3 := close - (atr * dca3_atr_multiplier)

strategy.entry("LongEntry1", strategy.long, limit=long_dca1)

strategy.entry("LongEntry2", strategy.long, limit=long_dca2)

strategy.entry("LongEntry3", strategy.long, limit=long_dca3)

strategy.exit("LongExit1", "LongEntry1", stop=long_sl)

strategy.exit("LongExit2", "LongEntry2", stop=long_sl)

strategy.exit("LongExit3", "LongEntry3", stop=long_sl)

if ssl_short_entry and in_date and not in_ssl_short

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

if in_ssl_long

strategy.close(id="LongEntry1", comment="Close Long1")

strategy.close(id="LongEntry2", comment="Close Long2")

strategy.close(id="LongEntry3", comment="Close Long3")

in_ssl_short := true

in_ssl_long := false

did_prev_bar_ssl_flip := true

short_sl := close + (atr * sl_atr_multiplier)

short_dca1 := close + (atr * dca1_atr_multiplier)

short_dca2 := close + (atr * dca2_atr_multiplier)

short_dca3 := close + (atr * dca3_atr_multiplier)

strategy.entry("ShortEntry1", strategy.short, limit=short_dca1)

strategy.entry("ShortEntry2", strategy.short, limit=short_dca2)

strategy.entry("ShortEntry3", strategy.short, limit=short_dca3)

strategy.exit("ShortExit1", "ShortEntry1", stop=short_sl)

strategy.exit("ShortExit2", "ShortEntry2", stop=short_sl)

strategy.exit("ShortExit3", "ShortEntry3", stop=short_sl)

- Trend Mengikuti Strategi dengan EMA

- Strategi kuantitatif Bar Perubahan Peratusan Pembalikan Ganda

- Peralihan Bollinger Bands dengan MA Trend Filter

- Strategi Dagangan Kuantitatif Berasaskan RSI

- Strategi Perdagangan Crossover Multi Moving Average

- Strategi Crossover Purata Bergerak

- Auto S/R Breakout Strategi

- Strategi Pembukaan dan Penutupan Saluran Harga Momentum

- Strategi Crossover Purata Bergerak yang Ditingkatkan dengan Panduan Tren Pasaran

- Strategi Dagangan Lilin Yang Besar

- Strategi Masa ADX Purata Bergerak Berganda

- BB Peratusan Indeks Trend Memudar Strategi

- MACD Bollinger Turtle Strategi Perdagangan

- Triple SuperTrend dan Strategi RSI Stoch

- 1% Keuntungan Moving Average Cross Strategy

- Strategi Dagangan Crossover Purata Bergerak Kuantitatif Bertingkat

- strategi penunjuk RSI tambahan berbilang

- Strategi Trend Crossover Purata Bergerak Berganda

- Strategi Bollinger Bands pembalikan

- Strategi Trend ATR-ADX yang Sesuai V2