Gambaran keseluruhan

Strategi ini menggunakan persimpangan rata-rata dan indikator MACD sebagai isyarat perdagangan utama. Strategi ini menggunakan persimpangan rata-rata cepat dengan beberapa garis rata-rata perlahan sebagai isyarat pembukaan kedudukan, sambil menggabungkan positif-negatif dari grafik tiang MACD yang perlahan sebagai asas penilaian trend. Strategi ini menetapkan beberapa tahap berhenti dan berhenti pada masa yang sama untuk membuka kedudukan, dan terus mengubah kedudukan berhenti untuk mengunci keuntungan dengan peningkatan masa memegang kedudukan.

Prinsip Strategi

- Garis purata pantas dan garis purata perlahan 1 bersilang ke atas, sementara harga penutupan berada di atas garis purata perlahan 2, grafik MACD lebih besar daripada 0, melakukan lebih banyak;

- Garis purata pantas dan garis purata perlahan 1 berpusat ke bawah, sementara harga penutupan berada di bawah garis purata perlahan 2, carta MACD kurang dari 0, kosong;

- Bukaan kedudukan pada masa yang sama dengan pelbagai tahap berhenti dan berhenti, berhenti kedudukan berdasarkan pilihan risiko, dan berhenti kedudukan terus disesuaikan dengan tempoh memegang kedudukan, secara beransur-ansur mengunci keuntungan;

- Tempoh garis rata-rata, parameter MACD, dan paras penangguhan berhenti boleh disesuaikan secara fleksibel untuk menyesuaikan diri dengan keadaan pasaran yang berbeza.

Strategi ini menggunakan trend tangkapan silang linear, sambil mengesahkan arah dengan indikator MACD, meningkatkan kebolehpercayaan penghakiman trend. Tetapan stop loss bertingkat dapat mengawal risiko dan keuntungan dengan lebih baik.

Kelebihan Strategik

- Garis rata adalah kaedah klasik untuk menjejaki trend, dan ia dapat menangkap pembentukan trend pada masa yang tepat.

- Penggunaan garis purata pelbagai peringkat membolehkan penilaian yang lebih menyeluruh mengenai kekuatan dan kesinambungan trend;

- Penunjuk MACD dapat mengesan trend dan menilai momentum dengan berkesan, sebagai pelengkap yang kuat untuk persilangan garis rata-rata;

- Tetapan multi-tahap untuk menghentikan dan menghentikan kerosakan secara dinamik dapat mengawal risiko, menjimatkan keuntungan, dan meningkatkan kestabilan sistem;

- Parameter boleh laras, beradaptasi, dan boleh disesuaikan dengan pelbagai jenis dan kitaran.

Risiko Strategik

- Terdapat risiko bahawa isyarat akan terlewat di tengah-tengah garis rata-rata dan mungkin akan terlepas trend awal atau mengejar kenaikan.

- Penetapan parameter yang tidak betul boleh menyebabkan terlalu banyak perdagangan atau terlalu lama memegang kedudukan, meningkatkan kos dan risiko;

- Tetapan stop loss yang terlalu radikal boleh menyebabkan stop loss yang terlalu awal, dan tetapan stop loss yang terlalu konservatif boleh menjejaskan keuntungan;

- Perubahan trend atau pergerakan pasaran boleh menyebabkan strategi gagal.

Risiko ini boleh dikawal dengan cara mengoptimumkan parameter, menyesuaikan kedudukan, menetapkan syarat tambahan dan sebagainya. Tetapi tidak ada strategi yang dapat mengelakkan risiko sepenuhnya dan memerlukan perhatian pelabur.

Arah pengoptimuman strategi

- Ia boleh dipertimbangkan untuk memperkenalkan lebih banyak petunjuk seperti RSI, BRI dan lain-lain untuk mengukuhkan lagi trend dan isyarat;

- Pengoptimuman yang lebih halus boleh dilakukan pada tetapan stop loss, seperti mempertimbangkan ATR atau stop loss peratusan;

- Ia boleh menyesuaikan parameter mengikut kadar turun naik pasaran yang dinamik, meningkatkan daya serap;

- Modul pengurusan kedudukan boleh diperkenalkan untuk menyesuaikan saiz kedudukan mengikut keadaan risiko;

- Strategi boleh dikumpulkan, membina gabungan strategi untuk menyebarkan risiko.

