Strategi Kecenderungan Kuantitatif Berdasarkan Multi-faktor

Penulis:ChaoZhang, Tarikh: 2024-01-12 11:09:40Tag:

Ringkasan

Strategi ini secara komprehensif mempertimbangkan faktor-faktor seperti jumlah dagangan, turun naik, kedudukan harga penutupan, trend, dan lain-lain untuk mengenal pasti peluang perdagangan.

Prinsip Strategi

Idea teras strategi ini adalah untuk mengenal pasti titik masuk dan keluar dengan menggabungkan terobosan yang tidak normal dalam jumlah dagangan, kedudukan penutupan, julat turun naik dan faktor lain.

Secara khusus, strategi ini mengira jumlah dagangan purata dalam tempoh masa. Apabila jumlah dagangan tempoh semasa menunjukkan terobosan yang tidak normal, ia mungkin menunjukkan pembalikan trend. Di samping itu, jika harga penutupan berhampiran dengan had atas atau bawah julat turun naik, ia juga menyiratkan pembalikan trend yang mungkin. Dengan menggabungkan jumlah dagangan dan kedudukan penutupan, titik masuk dan keluar yang berpotensi dapat dinilai pada mulanya.

Untuk mengesahkan isyarat perdagangan, strategi ini juga mengambil kira julat turun naik. Jika turun naik semasa memecahkan tahap purata dalam tempoh, ia membentuk keadaan pertama isyarat perdagangan. Kemudian jika harga penutupan bar naik jatuh di separuh bawah julat turun naik dengan peningkatan jumlah, isyarat jual dihasilkan. Sebaliknya, jika harga penutupan bar turun terletak di separuh atas julat turun naik dengan penurunan jumlah, maka isyarat beli dihasilkan.

Di samping itu, strategi ini juga menggunakan purata bergerak untuk menentukan trend keseluruhan.

Dengan mengintegrasikan penunjuk di atas, strategi ini dapat mengenal pasti titik masuk dan keluar pasaran dengan berkesan.

Kelebihan

Kelebihan terbesar strategi ini ialah ia mengambil kira pelbagai faktor untuk membuat keputusan, menjadikan isyarat perdagangan lebih boleh dipercayai.

- Mengesan tanda-tanda pembalikan trend awal dengan jumlah dagangan yang tidak normal.

- Tentukan trend sebenar dengan julat turun naik dan kedudukan penutupan, mengelakkan bunyi jangka pendek.

- Memastikan strategi sejajar dengan trend utama dengan memeriksa purata bergerak jangka sederhana dan panjang.

- Mengurangkan kerugian dengan mengesahkan isyarat dari pelbagai aspek.

Risiko

Terdapat juga beberapa risiko strategi ini:

- Kompleks untuk mengoptimumkan parameter dengan pelbagai faktor.

- Tidak dapat mengelakkan isyarat palsu sepenuhnya.

- Penghakiman trend utama yang salah boleh memberi kesan negatif kepada prestasi keseluruhan.

- Parameter turun naik memerlukan penyesuaian dalam persekitaran pasaran yang berbeza.

Arahan pengoptimuman

Aspek utama strategi ini boleh dioptimumkan:

- Gunakan model pembelajaran mesin untuk menyesuaikan parameter automatik.

- Tambahkan mekanisme stop loss untuk mengawal risiko.

- Mengintegrasikan lebih banyak faktor seperti aliran wang untuk menentukan trend utama.

- Reka bentuk parameter volatiliti adaptif.

Kesimpulan

Strategi ini mengenal pasti peluang perdagangan dengan mengambil kira pelbagai faktor. Kelebihannya terletak pada mekanisme isyarat yang komprehensif dan prestasi yang stabil, sementara risiko utama berasal dari penyesuaian parameter dan ramalan trend utama yang tidak tepat. Beberapa teknik seperti pembelajaran mesin dapat digunakan untuk pengoptimuman lanjut pada masa akan datang. Secara keseluruhan, ini adalah strategi dengan alasan yang baik dan prestasi praktikal yang menjanjikan.

