Strategi Combo Bandpass Breakout

Penulis:ChaoZhang, Tarikh: 2024-02-01 10:45:12Tag:

Ringkasan

Ini adalah strategi gabungan yang didorong oleh dua faktor - pembalikan dan bandpass, yang mencapai lapisan pelbagai faktor dan menyesuaikan diri dengan keadaan pasaran yang berbeza.

Logika Strategi

Strategi ini terdiri daripada dua sub-strategi:

-

123 Strategi Pembalikan: Apabila harga penutupan turun selama dua hari berturut-turut, jika penutupan hari ini menembusi harga terendah dalam dua hari sebelumnya, dan garis cepat osilator Stochastic 9 hari melintasi di atas garis perlahan, pergi panjang. Apabila harga penutupan naik selama dua hari berturut-turut, jika penutupan hari ini turun di bawah harga tertinggi dalam dua hari sebelumnya, dan garis cepat melintasi di bawah garis perlahan, pergi pendek.

-

Penapis Bandpass: Mengira penunjuk bandpass dalam tempoh tertentu, pergi panjang apabila ia di atas ambang, dan pergi pendek apabila di bawah.

Isyarat gabungan adalah: mengambil kedudukan panjang jika kedua-dua strategi memberi isyarat panjang, mengambil kedudukan pendek jika kedua-dua memberi isyarat pendek, sebaliknya membersihkan semua kedudukan.

Kelebihan

- Didorong oleh faktor dua, menyesuaikan diri dengan pelbagai keadaan pasaran, menguntungkan di seluruh rejim

- 123 pembalikan menangkap peluang pembalikan di pasaran terhad julat

- Penapis bandpass menjejaki trend di pasaran trend

- Isyarat gabungan mengesahkan dan mengelakkan perdagangan yang salah

Risiko

- Parameter yang tidak betul boleh menyebabkan perdagangan berlebihan

- Banyak kerugian boleh berlaku di pasaran yang bergelombang

- Kos transaksi perlu dipantau

Peningkatan

- Tune parameter penapis bandpass untuk mengoptimumkan pengiraan bandpass

- Sesuaikan 123 parameter pembalikan untuk mengoptimumkan pengenalan pembalikan panjang / pendek

- Menambah stop loss kepada kawalan kerugian untuk perdagangan tunggal

Ringkasan

Strategi ini mengintegrasikan faktor pembalikan dan trend untuk mencapai perdagangan kuantitatif yang didorong oleh pelbagai faktor. Pengesahan faktor dua mengurangkan kebarangkalian perdagangan yang salah, menjadikan strategi berfungsi dengan baik di pelbagai pasaran. Penambahbaikan lanjut pada penyesuaian parameter dan stop loss akan meningkatkan kestabilan dan keuntungan strategi.

