Tiga Candle Reversal Trend Strategi

Penulis:ChaoZhang, Tarikh: 2024-02-18 09:48:28Tag:

Ringkasan

Three Candle Reversal Trend Strategy adalah strategi perdagangan jangka pendek yang mengenal pasti pembalikan dalam trend jangka pendek dengan mengesan tiga lilin bullish atau bearish berturut-turut diikuti dengan lilin yang menelan ke arah yang bertentangan, digabungkan dengan pelbagai penunjuk teknikal untuk menapis isyarat kemasukan.

Logika Strategi

Logik utama strategi ini adalah untuk mengenal pasti corak tiga lilin bullish atau bearish berturut-turut pada carta, yang biasanya menyiratkan pembalikan yang akan berlaku dalam trend jangka pendek. Apabila tiga lilin bearish dikesan, tunggu lilin bullish yang akan datang untuk pergi panjang. Sebaliknya, apabila tiga lilin bullish dikesan, tunggu lilin bearish yang akan datang untuk pergi pendek. Ini membolehkan menangkap peluang pembalikan dalam trend jangka pendek dengan tepat pada masanya.

Di samping itu, pelbagai penunjuk teknikal diperkenalkan untuk menapis isyarat kemasukan. Dua garis SMA dengan tetapan parameter yang berbeza diterima pakai, dan kedudukan kemasukan hanya dipertimbangkan apabila SMA yang lebih cepat melintasi garis yang lebih perlahan. Di samping itu, penunjuk regresi linear digunakan untuk menilai sama ada pasaran berkisar atau trend, dan perdagangan hanya diambil dalam keadaan trend. Terdapat juga pilihan untuk menggabungkan corak lilin dengan salib emas SMA untuk isyarat kemasukan tambahan. Melalui penilaian komprehensif penunjuk ini, kebanyakan bunyi boleh ditapis dan ketepatan kemasukan dapat ditingkatkan.

Untuk stop loss dan mengambil keuntungan, strategi ini memerlukan nisbah risiko-balasan minimum 1: 3. Penunjuk ATR berdasarkan turun naik harga N lilin baru-baru ini digunakan untuk menentukan tahap stop loss dengan peratusan offset. mengambil keuntungan kemudian dikira dengan sewajarnya untuk menyasarkan pulangan berlebihan yang betul untuk risiko yang diambil.

Kelebihan

Strategi Trend Pembalikan Tiga Lilin mempunyai kelebihan berikut:

- Mengenali pembalikan trend jangka pendek untuk peluang tepat pada masanya

- Keakuratan kemasukan yang lebih baik melalui pelbagai penapis penunjuk

- Profil risiko-balasan yang munasabah dengan stop loss dan mengambil keuntungan yang sesuai

- Parameter mudah untuk mudah difahami dan digunakan

Risiko

Terdapat juga beberapa risiko yang perlu diperhatikan untuk strategi ini:

- Pembalikan jangka pendek tidak semestinya menunjukkan pembalikan trend jangka panjang. Trend jangka masa yang lebih tinggi harus dipantau. Purata bergerak jangka panjang boleh ditambah sebagai penapis.

- Corak candlestick tunggal boleh menghasilkan isyarat palsu. Penghakiman tambahan lain boleh dipertimbangkan.

- Tetapan stop loss boleh terlalu agresif.

- Data backtest yang tidak mencukupi membawa kepada ketidakpastian dalam prestasi dagangan sebenar.

Arahan Peningkatan

Strategi ini boleh ditingkatkan dalam aspek berikut:

- Sesuaikan parameter untuk purata bergerak dan regresi linear untuk mengenal pasti trend dengan lebih baik.

- Tambah penunjuk lain seperti Stoch untuk pengesahan isyarat tambahan.

- Mengoptimumkan parameter ATR dan peratusan stop loss untuk mengimbangi risiko dan pulangan.

- Memperkenalkan mekanisme pengesanan trend untuk meningkatkan keuntungan.

- Menubuhkan sistem pengurusan modal yang kukuh untuk mengawal risiko perdagangan.

