Strategi silang purata bergerak bertimbang momentum dinamik

Penulis:ChaoZhang, Tarikh: 2024-01-12 12:04:55Tag:

Ringkasan

Strategi ini menghasilkan isyarat beli dan jual apabila dua Purata Bergerak Purata Bergerak Eksponen (MAEMA) dengan tempoh yang berbeza bersilang.

Prinsip-prinsip

- Mengira MAEMA pantas (80 tempoh) dan MAEMA perlahan (144 tempoh).

- Garis cepat mencerminkan trend jangka pendek dan titik pembalikan. Garis perlahan mencerminkan arah trend utama.

- Apabila garisan pantas melintasi di atas garisan perlahan, isyarat beli dihasilkan. Apabila garisan pantas melintasi di bawah garisan perlahan, isyarat jual dihasilkan.

- Strategi ini juga memetakan 3 titik ramalan, mewakili nilai yang mungkin untuk tempoh seterusnya, untuk menentukan trend silang masa depan.

- Strategi ini menggunakan sepenuhnya momentum dan fungsi ramalan MAEMA itu sendiri.

Kelebihan

- MAEMA sendiri menggabungkan faktor momentum untuk menangkap perubahan trend lebih cepat.

- Strategi purata bergerak berganda menilai trend dalam jangka masa yang berbeza.

- Menggabungkan penyeberangan garis yang cepat dan perlahan dan titik ramalan MAEMA sendiri menjadikan isyarat perdagangan lebih boleh dipercayai.

- Carta automatik lengkap memberikan pantulan intuitif mengenai turun naik pasaran.

Risiko

- Apabila turun naik yang tidak normal berlaku, kepekaan MAEMA mungkin terlalu tinggi, menghasilkan isyarat palsu.

- Sistem purata bergerak cenderung memberikan isyarat palsu semasa pasaran terhad julat. penapis tambahan boleh ditambah.

- Tempoh untuk garis pantas dan perlahan harus ditentukan dengan mencari parameter optimum untuk setiap produk.

Peningkatan

- Mengoptimumkan tempoh MAEMA cepat dan perlahan untuk mencari kombinasi parameter terbaik.

- Tambahkan keadaan penapis untuk mengelakkan pembukaan kedudukan semasa pasaran zigzag.

- Teruskan menyesuaikan kelipatan ATR, hentian belakang berdasarkan hasil backtest untuk mengurangkan positif palsu dan mengawal risiko.

Ringkasan

Strategi ini menilai perubahan trend pasaran menggunakan MAEMA crossover purata bergerak berganda. Prinsip asasnya mudah dan jelas. Digabungkan dengan momentum dan keupayaan ramalan MAEMA itu sendiri, ia berkesan dalam mengenal pasti isyarat pembalikan. Perhatian harus diberikan kepada pengoptimuman parameter dan meningkatkan penapis untuk meningkatkan ketahanan.

