Strategi Intraday mengikut arah aliran dengan berbilang hentian

Gambaran keseluruhan

Strategi ini menggabungkan beberapa ATR dinamik berhenti dan Renko blok yang diperbaiki untuk menangkap trend intraday. Ia menggabungkan indikator trend dan blok indikator, mewujudkan analisis pelbagai tempoh masa, yang dapat mengenal pasti arah trend dan menghentikan kerugian tepat pada masanya.

Prinsip Strategi

Pusat strategi ini terletak pada mekanisme berhenti ATR berganda. Ia menetapkan 3 kumpulan berhenti ATR dinamik dengan parameter 5 kali ganda ATR, 10 kali ganda ATR dan 15 kali ganda ATR. Apabila harga jatuh ke bawah tiga kumpulan berhenti, ini menunjukkan bahawa trend berubah, dan ketika itu posisi terbuka.

Bahagian teras yang lain adalah blok Renko yang diperbaiki. Blok ini membahagikan kenaikan berdasarkan nilai ATR, dan digabungkan dengan indikator SMA untuk menilai arah trend.

Syarat masuk dilakukan apabila harga menembusi 3 kumpulan ATR berhenti ke atas, dan apabila harga jatuh ke bawah 3 kumpulan ATR berhenti ke bawah. Syarat keluar dilakukan apabila harga mencetuskan satu kumpulan ATR berhenti atau Renko block warna perubahan.

Kelebihan Strategik

- Penangguhan pelbagai ATR, kawalan risiko yang berkesan

- Modul Renko yang lebih baik, lebih sensitif dan boleh menghentikan kerosakan lebih awal

- Gabungan penunjuk trend dan penunjuk blok untuk memastikan trend ditangkap

- Analisis pelbagai kerangka masa untuk menilai arah trend dengan lebih yakin

- Parameter boleh disesuaikan dengan keadaan pasaran yang berbeza

Risiko dan pengoptimuman strategi

Risiko utama strategi ini adalah bahawa stop loss akan diperluaskan oleh penembusan. Ia boleh dioptimumkan dengan kaedah berikut:

- Menyesuaikan kelipatan ATR yang terhad, dengan kelonggaran yang sesuai dalam pasaran yang lebih kuat; dengan kekerapan yang sesuai dalam pasaran yang lebih lemah

- Sesuaikan parameter kitaran ATR blok Renko untuk mengimbangi sensitiviti dan kestabilan

- Menambah penunjuk hentian lain, seperti saluran Donchian, untuk memastikan hentian lebih dipercayai

- Menambah penapis untuk mengelakkan perdagangan yang kerap dalam penyusunan

ringkaskan

Strategi ini secara keseluruhannya sesuai untuk keadaan trend Intraday yang kuat, ciri-cirinya adalah sains penyetempatan berhenti, indikator blok dapat mengenal pasti perubahan trend lebih awal. Dengan menyesuaikan parameter yang dapat disesuaikan dengan keadaan pasaran yang berbeza, ini adalah strategi pengesanan trend yang layak untuk diuji di lapangan.