Dengan pengoptimuman dan penambahbaikan yang berterusan, anda boleh membuat strategi yang lebih stabil dan boleh dipercayai dan lebih sesuai dengan keadaan pasaran yang berubah-ubah. Tetapi pengoptimuman perlu berhati-hati dan mengelakkan terlalu sesuai.

ringkaskan

Strategi ini digabungkan dengan penyambungan garis rata dan penunjuk MACD untuk membina sistem perdagangan yang agak lengkap. Reka bentuk garis rata bertingkat dan operasi berbilang kepala meningkatkan keupayaan sistem untuk menangkap trend dan keupayaan untuk mengawal risiko. Logik strategi jelas, mudah difahami dan dilaksanakan, sesuai untuk pengoptimuman dan penambahbaikan lanjut.

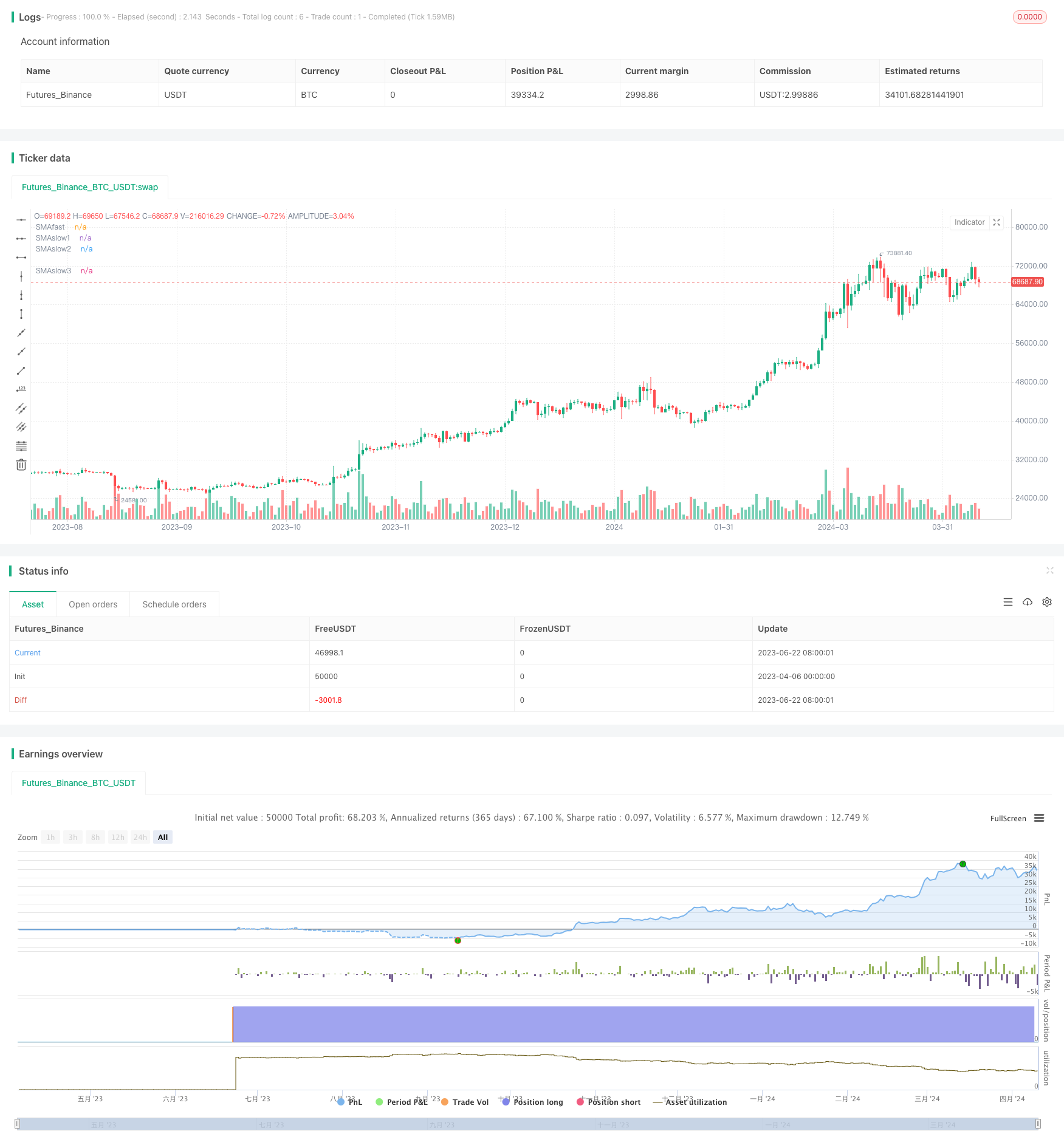

/*backtest

start: 2023-04-06 00:00:00

end: 2024-04-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxmirus

//@version=5

strategy("My strategy_Cross_SMA(EMA)+Macd,slow3",overlay=true)

// ver 4

// Date Inputs

startDate = input(timestamp('2019-01-01T00:00:00+0300'), '' , inline='time1',

tooltip=' Время первого бара расчета стратегии. Первый ордер может быть выставлен на следующем баре после стартового.')

finishDate = input(timestamp('2044-01-01T00:00:00+0300'), '' , inline='time2',

tooltip=' Время после которого больше не будут размещаться ордера входа в позицию.')

// Calculate start/end date and time condition

time_cond = true

//SMA(EMA) Inputs

fast=input.int(12, title="Fastlength",group="MA")

slow1=input.int(54,title="Slowlength1",group="MA")

slow2=input.int(100, title="Slowlength2",group="MA")

slow3=input.int(365, title="Slowlength3",group="MA")

fastma=input.string(title="Fastlength", defval="EMA",options=["SMA","EMA"],group="MA")

slowma1=input.string(title="Slowlength1", defval="EMA",options=["SMA","EMA"],group="MA")

slowma2=input.string(title="Slowlength2", defval="EMA",options=["SMA","EMA"],group="MA")