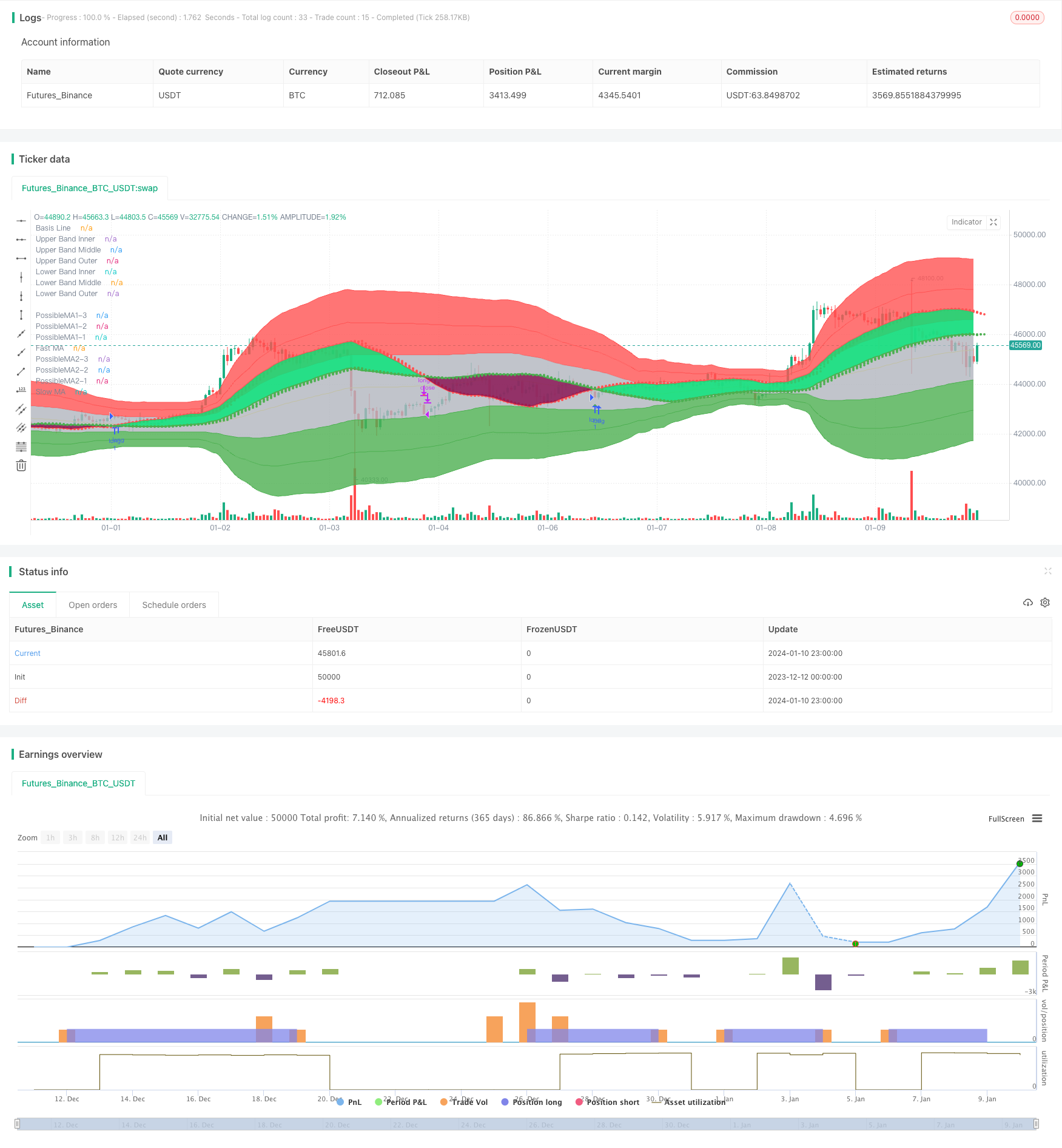

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © informanerd

//@version=4

strategy("MultiType Shifting Predictive MAs Crossover", shorttitle = "MTSPMAC + MBHB Strategy", overlay = true)

//inputs

predict = input(true, "Show MA Prediction Tails")

trendFill = input(true, "Fill Between MAs Based on Trend")

signal = input(true, "Show Cross Direction Signals")

showMA1 = input(true, "[ Show Fast Moving Average ]══════════")

type1 = input("MAEMA (Momentum Adjusted Exponential)", "Fast MA Type", options = ["MAEMA (Momentum Adjusted Exponential)", "DEMA (Double Exponential)", "EMA (Exponential)", "HMA (Hull)", "LSMA (Least Squares)", "RMA (Adjusted Exponential)", "SMA (Simple)", "SWMA (Symmetrically Weighted)", "TEMA (Triple Exponential)", "TMA (Triangular)", "VMA / VIDYA (Variable Index Dynamic Average)", "VWMA (Volume Weighted)", "WMA (Weighted)"])

src1 = input(high, "Fast MA Source")

len1 = input(80, "Fast MA Length", minval = 2)

shift1 = input(0, "Fast MA Shift")

maThickness1 = input(2, "Fast MA Thickness", minval = 1)

trendColor1 = input(false, "Color Fast MA Based on Detected Trend")

showBand1 = input(false, "Show Fast MA Range Band")

atrPer1 = input(20, "Fast Band ATR Lookback Period")

atrMult1 = input(3, "Fast Band ATR Multiplier")