Kesimpulan

Kesimpulannya, Three Candle Reversal Trend Strategy adalah strategi perdagangan jangka pendek yang mudah yang memanfaatkan corak harga dan pelbagai penunjuk untuk menangkap peluang pembalikan, yang dibina berdasarkan profil risiko-balasan yang seimbang. Ia memberikan hasil yang terhormat dengan kerumitan yang agak rendah, dan bernilai perhatian dan ujian pelabur.

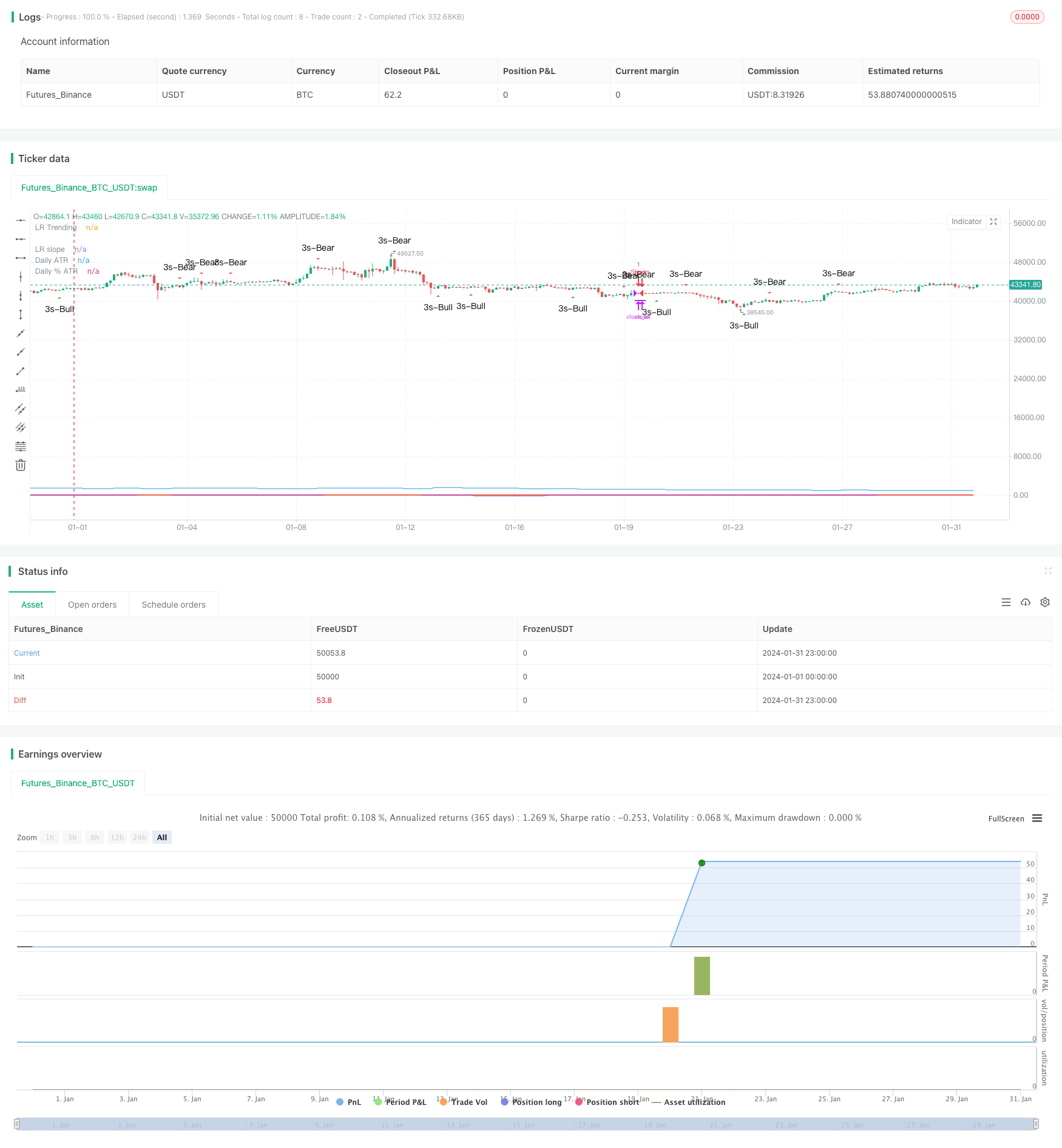

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © platsn

//

// Mainly developed for SPY trading on 1 min chart. But feel free to try on other tickers.