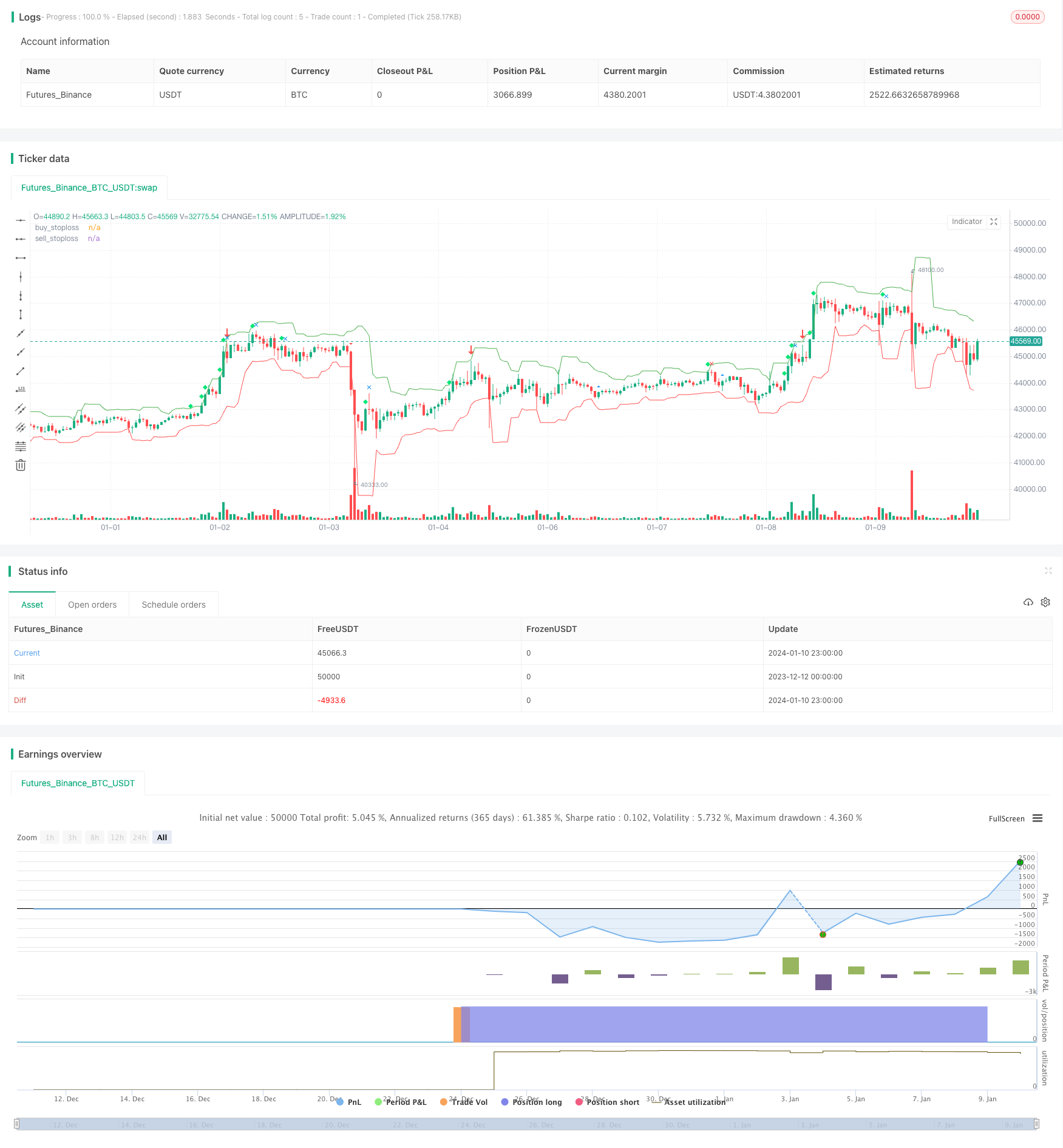

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("volume spread analysis ", overlay=true)

volavg = sma(volume,40)

c= close

l=low

h=high

v=volume

volmean = stdev(volavg,30)

volupband3 = volavg + 3*volmean

volupband2 = volavg + 2*volmean

volupband1 = volavg + 1*volmean

voldnband1 = volavg -1*volmean

voldnband2 = volavg -2*volmean

midprice = (high+low)/2

spread = (high-low)

avgspread = sma(spread,80)

avgspreadbar = spread > avgspread

widerangebar = spread>(1.5*avgspread)

narrowrangebar = spread<(0.7*avgspread)

lowvolume = volume<volume[1] and volume<volume[2]

upbar = close>close[1]

downbar = close<close[1]

highvolume = volume>volume[1] and volume[1]>volume[2]

closefactor = close-low

clsposition = spread/closefactor

closeposition = iff(closefactor==0,avgspread,clsposition)