showMA2 = input(true, "[ Show Slow Moving Average ]══════════")

type2 = input("MAEMA (Momentum Adjusted Exponential)", "Slow MA Type", options = ["MAEMA (Momentum Adjusted Exponential)", "DEMA (Double Exponential)", "EMA (Exponential)", "HMA (Hull)", "LSMA (Least Squares)", "RMA (Adjusted Exponential)", "SMA (Simple)", "SWMA (Symmetrically Weighted)", "TEMA (Triple Exponential)", "TMA (Triangular)", "VMA / VIDYA (Variable Index Dynamic Average)", "VWMA (Volume Weighted)", "WMA (Weighted)"])

src2 = input(close, "Slow MA Source")

len2 = input(144, "Slow MA Length", minval = 2)

shift2 = input(0, "Slow MA Shift")

maThickness2 = input(2, "Slow MA Thickness", minval = 1)

trendColor2 = input(false, "Color Slow MA Based on Detected Trend")

showBand2 = input(false, "Show Slow MA Range Band")

atrPer2 = input(20, "Slow Band ATR Lookback Period")

atrMult2 = input(3, "Slow Band ATR Multiplier")

//ma calculations

ma(type, src, len) =>

if type == "MAEMA (Momentum Adjusted Exponential)"

goldenRatio = (1 + sqrt(5)) / 2

momentumLen = round(len / goldenRatio), momentum = change(src, momentumLen), probabilityLen = len / goldenRatio / goldenRatio

ema(src + (momentum + change(momentum, momentumLen) * 0.5) * sum(change(src) > 0 ? 1 : 0, round(probabilityLen)) / probabilityLen, len)

else if type == "DEMA (Double Exponential)"

2 * ema(src, len) - ema(ema(src, len), len)

else if type == "EMA (Exponential)"

ema(src, len)

else if type == "HMA (Hull)"

wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

else if type == "LSMA (Least Squares)"

3 * wma(src, len) - 2 * sma(src, len)

else if type == "RMA (Adjusted Exponential)"

rma(src, len)

else if type == "SMA (Simple)"

sma(src, len)

else if type == "SWMA (Symmetrically Weighted)"

swma(src)

else if type == "TEMA (Triple Exponential)"

3 * ema(src, len) - 3 * ema(ema(src, len), len) + ema(ema(ema(src, len), len), len)

else if type == "TMA (Triangular)"

swma(wma(src, len))

else if type == "VMA / VIDYA (Variable Index Dynamic Average)"

smoothing = 2 / len, volIndex = abs(cmo(src, len) / 100)

vma = 0., vma := (smoothing * volIndex * src) + (1 - smoothing * volIndex) * nz(vma[1])

else if type == "VWMA (Volume Weighted)"

vwma(src, len)

else if type == "WMA (Weighted)"

wma(src, len)

ma1 = ma(type1, src1, len1)

ma2 = ma(type2, src2, len2)

//ma predictions

pma11 = len1 > 2 ? (ma(type1, src1, len1 - 1) * (len1 - 1) + src1 * 1) / len1 : na

pma12 = len1 > 3 ? (ma(type1, src1, len1 - 2) * (len1 - 2) + src1 * 2) / len1 : na

pma13 = len1 > 4 ? (ma(type1, src1, len1 - 3) * (len1 - 3) + src1 * 3) / len1 : na

pma21 = len2 > 2 ? (ma(type2, src2, len2 - 1) * (len2 - 1) + src2 * 1) / len2 : na

pma22 = len2 > 3 ? (ma(type2, src2, len2 - 2) * (len2 - 2) + src2 * 2) / len2 : na

pma23 = len2 > 4 ? (ma(type2, src2, len2 - 3) * (len2 - 3) + src2 * 3) / len2 : na