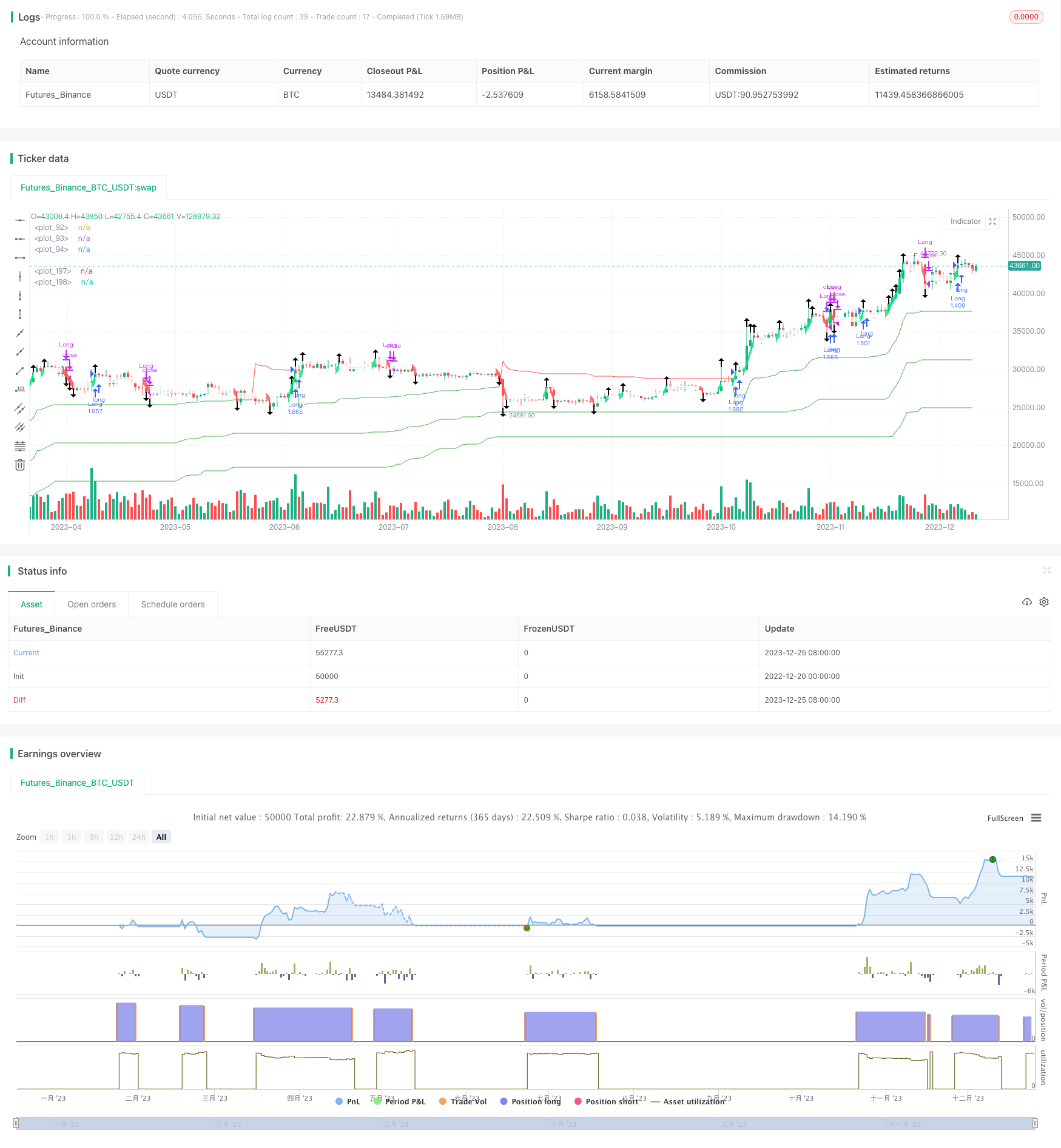

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Lancelot vstop intraday strategy", overlay=true, currency=currency.NONE, initial_capital = 100, commission_type=strategy.commission.percent,

commission_value=0.075, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

///Volatility Stop///

lengtha = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1a = 5

atr_a = atr(lengtha)

max1a = 0.0

min1a = 0.0

is_uptrend_preva = false

stopa = 0.0

vstop_preva = 0.0

vstop1a = 0.0

is_uptrenda = false

is_trend_changeda = false

max_a = 0.0

min_a = 0.0

vstopa = 0.0

max1a := max(nz(max_a[1]), ohlc4)

min1a := min(nz(min_a[1]), ohlc4)

is_uptrend_preva := nz(is_uptrenda[1], true)

stopa := is_uptrend_preva ? max1a - mult1a * atr_a : min1a + mult1a * atr_a

vstop_preva := nz(vstopa[1])

vstop1a := is_uptrend_preva ? max(vstop_preva, stopa) : min(vstop_preva, stopa)

is_uptrenda := ohlc4 - vstop1a >= 0

is_trend_changeda := is_uptrenda != is_uptrend_preva

max_a := is_trend_changeda ? ohlc4 : max1a

min_a := is_trend_changeda ? ohlc4 : min1a

vstopa := is_trend_changeda ? is_uptrenda ? max_a - mult1a * atr_a : min_a + mult1a * atr_a :

vstop1a

///Volatility Stop///

lengthb = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1b = 10

atr_b = atr(lengthb)

max1b = 0.0

min1b = 0.0

is_uptrend_prevb = false

stopb = 0.0

vstop_prevb = 0.0

vstop1b = 0.0

is_uptrendb = false

is_trend_changedb = false

max_b = 0.0

min_b = 0.0

vstopb = 0.0

max1b := max(nz(max_b[1]), ohlc4)

min1b := min(nz(min_b[1]), ohlc4)

is_uptrend_prevb := nz(is_uptrendb[1], true)

stopb := is_uptrend_prevb ? max1b - mult1b * atr_b : min1b + mult1b * atr_b

vstop_prevb := nz(vstopb[1])

vstop1b := is_uptrend_prevb ? max(vstop_prevb, stopb) : min(vstop_prevb, stopb)

is_uptrendb := ohlc4 - vstop1b >= 0

is_trend_changedb := is_uptrendb != is_uptrend_prevb

max_b := is_trend_changedb ? ohlc4 : max1b

min_b := is_trend_changedb ? ohlc4 : min1b

vstopb := is_trend_changedb ? is_uptrendb ? max_b - mult1b * atr_b : min_b + mult1b * atr_b :

vstop1b

///Volatility Stop///

lengthc = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1c = 15

atr_c = atr(lengthc)