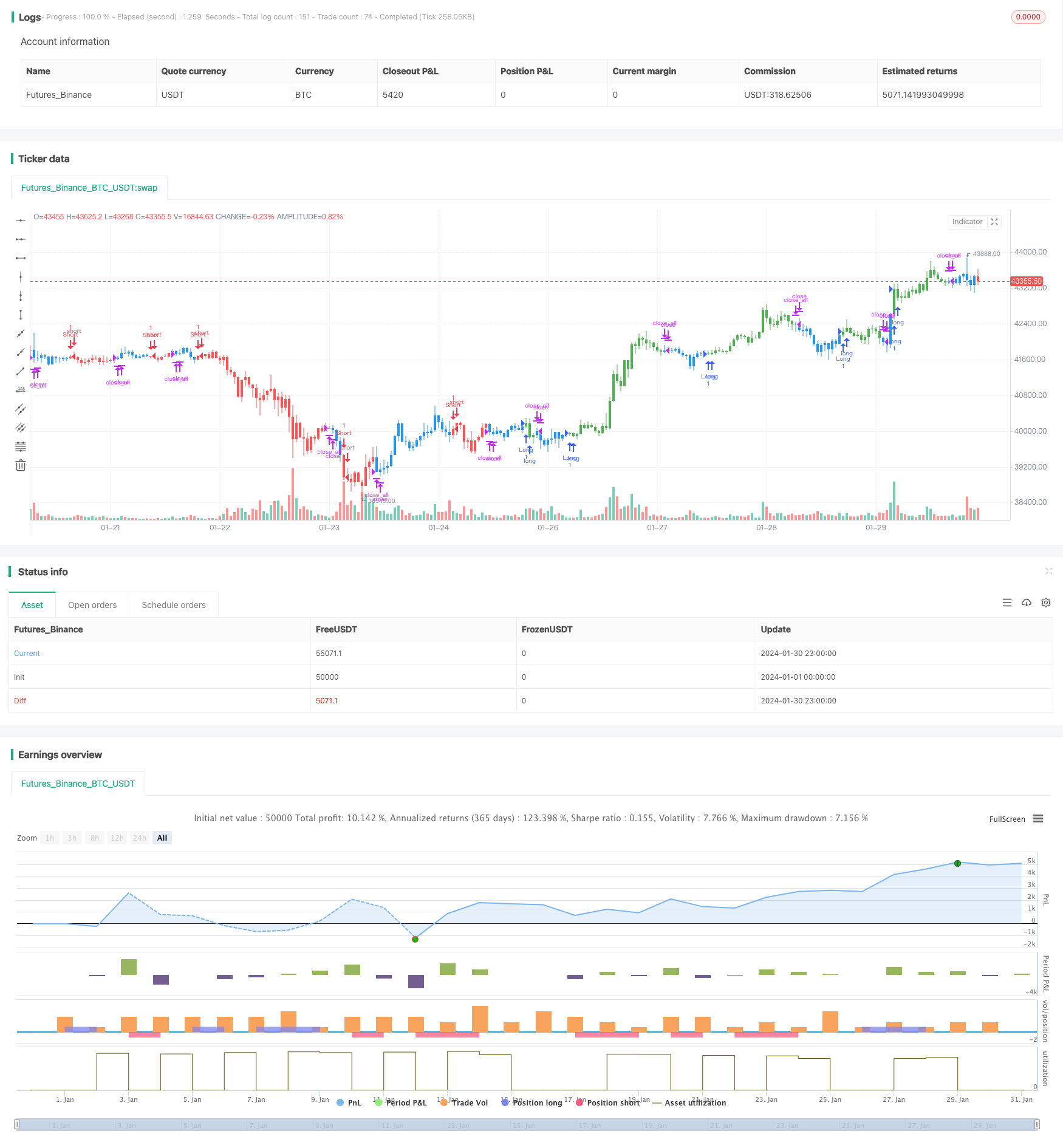

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/05/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Bandpass_Filter(Length, Delta, TriggerLevel) =>

xPrice = hl2

beta = cos(3.14 * (360 / Length) / 180)

gamma = 1 / cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - sqrt(gamma * gamma - 1)

BP = 0.0

pos = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos := iff(BP > TriggerLevel, 1,

iff(BP <= TriggerLevel, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bandpass Filter", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthBF = input(20, minval=1)

Delta = input(0.5)

TriggerLevel = input(0)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBandpass_Filter = Bandpass_Filter(LengthBF, Delta, TriggerLevel)

pos = iff(posReversal123 == 1 and posBandpass_Filter == 1 , 1,

iff(posReversal123 == -1 and posBandpass_Filter == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

- Ichimoku Cloud Trend Mengikuti Strategi

- Strategi Dagangan Jangka Panjang Berdasarkan Bollinger Bands

- Strategi Saluran Purata Bergerak Bertiga untuk Tambang Bersabar Maklumat Bernilai dari Garis Candlestick

- Strategi Yang Yang Yang Yang

- Strategi Peratusan Kerugian Hentian

- Trend Purata Bergerak Tiga Berikutan Strategi

- Mengesan strategi perdagangan Stop Loss Moving Average

- Indikator berganda Purata Trend Pembalikan Mengikut Strategi

- Saluran Harga Dinamik dengan Strategi Pengesanan Stop Loss

- Strategi Bollinger Bands Stop Loss Dinamik

- Strategi Crossover Purata Bergerak Dinamik

- EMA Crossover Trend Mengikut Strategi

- Strategi Dagangan Jangka Pendek Berdasarkan RSI dan SMA

- Strategi Dagangan Intraday Momentum Breakout

- KDJ Golden Cross Long Entry Strategy

- Strategi Ribut Breakback dalam Peluang Tersembunyi

- Strategi Pengesanan Momentum Jangka Masa

- Trend purata bergerak mengikut strategi

- Pivot SuperTrend Strategi Melalui Pelbagai Jangka Masa

- corak candlestick kuantitatif dan trend mengikut strategi