//ma range bands

r1 = atr(atrPer1) * atrMult1

hBand1 = ma1 + r1

lBand1 = ma1 - r1

r2 = atr(atrPer2) * atrMult2

hBand2 = ma2 + r2

lBand2 = ma2 - r2

//drawings

ma1Plot = plot(showMA1 ? ma1 : na, "Fast MA", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, maThickness1, offset = shift1)

ma2Plot = plot(showMA2 ? ma2 : na, "Slow MA", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, maThickness2, offset = shift2)

fill(ma1Plot, ma2Plot, trendFill and ma1 > ma2 ? color.lime : trendFill and ma1 < ma2 ? color.maroon : na, 90)

plot(showMA1 and predict ? pma11 : na, "PossibleMA1-1", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 1, show_last = 1)

plot(showMA1 and predict ? pma12 : na, "PossibleMA1-2", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 2, show_last = 1)

plot(showMA1 and predict ? pma13 : na, "PossibleMA1-3", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 3, show_last = 1)

plot(showMA2 and predict ? pma21 : na, "PossibleMA2-1", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 1, show_last = 1)

plot(showMA2 and predict ? pma22 : na, "PossibleMA2-2", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 2, show_last = 1)

plot(showMA2 and predict ? pma23 : na, "PossibleMA2-3", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 3, show_last = 1)

plot(showBand1 ? hBand1 : na, "Fast Higher Band", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, offset = shift1)

plot(showBand1 ? lBand1 : na, "Fast Lower Band", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, offset = shift1)

plot(showBand2 ? hBand2 : na, "Slow Higher Band", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, offset = shift2)

plot(showBand2 ? lBand2 : na, "Slow Lower Band", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, offset = shift2)

//crosses & alerts

up = crossover(ma1, ma2)

down = crossover(ma2, ma1)

plotshape(signal ? up : na, "Buy", shape.triangleup, location.belowbar, color.green, offset = shift1, size = size.small)

plotshape(signal ? down : na, "Sell", shape.triangledown, location.abovebar, color.red, offset = shift1, size = size.small)

alertcondition(up, "Buy", "Buy")

alertcondition(down, "Sell", "Sell")

// @version=1

// Title: "Multi Bollinger Heat Bands - EMA/Breakout options".

// Author: JayRogers

//

// * Description *

// Short: It's your Basic Bollinger Bands, but 3 of them, and some pointy things.

//

// Long: Three stacked sma based Bollinger Bands designed just to give you a quick visual on the "heat" of movement.

// Set inner band as you would expect, then set your preferred additional multiplier increments for the outer 2 bands.

// Option to use EMA as alternative basis, rather than SMA.

// Breakout indication shapes, which have their own multiplier seperate from the BB's; but still tied to same length/period.

// strategy(shorttitle="[JR]MBHB_EBO", title="[JR] Multi Bollinger Heat Bands - EMA/Breakout options", overlay=true)

// Bollinger Bands Inputs

bb_use_ema = input(false, title="Use EMA Basis?")

bb_length = input(80, minval=1, title="Bollinger Length")

bb_source = input(close, title="Bollinger Source")

bb_mult = input(1.0, title="Base Multiplier", minval=0.001, maxval=50)

bb_mult_inc = input(1, title="Multiplier Increment", minval=0.001, maxval=2)

// Breakout Indicator Inputs

break_mult = input(3, title="Breakout Multiplier", minval=0.001, maxval=50)

breakhigh_source = input(high, title="High Break Source")

breaklow_source = input(low, title="Low Break Source")

bb_basis = bb_use_ema ? ema(bb_source, bb_length) : sma(bb_source, bb_length)

// Deviation

// * I'm sure there's a way I could write some of this cleaner, but meh.

dev = stdev(bb_source, bb_length)

bb_dev_inner = bb_mult * dev

bb_dev_mid = (bb_mult + bb_mult_inc) * dev

bb_dev_outer = (bb_mult + (bb_mult_inc * 2)) * dev

break_dev = break_mult * dev

// Upper bands

inner_high = bb_basis + bb_dev_inner

mid_high = bb_basis + bb_dev_mid

outer_high = bb_basis + bb_dev_outer

// Lower Bands

inner_low = bb_basis - bb_dev_inner

mid_low = bb_basis - bb_dev_mid

outer_low = bb_basis - bb_dev_outer

// Breakout Deviation

break_high = bb_basis + break_dev

break_low = bb_basis - break_dev

// plot basis

plot(bb_basis, title="Basis Line", color=color.yellow, transp=50)