max1c = 0.0

min1c = 0.0

is_uptrend_prevc = false

stopc = 0.0

vstop_prevc = 0.0

vstop1c = 0.0

is_uptrendc = false

is_trend_changedc = false

max_c = 0.0

min_c = 0.0

vstopc = 0.0

max1c := max(nz(max_c[1]), ohlc4)

min1c := min(nz(min_c[1]), ohlc4)

is_uptrend_prevc := nz(is_uptrendc[1], true)

stopc := is_uptrend_prevc ? max1c - mult1c * atr_c : min1c + mult1c * atr_c

vstop_prevc := nz(vstopc[1])

vstop1c := is_uptrend_prevc ? max(vstop_prevc, stopc) : min(vstop_prevc, stopc)

is_uptrendc := ohlc4 - vstop1c >= 0

is_trend_changedc := is_uptrendc != is_uptrend_prevc

max_c := is_trend_changedc ? ohlc4 : max1c

min_c := is_trend_changedc ? ohlc4 : min1c

vstopc := is_trend_changedc ? is_uptrendc ? max_c - mult1c * atr_c : min_c + mult1c * atr_c :

vstop1c

plot(vstopa, color=is_uptrenda ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopb, color=is_uptrendb ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopc, color=is_uptrendc ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstopa and close > vstopb and close > vstopc and vstopa > vstopb and vstopa > vstopc and vstopb > vstopc

vstoplongclosecondition = crossunder(close, vstopa)

vstopshortcondition = close < vstopa and close < vstopb and close < vstopc and vstopa < vstopb and vstopa < vstopc and vstopb < vstopc

vstopshortclosecondition = crossover(close, vstopa)

///Renko///

TF = input(title='TimeFrame', type=input.resolution, defval="240")

ATRlength = input(title="ATR length", type=input.integer, defval=60, minval=2, maxval=100)

SMAlength = input(title="SMA length", type=input.integer, defval=5, minval=2, maxval=100)

SMACurTFlength = input(title="SMA CurTF length", type=input.integer, defval=20, minval=2, maxval=100)

HIGH = security(syminfo.tickerid, TF, high)

LOW = security(syminfo.tickerid, TF, low)

CLOSE = security(syminfo.tickerid, TF, close)

ATR = security(syminfo.tickerid, TF, atr(ATRlength))

SMA = security(syminfo.tickerid, TF, sma(close, SMAlength))

SMACurTF = sma(close, SMACurTFlength)

RENKOUP = float(na)

RENKODN = float(na)

H = float(na)

COLOR = color(na)

BUY = int(na)

SELL = int(na)

UP = bool(na)

DN = bool(na)

CHANGE = bool(na)

RENKOUP := na(RENKOUP[1]) ? (HIGH + LOW) / 2 + ATR / 2 : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? (HIGH + LOW) / 2 - ATR / 2 : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP - RENKODN : RENKOUP[1] - RENKODN[1]

COLOR := na(COLOR[1]) ? color.white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

if not CHANGE and close >= RENKOUP[1] + H * 3

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 3

RENKODN := RENKOUP[1] + ATR * 2

COLOR := color.lime

SELL := 0

BUY := BUY + 3

BUY

if not CHANGE and close >= RENKOUP[1] + H * 2

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 2

RENKODN := RENKOUP[1] + ATR

COLOR := color.lime

SELL := 0

BUY := BUY + 2

BUY

if not CHANGE and close >= RENKOUP[1] + H

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR

RENKODN := RENKOUP[1]

COLOR := color.lime

SELL := 0

BUY := BUY + 1

BUY

if not CHANGE and close <= RENKODN[1] - H * 3

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 3

RENKOUP := RENKODN[1] - ATR * 2

COLOR := color.red

BUY := 0

SELL := SELL + 3

SELL

if not CHANGE and close <= RENKODN[1] - H * 2

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 2

RENKOUP := RENKODN[1] - ATR

COLOR := color.red

BUY := 0

SELL := SELL + 2

SELL

if not CHANGE and close <= RENKODN[1] - H

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR

RENKOUP := RENKODN[1]

COLOR := color.red

BUY := 0

SELL := SELL + 1

SELL

plotshape(UP, style=shape.arrowup, location=location.abovebar, size=size.normal)

plotshape(DN, style=shape.arrowdown, location=location.belowbar, size=size.normal)

p1 = plot(RENKOUP, style=plot.style_line, linewidth=1, color=COLOR)

p2 = plot(RENKODN, style=plot.style_line, linewidth=1, color=COLOR)

fill(p1, p2, color=COLOR, transp=80)

///Long Entry///

longcondition = vstoplongcondition and UP

if (longcondition)

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = vstoplongclosecondition or DN

if (closeconditionlong)

strategy.close("Long")

// ///Short Entry///

// shortcondition = vstopshortcondition and DN

// if (shortcondition)

// strategy.entry("Short", strategy.short)

// ///Short exit///

// closeconditionshort = vstopshortclosecondition or UP

// if (closeconditionshort)

// strategy.close("Short")