// Basic idea of this strategy is to look for 3 candle reversal pattern within trending market structure. The 3 candle reversal pattern consist of 3 consecutive bullish or bearish candles,

// followed by an engulfing candle in the opposite direction. This pattern usually signals a reversal of short term trend. This strategy also uses multiple moving averages to filter long or short

// entries. ie. if the 21 smoothed moving average is above the 50, only look for long (bullish) entries, and vise versa. There is option change these moving average periods to suit your needs.

// I also choose to use Linear Regression to determine whether the market is ranging or trending. It seems the 3 candle pattern is more successful under trending market. Hence I use it as a filter.

// There is also an option to combine this strategy with moving average crossovers. The idea is to look for 3 canddle pattern right after a fast moving average crosses over a slow moving average.

// By default , 21 and 50 smoothed moving averages are used. This gives additional entry opportunites and also provides better results.

// This strategy aims for 1:3 risk to reward ratio. Stop losses are calculated using the closest low or high values for long or short entries, respectively, with an offset using a percentage of

// the daily ATR value. This allows some price flucuation without being stopped out prematurely. Price target is calculated by multiplying the difference between the entry price and the stop loss

// by a factor of 3. When price target is reach, this strategy will set stop loss at the price target and wait for exit considion to maximize potential profit.

// This strategy will exit an order if an opposing 3 candle pattern is detected, this could happend before stop loss or price target is reached, and may also happen after price target is reached.

// *Note that this strategy is designed for same day SPY option scalping. I haven't determined an easy way to calculate the # of contracts to represent the equivalent option values. Plus the option

// prices varies greatly depending on which strike and expiry that may suits your trading style. Therefore, please be mindful of the net profit shown. By default, each entry is approxiately equal

// to buying 10 of same day or 1 day expiry call or puts at strike $1 - $2 OTM. This strategy will close all open trades at 3:45pm EST on Mon, Wed, and Fri.

// **Note that this strategy also takes into account of extended market data.

// ***Note pyramiding is set to 2 by default, so it allows for multiple entries on the way towards price target.

// Remember that market conditions are always changing. This strategy was only able to be backtested using 1 month of data. This strategy may not work the next month. Please keep that in mind.

// *****************************************************************************************************************************************************************************************************

//@version=5

strategy("3 Candle Strike Stretegy", overlay=true, pyramiding=2, initial_capital=5000, commission_type=strategy.commission.cash_per_contract, commission_value = 0.01)

// ******************** Period **************************************

startY = input(title='Start Year', defval=2011, group = "Trading window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Trading window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Trading window")

finishY = input(title='Finish Year', defval=2050, group = "Trading window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Trading window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Trading window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

t1 = time(timeframe.period, "0930-1545:23456")

window = true

// *****************************************************

isSPY = input.bool(defval=true,title="SPY trading only", group = "Trading Options")

SPY_option = input.int(defval=10,title="# of SPY options per trade", group = "Trading Options")

reinvest = input.bool(defval=false,title="reinvest profit?", group = "Trading Options")

src = close

// ***************************************************************************************************** Daily ATR *****************************************************

// Inputs

atrlen = input.int(14, minval=1, title="ATR period", group = "Daily ATR")

iPercent = input.float(5, minval=1, maxval=100, step=0.1, title="% ATR to use for SL / PT", group = "Daily ATR")

// PTPercent = input.int(100, minval=1, title="% ATR for PT")

// Logic

percentage = iPercent * 0.01

datr = request.security(syminfo.tickerid, "1D", ta.rma(ta.tr, atrlen))

datrp = datr * percentage

// datrPT = datr * PTPercent * 0.01

plot(datr,"Daily ATR")

plot(datrp, "Daily % ATR")