vb = volume>volavg or volume>volume[1]

upclose = close>=((spread*0.7)+low)// close is above 70% of the bar

downclose = close<=((spread*0.3)+low)// close is below the 30% of the bar

aboveclose = close>((spread*0.5)+low)// close is between 50% and 70% of the bar

belowclose = close<((spread*0.5)+low)// close is between 50% and 30% of the bar

midclose = close>((spread*0.3)+low) and c<((spread*0.7)+l)// close is between 30% and 70% of the bar

verylowclose = closeposition>4//close is below 25% of the bar

veryhighclose = closeposition<1.35// close is above 80% of the bar

closepos = iff(close<=((spread*0.2)+low),1,iff(close<=((spread*0.4)+low),2,iff(close<=((spread*0.6)+low),3,iff(close<=((spread*0.8)+low),4,5))))

// 1 = downclose, 2 = belowclose, 3 = midclose, 4 = aboveclose, 5 = upclose

volpos = iff(volume>volavg*2,1,iff(volume>volavg*1.3,2,iff(volume>volavg,3,iff(volume<volavg and volume>volavg*0.7,4,5))))

//// 1 = very high, 2 = high, 3 = above average, 4 = less than average, 5 = low

freshgndhi = close > highestbars(h,5)

freshgndlo = close < lowestbars(l,5)

//========================trend estimation =========================

//jtrend=sma(close,5)

//trendlongterm = linreg(jtrend,40)

//trendmediumterm = linreg(jtrend,10)

//trendshortterm = linreg(jtrend,3)

//tls=linreg(jtrend,3)

minperiodsrwist = input(title="short term min periods", defval=2, minval=1)

maxperiodsrwist = input(title="short term max periods", defval=8, minval=1)

minperiodsrwilt = input(title="long term min periods", defval=10, minval=1)

maxperiodsrwilt = input(title="long term max periods", defval=40, minval=1)

rwhmins = (high - nz(low[minperiodsrwist])) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwhmaxs = (high - nz(low[maxperiodsrwist])) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwhs = max( rwhmins, rwhmaxs )

rwlmins = (nz(high[minperiodsrwist]) - low) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwlmaxs = (nz(high[maxperiodsrwist]) - low) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwls = max( rwlmins, rwlmaxs )

rwhminl = (high - nz(low[minperiodsrwilt])) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwhmaxl = (high - nz(low[maxperiodsrwilt])) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwhl = max( rwhminl, rwhmaxl )

rwlminl = (nz(high[minperiodsrwilt]) - low) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwlmaxl = (nz(high[maxperiodsrwilt]) - low) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwll = max( rwlminl, rwlmaxl )

ground = rwhs

sky = rwls

j = rwhs-rwls

k = rwhl-rwll

j2 = rwhl

k2 = rwll

ja = cross(j,1)

jb = cross(1,j)

jc = cross(-1,j)

jd = cross(j,-1)

j2a = cross(j2,1)

j2b = cross(1,j2)

k2a = cross(k2,1)

k2b = cross(1,k2)

upmajoron = j > 1 and ja[1]

upmajoroff = j < 1 and jb[1]

upminoron = j2 > 1 and j2a[1]

upminoroff = j2 < 1 and j2b[1]

dnmajoron = j < -1 and jc[1]

dnmajoroff = j > -1 and jd[1]

dnminoron = k2 > 1 and k2a[1]

dnminoroff = k2 < 1 and k2b[1]

upimd = iff(ground > 1, 1,0)

dnimd = iff(sky > 1, 1, 0)

upmajor = iff(j>1,1,iff(j<(-1),-1,0))

upminor = iff(j2>1,1,-1)

dnminor = iff(k2>1,1,-1)

//======================================================================|

Buy_stop = lowest(low[1],5) - atr(20)[1]

plot(Buy_stop, color=red, title="buy_stoploss")

Sell_stop = highest(high[1],5) + atr(20)[1]

plot(Sell_stop, color=green, title="sell_stoploss")

