Strategi Scalping Saluran Volatiliti Noro

Gambaran keseluruhan

Strategi scalping saluran harga Noro (Noro’s Price Channel Scalping Strategy) adalah strategi perdagangan scalping berdasarkan saluran harga dan pita harga. Strategi ini menggunakan saluran harga dan turun naik harga untuk mengenal pasti trend pasaran dan masuk apabila terdapat perubahan arah trend.

Prinsip Strategi

Strategi ini pertama-tama mengira saluran harga tertinggi ((lasthigh) dan saluran harga terendah ((lastlow)), kemudian mengira garis tengah saluran harga ((center) ◄ kemudian mengira jarak harga dengan garis tengah ((dist) dan purata bergerak sederhana jarak ((distsma) ◄ berdasarkan ini dapat mengira jalur pergerakan harga 1 kali ganda ((hd dan ld) dan 2 kali ganda ((hd2 dan ld2) jarak garis tengah ◄

Apabila harga atas melalui 1 kali ganda dari garis tengah, maka ia dianggap sebagai bullish. Apabila harga bawah melalui 1 kali ganda dari garis tengah, maka ia dianggap sebagai bearish. Strategi ini dilakukan apabila terdapat tanda-tanda kemerosotan.

Kelebihan Strategik

- Menggunakan Saluran Harga untuk Mengesan Trend Pasaran dan Mengelakkan Kesilapan Perdagangan

- Menerima titik perubahan dengan tepat berdasarkan turun naik harga untuk menentukan sama ada trend akan merosot atau tidak

- Cara Scalping untuk Mendapatkan Keuntungan dengan Cepat

Risiko Strategik

- Apabila harga turun naik, saluran harga dan jalur turun naik mungkin tidak berfungsi

- Perdagangan scalping memerlukan frekuensi perdagangan yang lebih tinggi, mudah meningkatkan kos perdagangan dan risiko slippage

- Strategi Hentikan Kerosakan Perlu Dipertimbangkan Untuk Mengendalikan Risiko Kerosakan

Pengoptimuman Strategi

- Optimumkan saluran harga dan parameter band, menyesuaikan diri dengan keadaan pasaran yang lebih banyak

- Mengambil trend dan titik balik dalam kombinasi dengan petunjuk lain

- Meningkatkan strategi hentikan kerugian

- Mengambil kira kos transaksi dan kesan slippage

ringkaskan

Strategi scalping saluran gelombang nol secara keseluruhan adalah strategi yang sangat sesuai untuk perdagangan scalping. Ia menggunakan saluran harga dan band turun naik untuk menilai pergerakan pasaran, dan membuka posisi terbalik apabila tanda-tanda puncak atau bawah muncul. Strategi ini mempunyai frekuensi perdagangan yang tinggi, keuntungan yang cepat, tetapi juga menghadapi risiko tertentu. Dengan pengoptimuman lanjut, strategi ini dapat digunakan di lebih banyak pasaran yang berbeza.