// ***************************************************************************************************************** Moving Averages ************************

len0 = input.int(8, minval=1, title='Fast EMA', group= "Moving Averages")

ema1 = ta.ema(src, len0)

len1 = input.int(21, minval=1, title='Fast SMMA', group= "Moving Averages")

smma1 = 0.0

sma_1 = ta.sma(src, len1)

smma1 := na(smma1[1]) ? sma_1 : (smma1[1] * (len1 - 1) + src) / len1

len2 = input.int(50, minval=1, title='Slow SMMA', group= "Moving Averages")

smma2 = 0.0

sma_2 = ta.sma(src, len2)

smma2 := na(smma2[1]) ? sma_2 : (smma2[1] * (len2 - 1) + src) / len2

len3 = input.int(200, minval=1, title='Slow SMMA', group= "Moving Averages")

smma3 = 0.0

sma_3 = ta.sma(src, len3)

smma3 := na(smma3[1]) ? sma_3 : (smma3[1] * (len3 - 1) + src) / len3

ma_bull = smma1 > smma2 and smma1 > smma1[1]

ma_bear = smma1 < smma2 and smma1 < smma1[1]

ma_bull_macro = smma1 > smma3 and smma2 > smma3

ma_bear_macro = smma1 < smma3 and smma2 < smma3

// plot(ma_bull? 1 : 0, "MA bull")

// plot(ma_bear? 1 : 0 , "MA bear")

// **************************************************************************************************************** Linear Regression *************************

//Input

clen = input.int(defval = 50, minval = 1, title = "Linear Regression Period", group = "Linear Regression")

slen = input.int(defval=50, minval=1, title="LR Slope Period" , group = "Linear Regression")

glen = input.int(defval=14, minval=1, title="LR Signal Period", group = "Linear Regression")

LR_thres = input.float(0.03, minval=0, step=0.001, title="LR Threshold for Ranging vs Trending" , group = "Linear Regression")

//Linear Regression Curve

lrc = ta.linreg(src, clen, 0)

//Linear Regression Slope

lrs = (lrc-lrc[1])/1

//Smooth Linear Regression Slope

slrs = ta.ema(lrs, slen)

//Signal Linear Regression Slope

alrs = ta.sma(slrs, glen)

up_accel = lrs > alrs and lrs > 0

down_accel = lrs < alrs and lrs < 0

LR_ranging = math.abs(slrs) <= LR_thres

LR_trending = math.abs(slrs) > LR_thres

plot(slrs, "LR slope")

plot(LR_trending?1:0, "LR Trending")

// *********************************************************************************************************************************** Candle conditions **************************

bull_3s = close[3] <= open[3] and close[2] <= open[2] and close[1] <= open[1] and close > open[1]

bear_3s = close[3] >= open[3] and close[2] >= open[2] and close[1] >= open[1] and close < open[1]

plotshape(bull_3s, style=shape.triangleup, color=color.new(color.green, 0), location=location.belowbar, size=size.small, text='3s-Bull', title='3 Line Strike Up')

plotshape(bear_3s, style=shape.triangledown, color=color.new(color.red, 0), location=location.abovebar, size=size.small, text='3s-Bear', title='3 Line Strike Down')

// ***************************************************************************************************************************************** SL & PT ***********************************

RR = input.float(3.0, minval = 1, step = 0.1, title="Reward to Risk Ratio", group = "Trading Options")

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

last_high = math.max(high, high[1], high[2], high[3])

last_low = math.min(low, low[1], low[2], low[3])

long_SL = last_low - datrp

short_SL = last_high + datrp

long_PT = last_high

short_PT = last_low

last_entry = strategy.opentrades.entry_price(strategy.opentrades-1)

risk = last_entry - long_SL

if strategy.opentrades > 0

long_SL := math.min(long_SL[barsSinceLastEntry()], last_low)

short_SL := math.max(short_SL[barsSinceLastEntry()], last_high)

risk := last_entry - long_SL

long_PT := last_entry + (last_entry - long_SL) * RR

short_PT := last_entry - (short_SL - last_entry) * RR

else

long_PT := open + (open - long_SL) * RR

short_PT := open - (short_SL - open) * RR

// plot(short_SL,title = "Short SL", color=color.new(color.purple,30))

// plot(long_SL,title = "Long SL", color=color.new(color.purple,30))

// plot(long_PT,title = "Long PT", color=color.new(color.white,50))

// plot(short_PT,title = "Short PT", color=color.new(color.white,50))

// plot(last_entry, title = "Last entry")