//======================================================================|

//upthrustbar = widerangebar and downclose and upimd==1 and high>high[1] //wrb and uhs and fresh ground

nut = widerangebar and downclose and freshgndhi and highvolume // new signal

bc = widerangebar and aboveclose and volume == highest(volume,60) and upmajor==1 // new signal

upthrustbar = widerangebar and (closepos==1 or closepos==2) and upminor>0 and high>high[1] and (upimd>0or upmajor>0) and volpos <4// after minor up trend

upthrustbartrue = widerangebar and closepos==1 and upmajor>0 and high>high[1] and volpos <4//occurs after a major uptrend

upthrustcond1 = upthrustbar[1] and downbar and not narrowrangebar

upthrustcond2 = upthrustbar[1] and downbar and volpos == 2

upthrustcond3 = upthrustbar and volpos ==1

toprevbar = volume[1]>volavg and upbar[1] and widerangebar[1] and downbar and downclose and widerangebar and upmajor>0 and high==highest(high,10)

pseudoupthrust = upbar[1] and high>high[1] and volume[1]>1.5*volavg and downbar and downclose and not upthrustbar

pseudoutcond = pseudoupthrust[1] and downbar and downclose and not upthrustbar

trendchange = upbar[1] and high==highest(high,5) and downbar and (downclose or midclose) and volume>volavg and upmajor>0 and upimd>0 and not widerangebar and not pseudoupthrust

nodemandbarut = upbar and narrowrangebar and lowvolume and closepos> 3 and ((upminor>0 and upimd>0)or (upminor<0 and upminor>0))//in a up market

nodemandbardt = upbar and narrowrangebar and lowvolume and closepos> 3 and (upminor<=0or upimd<=0)// in a down or sidewayss market

nosupplybar = downbar and narrowrangebar and lowvolume and closepos<3 and ((upminor<1 and upimd<1)or (upminor>0 and upimd<1))

lowvoltest = low==lowest(low,5) and upclose and lowvolume//lowvolume and l<low[1] and upclose

lowvoltest1 = low==lowest(low,5) and volume<volavg and low<low[1] and upclose and upminor>0 and upmajor>0// and widerangebar

lowvoltest2 = lowvoltest[1] and upbar and upclose

sellcond1 = (upthrustcond1 or upthrustcond2 or upthrustcond3)

sellcond2 = sellcond1[1]==0

sellcond = sellcond1 and sellcond2

strengthdown0 = upmajor<0 and volpos<4 and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0// strength after a long down trend

strengthdown = volpos<4 and downbar[1] and upbar and closepos>3 and upimd<=00 and upminor<0// strength after a down trend

strengthdown1 = upmajor<0 and volume>(volavg*1.5) and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0//strength after downtrend . high volume

strengthdown2 = upimd<=0 and volume[1]<volavg and upbar and veryhighclose and volpos<4

buycond1 = strengthdown or strengthdown1

buycond = upbar and buycond1[1]

stopvolume = low==lowest(low,5) and (upclose or midclose) and v>1.5*volavg and upmajor<0

revupthrust = upmajor<0 and upbar and upclose and volume>volume[1] and volume>volavg and widerangebar and downbar[1] and downclose[1] and upminor<0

effortup = high>high[1] and low>low[1] and close>close[1] and close>=((high-low)*0.7+low) and spread>avgspread and volpos<4//and open<=((high-low)*0.3+low)

effortupfail = effortup[1] and (upthrustbar or upthrustcond1 or upthrustcond2 or upthrustcond3 or (downbar and avgspreadbar))

effortdown = high<high[1] and low<low[1] and close<close[1] and close<=((high-low)*0.25+low) and widerangebar and volume>volume[1]//o>=((high-low)*0.75+

effortdownfail = effortdown[1] and ((upbar and avgspreadbar)or revupthrust or buycond1)

upflag = (sellcond or buycond or effortup or effortupfail or stopvolume or effortdown or effortdownfail or revupthrust or nodemandbardt or nodemandbarut or nosupplybar or lowvoltest or lowvoltest1 or lowvoltest2 or bc)

bullbar = (volume>volavg or volume>volume[1]) and closeposition <2 and upbar and not upflag

bearbar = vb and downclose and downbar and spread>avgspread and not upflag

buy = (upbar and revupthrust[1])or lowvoltest2

burely = strengthdown1 and stopvolume[1]or (upbar and revupthrust[1])or lowvoltest2

//buy = effortup and lowvoltest2[1]

//sell = upthrustbartrue

sell = effortup[1] and effortupfail and upthrustcond3 and upthrustbartrue and toprevbar

strategy.entry("simpleBuy", strategy.long, when= (upbar and revupthrust[1])or lowvoltest2 )

strategy.close("simpleBuy",when=upthrustbartrue )

//strategy.entry("simpleSell", strategy.short,when= upthrustbartrue )

//strategy.close("simpleSell",when= (upbar and revupthrust[1])or lowvoltest2)