slowma3=input.string(title="Slowlength3", defval="EMA",options=["SMA","EMA"],group="MA")

fastlength = fastma == "EMA" ? ta.ema(close, fast) : ta.sma(close, fast)

slowlength1 = slowma1 == "EMA" ? ta.ema(close, slow1) : ta.sma(close, slow1)

slowlength2 = slowma2 == "EMA" ? ta.ema(close, slow2) : ta.sma(close, slow2)

slowlength3 = slowma3 == "EMA" ? ta.ema(close, slow3) : ta.sma(close, slow3)

//Macd Inputs

macdfastline = input.int(12, title="FastMacd",group="MACD")

macdslowline = input.int(26,title="SlowMacd",group="MACD")

macdhistline = input.int(9,title="HistMacd",group="MACD")

src=input(defval=close,title="Source",group="MACD")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

fast_ma = sma_source == "SMA" ? ta.sma(src, macdfastline) : ta.ema(src, macdfastline)

slow_ma = sma_source == "SMA" ? ta.sma(src, macdslowline) : ta.ema(src, macdslowline)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, macdhistline) : ta.ema(macd, macdhistline)

hist = macd - signal

//fastMACD = ta.ema(close, macdline) - ta.ema(close, signalline)

//signalMACD = ta.ema(MACD, histline)

//histMACD = MACD - aMACD

//EMA Plot

plot(fastlength,title="SMAfast",color=color.blue)

plot(slowlength1,title="SMAslow1",color=color.orange)

plot(slowlength2,title="SMAslow2",color=color.red)

plot(slowlength3,title="SMAslow3",color=color.black)

//Macd plot

//col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

//col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

//col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

//col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

//col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

//col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)))

//plot(macd, title="MACD", color=col_macd)

//plot(signal, title="Signal", color=col_signal)