// plot and fill upper bands

ubi = plot(inner_high, title="Upper Band Inner", color=color.red, transp=90)

ubm = plot(mid_high, title="Upper Band Middle", color=color.red, transp=85)

ubo = plot(outer_high, title="Upper Band Outer", color=color.red, transp=80)

fill(ubi, ubm, title="Upper Bands Inner Fill", color=color.red, transp=90)

fill(ubm, ubo, title="Upper Bands Outer Fill",color=color.red, transp=80)

// plot and fill lower bands

lbi = plot(inner_low, title="Lower Band Inner", color=color.green, transp=90)

lbm = plot(mid_low, title="Lower Band Middle", color=color.green, transp=85)

lbo = plot(outer_low, title="Lower Band Outer", color=color.green, transp=80)

fill(lbi, lbm, title="Lower Bands Inner Fill", color=color.green, transp=90)

fill(lbm, lbo, title="Lower Bands Outer Fill", color=color.green, transp=80)

// center channel fill

fill(ubi, lbi, title="Center Channel Fill", color=color.silver, transp=100)

// plot breakouts

plotshape(breakhigh_source >= break_high, title="High Breakout", style=shape.triangledown, location=location.abovebar, size=size.tiny, color=color.white, transp=0)

plotshape(breaklow_source <= break_low, title="Low Breakout", style=shape.triangleup, location=location.belowbar, size=size.tiny, color=color.white, transp=0)

High_Break = breakhigh_source >= break_high

Low_Break = breaklow_source <= break_low

// Conditions

Stop_Momentum = low < ma1

//Strategy Tester

strategy.entry("long", strategy.long, when=(up and (hlc3 < inner_high)))

strategy.close("long", when=down)

strategy.entry("longwickdown", strategy.long, when=Low_Break)

strategy.close("longwickdown", when=(high > ma1))

//true signals test

//var winCount = 0, var loseCount = 0, testBarIndex = 1

//if (up[testBarIndex] and close > close[testBarIndex]) or (down[testBarIndex] and close < close[testBarIndex])

// label.new(bar_index, 0, "W", yloc = yloc.abovebar, color = color.green)

// winCount := winCount + 1

//else if (up[testBarIndex] and close < close[testBarIndex]) or (down[testBarIndex] and close > close[testBarIndex])

// label.new(bar_index, 0, "L", yloc = yloc.abovebar, color = color.red)

// loseCount := loseCount + 1

//winRate = label.new(time + (time - time[1]) * 2, ohlc4, tostring(round(winCount / (winCount + loseCount) * 100)) + "%", xloc = xloc.bar_time, color = color.orange, style = label.style_label_left)

//if not na(winRate[1])

// label.delete(winRate[1])

Lebih lanjut

- Strategi Pendapatan EMA Golden Cross Berganda

- Strategi Regresi Santa Claus Dinamik

- Strategi Perdagangan Kuantiti Indeks RSI

- RSI V-bentuk corak Swing Strategi Dagangan

- Strategi Volatiliti ATR Terobosan Momentum

- Strategi Momentum RSI Berasaskan Interpolasi Polinomial

- Strategi Kombo Pembalikan Momentum

- Strategi Ribbon Hash BTC

- Strategi penyeberangan purata bergerak pelbagai peringkat untuk Quant Masters

- Strategi Dagangan Pembalikan Nisbah Volume

- Strategi Perdagangan Kuasa Bull

- Strategi Pengesanan Purata Bergerak Harian untuk Nilai Emas

- Purata Bergerak Berbilang Jangka Masa Digabungkan Dengan Jam Dagangan Strategi Dagangan Kuantitatif

- Strategi Dagangan Berbilang Jangka Masa Berdasarkan MACD

- Strategi Pengesanan Kuasa Beruang

- Trend Mengikut Strategi Dagangan Berdasarkan Pelbagai Penunjuk

- Strategi Perdagangan Swing dengan 20/50 EMA Cross

- Dinamis Trend Tracking Strategi yang dioptimumkan

- Strategi purata bergerak berganda digabungkan dengan penunjuk stochastic

- Strategi Pengesanan Trend Berdasarkan Purata Bergerak dan Julat Benar Purata