//|============================================================================================|

//data = close >= open

//plotshape(true, style=shape.flag, color=data ? green : red)

plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.arrowdown ,size=size.huge,color=red )

//plotshape(toprevbar ,title="toprevbar" ,style=shape.flag ,size=size.small,color=blue )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.circle ,size=size.small,color=blue )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangleup ,size=size.small,color=red )

plotshape(trendchange ,title="trendchange" ,style=shape.xcross ,size=size.small,color=red )

//plotshape((nodemandbardt) ,title="(nodemandbardt" ,style=shape.square ,size=size.small,color=orange )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.cross ,size=size.small,color=blue)

plotshape(revupthrust ,title="revupthrust" ,style=shape.arrowup ,size=size.huge,color=green )

//plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.cross ,size=size.small,color=red )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangledown ,size=size.small,color=white )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.arrowup ,size=size.small,color=blue )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labelup ,size=size.small,color=orange )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labeldown ,size=size.small,color=yellow )

//plotshape(nodemandbardt ,title="nodemandbardt" ,style=shape.diamond ,size=size.small,color=yellow )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.xcross ,size=size.small,color=blue )

plotshape(lowvoltest ,title="lowvoltest" ,style=shape.triangleup ,size=size.small,color=blue )

//plotshape(lowvoltest2 ,title="lowvoltest2" ,style=shape.triangledown ,size=size.small,color=yellow )

//plotshape(strengthdown ,title="strengthdown" ,style=shape.flag ,size=size.small,color=green)

//plotshape(strengthdown ,title="strengthdown" ,style=shape.circle ,size=size.small,color=lime )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowup ,size=size.small,color=silver )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowdown ,size=size.small,color=red )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labelup ,size=size.small,color=green )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labeldown ,size=size.small,color=yellow )

plotshape(effortup ,title="effortup" ,style=shape.diamond ,size=size.small,color=lime )

plotshape(effortupfail ,title="effortupfail" ,style=shape.xcross ,size=size.small,color=blue )

//plotshape(effortupfail ,title="effortupfail" ,style=shape.cross ,size=size.small,color=white )

plotshape(effortdown ,title="effortdown" ,style=shape.triangledown ,size=size.small,color=red )

plotshape(effortdownfail ,title="effortdownfail" ,style=shape.xcross ,size=size.small,color=green )

//plotshape(effortdownfail ,title="effortdownfail" ,style=shape.flag ,size=size.small,color=white )

//plotshape(buycond ,title="buycond" ,style=shape.circle ,size=size.small,color=green )

//plotshape(sellcond ,title="sellcond" ,style=shape.arrowup ,size=size.small,color=orange )

//plotshape((nut) ,title="(nut)" ,style=shape.arrowdown ,size=size.small,color=lime )

//plotshape((bc ) ,title="(bc" ,style=shape.labelup ,size=size.small,color=red )

//plotshape(buy ,title="buy" ,style=shape.labeldown ,size=size.small,color=white )

- Strategi Perdagangan Kuasa Bull

- Strategi Pengesanan Purata Bergerak Harian untuk Nilai Emas

- Purata Bergerak Berbilang Jangka Masa Digabungkan Dengan Jam Dagangan Strategi Dagangan Kuantitatif

- Strategi Dagangan Berbilang Jangka Masa Berdasarkan MACD

- Strategi Pengesanan Kuasa Beruang

- Trend Mengikut Strategi Dagangan Berdasarkan Pelbagai Penunjuk

- Strategi Perdagangan Swing dengan 20/50 EMA Cross

- Dinamis Trend Tracking Strategi yang dioptimumkan

- Strategi purata bergerak berganda digabungkan dengan penunjuk stochastic

- Strategi Pengesanan Trend Berdasarkan Purata Bergerak dan Julat Benar Purata

- Strategi Perdagangan Berasaskan Derivatif

- Strategi MACD Lama sahaja

- Strategi Trend Crossover Purata Bergerak

- Strategi Dagangan Kuantitatif Berasaskan SMA Crossover

- Strategi Hentikan Kerugian

- Strategi Sokongan dan Rintangan dengan Penembusan Volume dan Hentian Hentian

- Memindahkan strategi Stop Loss berdasarkan mata mengambil keuntungan dan Stop Loss

- Strategi Stop Loss Peratusan

- Strategi Gabungan Keseimbangan Kuasa Rata-rata Bergerak Berganda dan Bull Bear

- Strategi Pemegang Sederhana