//Take profit

tp1=input.float(5.1,title="Take Profit1_%",step=0.1)/100

tp2=input.float(10.1,title="Take Profit2_%",step=0.1)/100

//Stop loss

sl1=input.float(5.1,title="Stop loss1_%",step=0.1)/100

sl2=input.float(0.1,title="Stop loss2_%",step=0.1)/100

sl3=input.float(-5.5,title="Stop loss3_%", step=0.1)/100

//Qty closing position

Qty1 = input.float(0.5, title="QtyClosingPosition1",step=0.01)

Qty2 = input.float(0.25, title="QtyClosingPosition2",step=0.01)

//Take profit Long and Short

LongTake1=strategy.position_avg_price*(1+tp1)

LongTake2=strategy.position_avg_price*(1+tp2)

ShortTake1=strategy.position_avg_price*(1-tp1)

ShortTake2=strategy.position_avg_price*(1-tp2)

//Plot Levels Take

plot(strategy.position_size > 0 ? LongTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongTake2 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake2 : na,color=color.green,style=plot.style_linebr)

//Stop loss long and short

LongStop1=strategy.position_avg_price*(1-sl1)

LongStop2=strategy.position_avg_price*(1-sl2)

LongStop3=strategy.position_avg_price*(1-sl3)

ShortStop1=strategy.position_avg_price*(1+sl1)

ShortStop2=strategy.position_avg_price*(1+sl2)

ShortStop3=strategy.position_avg_price*(1+sl3)

//Stop=strategy.position_avg_price

//Plot Levels Stop

plot(strategy.position_size > 0 ? LongStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop3 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop3 : na,color=color.red,style=plot.style_linebr)

//Entry condition

LongCondition1 = ta.crossover(fastlength, slowlength1)

LongCondition2 = close>slowlength2

LongCondition3 = time_cond

LongCondition4=close>slowlength3

//LongCondition5=slowlength100>slowlength3

LongCondition6 = hist > 0

buy=(LongCondition1 and LongCondition2 and LongCondition3 and LongCondition4 and LongCondition6 ) and strategy.position_size<=0

//longCondition3 = nz(strategy.position_size) == 0//если отсутствует открытая позиция

ShortCondition1 = ta.crossunder(fastlength, slowlength1)

ShortCondition2 = close<slowlength2

ShortCondition3 = time_cond

ShortCondition4=close<slowlength3

//ShortCondition5=slowlength100<slowlength3

ShortCondition6=hist < 0

sell=(ShortCondition1 and ShortCondition2 and ShortCondition3 and ShortCondition4 and ShortCondition6 ) and strategy.position_size>=0

//Strategy entry

strategy.cancel_all(not strategy.position_size)

if(buy)

strategy.cancel_all()

strategy.entry("Buy",strategy.long)

if(sell)

strategy.cancel_all()

strategy.entry("Sell",strategy.short)

//Strategy Long exit

var int exitCounter=0

exitCounter := not strategy.position_size or strategy.position_size > 0 and strategy.position_size[1] < 0 or strategy.position_size < 0 and strategy.position_size[1] > 0 ? 0:

strategy.position_size > 0 and strategy.position_size[1]>strategy.position_size? exitCounter[1] + 1:

strategy.position_size < 0 and strategy.position_size[1]<strategy.position_size? exitCounter[1] - 1:

exitCounter[1]

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long1",strategy.short, qty=math.abs(strategy.position_size*Qty1), limit=LongTake1, oca_name='Long1', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long2",strategy.short, qty=math.abs(strategy.position_size*Qty2), limit=LongTake2, oca_name='Long2', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Stop Long1",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop1,oca_name='Long1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==1

strategy.order("Stop Long2",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop2,oca_name='Long2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==2

strategy.order("Stop Long3",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop3)

// Strategy Short exit

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short1", strategy.long, qty=math.abs(strategy.position_size*Qty1), limit=ShortTake1, oca_name='Short1', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short2", strategy.long, qty=math.abs(strategy.position_size*Qty2), limit=ShortTake2, oca_name='Short2', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Stop Short1",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop1,oca_name='Short1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-1

strategy.order("Stop Short2",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop2,oca_name='Short2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-2

strategy.order("Stop Short3",strategy.long,qty=math.abs(strategy.position_size),stop=ShortStop3)