// plot(risk, title = "Risk")

// **************************************************************************************************************************************** Trade Pauses ****************************************

bool trade_pause = false

bool trade_pause2 = false

if high - low > datr*0.3

trade_pause := true

else

trade_pause := false

no_longat10 = input.bool(true, title="No long entry between 10 - 10:30 (Avoid 10 am dump)", group = "Trading Options")

// ************************************************************************************************************************************ Entry conditions **************************

trade_3s = input.bool(title='Trade 3s candle pattern', defval=true, group = "Trading Options")

L_entry1 = bull_3s and ma_bull and LR_trending

S_entry1 = bear_3s and ma_bear and LR_trending

trade_ma_reversal = input.bool(title='Trade MA Cross Reversal Signal', defval=true, group = "Trading Options")

L_entry2 = ma_bear_macro and ema1 > smma1 and bull_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

S_entry2 = ma_bull_macro and ema1 < smma1 and bear_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

// ************************************************************************************************************************************** Exit Conditions ********************************

// bsle_thres = input.int(0, "Bar since entry threshold")

// exit0 = barsSinceLastEntry() >= bsle_thres

exit0 = true

L_exit1 = bear_3s

S_exit1 = bull_3s

// ************************************************************************************************************************************ Entry and Exit orders *****************************

strategy.initial_capital = 50000

trade_amount = math.floor(strategy.initial_capital / close)

if isSPY

if strategy.netprofit > 0 and reinvest

trade_amount := math.floor((strategy.initial_capital + strategy.netprofit) * 0.2 / 600) * 10 * SPY_option

else

trade_amount := math.floor(strategy.initial_capital * 0.2 / 600) * 10 * SPY_option

if not(trade_pause) and not(trade_pause2) and time(timeframe.period, "0930-1540:23456")

if trade_3s

if not(time(timeframe.period, "1000-1030:23456")) and no_longat10

strategy.entry("Long", strategy.long, 1, when = L_entry1 and window, comment="Long 3s" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry1 and window, comment = "Short 3s" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if trade_ma_reversal

strategy.entry("Long", strategy.long, 1, when = L_entry2 and window, comment="Long MA cross" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry2 and window, comment = "Short MA corss" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if high > long_PT

long_SL := low[1]

strategy.exit("Exit", "Long", when = exit0 and low < long_PT, stop= long_SL, comment = "Exit Long SL/PT hit")

strategy.close("Long", when = L_exit1, comment = "Exit on Bear Signal")

if low < short_PT

short_SL := high[1]

strategy.exit("Exit", "Short", when= exit0 and high > short_PT, stop= short_SL, comment = "Exit Short SL/PT hit")

strategy.close("Short", when = S_exit1, comment = "Exit on Bull Signal")

if time(timeframe.period, "1545-1600:246")

strategy.close_all()

- 3 Strategi pembalikan selang swing purata bergerak

- Strategi Pullback Pelancongan Purata Pelancongan Kebalikan

- Strategi Pengembara Trend Multi-Timeframe

- DCCI Breakout Strategi

- Strategi Quant Osilasi Harga Berkeyakinan Berganda

- Strategi Pengesanan Trend Volatiliti

- Strategi Pengesanan Pembalikan Kuantit Dual-Pengemudi

- Strategi Isyarat Trend Tumpukan

- Swing Points Breakouts Strategi jangka panjang

- Strategi Dagangan Kuantitatif Berdasarkan Pendaftaran Penembusan Purata Bergerak Dinamis

- Adaptive Dual Breakthrough Trading Strategy

- Strategi Dagangan Kuantitatif untuk Pembalikan Bawah

- Strategi Gabungan Pengoptimuman Trend Momentum

- Strategi Bollinger Bands Berbilang Purata Bergerak

- Strategi Penembusan Purata Bergerak

- SuperTrend Strategi Hentian Terakhir Berdasarkan Heikin Ashi

- Purata Bergerak Berganda Dengan Strategi Pecahkan Momentum

- Strategi Penembusan Bollinger Band Berdasarkan VWAP

- Fibonacci Retracement Strategi Stop Loss Dinamik

- EMA Dinamik dan Strategi Crossover MACD