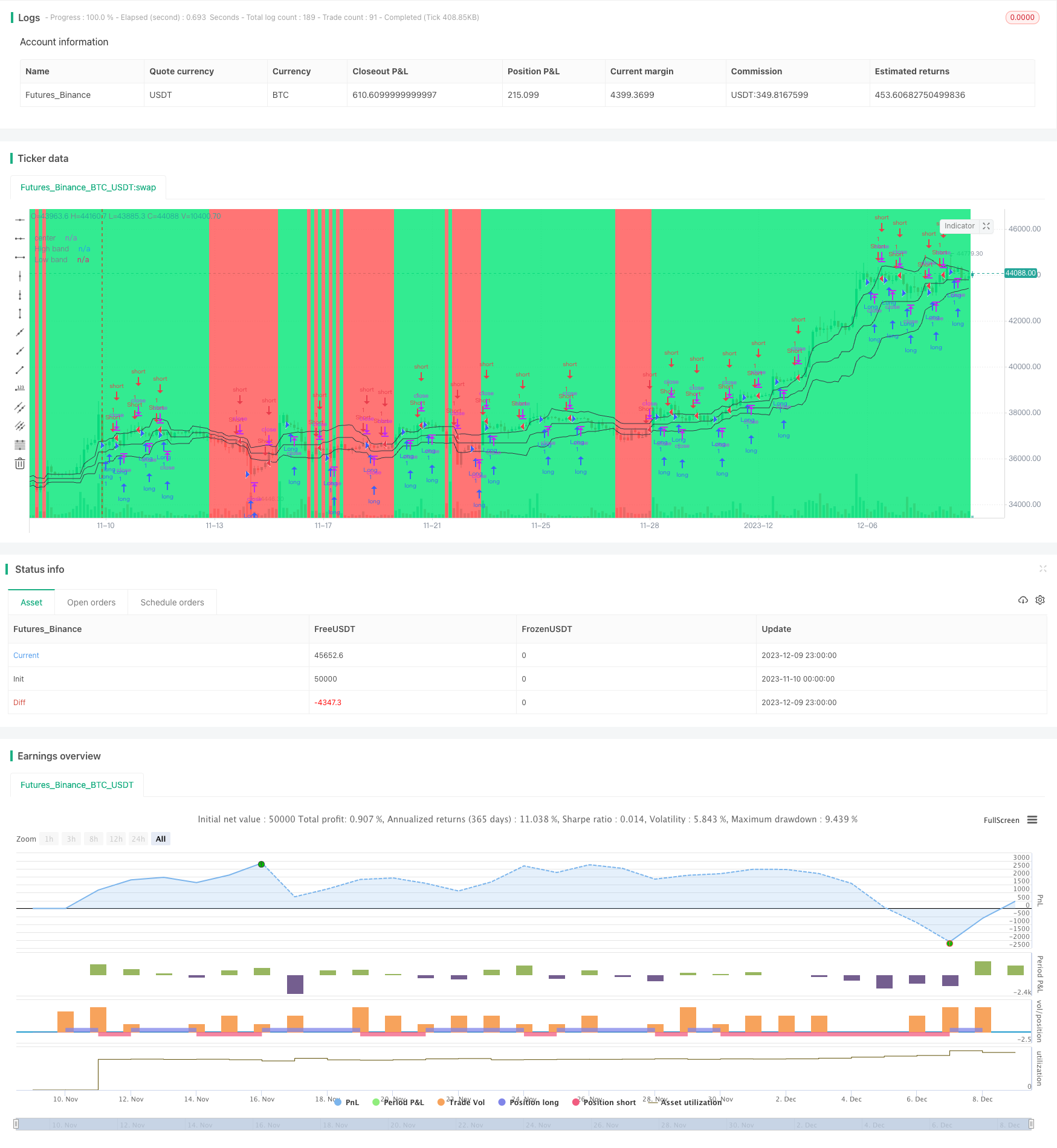

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-10 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Noro's Bands Scalper Strategy v1.0", shorttitle = "Scalper str 1.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=100.0, pyramiding=0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

len = input(20, defval = 20, minval = 2, maxval = 200, title = "Period")

needbb = input(true, defval = true, title = "Show Bands")

needbg = input(true, defval = true, title = "Show Background")

src = close

//PriceChannel

lasthigh = highest(src, len)

lastlow = lowest(src, len)

center = (lasthigh + lastlow) / 2

//Distance

dist = abs(src - center)

distsma = sma(dist, len)

hd = center + distsma

ld = center - distsma

hd2 = center + distsma * 2

ld2 = center - distsma * 2

//Trend

trend = close < ld and high < hd ? -1 : close > hd and low > ld ? 1 : trend[1]

//Lines

colo = needbb == false ? na : black

plot(hd, color = colo, linewidth = 1, transp = 0, title = "High band")

plot(center, color = colo, linewidth = 1, transp = 0, title = "center")

plot(ld, color = colo, linewidth = 1, transp = 0, title = "Low band")

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 80)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up7 = trend == 1 and bar == -1 and bar[1] == -1 ? 1 : 0

dn7 = trend == 1 and bar == 1 and bar[1] == 1 and close > strategy.position_avg_price ? 1 : 0

up8 = trend == -1 and bar == -1 and bar[1] == -1 and close < strategy.position_avg_price ? 1 : 0

dn8 = trend == -1 and bar == 1 and bar[1] == 1 ? 1 : 0

if up7 == 1 or up8 == 1

strategy.entry("Long", strategy.long, needlong == false ? 0 : trend == -1 ? 0 : na)

if dn7 == 1 or dn8 == 1

strategy.entry("Short", strategy.short, needshort == false ? 0 : trend == 1 ? 0 : na)